The financial services industry stands at the precipice of a revolutionary transformation as artificial intelligence and alternative data sources fundamentally reshape the landscape of credit scoring and risk assessment. Traditional credit scoring models, which have dominated the lending industry for decades, are increasingly being supplemented and in many cases replaced by sophisticated machine learning algorithms that can process vast amounts of diverse data to create more accurate, inclusive, and comprehensive assessments of creditworthiness.

Discover the latest trends in AI and financial technology to understand how cutting-edge innovations are transforming traditional banking and lending practices. This technological evolution represents more than just an incremental improvement in existing systems; it constitutes a paradigm shift that promises to extend financial services to previously underserved populations while simultaneously reducing risk for lenders and improving outcomes for borrowers.

The Evolution Beyond Traditional Credit Scoring

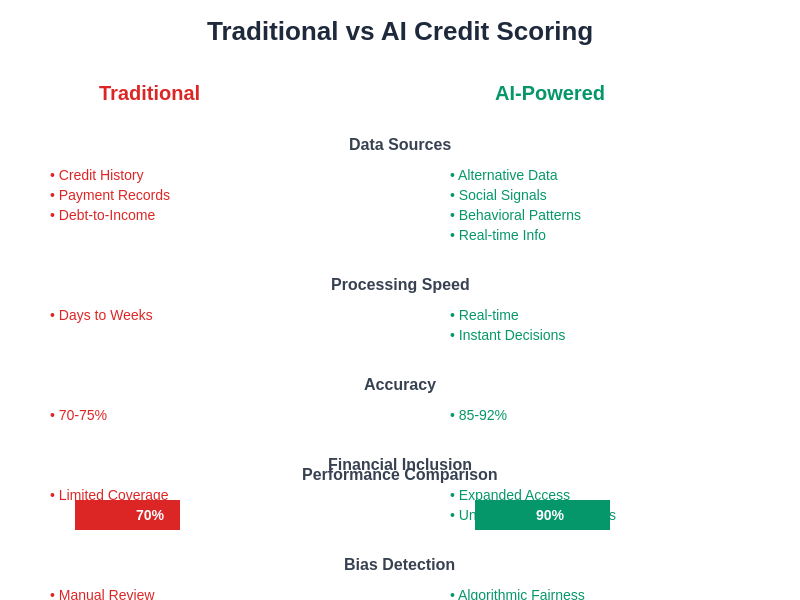

Traditional credit scoring systems have long relied on a limited set of financial data points, primarily focusing on payment history, credit utilization, length of credit history, types of credit accounts, and recent credit inquiries. While these factors have provided a reasonable foundation for credit assessment, they inherently exclude millions of individuals who lack sufficient traditional credit history, creating a significant barrier to financial inclusion and economic opportunity.

