The landscape of due diligence has been fundamentally transformed by the integration of artificial intelligence into virtual data room platforms, creating unprecedented opportunities for enhanced analysis, risk assessment, and strategic decision-making. Among the leading platforms in this space, Ansarada and Intralinks have emerged as prominent competitors, each offering unique approaches to AI-powered due diligence that cater to different organizational needs and priorities. This comprehensive analysis explores the distinctive features, capabilities, and strategic advantages of both platforms to help organizations make informed decisions about their virtual data room investments.

Stay updated with the latest AI trends in business technology as virtual data room platforms continue to evolve with cutting-edge artificial intelligence capabilities that are reshaping how organizations conduct due diligence processes. The integration of AI into these platforms represents a paradigm shift that extends far beyond simple document storage and sharing, encompassing intelligent analysis, predictive insights, and automated risk assessment capabilities that were previously unimaginable in traditional due diligence workflows.

Understanding AI-Powered Due Diligence

The evolution of due diligence from manual document review processes to AI-enhanced analytical workflows has revolutionized how organizations approach mergers, acquisitions, fundraising, and strategic partnerships. Traditional due diligence required extensive human resources, prolonged timelines, and significant risk of human error in document analysis and risk identification. Modern AI-powered virtual data rooms have addressed these challenges by introducing sophisticated machine learning algorithms, natural language processing capabilities, and automated pattern recognition systems that can process vast volumes of documents with unprecedented speed and accuracy.

The transformation extends beyond mere efficiency improvements, encompassing enhanced quality of analysis through AI systems capable of identifying subtle patterns, relationships, and potential risks that might escape human review. These platforms leverage advanced analytics to provide stakeholders with actionable insights, predictive modeling, and comprehensive risk assessments that inform strategic decision-making processes. The integration of AI has also improved collaboration capabilities, enabling distributed teams to work more effectively while maintaining stringent security protocols and audit trails essential for high-stakes business transactions.

Ansarada: AI-Native Due Diligence Platform

Ansarada has positioned itself as an AI-native virtual data room platform that leverages artificial intelligence as a core component of its service delivery rather than an add-on feature. The platform’s AI capabilities are deeply integrated into every aspect of the due diligence process, from initial document organization and categorization to advanced analytics and deal outcome prediction. This comprehensive approach to AI integration has enabled Ansarada to offer unique features such as automated due diligence preparation, intelligent document indexing, and predictive deal analytics that provide users with unprecedented insights into transaction dynamics.

The platform’s machine learning algorithms continuously analyze user behavior patterns, document access frequencies, and stakeholder engagement levels to generate actionable intelligence about deal progression and potential outcomes. Ansarada’s AI system can identify critical documents, flag potential issues, and provide recommendations for addressing concerns before they become deal-breaking obstacles. This proactive approach to risk management has proven particularly valuable for organizations conducting complex transactions where early identification and mitigation of potential issues can significantly impact deal success rates and transaction timelines.

Explore advanced AI capabilities with Claude to understand how cutting-edge artificial intelligence can enhance your due diligence processes through sophisticated analysis and strategic insights. The integration of multiple AI technologies creates a comprehensive ecosystem that supports every aspect of the transaction lifecycle from initial preparation through final closing.

Intralinks: Enterprise-Grade AI Integration

Intralinks has established itself as a leader in enterprise-grade virtual data room solutions by focusing on robust security, scalability, and comprehensive AI-enhanced features designed for large-scale, complex transactions. The platform’s approach to artificial intelligence emphasizes practical applications that enhance existing workflows rather than replacing traditional due diligence methodologies. This balanced approach has made Intralinks particularly attractive to large enterprises and financial institutions that require sophisticated AI capabilities while maintaining familiar operational frameworks and compliance procedures.

The platform’s AI-powered document analysis capabilities include intelligent content recognition, automated redaction suggestions, and advanced search functionality that can identify relevant information across diverse document types and formats. Intralinks has also invested significantly in developing AI-driven user behavior analytics that provide administrators with detailed insights into stakeholder engagement patterns, document access trends, and potential security concerns. These capabilities enable organizations to optimize their due diligence processes while maintaining the highest levels of data security and regulatory compliance.

