The financial services industry faces an unprecedented challenge in balancing regulatory compliance with customer experience while combating increasingly sophisticated financial crimes. Artificial intelligence has emerged as the cornerstone technology transforming Know Your Customer (KYC) and Anti-Money Laundering (AML) processes, revolutionizing how financial institutions verify identities, detect suspicious activities, and maintain compliance with evolving regulatory requirements across global markets.

Stay updated with the latest AI innovations in fintech to understand how cutting-edge technologies are reshaping financial compliance and security landscapes. The integration of AI into KYC and AML workflows represents a fundamental shift from reactive compliance measures to proactive risk management systems that can adapt to emerging threats while maintaining operational efficiency and regulatory adherence.

The Evolution of Financial Compliance Technology

Traditional KYC and AML processes have long relied on manual document review, rule-based systems, and static risk assessment models that struggle to keep pace with the volume and complexity of modern financial transactions. These legacy systems often produce high false positive rates, require extensive human intervention, and fail to detect sophisticated money laundering schemes that exploit system vulnerabilities and regulatory gaps across different jurisdictions.

The advent of artificial intelligence has fundamentally transformed this landscape by introducing dynamic learning capabilities, pattern recognition algorithms, and real-time analysis systems that can process vast amounts of structured and unstructured data to identify potential risks and compliance issues. This technological evolution has enabled financial institutions to move beyond simple rule-based detection toward intelligent systems that can understand context, recognize emerging patterns, and adapt to new threats as they develop.

Advanced Identity Verification Through AI

Modern AI-powered identity verification systems leverage multiple technologies including optical character recognition, facial recognition, document authentication, and biometric analysis to create comprehensive identity profiles that are significantly more secure and accurate than traditional verification methods. These systems can analyze document authenticity through advanced image processing algorithms that detect subtle signs of tampering, verify facial matches across multiple sources, and cross-reference identity information against global databases in real-time.

The sophistication of AI identity verification extends beyond simple document checking to include behavioral biometrics, device fingerprinting, and contextual analysis that considers user behavior patterns, geographic locations, and transaction histories to build comprehensive risk profiles. This multi-layered approach significantly reduces the likelihood of identity fraud while streamlining the customer onboarding process through automated verification workflows that can complete complex identity checks in seconds rather than days.

Enhance your AI capabilities with Claude’s advanced reasoning for developing sophisticated compliance systems that can handle complex regulatory requirements and emerging financial crime patterns. The combination of natural language processing and machine learning enables the development of intelligent compliance systems that can interpret regulatory documents, analyze transaction narratives, and identify potential compliance violations across multiple jurisdictions.

Machine Learning in Transaction Monitoring

Transaction monitoring represents one of the most critical applications of AI in AML compliance, where machine learning algorithms analyze millions of transactions daily to identify patterns indicative of money laundering, terrorist financing, or other financial crimes. These systems employ advanced analytics including anomaly detection, network analysis, and predictive modeling to uncover suspicious activities that might escape traditional rule-based monitoring systems.

The power of AI transaction monitoring lies in its ability to understand complex relationships between entities, recognize evolving money laundering typologies, and adapt to new criminal methodologies without requiring manual rule updates. Machine learning models can identify subtle patterns across seemingly unrelated transactions, detect structuring activities designed to avoid reporting thresholds, and recognize sophisticated layering schemes that attempt to obscure the origin of illicit funds through complex transaction chains.

Natural Language Processing for Regulatory Intelligence

Natural language processing has revolutionized how financial institutions interpret and implement regulatory requirements by enabling automated analysis of regulatory documents, policy updates, and enforcement actions across multiple jurisdictions. AI systems can extract relevant compliance requirements from complex regulatory texts, identify changes in regulatory expectations, and automatically update monitoring rules and risk assessment parameters to maintain ongoing compliance.

This capability extends to the analysis of transaction descriptions, customer communications, and external news sources to identify potential reputational risks and regulatory concerns that might impact customer relationships or transaction processing decisions. Natural language processing enables financial institutions to maintain comprehensive awareness of evolving regulatory landscapes while automating the translation of regulatory requirements into operational compliance controls.