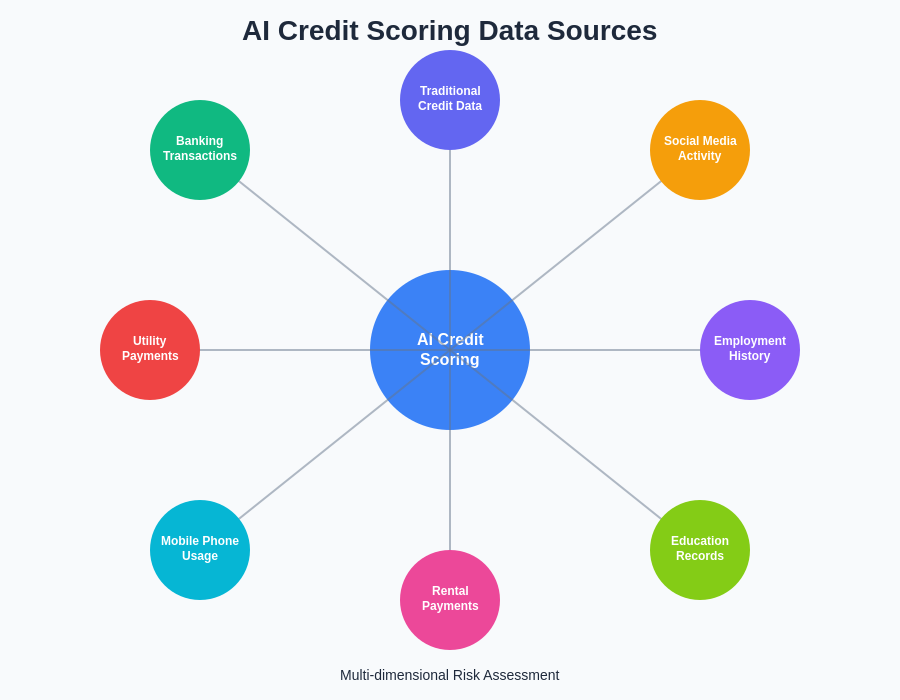

The emergence of artificial intelligence in credit scoring has opened unprecedented possibilities for incorporating alternative data sources that can provide deeper insights into an individual’s financial behavior and creditworthiness. These alternative data sources include utility payment histories, rental payment records, banking transaction patterns, mobile phone usage data, social media activity, educational backgrounds, employment histories, and even behavioral patterns derived from digital interactions. This comprehensive approach to data collection and analysis enables lenders to develop more nuanced and accurate assessments of credit risk while extending opportunities to individuals who would otherwise be excluded from traditional lending systems.

The integration of machine learning models into credit scoring processes has also enabled real-time risk assessment and dynamic pricing models that can adapt to changing economic conditions and individual circumstances. Unlike static traditional models that rely on historical data snapshots, AI-powered systems can continuously update risk assessments based on new information, providing more responsive and accurate credit decisions that benefit both lenders and borrowers.

Alternative Data Sources Revolutionizing Risk Assessment

The scope and variety of alternative data sources available for modern credit scoring applications represent a fundamental departure from traditional approaches to risk assessment. Utility payment data, including electricity, gas, water, and telecommunications bills, provides valuable insights into an individual’s payment reliability and financial stability over extended periods. This information is particularly valuable for assessing individuals with limited traditional credit history, as utility payments are nearly universal and provide consistent behavioral indicators across diverse demographic groups.

Banking transaction data offers another rich source of alternative information that can reveal spending patterns, income stability, savings behaviors, and financial management capabilities. Advanced machine learning algorithms can analyze transaction frequencies, merchant categories, payment timing, and account balance fluctuations to identify patterns that correlate with creditworthiness. This transactional analysis can reveal insights that traditional credit reports might miss, such as seasonal income variations, emergency fund management, and discretionary spending behaviors that indicate financial discipline.

Experience advanced AI capabilities with Claude for sophisticated data analysis and machine learning model development in financial technology applications. Digital footprint analysis has emerged as another powerful alternative data source, encompassing everything from mobile phone usage patterns to online shopping behaviors and social media activity. While privacy considerations remain paramount, anonymized and aggregated digital behavior data can provide valuable insights into lifestyle stability, social connections, and decision-making patterns that correlate with financial responsibility.

Educational and employment data, including degree levels, institution rankings, employment tenure, and industry sectors, can provide predictive insights into future earning potential and career stability. Machine learning models can identify correlations between educational achievements, career trajectories, and long-term financial success, enabling more forward-looking credit assessments that consider an individual’s potential rather than solely relying on past financial performance.

Machine Learning Models Transforming Credit Decisions

The application of sophisticated machine learning algorithms to credit scoring has enabled the development of models that far exceed the predictive accuracy and inclusivity of traditional statistical approaches. Ensemble methods, which combine multiple machine learning algorithms to create more robust predictions, have proven particularly effective in credit scoring applications. These models can simultaneously process hundreds or thousands of variables from diverse data sources, identifying complex patterns and relationships that would be impossible for human analysts or traditional statistical models to detect.

Deep learning neural networks have demonstrated exceptional capability in processing unstructured data sources such as text-based financial communications, social media content, and image-based documentation. These models can extract meaningful insights from complex data types that traditional scoring models cannot incorporate, such as analyzing the sentiment and content of customer service interactions, social media posts, or even satellite imagery of residential areas to assess economic conditions and stability.

Gradient boosting machines and random forest algorithms have become particularly popular in credit scoring applications due to their ability to handle large datasets with mixed data types while providing interpretable results that satisfy regulatory requirements. These models can automatically identify the most relevant features from vast alternative data sets, reducing the risk of overfitting while maximizing predictive accuracy across diverse population segments.

The implementation of real-time machine learning models has enabled dynamic credit scoring that can adjust risk assessments based on changing circumstances and new information. These adaptive systems can incorporate streaming data from various sources to continuously update credit scores, enabling more responsive lending decisions and allowing borrowers to benefit immediately from positive changes in their financial circumstances.