Feature Comparison and Analysis

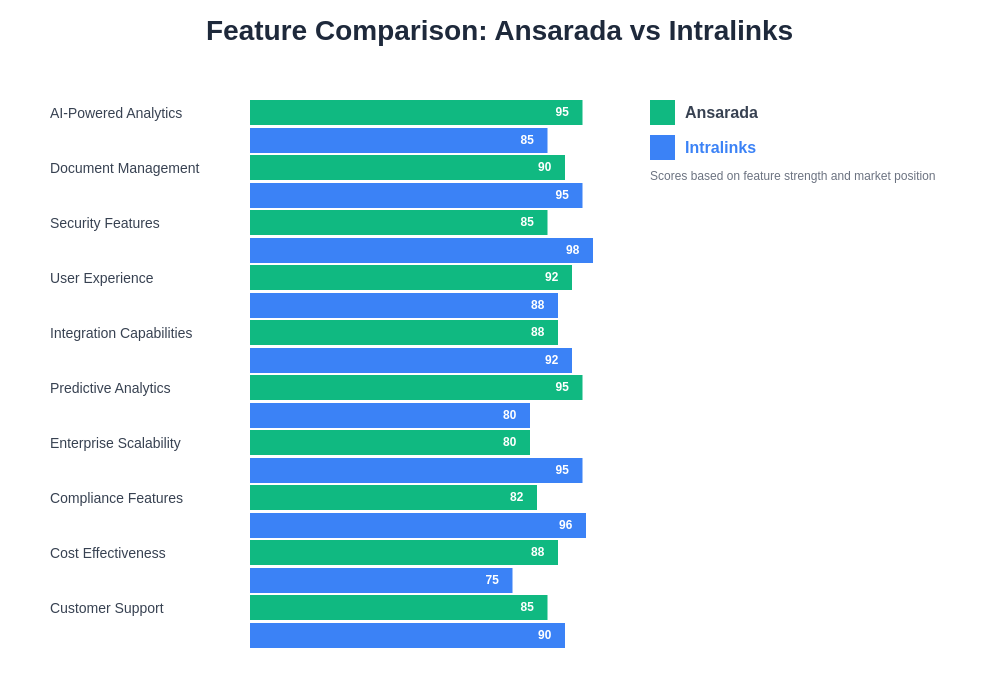

The comparison between Ansarada and Intralinks reveals distinct approaches to AI implementation that reflect different philosophical perspectives on the role of artificial intelligence in due diligence processes. Ansarada’s AI-first approach emphasizes automation, prediction, and intelligent assistance throughout the entire transaction lifecycle, while Intralinks focuses on enhancing traditional due diligence workflows with carefully integrated AI capabilities that complement human expertise and decision-making processes.

Both platforms offer sophisticated document management capabilities enhanced by artificial intelligence, but their implementations differ significantly in scope and approach. Ansarada’s AI system provides more comprehensive automation features, including intelligent document categorization, automated Q&A preparation, and predictive analytics for deal outcomes. Intralinks, conversely, emphasizes human-AI collaboration through features such as AI-assisted document review, intelligent search capabilities, and enhanced security monitoring that augment rather than replace human judgment and expertise.

The comprehensive feature analysis reveals distinct strengths and strategic positioning for each platform, with Ansarada excelling in AI-powered analytics and predictive capabilities while Intralinks demonstrates superior enterprise scalability and security features that cater to large-scale, complex transactions.

Security and Compliance Considerations

Security remains paramount in virtual data room selection, and both Ansarada and Intralinks have implemented comprehensive security frameworks enhanced by artificial intelligence capabilities. The integration of AI into security protocols has enabled both platforms to offer advanced threat detection, behavioral analytics, and automated compliance monitoring that significantly exceed traditional security measures. These AI-enhanced security features provide organizations with unprecedented visibility into data access patterns, potential security risks, and compliance violations that could compromise sensitive transaction information.