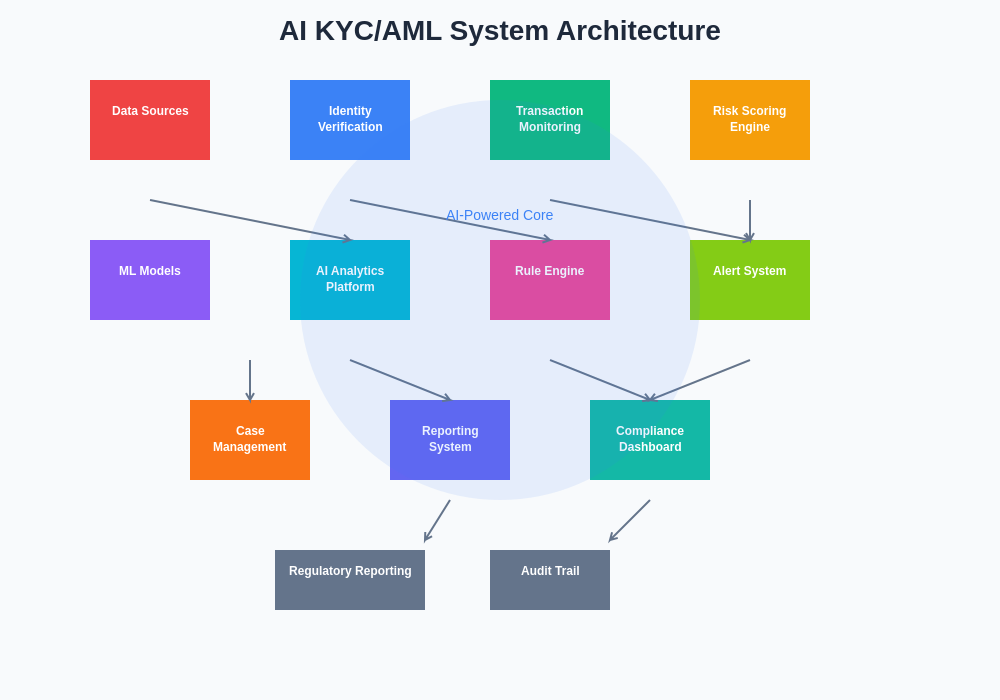

The modern AI-powered KYC/AML architecture integrates multiple data sources, processing engines, and decision-making algorithms to create a comprehensive compliance ecosystem that can handle complex regulatory requirements while maintaining operational efficiency and customer experience standards.

Real-Time Risk Assessment and Scoring

AI-powered risk assessment systems continuously evaluate customer and transaction risks using dynamic scoring models that consider multiple factors including customer behavior patterns, geographic risks, transaction characteristics, and external risk indicators. These systems provide real-time risk scores that enable financial institutions to make informed decisions about transaction processing, customer relationships, and regulatory reporting requirements.

The sophistication of modern risk scoring extends beyond simple weighted algorithms to include ensemble models that combine multiple machine learning approaches, contextual risk factors that consider current events and regulatory focus areas, and adaptive learning mechanisms that continuously improve risk prediction accuracy based on historical outcomes and emerging threat intelligence.

Automated Suspicious Activity Reporting

The generation of Suspicious Activity Reports (SARs) has been significantly enhanced through AI automation that can analyze complex transaction patterns, gather relevant supporting information, and generate comprehensive narrative reports that meet regulatory requirements while reducing the manual effort required from compliance teams. These systems can identify the specific activities that triggered suspicion, compile relevant transaction histories, and generate detailed explanations that satisfy regulatory expectations for SAR quality and completeness.

AI-powered SAR generation includes intelligent case management capabilities that can prioritize investigations based on risk levels, automatically gather supporting documentation from multiple systems, and maintain comprehensive audit trails that demonstrate the thoroughness of compliance investigations. This automation enables compliance teams to focus on high-risk cases while ensuring that all suspicious activities are properly documented and reported within regulatory timeframes.

Leverage Perplexity’s research capabilities for comprehensive regulatory research and compliance intelligence that can inform the development of sophisticated AML detection systems. The ability to quickly research emerging financial crime typologies, regulatory guidance, and enforcement trends enables the development of more effective compliance systems that can anticipate and respond to evolving threats.

Enhanced Customer Due Diligence

AI has transformed customer due diligence processes by enabling comprehensive analysis of customer backgrounds, business relationships, and potential risk factors through automated screening against global databases, sanctions lists, and adverse media sources. These systems can perform continuous monitoring of customer risk profiles, automatically detect changes in risk status, and trigger appropriate due diligence updates when risk factors change.

The integration of artificial intelligence into enhanced due diligence processes includes sophisticated entity resolution capabilities that can identify connections between seemingly unrelated parties, ownership structure analysis that can uncover complex beneficial ownership arrangements, and predictive risk modeling that can anticipate potential compliance issues before they materialize into actual violations.