Enhancing Financial Inclusion Through AI Innovation

One of the most significant impacts of AI-powered credit scoring has been its ability to extend financial services to previously underserved populations, including young adults with limited credit history, immigrants without established credit records, and individuals from economically disadvantaged backgrounds who may have been excluded from traditional lending systems. By incorporating alternative data sources and sophisticated analytical techniques, AI models can identify creditworthy individuals who would be rejected by traditional scoring systems.

The diversity of data sources available to modern AI credit scoring systems enables a more comprehensive and inclusive approach to risk assessment that goes beyond traditional financial metrics. This multi-dimensional analysis considers various aspects of an individual’s life and behavior patterns to create a holistic view of creditworthiness.

Machine learning models have proven particularly effective at identifying and mitigating bias in credit scoring processes, as they can be designed to focus on predictive factors while minimizing the influence of demographic characteristics that may lead to discriminatory outcomes. Advanced algorithmic fairness techniques ensure that AI credit scoring systems provide equal opportunities across different demographic groups while maintaining predictive accuracy and risk management effectiveness.

The global nature of AI credit scoring solutions has also enabled financial inclusion initiatives in developing markets where traditional credit infrastructure may be limited or non-existent. Mobile-based financial services powered by AI can provide credit assessments using telecommunications data, mobile money transaction histories, and other locally available data sources, extending financial services to populations that have been historically excluded from formal banking systems.

Risk Management and Regulatory Compliance

The implementation of AI credit scoring systems has necessitated the development of sophisticated risk management frameworks that can handle the complexity and scale of modern machine learning models while ensuring compliance with evolving regulatory requirements. Model governance processes must address issues such as algorithmic transparency, bias detection and mitigation, data privacy protection, and ongoing model performance monitoring to maintain regulatory approval and consumer trust.

Explainable AI techniques have become essential components of modern credit scoring systems, as regulators and consumers increasingly demand transparency in algorithmic decision-making processes. Advanced interpretation methods can provide clear explanations of how specific data points and patterns contribute to credit decisions, enabling better customer communication and regulatory compliance while maintaining the sophisticated analytical capabilities of complex machine learning models.

Leverage Perplexity’s research capabilities for comprehensive analysis of regulatory frameworks and compliance requirements in AI-powered financial services. Continuous model monitoring and validation processes ensure that AI credit scoring systems maintain their predictive accuracy and fairness over time, as economic conditions change and new data patterns emerge. These monitoring systems can detect model drift, performance degradation, and potential bias issues, enabling proactive adjustments to maintain optimal performance and regulatory compliance.

The integration of privacy-preserving technologies such as differential privacy, federated learning, and homomorphic encryption has enabled the development of AI credit scoring systems that can leverage sensitive alternative data sources while protecting individual privacy and maintaining compliance with data protection regulations such as GDPR and CCPA.

Advanced Algorithmic Techniques and Model Innovation

The sophistication of modern AI credit scoring systems extends far beyond traditional machine learning approaches, incorporating cutting-edge techniques such as graph neural networks that can analyze complex relationship patterns between individuals, businesses, and financial institutions. These network-based models can identify risk factors that emerge from social and economic connections, providing additional layers of insight that enhance traditional individual-focused assessments.

Reinforcement learning algorithms have shown promise in optimizing credit scoring decisions by learning from the outcomes of previous lending decisions and continuously improving risk assessment accuracy. These adaptive systems can automatically adjust their decision-making criteria based on real-world performance data, leading to more effective risk management and better customer outcomes over time.

Time series analysis and sequential modeling techniques enable AI credit scoring systems to understand temporal patterns in financial behavior, identifying trends and seasonality that can provide valuable insights into future creditworthiness. These models can detect improving or deteriorating financial conditions before they become apparent in traditional credit reports, enabling more proactive and responsive lending decisions.

Ensemble learning approaches that combine multiple specialized models have proven particularly effective in handling the diversity and complexity of alternative data sources. These systems can simultaneously process structured financial data, unstructured text information, time series patterns, and network relationships to create comprehensive risk assessments that leverage the strengths of different analytical approaches.

Data Quality and Integration Challenges

The successful implementation of AI credit scoring systems requires sophisticated data integration and quality management processes that can handle the volume, variety, and velocity of alternative data sources. Data normalization techniques must account for differences in data formats, collection methods, and reporting standards across various alternative data providers, ensuring that machine learning models receive consistent and reliable input data.

