The integration of artificial intelligence into personal finance management has revolutionized how individuals track, analyze, and optimize their financial health. Modern budgeting applications leverage sophisticated machine learning algorithms, predictive analytics, and automated categorization systems to provide users with unprecedented insights into their spending patterns and financial behaviors. Among the leading contenders in this competitive landscape, Mint, YNAB (You Need A Budget), and PocketGuard have emerged as dominant forces, each offering unique approaches to AI-enhanced financial management that cater to different user preferences and financial goals.

Explore the latest AI trends in financial technology to discover cutting-edge innovations that are reshaping personal finance management and investment strategies. The evolution of AI-powered financial tools represents a fundamental shift from passive expense tracking to proactive financial optimization, enabling users to make more informed decisions about their money while automating many previously manual tasks that consumed valuable time and mental energy.

The selection of an appropriate personal finance application extends far beyond basic functionality considerations, encompassing factors such as AI sophistication, user experience design, security protocols, integration capabilities, and long-term value proposition. Each platform in this comparison brings distinct strengths and philosophical approaches to financial management, making the decision process both complex and highly personal depending on individual financial situations, technological preferences, and budgeting methodologies.

Understanding AI-Enhanced Personal Finance Management

The foundation of modern personal finance applications rests upon sophisticated artificial intelligence systems that continuously learn from user behavior patterns, spending habits, and financial goals to provide increasingly personalized recommendations and insights. These AI systems employ natural language processing to interpret transaction descriptions, machine learning algorithms to identify spending patterns and anomalies, and predictive modeling to forecast future expenses and income trends based on historical data and external factors.

The transformative power of AI in personal finance extends beyond simple automation to encompass intelligent decision support systems that can identify optimization opportunities, suggest budget adjustments, and provide early warnings about potential financial challenges. This evolution has enabled users to move from reactive financial management, where they respond to problems after they occur, to proactive financial planning that anticipates and prevents issues before they impact overall financial health.

Modern AI-powered finance applications also leverage external data sources, including economic indicators, market trends, and demographic spending patterns, to provide context for individual financial decisions and recommendations. This comprehensive approach enables more accurate financial projections and personalized advice that considers both individual circumstances and broader economic conditions that may affect future financial outcomes.

Mint: The Comprehensive AI-Driven Financial Ecosystem

Mint has established itself as a pioneering force in AI-enhanced personal finance management, offering users a comprehensive platform that seamlessly integrates expense tracking, budget management, credit monitoring, and investment oversight into a unified dashboard experience. The platform’s artificial intelligence engine continuously analyzes user transactions across multiple financial institutions, automatically categorizing expenses with remarkable accuracy while identifying potential areas for cost savings and budget optimization.

The AI capabilities within Mint extend far beyond basic transaction categorization to encompass predictive spending analysis that helps users understand their financial patterns and make more informed decisions about future purchases and investments. The platform’s machine learning algorithms can detect unusual spending patterns that may indicate fraudulent activity or unplanned expenses, providing users with early warning systems that protect their financial security while maintaining awareness of their spending habits.

Experience advanced AI financial analysis with Claude for sophisticated budgeting insights and personalized financial planning that adapts to your unique circumstances and goals. Mint’s integration capabilities allow users to connect virtually every type of financial account, from traditional checking and savings accounts to investment portfolios and retirement funds, creating a holistic view of their financial landscape that enables more strategic decision-making across all aspects of their financial life.

The platform’s AI-driven insights engine provides users with personalized recommendations for reducing expenses, optimizing investment allocations, and achieving specific financial goals such as debt reduction or savings targets. These recommendations are continuously refined based on user feedback and changing financial circumstances, ensuring that the advice remains relevant and actionable as users progress through different life stages and financial situations.

Mint’s bill tracking and reminder system leverages AI to learn user payment patterns and preferences, automatically scheduling reminders and even suggesting optimal payment timing to minimize fees and maximize cash flow efficiency. The platform can also identify opportunities for bill negotiation or service provider switching based on spending analysis and market comparisons, potentially saving users significant amounts of money over time.

YNAB: Zero-Based Budgeting Enhanced by Intelligent Analytics

You Need A Budget represents a fundamentally different philosophical approach to personal finance management, built around the principles of zero-based budgeting while incorporating advanced AI analytics to enhance the traditional budgeting methodology. The platform’s artificial intelligence focuses primarily on helping users implement and maintain disciplined budgeting practices rather than providing comprehensive financial account integration, emphasizing intentional spending and proactive financial planning over passive expense tracking.