Cross-Border Compliance and Regulatory Harmonization

International financial transactions require compliance with multiple regulatory frameworks that often have conflicting requirements and different risk assessment approaches. AI systems can navigate these complexities by maintaining comprehensive databases of regulatory requirements across different jurisdictions, automatically applying appropriate compliance standards based on transaction characteristics, and identifying potential conflicts that require manual review.

The global nature of modern financial crime requires AI systems that can understand cultural contexts, recognize jurisdiction-specific money laundering typologies, and adapt compliance controls to meet local regulatory expectations while maintaining consistency with international standards. This capability is essential for multinational financial institutions that must demonstrate compliance across multiple regulatory regimes while maintaining operational efficiency.

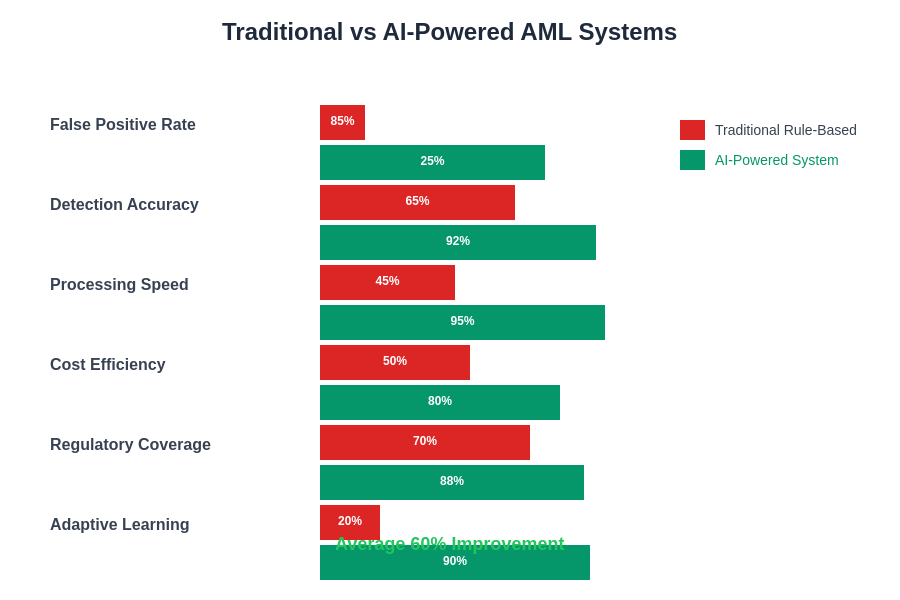

The comparison between traditional rule-based AML systems and modern AI-powered solutions demonstrates significant improvements in detection accuracy, false positive reduction, processing speed, and overall compliance effectiveness across multiple key performance indicators.

Integration with External Data Sources

Modern AI KYC/AML systems integrate vast amounts of external data including sanctions databases, adverse media sources, corporate registries, and threat intelligence feeds to create comprehensive risk profiles that extend far beyond traditional financial data. This integration enables financial institutions to identify previously unknown risks, verify customer information across multiple sources, and maintain up-to-date awareness of changing risk factors that might impact customer relationships.

The sophistication of external data integration includes real-time API connections to authoritative data sources, intelligent data fusion algorithms that can resolve conflicting information from multiple sources, and automated validation processes that ensure data quality and accuracy. These capabilities enable financial institutions to maintain comprehensive and current risk assessments while reducing reliance on manual data gathering and verification processes.

Privacy and Data Protection Considerations

The implementation of AI in KYC/AML processes must carefully balance compliance effectiveness with privacy protection requirements under regulations such as GDPR, CCPA, and other data protection frameworks. AI systems must implement privacy-by-design principles that minimize data collection, ensure secure data processing, and maintain comprehensive audit trails that demonstrate compliance with data protection requirements.

Advanced privacy protection techniques including differential privacy, federated learning, and secure multi-party computation enable AI systems to perform sophisticated analysis while protecting individual privacy rights and maintaining compliance with evolving data protection regulations. These approaches ensure that financial institutions can leverage the power of AI for compliance purposes without compromising customer privacy or violating data protection requirements.

Regulatory Technology Integration

The integration of AI KYC/AML systems with broader regulatory technology platforms enables comprehensive compliance management that extends beyond financial crime detection to include regulatory reporting, stress testing, and risk management functions. This integration creates unified compliance ecosystems that can share data, coordinate responses, and maintain consistent risk assessment approaches across different regulatory requirements.

RegTech integration includes automated regulatory reporting capabilities that can generate required filings directly from AML monitoring systems, comprehensive audit trail management that maintains detailed records of all compliance activities, and regulatory change management systems that can automatically update compliance controls based on new regulatory requirements or enforcement guidance.

