The mortgage industry stands at the precipice of a technological revolution that promises to transform the fundamental processes governing home financing. Artificial intelligence has emerged as the driving force behind this transformation, introducing automated loan approval systems that streamline traditional underwriting processes while maintaining the rigorous standards necessary for sound lending practices. This evolution represents more than mere technological advancement; it signifies a complete reimagining of how financial institutions assess risk, evaluate borrowers, and deliver mortgage services in an increasingly digital economy.

Explore the latest AI innovations in financial services to understand how cutting-edge technologies are reshaping traditional banking and lending practices. The integration of AI into mortgage underwriting represents a convergence of advanced analytics, machine learning algorithms, and comprehensive data processing capabilities that together create a more efficient, accurate, and accessible home financing ecosystem.

The Evolution of Mortgage Underwriting Technology

Traditional mortgage underwriting has long been characterized by manual processes, extensive paperwork, and prolonged approval timelines that often frustrated both borrowers and lenders. The conventional approach required loan officers to manually review credit reports, verify income documentation, assess property values, and evaluate debt-to-income ratios through time-intensive procedures that could take weeks or even months to complete. This manual framework, while thorough, created bottlenecks in the lending process and limited the ability of financial institutions to serve growing numbers of borrowers efficiently.

The advent of AI-powered underwriting systems has fundamentally altered this landscape by introducing sophisticated algorithms capable of processing vast amounts of financial data in real-time. These systems can simultaneously analyze credit histories, employment records, bank statements, tax returns, and property appraisals while cross-referencing this information against historical lending data and market trends. The result is a comprehensive risk assessment that can be completed in minutes rather than weeks, enabling lenders to make informed decisions quickly while maintaining the thoroughness necessary for responsible lending practices.

Machine Learning Algorithms in Risk Assessment

The core strength of AI mortgage underwriting lies in its sophisticated machine learning algorithms that continuously improve their predictive accuracy through exposure to new data patterns and lending outcomes. These algorithms analyze thousands of variables that traditional underwriting might overlook, including spending patterns, savings behaviors, employment stability indicators, and even social media activity when permitted by borrowers. By examining these comprehensive data sets, AI systems can identify subtle patterns that correlate with loan performance, enabling more nuanced risk assessments than traditional credit scoring methods alone.

Machine learning models excel at detecting non-linear relationships between variables that human underwriters might miss or find difficult to quantify consistently. For instance, an AI system might identify that borrowers with certain combinations of education levels, employment sectors, and spending patterns demonstrate lower default rates even when their credit scores fall below traditional approval thresholds. This capability allows lenders to extend credit to qualified borrowers who might otherwise be rejected by conventional underwriting criteria while maintaining portfolio quality and regulatory compliance.

Discover advanced AI capabilities with Claude for sophisticated financial analysis and decision-making processes that enhance lending accuracy and efficiency. The integration of advanced AI systems enables financial institutions to make more informed lending decisions while reducing processing time and operational costs.

Automated Document Processing and Verification

One of the most significant advantages of AI-powered mortgage underwriting systems lies in their ability to automatically process and verify the extensive documentation required for loan applications. Traditional underwriting required manual review of bank statements, tax returns, pay stubs, employment verification letters, and numerous other financial documents, creating opportunities for human error and significantly extending processing times. AI systems equipped with optical character recognition and natural language processing capabilities can instantly extract relevant information from these documents, verify their authenticity, and cross-reference data points for consistency and accuracy.

These automated verification systems can detect discrepancies that might indicate fraud or documentation errors, flagging potential issues for human review while allowing straightforward applications to proceed without delay. The technology can analyze bank statements to verify income patterns, assess spending behaviors, and identify potential red flags such as unusual large deposits or irregular payment patterns. This comprehensive document analysis ensures that loan decisions are based on accurate, verified information while dramatically reducing the time required for documentation review.

Real-Time Credit and Financial Analysis

AI mortgage underwriting systems leverage real-time data feeds to provide up-to-the-minute assessments of borrower financial health and market conditions. Unlike traditional systems that rely on static credit reports and historical financial statements, AI platforms can access current account balances, recent transaction histories, and live employment verification data to create dynamic borrower profiles that reflect the most current financial circumstances. This real-time analysis capability enables lenders to make decisions based on the borrower’s actual current situation rather than outdated information that might not accurately represent their financial capacity.