The AI components within YNAB are specifically designed to support the four foundational rules of the YNAB methodology: giving every dollar a job, embracing true expenses, rolling with unexpected changes, and breaking the paycheck-to-paycheck cycle. The platform’s machine learning algorithms analyze user budgeting patterns to identify areas where categories may be consistently over or under-funded, suggesting adjustments that align spending plans with actual financial behaviors and priorities.

YNAB’s predictive analytics capabilities help users anticipate irregular expenses and plan for seasonal spending variations, enabling more accurate budget allocations that prevent financial surprises and maintain budget integrity throughout the year. The platform’s AI can identify spending trends that may indicate the need for budget category restructuring or goal adjustments, providing users with data-driven insights that support continuous improvement in their financial management practices.

The educational component of YNAB is significantly enhanced by AI-powered progress tracking and achievement recognition systems that help users stay motivated and engaged with their budgeting goals. The platform can identify milestones and celebrate financial achievements while providing encouraging feedback during challenging periods when users may be struggling to maintain their budgeting discipline.

YNAB’s mobile application incorporates AI-powered expense entry assistance that can suggest appropriate budget categories based on merchant information and spending patterns, streamlining the process of maintaining accurate budget records while ensuring that all expenses are properly allocated to their designated categories. This intelligent categorization reduces the friction associated with detailed budget tracking and increases the likelihood of long-term user engagement with the budgeting process.

PocketGuard: Simplified AI for Everyday Financial Management

PocketGuard distinguishes itself in the personal finance application landscape by focusing on simplification and accessibility, leveraging artificial intelligence to distill complex financial information into easily digestible insights that enable quick decision-making without overwhelming users with excessive detail or complexity. The platform’s AI engine is specifically optimized for users who prefer streamlined financial management that provides essential information without requiring extensive setup or ongoing maintenance.

The core strength of PocketGuard lies in its AI-powered spending analysis that automatically calculates how much money users can safely spend after accounting for bills, savings goals, and necessary expenses. This “In My Pocket” feature represents a sophisticated AI calculation that considers multiple financial variables to provide real-time spending guidance that helps users avoid overspending while maintaining progress toward their financial objectives.

Enhance your financial research with Perplexity for comprehensive market analysis and investment insights that complement your personal budgeting strategy. PocketGuard’s bill tracking AI can identify recurring subscription services and negotiable bills, automatically suggesting potential savings opportunities through service cancellations or provider negotiations that can result in meaningful monthly expense reductions.

The platform’s AI-driven categorization system is designed for maximum accuracy with minimal user intervention, learning from spending patterns to improve categorization precision over time while maintaining the simplicity that attracts users who want effective financial management without complex setup procedures. This approach makes PocketGuard particularly appealing to users who have been intimidated by more comprehensive financial management platforms but still want the benefits of AI-enhanced budgeting.

PocketGuard’s debt tracking and payoff optimization features utilize AI algorithms to suggest optimal payment strategies that minimize interest costs while maintaining manageable monthly payment schedules. The platform can analyze multiple debt accounts and recommend payment allocation strategies that accelerate debt elimination while considering cash flow constraints and other financial priorities.