Performance Metrics and Effectiveness Measurement

The effectiveness of AI KYC/AML systems is measured through sophisticated performance metrics that include detection accuracy rates, false positive reduction percentages, processing time improvements, and regulatory examination outcomes. These metrics enable financial institutions to demonstrate the value of their AI investments while identifying areas for continued improvement and optimization.

Advanced performance measurement includes predictive analytics that can forecast future compliance risks, cost-benefit analysis that can quantify the return on investment for AI compliance systems, and benchmarking capabilities that can compare performance against industry standards and best practices. This comprehensive measurement approach ensures that AI systems deliver measurable improvements in compliance effectiveness and operational efficiency.

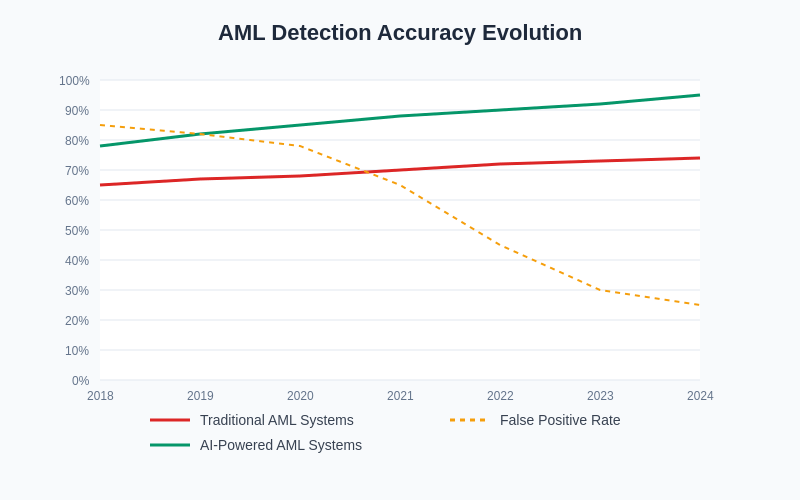

The evolution of AML detection accuracy demonstrates the significant improvements achieved through AI implementation, showing substantial reductions in false positives while maintaining or improving true positive detection rates over traditional rule-based systems.

Future Developments and Emerging Technologies

The future of AI in KYC/AML continues to evolve with emerging technologies including quantum computing, advanced neural networks, and distributed ledger technologies that promise to further enhance compliance capabilities while addressing current limitations in processing speed, scalability, and cross-institutional cooperation. These developments will enable even more sophisticated analysis capabilities while maintaining the privacy and security requirements essential for financial compliance.

Emerging AI technologies include explainable AI systems that can provide detailed explanations for compliance decisions, federated learning approaches that enable collaborative threat detection without sharing sensitive data, and advanced simulation capabilities that can model potential money laundering scenarios to test and improve detection systems. These innovations will continue to advance the effectiveness of AI compliance systems while addressing regulatory concerns about algorithmic transparency and accountability.

Implementation Challenges and Best Practices

Successful implementation of AI KYC/AML systems requires careful attention to data quality, model governance, regulatory approval processes, and staff training requirements that ensure effective deployment and ongoing management of sophisticated compliance technologies. Financial institutions must develop comprehensive implementation strategies that address technical, regulatory, and operational considerations while maintaining business continuity throughout the deployment process.

Best practices for AI compliance implementation include phased deployment approaches that enable gradual system integration, comprehensive testing protocols that validate system performance across diverse scenarios, and ongoing monitoring programs that ensure continued effectiveness and regulatory compliance. These practices help ensure that AI investments deliver expected benefits while minimizing implementation risks and regulatory concerns.

The transformation of financial compliance through artificial intelligence represents a fundamental shift toward more effective, efficient, and adaptive approaches to regulatory compliance and financial crime detection. As these technologies continue to evolve, financial institutions that successfully implement AI KYC/AML systems will be better positioned to manage compliance risks, protect against financial crimes, and maintain competitive advantages in an increasingly complex regulatory environment. The future of financial compliance lies in the intelligent integration of human expertise with advanced AI capabilities that can adapt to emerging threats while maintaining the highest standards of regulatory compliance and customer protection.

Disclaimer

This article is for informational purposes only and does not constitute legal, regulatory, or professional advice. The implementation of AI KYC/AML systems should be undertaken with appropriate legal and regulatory guidance. Readers should consult with qualified professionals and conduct thorough due diligence before implementing any compliance technologies. Regulatory requirements vary by jurisdiction and may change over time, requiring ongoing monitoring and system updates to maintain compliance.