The integration of real-time data also allows AI systems to adjust risk assessments based on changing market conditions, economic indicators, and regulatory requirements. These systems can automatically incorporate new risk factors, update scoring models based on recent lending performance data, and adjust approval criteria in response to market volatility or regulatory changes. This dynamic approach ensures that lending decisions remain aligned with current market realities and regulatory expectations while maintaining consistent risk management standards.

Enhanced Fraud Detection Capabilities

The sophisticated pattern recognition capabilities of AI systems have proven particularly valuable in detecting mortgage fraud, a persistent challenge that costs the industry billions of dollars annually. AI algorithms can analyze application data, documentation patterns, and borrower behaviors to identify potential fraud indicators that might escape human detection. These systems can recognize subtle inconsistencies in documentation, identify suspicious application patterns, and detect coordinated fraud schemes that involve multiple applications or parties.

Machine learning models trained on historical fraud data can identify emerging fraud patterns and adapt their detection capabilities to address new schemes as they develop. The systems can analyze metadata from digital documents to detect potential alterations, verify the consistency of information across multiple data sources, and flag applications that exhibit characteristics similar to previously identified fraudulent cases. This proactive approach to fraud detection protects lenders from financial losses while ensuring that legitimate borrowers are not unfairly impacted by overly restrictive verification processes.

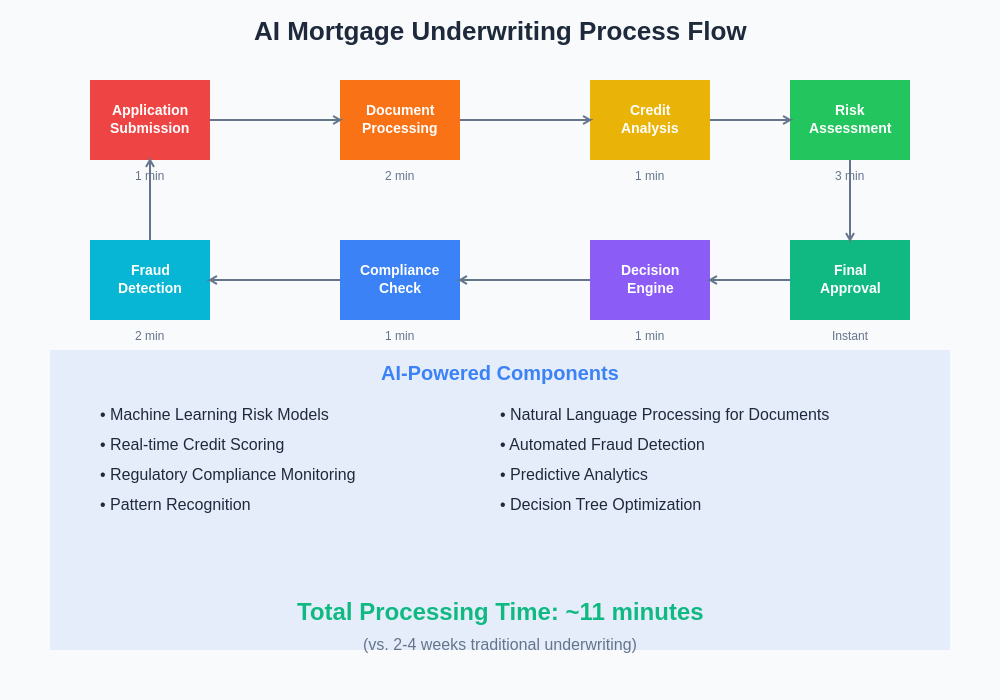

The automated underwriting workflow demonstrates how AI systems seamlessly integrate multiple data sources and analysis stages to produce comprehensive loan decisions. This streamlined process reduces manual intervention while maintaining thorough risk assessment and regulatory compliance throughout the approval pipeline.

Improved Borrower Experience and Accessibility

AI-powered mortgage underwriting has significantly enhanced the borrower experience by reducing application processing times, providing faster loan decisions, and offering more transparent communication throughout the approval process. Borrowers can receive preliminary loan decisions within minutes of submitting their applications, allowing them to move forward with home purchases or refinancing plans with greater confidence and speed. This rapid response capability is particularly valuable in competitive real estate markets where quick financing approval can determine whether a buyer successfully secures their desired property.

