The accounting profession stands at the precipice of a revolutionary transformation as artificial intelligence reshapes traditional financial management practices. From automated transaction categorization to sophisticated tax optimization strategies, AI-powered accounting systems are fundamentally altering how businesses and individuals approach financial record-keeping, compliance, and strategic planning. This technological evolution represents far more than simple automation; it embodies a paradigm shift toward intelligent financial management that combines human expertise with machine precision to deliver unprecedented accuracy, efficiency, and insight.

Explore the latest AI trends in finance and accounting to understand how cutting-edge technologies are revolutionizing financial management across industries. The integration of artificial intelligence into accounting workflows has created opportunities for enhanced accuracy, reduced manual labor, and more strategic financial decision-making that extends far beyond traditional bookkeeping functions.

The Foundation of AI-Powered Accounting

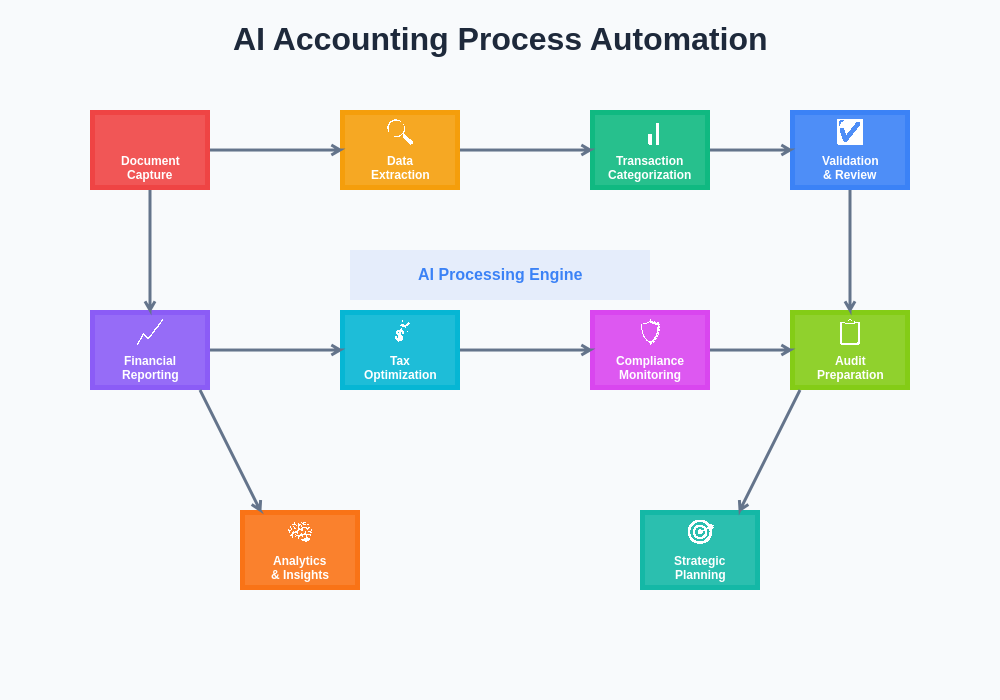

Modern AI accounting systems leverage sophisticated machine learning algorithms, natural language processing, and computer vision technologies to automate complex financial tasks that previously required extensive human intervention. These systems can analyze invoices, receipts, bank statements, and other financial documents with remarkable accuracy, automatically extracting relevant information and categorizing transactions according to established accounting principles and business-specific requirements.

The foundational capabilities of AI accounting extend beyond simple data entry automation to encompass intelligent pattern recognition, anomaly detection, and predictive analytics that help businesses maintain accurate financial records while identifying potential issues before they become significant problems. This proactive approach to financial management enables organizations to maintain compliance, optimize cash flow, and make informed strategic decisions based on real-time financial insights.

Automated Transaction Processing and Categorization

One of the most transformative applications of AI in accounting involves the automated processing and categorization of financial transactions. Traditional bookkeeping requires manual review and classification of each transaction, a time-consuming process prone to human error and inconsistency. AI-powered systems can automatically analyze transaction data, vendor information, and payment patterns to accurately categorize expenses, income, and other financial activities according to established chart of accounts and tax requirements.