Ansarada’s AI-powered security framework includes intelligent access control systems that can dynamically adjust permissions based on user behavior patterns and transaction phases. The platform’s machine learning algorithms continuously monitor user activities to identify potential security threats or unusual access patterns that might indicate unauthorized data access or potential breaches. This proactive approach to security monitoring has proven particularly effective for organizations conducting sensitive transactions where data security breaches could have significant legal, financial, and reputational consequences.

Intralinks has implemented equally sophisticated AI-enhanced security measures, with particular emphasis on enterprise-grade compliance capabilities that meet the stringent requirements of large financial institutions and multinational corporations. The platform’s AI systems provide comprehensive audit trails, automated compliance reporting, and intelligent risk assessment capabilities that help organizations maintain regulatory compliance while conducting complex due diligence processes. These features have made Intralinks particularly attractive to organizations operating in heavily regulated industries where compliance failures could result in severe penalties and legal consequences.

Discover comprehensive AI research capabilities with Perplexity to enhance your due diligence research processes with advanced information gathering and analysis capabilities that complement virtual data room platforms. The combination of multiple AI tools creates a comprehensive due diligence ecosystem that maximizes efficiency and accuracy throughout the transaction process.

User Experience and Interface Design

The user experience represents a critical differentiator between Ansarada and Intralinks, with each platform offering distinct approaches to interface design and workflow optimization. Ansarada has prioritized intuitive design and AI-powered user assistance that guides users through complex due diligence processes with minimal training requirements. The platform’s interface leverages artificial intelligence to personalize user experiences, provide contextual recommendations, and streamline navigation through large document repositories. This approach has proven particularly effective for organizations with limited due diligence experience or those seeking to minimize training requirements for stakeholders participating in transaction processes.

Intralinks has focused on creating a professional, enterprise-grade interface that balances sophisticated functionality with operational familiarity for experienced due diligence professionals. The platform’s AI enhancements are seamlessly integrated into traditional workflow patterns, providing users with enhanced capabilities without requiring significant changes to established processes. This approach has resonated strongly with large organizations and financial institutions that value continuity and predictability in their due diligence operations while seeking the benefits of AI-enhanced capabilities.

Performance and Scalability Analysis

Performance characteristics and scalability capabilities represent crucial considerations for organizations selecting virtual data room platforms, particularly those conducting large-scale transactions involving thousands of documents and numerous stakeholders. Both Ansarada and Intralinks have invested heavily in developing robust technical infrastructures capable of supporting high-volume, high-stakes transactions while maintaining optimal performance levels throughout the due diligence process.

Ansarada’s AI-optimized architecture provides exceptional performance for document processing, analysis, and retrieval operations, with machine learning algorithms that continuously optimize system performance based on usage patterns and demand fluctuations. The platform’s scalability has been demonstrated through successful deployment in transactions ranging from small private placements to large multinational mergers, with AI systems that automatically adjust resource allocation to maintain optimal performance levels regardless of transaction size or complexity.

Intralinks has established itself as a leader in enterprise-scale performance through decades of experience supporting large, complex transactions for major financial institutions and multinational corporations. The platform’s AI enhancements have been carefully designed to enhance rather than compromise performance, with intelligent caching, predictive loading, and optimized data processing algorithms that maintain exceptional responsiveness even under heavy usage loads. This focus on performance reliability has made Intralinks particularly attractive to organizations conducting time-sensitive transactions where system downtime or performance degradation could have significant financial implications.