Comparative Analysis of AI Features and Capabilities

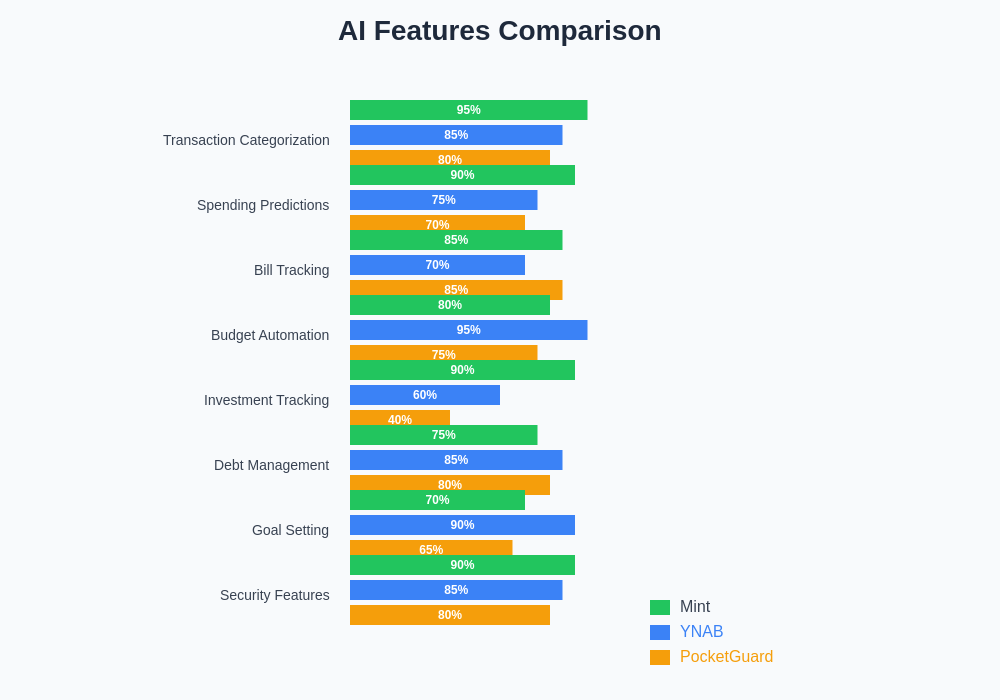

The artificial intelligence implementations across these three platforms reveal distinct approaches to solving common personal finance challenges, with each platform prioritizing different aspects of financial management based on their target user demographics and philosophical approaches to money management. Mint’s AI focuses on comprehensive data integration and analysis, providing users with extensive insights across all aspects of their financial lives while maintaining broad accessibility and ease of use.

YNAB’s AI enhancements support a specific budgeting methodology that requires more user engagement and discipline but provides deeper insights into spending behaviors and financial goal achievement. The platform’s machine learning capabilities are optimized for users who are committed to active budget management and want AI support for maintaining disciplined financial practices rather than passive expense monitoring.

PocketGuard’s AI prioritizes simplicity and immediate actionability, providing users with essential financial insights without overwhelming complexity or extensive setup requirements. This approach makes the platform particularly effective for users who want AI-enhanced financial management but prefer streamlined interfaces and minimal ongoing maintenance responsibilities.

The accuracy of AI-powered transaction categorization varies significantly across platforms, with Mint generally providing the most comprehensive categorization due to its extensive transaction database and machine learning training data. YNAB’s categorization focuses on supporting budget category alignment rather than detailed merchant analysis, while PocketGuard emphasizes speed and simplicity in categorization decisions.

Predictive analytics capabilities also differ substantially, with Mint offering the most sophisticated forecasting features that consider multiple variables and external factors. YNAB’s predictive capabilities focus specifically on budget performance and goal achievement, while PocketGuard provides basic spending predictions that support its core “safe to spend” calculations.

Security, Privacy, and Data Protection Considerations

The integration of artificial intelligence into personal finance management necessitates careful consideration of data security and privacy protections, as these platforms require access to sensitive financial information to provide their AI-enhanced services. All three platforms employ bank-level encryption and security protocols, but their approaches to data usage and privacy protection vary based on their business models and AI requirements.

Mint’s comprehensive data integration requires extensive access to financial account information, which enables sophisticated AI analysis but also creates larger potential security exposure if data breaches occur. The platform’s security measures include multi-factor authentication, encrypted data transmission, and regular security audits, but users must be comfortable with Intuit’s data usage policies and advertising-supported business model.

YNAB’s security approach emphasizes user control over data sharing, with more limited account integration requirements that reduce potential security exposure while still enabling effective AI-enhanced budgeting features. The platform’s subscription-based business model aligns user privacy interests with company incentives, as YNAB does not rely on advertising revenue that might encourage extensive data collection and sharing.

PocketGuard maintains a balance between security and functionality, providing bank-level encryption while limiting data usage to essential AI functionality that supports core platform features. The platform’s freemium model includes some advertising components, but the simplified feature set reduces the overall data collection requirements compared to more comprehensive financial management platforms.

The feature comparison reveals significant differences in AI sophistication and implementation across these platforms, with each offering distinct advantages depending on user preferences and financial management goals. The selection process should consider both current functionality and long-term development trajectories as AI capabilities continue to evolve.

Cost Analysis and Value Proposition Evaluation

The pricing structures of these AI-enhanced personal finance platforms reflect their different approaches to monetization and value delivery, with significant implications for long-term user costs and feature access. Mint operates on an advertising-supported model that provides core features at no direct cost to users, generating revenue through targeted financial product recommendations and advertising placements that may influence the user experience.