This automation extends to invoice processing, where AI systems can extract key information from supplier invoices, match them against purchase orders, and flag discrepancies for human review. The technology can handle various document formats, languages, and layouts, making it particularly valuable for businesses that work with diverse suppliers and international partners. The result is significantly reduced processing time, improved accuracy, and enhanced visibility into accounts payable and receivable activities.

The systematic approach to AI-powered accounting encompasses every stage of financial data processing, from initial document capture through final reporting and analysis. This comprehensive automation ensures consistency, reduces errors, and provides real-time visibility into financial performance across all business operations.

Discover advanced AI capabilities with Claude for complex financial analysis and strategic planning that goes beyond basic bookkeeping to provide comprehensive business intelligence and decision support.

Intelligent Tax Optimization and Compliance

Tax optimization represents one of the most sophisticated applications of AI in accounting, where machine learning algorithms analyze vast amounts of financial data to identify legitimate tax-saving opportunities while ensuring full compliance with ever-changing tax regulations. These systems can evaluate different tax strategies, assess the impact of various business decisions on tax liability, and recommend optimal timing for income recognition and expense deductions.

AI-powered tax systems continuously monitor changes in tax legislation across multiple jurisdictions, automatically updating calculations and recommendations to reflect new rules and regulations. This dynamic approach to tax compliance helps businesses avoid costly penalties while maximizing legitimate tax benefits through strategic planning and optimization. The technology can also simulate various scenarios to help business owners understand the tax implications of different strategic decisions before implementation.

The sophistication of AI tax optimization extends to multi-entity organizations where complex transfer pricing, international tax treaties, and jurisdictional differences create intricate compliance requirements. AI systems can manage these complexities by maintaining comprehensive databases of tax rules, tracking inter-company transactions, and ensuring proper documentation and reporting across all relevant jurisdictions.

Real-Time Financial Reporting and Analytics

Modern AI accounting systems provide real-time financial reporting capabilities that transform how businesses monitor and analyze their financial performance. Unlike traditional accounting systems that require manual compilation of reports at month-end or quarter-end, AI-powered platforms continuously process financial data to provide up-to-date insights into cash flow, profitability, and key performance indicators.

These systems can generate customized reports and dashboards that highlight critical metrics, identify trends, and provide predictive analytics about future financial performance. The ability to access real-time financial information enables business leaders to make informed decisions quickly, respond to market changes proactively, and identify opportunities for operational improvements or strategic adjustments.

The analytical capabilities of AI accounting systems extend beyond basic financial reporting to include cash flow forecasting, budget variance analysis, and scenario planning. These tools help businesses optimize working capital management, identify seasonal patterns, and plan for future growth or economic uncertainties with greater precision and confidence.

Expense Management and Receipt Processing

Expense management has been revolutionized through AI-powered receipt processing and expense categorization systems that eliminate the tedious manual tasks associated with employee reimbursements and business expense tracking. Modern AI systems can automatically capture receipt information using optical character recognition technology, extract relevant details such as vendor names, amounts, dates, and expense categories, and match expenses against company policies and tax requirements.

This automation extends to mileage tracking, where AI systems can analyze GPS data and calendar information to automatically calculate business travel expenses and distinguish between personal and business use of vehicles. The technology can also flag potentially fraudulent or non-compliant expenses, ensuring that businesses maintain proper controls over expense reimbursements while reducing administrative burden on employees and accounting staff.

The integration of AI expense management with corporate credit card systems and banking platforms creates a comprehensive view of business spending that enables more effective budget management and cost control. These systems can identify spending patterns, negotiate better vendor terms, and recommend cost-saving opportunities based on historical data analysis and industry benchmarking.