The comparison between traditional and AI-powered credit scoring approaches demonstrates significant improvements in accuracy, inclusivity, and processing speed, while also highlighting the increased complexity and data requirements of modern systems.

Real-time data processing capabilities have become essential for modern credit scoring applications, as the value of many alternative data sources depends on their timeliness and currency. Streaming data architectures and edge computing technologies enable the integration of real-time information into credit decisions, providing more responsive and accurate risk assessments.

Data privacy and security considerations require sophisticated technical implementations that can protect sensitive information while enabling effective machine learning model training and deployment. Advanced encryption techniques, secure multi-party computation, and privacy-preserving analytics enable the use of sensitive alternative data sources while maintaining individual privacy and regulatory compliance.

Industry Applications and Use Case Scenarios

The versatility of AI credit scoring systems has enabled their application across diverse financial services sectors, from traditional banking and mortgage lending to emerging fintech applications such as buy-now-pay-later services, peer-to-peer lending platforms, and cryptocurrency-based financial products. Each application domain presents unique challenges and opportunities that require specialized model development and deployment strategies.

Small business lending has particularly benefited from AI credit scoring innovations, as traditional business credit assessment methods often fail to capture the full picture of small business financial health and potential. Alternative data sources such as online reviews, social media presence, supply chain relationships, and digital payment processing volumes can provide valuable insights into business performance and viability that complement traditional financial statements and credit histories.

Consumer lending applications have leveraged AI credit scoring to develop more personalized and responsive lending products that can adapt to individual circumstances and preferences. Dynamic pricing models can offer customized interest rates and terms based on comprehensive risk assessments, while real-time decision-making capabilities enable instant loan approvals and disbursements.

The integration of AI credit scoring into digital banking platforms has enabled the development of embedded financial services that can provide credit assessments and lending decisions within the context of other digital experiences. These seamless integrations improve customer experience while expanding access to credit products across diverse digital touchpoints.

Economic Impact and Market Transformation

The widespread adoption of AI credit scoring systems has generated significant economic benefits through improved risk management, expanded financial inclusion, and reduced operational costs for financial institutions. More accurate risk assessments have enabled lenders to reduce default rates while expanding their customer base, creating value for both financial institutions and consumers who gain access to better pricing and more appropriate credit products.

The democratization of credit scoring technology through cloud-based AI platforms and API services has enabled smaller financial institutions and fintech startups to compete more effectively with larger established players. This increased competition has driven innovation and improved customer outcomes across the financial services industry.

Global economic research indicates that improved financial inclusion through AI credit scoring could unlock trillions of dollars in economic value by enabling previously excluded populations to access credit for education, business development, and major purchases. This economic empowerment has far-reaching implications for poverty reduction, economic growth, and social mobility.

Future Developments and Emerging Trends

The future of AI credit scoring promises even more sophisticated and inclusive approaches to risk assessment, with emerging technologies such as quantum computing potentially enabling the analysis of exponentially larger and more complex datasets. Advances in natural language processing and computer vision may unlock new alternative data sources such as video-based interviews, document analysis, and real-time behavioral assessment.

The integration of blockchain technology and decentralized finance protocols may enable new models of credit scoring that give individuals greater control over their financial data while maintaining privacy and security. These decentralized approaches could reduce dependence on centralized credit bureaus while enabling more transparent and equitable credit assessment processes.

Continued advances in explainable AI and algorithmic fairness will likely lead to even more transparent and equitable credit scoring systems that can provide detailed explanations of decision-making processes while ensuring fair treatment across all demographic groups. These developments will be crucial for maintaining public trust and regulatory approval as AI credit scoring systems become more prevalent.

The evolution toward fully automated, real-time credit ecosystems may eventually enable instant credit decisions and dynamic risk pricing that can adapt to changing economic conditions and individual circumstances in real-time. These advanced systems will require sophisticated infrastructure and governance frameworks but promise to deliver unprecedented levels of efficiency and customer service in financial markets.

Disclaimer

This article is for informational purposes only and does not constitute financial or investment advice. The views expressed are based on current understanding of AI technologies and their applications in credit scoring and financial services. Readers should conduct their own research and consult with qualified financial professionals before making decisions related to credit products or financial services. The effectiveness and fairness of AI credit scoring systems may vary depending on implementation, data sources, and regulatory environments. Financial institutions and technology providers should ensure compliance with applicable laws and regulations when developing or deploying AI credit scoring solutions.