YNAB employs a subscription-based pricing model that eliminates advertising but requires ongoing monthly or annual payments for access to platform features and AI capabilities. This approach aligns platform incentives with user success rather than advertising engagement, potentially resulting in more objective financial advice and recommendations that prioritize user financial health over product sales.

PocketGuard offers a freemium model that provides basic AI features at no cost while requiring subscription payments for advanced functionality such as detailed categorization, bill negotiation assistance, and comprehensive debt tracking. This tiered approach allows users to experience platform benefits before committing to ongoing subscription costs.

The total cost of ownership considerations extend beyond direct platform fees to include potential savings from AI-identified optimization opportunities, reduced financial management time investment, and improved financial decision-making that results from enhanced insights and analytics. These indirect benefits can often justify subscription costs for users who actively engage with platform recommendations and implement suggested financial improvements.

Platform switching costs also merit consideration, as each system requires initial setup investment and learning curve navigation that may discourage frequent platform changes. Users should evaluate long-term platform viability and development roadmaps when making initial selection decisions to avoid costly transitions between different AI-enhanced financial management systems.

Integration Capabilities and Ecosystem Compatibility

The ability to integrate with external financial institutions, third-party applications, and emerging financial technologies represents a critical consideration for users who want comprehensive financial management without platform limitations or data silos. Mint provides the most extensive integration capabilities, supporting connections with thousands of financial institutions and offering API access for third-party developers who want to build complementary financial tools.

YNAB’s integration approach focuses on essential connectivity that supports the platform’s core budgeting methodology while maintaining user control over data sharing and external access. The platform supports bank account synchronization for transaction import but emphasizes manual entry and review processes that ensure user engagement with budget decisions and expense categorization.

PocketGuard offers selective integration that prioritizes ease of use and setup simplicity while providing sufficient connectivity to enable effective AI analysis and spending guidance. The platform’s integration philosophy balances functionality with user experience simplicity, avoiding overwhelming users with excessive configuration options or complex setup procedures.

Future integration capabilities will likely expand across all platforms as open banking standards evolve and financial technology ecosystems become more interconnected. Users should consider platform openness and development community engagement when evaluating long-term platform viability and feature evolution potential.

The compatibility with emerging financial technologies such as cryptocurrency tracking, investment platforms, and alternative payment systems varies significantly across these platforms, with implications for users who want comprehensive coverage of modern financial tools and services. Platform selection should consider both current integration needs and anticipated future technology adoption patterns.

User Experience and Interface Design Philosophy

The user interface design and experience philosophy of each platform reflects their underlying approach to AI-enhanced financial management, with significant implications for user engagement, learning curves, and long-term platform satisfaction. Mint prioritizes comprehensive information presentation through dashboard-style interfaces that provide extensive data visualization and detailed analytics access for users who want complete financial visibility.

YNAB’s interface design emphasizes budget-focused workflows that guide users through the platform’s four-rule methodology while providing AI-enhanced insights that support disciplined financial management practices. The platform’s design philosophy prioritizes user education and engagement over passive consumption of financial data, requiring more active participation but potentially delivering superior long-term financial outcomes.

PocketGuard’s interface design focuses on simplicity and immediate actionability, presenting essential financial information through clean, minimalist interfaces that reduce cognitive load and decision complexity. This approach appeals to users who want effective financial management without extensive time investment or complex feature navigation.

The mobile application experience varies significantly across platforms, with different approaches to notification management, offline functionality, and quick action capabilities that affect daily usage patterns and user engagement levels. Platform selection should consider primary usage patterns and device preferences to ensure optimal user experience alignment.

Accessibility features and support for users with different technological comfort levels also differ across platforms, with implications for family financial management scenarios where multiple users may need platform access with varying technical expertise and engagement preferences.