Fraud Detection and Risk Management

AI-powered accounting systems excel at fraud detection and risk management through sophisticated pattern analysis and anomaly detection capabilities that can identify suspicious activities and potential fraudulent transactions. These systems continuously monitor financial data for unusual patterns, duplicate payments, unauthorized access attempts, and other indicators of potential fraud or security breaches.

The machine learning algorithms used in fraud detection become more sophisticated over time, learning from historical data and adapting to new fraud patterns as they emerge. This evolutionary approach to risk management provides increasingly effective protection against financial losses while reducing false positives that can disrupt legitimate business operations.

Risk management capabilities extend beyond fraud detection to include credit risk assessment, vendor risk evaluation, and compliance monitoring. AI systems can analyze customer payment patterns to identify potential collection issues, evaluate supplier financial stability to assess supply chain risks, and monitor regulatory compliance across multiple jurisdictions and regulatory frameworks.

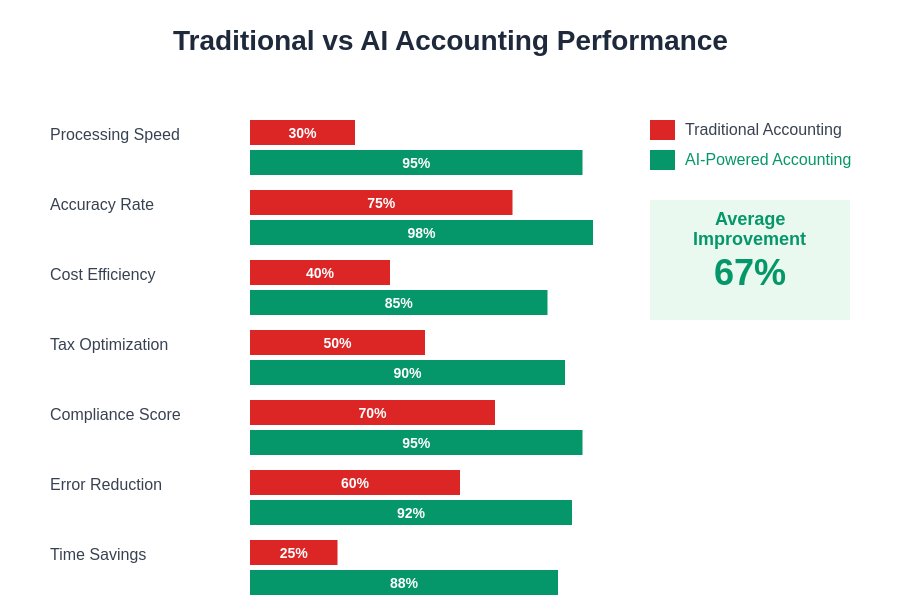

The performance improvements achieved through AI accounting implementation are substantial across all key metrics including processing speed, accuracy rates, cost reduction, and compliance effectiveness. Organizations utilizing AI-powered accounting systems consistently demonstrate superior operational efficiency and financial control compared to traditional manual approaches.

Integration with Business Systems and Workflows

The effectiveness of AI accounting systems is significantly enhanced through seamless integration with existing business systems including customer relationship management platforms, enterprise resource planning systems, and e-commerce platforms. This integration creates a unified view of business operations that enables more accurate financial reporting and better strategic decision-making.

API-based integrations allow AI accounting systems to automatically synchronize data with banking platforms, payment processors, inventory management systems, and other business applications. This real-time data synchronization eliminates manual data entry, reduces errors, and ensures that financial records accurately reflect current business activities across all operational areas.

The integration capabilities extend to document management systems where AI can automatically file and organize financial documents according to established taxonomies and retention policies. This systematic approach to document management improves audit readiness, facilitates regulatory compliance, and enhances overall organizational efficiency.

Enhance your research capabilities with Perplexity for comprehensive market analysis and financial intelligence that supports strategic decision-making and competitive positioning in rapidly evolving business environments.

Audit Trail and Compliance Documentation

AI accounting systems maintain comprehensive audit trails that document every transaction, modification, and system access to ensure complete transparency and regulatory compliance. These systems automatically generate documentation required for tax audits, financial reviews, and regulatory inspections while providing detailed logs of all system activities and user interactions.