Cost-Benefit Analysis and Value Proposition

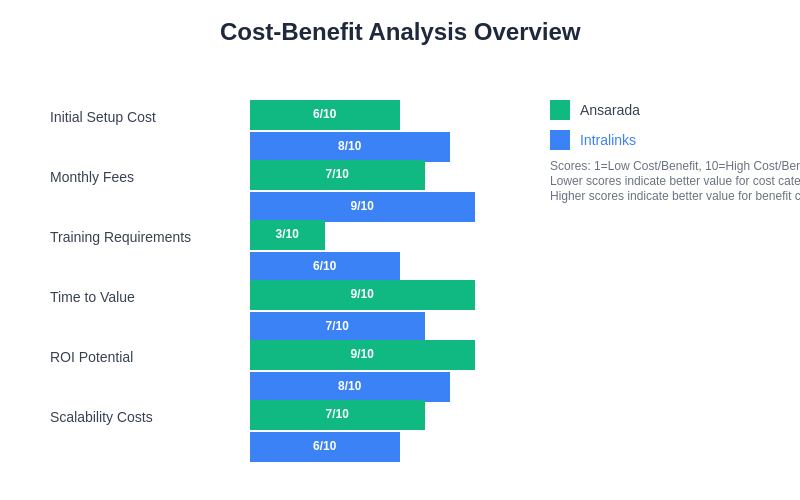

The economic considerations surrounding virtual data room selection extend beyond simple pricing comparisons to encompass comprehensive value assessments that include efficiency gains, risk mitigation, and strategic advantages provided by AI-enhanced capabilities. Both Ansarada and Intralinks offer compelling value propositions, but their economic models reflect different approaches to pricing and value delivery that align with their respective target markets and strategic positioning.

Ansarada’s pricing structure emphasizes the value of AI-powered efficiency gains and outcome optimization, with cost models that often demonstrate favorable returns through reduced transaction timelines, improved deal success rates, and enhanced stakeholder satisfaction. The platform’s AI capabilities can significantly reduce the human resources required for due diligence processes, resulting in substantial cost savings that often exceed the platform fees. Additionally, the predictive analytics and risk assessment capabilities provide strategic value that can influence deal structures, pricing negotiations, and risk mitigation strategies in ways that generate substantial financial benefits beyond direct cost savings.

The economic evaluation demonstrates varying value propositions across different cost and benefit categories, with each platform offering distinct advantages that align with specific organizational priorities and transaction requirements.

Intralinks positions itself as a premium enterprise solution that delivers exceptional value through comprehensive capabilities, proven reliability, and extensive support services that justify higher cost structures for organizations requiring enterprise-grade solutions. The platform’s AI enhancements provide additional value through improved efficiency and enhanced analysis capabilities while maintaining the stability and reliability that large organizations require for critical business transactions. The total cost of ownership analysis often favors Intralinks for organizations conducting frequent, large-scale transactions where the premium investment is justified by superior performance and comprehensive feature sets.

Integration Capabilities and Ecosystem Compatibility

Modern due diligence processes rarely operate in isolation, requiring virtual data room platforms to integrate seamlessly with existing technology ecosystems, enterprise software suites, and specialized due diligence tools. Both Ansarada and Intralinks have recognized this need and developed comprehensive integration capabilities enhanced by artificial intelligence that facilitate smooth data flow and process coordination across multiple platforms and systems.

Ansarada’s API-first architecture and AI-powered integration capabilities enable seamless connectivity with popular enterprise software suites, document management systems, and specialized due diligence tools. The platform’s machine learning algorithms can automatically map data fields, synchronize information across systems, and provide intelligent recommendations for optimizing integration configurations. These capabilities have proven particularly valuable for organizations with complex technology environments that require sophisticated data integration and process automation capabilities.

Intralinks has developed extensive integration partnerships and technical capabilities that reflect its focus on serving large enterprise clients with complex technology requirements. The platform’s AI-enhanced integration tools provide sophisticated data mapping, automated synchronization, and intelligent conflict resolution capabilities that ensure seamless operation across diverse technology environments. These capabilities have made Intralinks particularly attractive to organizations operating in heavily regulated industries where integration reliability and audit trail maintenance are critical compliance requirements.

Industry-Specific Applications and Specializations

The application of AI-powered virtual data rooms varies significantly across different industries and transaction types, with each platform offering specialized capabilities designed to address specific sector requirements and regulatory frameworks. Understanding these industry-specific strengths and limitations is essential for organizations seeking to maximize the value of their virtual data room investments while ensuring compliance with relevant regulations and industry best practices.

Ansarada has developed particular expertise in serving technology companies, startups, and growth-stage businesses through AI capabilities specifically designed to support venture capital funding, growth equity transactions, and technology asset valuations. The platform’s predictive analytics can provide valuable insights into valuation trends, market conditions, and investor behavior patterns that are particularly relevant for technology sector transactions. Additionally, the platform’s automated due diligence preparation capabilities have proven especially valuable for companies with limited transaction experience seeking to optimize their fundraising processes.