The automated nature of AI underwriting also provides more consistent and objective evaluation criteria, reducing the potential for human bias that might disadvantage certain groups of borrowers. AI systems evaluate applications based on quantifiable risk factors and predictive models rather than subjective assessments that might be influenced by unconscious biases. This objectivity can improve access to mortgage credit for underserved communities while ensuring that lending decisions remain based on sound financial principles and regulatory requirements.

Enhance your research capabilities with Perplexity for comprehensive analysis of financial markets and lending trends that inform better decision-making in mortgage and real estate sectors. The combination of AI-powered analysis tools creates a more informed and efficient lending environment for all participants.

Regulatory Compliance and Risk Management

The implementation of AI in mortgage underwriting must navigate complex regulatory requirements designed to ensure fair lending practices, consumer protection, and financial system stability. AI systems are programmed to automatically comply with regulations such as the Fair Credit Reporting Act, Equal Credit Opportunity Act, and various state lending laws, ensuring that automated decisions meet all applicable legal requirements. These systems maintain detailed audit trails of decision-making processes, enabling regulators and lenders to review and validate the reasoning behind loan approvals or denials.

Advanced AI platforms incorporate explainable AI features that provide clear documentation of the factors influencing loan decisions, addressing regulatory requirements for transparency in automated decision-making systems. This capability ensures that borrowers can understand why their applications were approved or denied while providing regulators with the information necessary to monitor compliance with fair lending requirements. The systematic nature of AI decision-making also helps lenders maintain consistent risk management standards across their entire loan portfolio.

Data Integration and Analytics Platform

Modern AI mortgage underwriting systems serve as comprehensive data integration platforms that consolidate information from numerous sources to create holistic borrower profiles. These platforms can simultaneously access credit bureaus, bank account data, employment verification services, property valuation databases, and market analysis tools to gather all relevant information for loan decisions. The integration of diverse data sources enables more accurate risk assessments while reducing the manual effort required to gather and verify borrower information.

The analytics capabilities of these platforms extend beyond individual loan decisions to provide portfolio-level insights that help lenders optimize their underwriting criteria and risk management strategies. AI systems can analyze loan performance data to identify factors that correlate with successful repayment, enabling continuous refinement of underwriting models and risk assessment criteria. This data-driven approach to portfolio management helps lenders maintain optimal risk-return profiles while adapting to changing market conditions and borrower characteristics.

Cost Reduction and Operational Efficiency

The automation provided by AI mortgage underwriting systems delivers significant cost savings for financial institutions by reducing the manual labor required for loan processing and enabling more efficient use of underwriting staff. Traditional underwriting required extensive human involvement in document review, verification processes, and risk assessment activities that could be time-intensive and prone to inconsistency. AI systems handle these routine tasks automatically, allowing human underwriters to focus on complex cases that require specialized expertise and judgment.

The operational efficiency gains from AI implementation extend beyond direct labor savings to include reduced processing times, improved accuracy rates, and enhanced capacity to handle higher loan volumes without proportional increases in staffing requirements. These efficiency improvements enable lenders to offer more competitive rates and terms to borrowers while maintaining healthy profit margins and operational sustainability. The scalability of AI systems also allows lenders to rapidly adjust their processing capacity in response to market demand fluctuations.