The documentation capabilities include automated generation of supporting schedules, reconciliation reports, and compliance certificates that demonstrate adherence to accounting standards and regulatory requirements. This systematic approach to documentation reduces audit preparation time, minimizes compliance costs, and provides greater confidence in financial reporting accuracy.

Advanced AI systems can also predict audit risks by analyzing transaction patterns and identifying areas that may require additional documentation or review. This proactive approach to audit preparation helps businesses address potential issues before they become significant problems during formal audit processes.

Cost Reduction and Operational Efficiency

The implementation of AI accounting systems delivers substantial cost reductions through automation of labor-intensive tasks, reduction of errors that require correction, and optimization of financial processes. Studies consistently demonstrate that businesses utilizing AI accounting solutions achieve significant reductions in processing costs while improving accuracy and turnaround times for financial reporting and analysis.

Operational efficiency improvements extend beyond cost savings to include enhanced capacity utilization where accounting staff can focus on higher-value analytical and strategic activities rather than routine data entry and processing tasks. This shift in resource allocation enables businesses to derive greater value from their accounting functions while improving job satisfaction for finance professionals.

The scalability of AI accounting systems provides additional cost benefits for growing businesses by eliminating the need for proportional increases in accounting staff as transaction volumes increase. This scalability advantage is particularly valuable for businesses experiencing rapid growth or seasonal fluctuations in activity levels.

Customization and Industry-Specific Solutions

Modern AI accounting platforms offer extensive customization capabilities that allow businesses to tailor the system functionality to match industry-specific requirements and unique operational characteristics. These customizations can include specialized chart of accounts structures, industry-specific reporting formats, and compliance requirements for regulated industries such as healthcare, construction, or financial services.

The machine learning capabilities of AI systems enable them to adapt to specific business patterns and preferences over time, improving accuracy and efficiency through continuous learning and optimization. This adaptive capability is particularly valuable for businesses with unique operational models or complex financial structures that require specialized handling.

Industry-specific AI accounting solutions incorporate deep domain knowledge and regulatory requirements that ensure compliance with sector-specific standards and best practices. These specialized solutions provide significant advantages over generic accounting software by addressing unique industry challenges and opportunities.

Future Developments and Emerging Technologies

The future of AI accounting holds tremendous promise with emerging technologies such as blockchain integration, advanced predictive analytics, and natural language interfaces that will further enhance system capabilities and user experiences. These developments will enable even greater automation, improved accuracy, and more sophisticated financial analysis and planning capabilities.

Blockchain integration promises to revolutionize transaction verification and audit trails by creating immutable records of all financial activities. This technology will enhance trust, reduce fraud risks, and streamline audit processes while providing unprecedented transparency in financial reporting and compliance documentation.

Advanced predictive analytics will enable AI accounting systems to provide more accurate forecasting, identify emerging trends, and recommend proactive strategies for optimizing financial performance. These capabilities will transform accounting from a primarily backward-looking function to a forward-looking strategic resource that drives business growth and success.

Natural language interfaces will make AI accounting systems more accessible to non-technical users while enabling more intuitive interaction with complex financial data and analysis. These interfaces will democratize access to sophisticated financial insights and enable broader participation in financial planning and decision-making processes.

The continued evolution of AI accounting technology promises to unlock new levels of efficiency, accuracy, and strategic value that will fundamentally transform how businesses approach financial management and planning. Organizations that embrace these technologies today will be better positioned to capitalize on future developments and maintain competitive advantages in increasingly complex business environments.

Disclaimer

This article is for informational purposes only and does not constitute financial, tax, or professional accounting advice. The views expressed are based on current understanding of AI technologies and their applications in accounting and finance. Readers should consult with qualified accounting professionals and consider their specific circumstances when implementing AI-powered accounting solutions. The effectiveness and suitability of AI accounting systems may vary depending on business requirements, regulatory environment, and implementation approach.