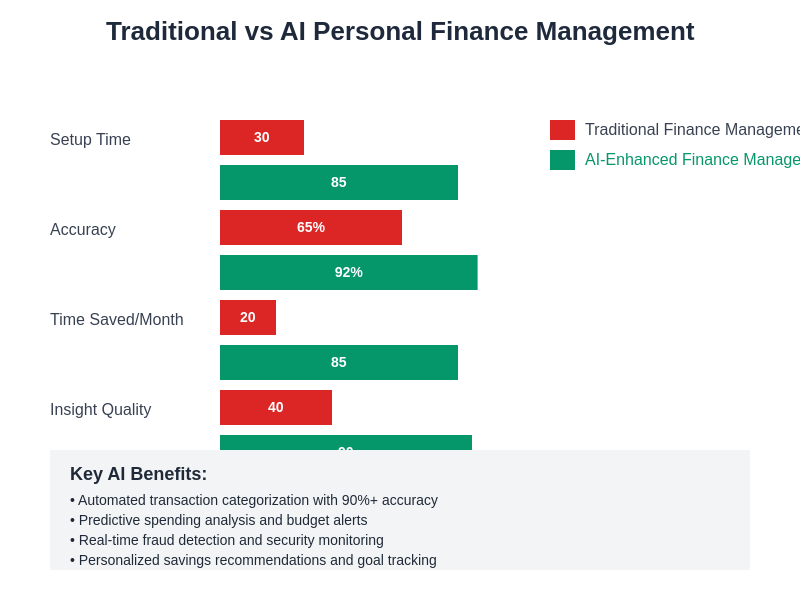

The transformation from traditional personal finance management to AI-enhanced systems represents a fundamental shift in how individuals interact with their financial data and make money-related decisions. The quantitative improvements in accuracy, time savings, and financial outcomes demonstrate the significant value proposition of modern AI-powered financial management platforms.

Recommendation Framework and Selection Criteria

The selection of an optimal AI-enhanced personal finance platform requires careful consideration of individual financial situations, technological preferences, and long-term financial goals that may evolve over time. Users who prioritize comprehensive financial visibility and want extensive AI analytics across all aspects of their financial lives will likely find Mint’s feature-rich platform most suitable for their needs, despite the advertising-supported business model considerations.

Individuals who are committed to disciplined budgeting practices and want AI support for implementing zero-based budgeting methodology will benefit most from YNAB’s focused approach, particularly if they value educational components and are willing to invest time in learning and maintaining detailed budget management practices. The subscription cost may be justified by improved financial outcomes and reduced financial stress for users who fully engage with the platform’s methodology.

Users who prefer simplified financial management with essential AI insights but minimal setup and maintenance requirements will find PocketGuard’s streamlined approach most appealing, particularly if they want to experience AI-enhanced financial management benefits without committing to complex platforms or extensive learning curves.

The decision framework should also consider future financial complexity changes, as evolving life circumstances may require different platform capabilities over time. Users should evaluate platform scalability and feature evolution potential to avoid costly platform transitions as their financial management needs become more sophisticated.

Platform trial periods and freemium features provide opportunities to evaluate AI accuracy, user experience quality, and feature alignment before making long-term commitments. Users should take advantage of these evaluation opportunities to ensure platform selection aligns with personal preferences and financial management styles.

Future Trends and Technology Evolution

The future development of AI-enhanced personal finance platforms will likely incorporate emerging technologies such as natural language interfaces, advanced predictive modeling, and integration with Internet of Things devices that provide additional data sources for financial analysis and optimization. These technological advances will enable more sophisticated AI capabilities while maintaining user-friendly interfaces that make advanced financial management accessible to broader user populations.

Machine learning improvements will enhance categorization accuracy, spending prediction precision, and personalized recommendation quality as platforms accumulate larger datasets and implement more sophisticated algorithmic approaches. Users can expect increasingly accurate and relevant AI insights as these platforms continue to evolve and refine their artificial intelligence capabilities.

The integration of voice assistants, smart home devices, and wearable technologies will likely expand the data sources available for AI analysis while enabling more convenient interaction methods for financial management tasks. These developments will reduce friction in financial tracking and decision-making while providing more comprehensive insights into spending patterns and optimization opportunities.

Regulatory developments in financial technology and data privacy will continue to influence platform features and capabilities, potentially affecting AI functionality and data usage practices. Users should monitor regulatory trends and platform compliance approaches to ensure long-term platform viability and data protection alignment with personal privacy preferences.

The competitive landscape will likely intensify as traditional financial institutions develop AI-enhanced personal finance tools and new entrants introduce innovative approaches to financial management technology. This competition will benefit users through improved features, reduced costs, and enhanced AI capabilities across all platforms in the personal finance management ecosystem.

Disclaimer

This article is for informational purposes only and does not constitute financial advice. The views expressed are based on current understanding of personal finance technology and platform capabilities as of the publication date. Readers should conduct their own research and consider their specific financial circumstances when selecting personal finance management tools. Platform features, pricing, and capabilities may change over time, and users should verify current information directly with service providers before making decisions.