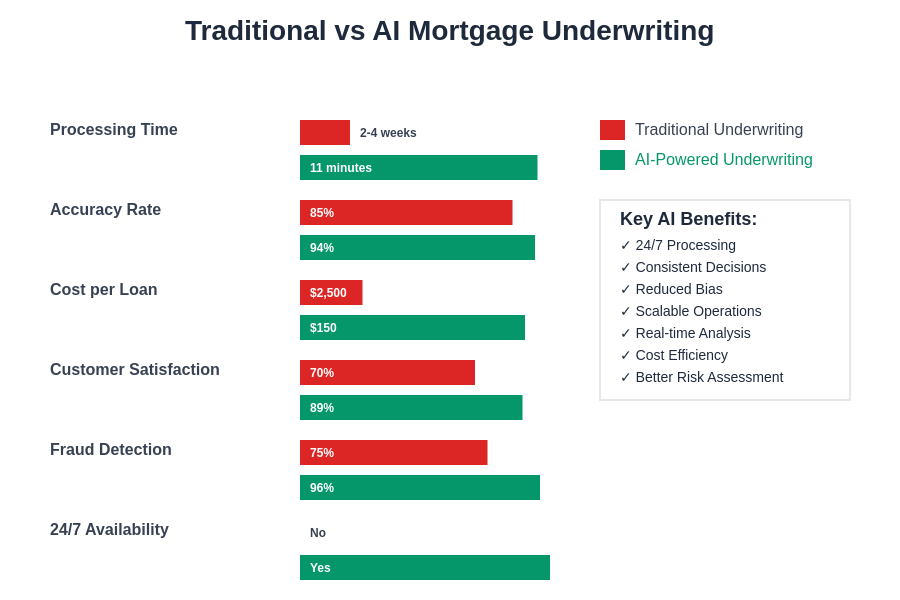

The comparative analysis demonstrates substantial improvements in processing time, accuracy rates, cost efficiency, and borrower satisfaction when transitioning from traditional manual underwriting to AI-powered automated systems. These metrics highlight the transformative impact of artificial intelligence on mortgage lending operations.

Quality Control and Continuous Improvement

AI mortgage underwriting systems incorporate sophisticated quality control mechanisms that continuously monitor decision accuracy and loan performance outcomes to identify opportunities for model improvement. These systems track the performance of approved loans over time, analyzing factors that correlate with successful repayment or default to refine their predictive algorithms. This continuous learning capability enables AI models to adapt to changing economic conditions, borrower behaviors, and market dynamics while maintaining consistent decision quality.

The quality control framework includes automated testing procedures that validate model performance against historical data and benchmark standards, ensuring that AI decisions meet accuracy and consistency requirements. Regular model validation processes examine the statistical performance of AI algorithms, identifying potential biases or drift in decision patterns that might indicate the need for model updates or recalibration. This systematic approach to quality management ensures that AI underwriting systems maintain high standards of decision quality while continuously improving their predictive capabilities.

Integration with Secondary Market Requirements

The secondary mortgage market plays a crucial role in providing liquidity to primary lenders, and AI underwriting systems are designed to ensure that approved loans meet the requirements of secondary market investors and government-sponsored enterprises. These systems incorporate the underwriting guidelines of major secondary market participants, including Fannie Mae, Freddie Mac, and various private investors, ensuring that originated loans can be successfully sold and securitized. This compatibility with secondary market requirements provides lenders with confidence that their AI-approved loans will find ready buyers in the secondary market.

AI systems can automatically verify compliance with secondary market guidelines throughout the underwriting process, flagging potential issues that might prevent loan sale and suggesting modifications that would bring applications into compliance. This proactive approach to secondary market compliance reduces the risk of loan buyback requests and ensures that lenders can efficiently convert their originated loans into liquid capital for additional lending activities. The integration of secondary market requirements into AI underwriting processes creates a seamless flow from loan origination to secondary market sale.

Future Developments and Industry Trends

The future of AI mortgage underwriting promises even more sophisticated capabilities as machine learning technologies continue to advance and new data sources become available for analysis. Emerging technologies such as alternative credit scoring models, blockchain-based verification systems, and Internet of Things data integration will further enhance the accuracy and comprehensiveness of automated underwriting decisions. These developments will enable lenders to serve increasingly diverse borrower populations while maintaining sound risk management practices.

The evolution toward fully digital mortgage processes will likely incorporate AI underwriting as a central component of end-to-end automation that spans from initial application through loan closing and servicing. This comprehensive digitization will reduce processing times even further while providing borrowers with seamless, user-friendly experiences that rival the convenience of other digital financial services. The continued refinement of AI algorithms and expansion of available data sources will enable even more precise risk assessments and personalized lending solutions.