Intralinks has established strong positions in traditional industries such as financial services, healthcare, energy, and manufacturing through comprehensive compliance capabilities and industry-specific feature sets that address complex regulatory requirements and transaction structures. The platform’s AI enhancements have been carefully designed to support the sophisticated analysis requirements of these industries while maintaining the security and compliance standards necessary for heavily regulated sectors. This specialization has made Intralinks the preferred choice for many large enterprises and financial institutions conducting complex, high-value transactions.

The strategic positioning analysis illustrates how each platform occupies distinct market segments, with Ansarada focusing on innovation-driven organizations seeking advanced AI capabilities and Intralinks serving enterprise clients requiring comprehensive scalability and regulatory compliance features.

Future Development and Innovation Trajectories

The future evolution of AI-powered virtual data rooms will likely be shaped by advancing artificial intelligence technologies, changing regulatory requirements, and evolving user expectations that demand increasingly sophisticated capabilities and seamless user experiences. Both Ansarada and Intralinks have demonstrated commitment to continuous innovation and technology advancement, but their development trajectories reflect different strategic priorities and market positioning approaches.

Ansarada’s development roadmap emphasizes expanding AI capabilities through advanced machine learning, natural language processing, and predictive analytics that will further automate due diligence processes and provide increasingly sophisticated strategic insights. The platform’s research and development investments focus on creating AI systems capable of conducting autonomous due diligence analysis, generating strategic recommendations, and predicting transaction outcomes with increasing accuracy and reliability. These capabilities promise to fundamentally transform how organizations approach due diligence by shifting focus from document review to strategic analysis and decision-making.

Intralinks continues to invest in enhancing its enterprise-grade capabilities through AI technologies that complement and enhance traditional due diligence workflows while maintaining the reliability and security standards that large organizations require. The platform’s innovation trajectory emphasizes practical AI applications that provide immediate value while maintaining compatibility with established business processes and regulatory frameworks. This approach reflects Intralinks’ commitment to serving large enterprise clients that prioritize stability and reliability alongside technological advancement.

The competitive landscape will likely continue evolving as both platforms expand their AI capabilities and explore new applications for artificial intelligence in due diligence processes. Organizations evaluating these platforms should consider not only current capabilities but also development trajectories and strategic commitments that will influence long-term value and competitive positioning.

Strategic Recommendations and Selection Criteria

The selection between Ansarada and Intralinks should be based on comprehensive evaluation of organizational requirements, transaction characteristics, and strategic objectives rather than simple feature comparisons or cost considerations. Organizations conducting frequent, large-scale transactions with complex regulatory requirements may find Intralinks’ enterprise-focused approach and comprehensive compliance capabilities more aligned with their needs, while organizations seeking maximum AI automation and predictive analytics may prefer Ansarada’s AI-native approach and innovative feature set.

The decision should also consider long-term strategic objectives and technology evolution plans, as both platforms offer different approaches to AI integration and future development that may align differently with organizational priorities and technology roadmaps. Organizations should evaluate not only current capabilities but also development trajectories, partnership ecosystems, and strategic commitments that will influence platform evolution and competitive positioning over time.

Ultimately, the optimal choice depends on finding the platform that best balances current requirements with future needs while providing the AI-enhanced capabilities necessary to support increasingly sophisticated due diligence processes and strategic decision-making requirements. Both platforms offer compelling value propositions and sophisticated AI capabilities that can significantly enhance due diligence efficiency and effectiveness when properly aligned with organizational needs and strategic objectives.

Disclaimer

This article is for informational purposes only and does not constitute professional advice regarding virtual data room selection or due diligence processes. The analysis presented is based on publicly available information and general industry knowledge as of the publication date. Organizations should conduct their own comprehensive evaluations, including security assessments, compliance reviews, and feature testing, before making platform selection decisions. The effectiveness and suitability of each platform may vary depending on specific organizational requirements, transaction types, and regulatory environments. Readers should consult with qualified professionals and conduct direct platform evaluations to determine the most appropriate solution for their specific needs.