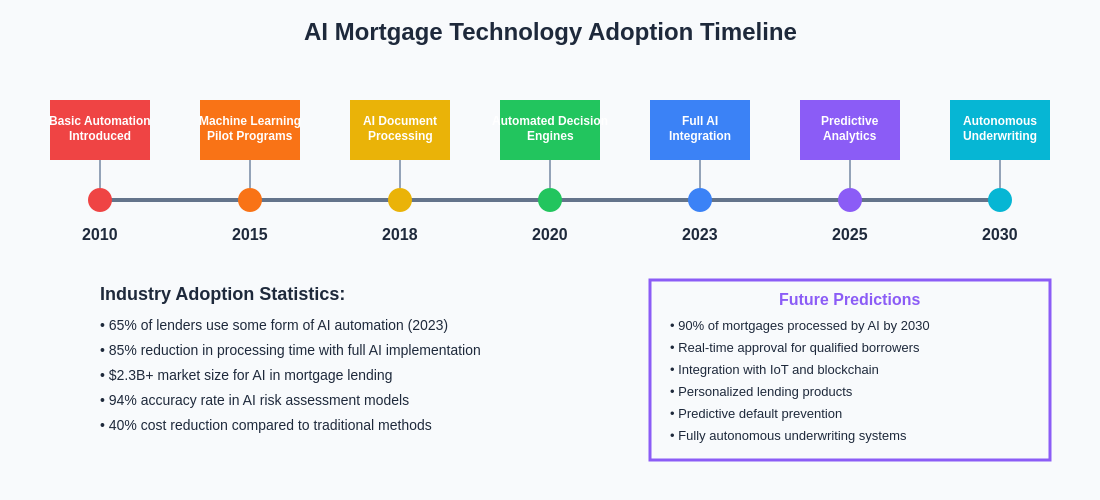

The technology adoption timeline illustrates the progressive integration of AI capabilities into mortgage underwriting, from early automated decision systems to future predictive analytics and fully autonomous processing platforms. This evolution represents a fundamental transformation in how mortgage lending operates across the financial services industry.

Industry Impact and Market Transformation

The widespread adoption of AI mortgage underwriting is reshaping competitive dynamics within the mortgage industry, creating advantages for lenders who effectively implement these technologies while challenging traditional business models that rely heavily on manual processes. Early adopters of AI underwriting systems have gained significant market share by offering faster decision times, more competitive rates, and superior customer experiences that meet evolving borrower expectations for digital service delivery.

The transformation extends beyond individual lenders to influence the broader mortgage ecosystem, including mortgage brokers, real estate agents, and settlement service providers who must adapt their processes to accommodate faster loan approvals and digital documentation requirements. This ecosystem-wide change is driving innovation throughout the real estate finance industry while creating new opportunities for technology vendors and service providers who support digital mortgage processes.

The democratization of advanced underwriting capabilities through AI technology is enabling smaller lenders and credit unions to compete more effectively with large banks by accessing sophisticated risk assessment tools that were previously available only to institutions with extensive technological resources. This leveling of the competitive playing field benefits borrowers through increased competition and innovation while supporting a more diverse and resilient mortgage lending industry.

Conclusion and Strategic Implications

The integration of artificial intelligence into mortgage underwriting represents a paradigm shift that extends far beyond simple process automation to encompass fundamental changes in how financial institutions assess risk, serve customers, and compete in the marketplace. The benefits of AI-powered underwriting systems including improved processing speed, enhanced accuracy, reduced costs, and better borrower experiences create compelling value propositions for lenders while supporting broader industry objectives of increased efficiency and accessibility.

The strategic implications of AI adoption in mortgage underwriting require careful consideration of implementation challenges, regulatory compliance requirements, and the need for ongoing investment in technology infrastructure and staff training. Successful implementation demands thoughtful integration of AI capabilities with existing operational processes, comprehensive quality control frameworks, and commitment to continuous improvement and adaptation as technologies and market conditions evolve.

The future success of mortgage lenders will increasingly depend on their ability to effectively leverage AI and other advanced technologies while maintaining the human expertise and judgment necessary for complex lending decisions and customer relationship management. The organizations that successfully balance technological innovation with sound lending principles and excellent customer service will be best positioned to thrive in the evolving mortgage landscape shaped by artificial intelligence and digital transformation.

Disclaimer

This article is for informational purposes only and does not constitute financial, legal, or investment advice. The views expressed are based on current understanding of AI technologies and their applications in mortgage underwriting. Readers should conduct their own research and consult with qualified professionals when making decisions about mortgage lending, technology implementation, or financial services. The effectiveness and regulatory compliance of AI underwriting systems may vary depending on specific implementations, market conditions, and regulatory requirements.