The financial services industry continues to grapple with an increasingly complex regulatory landscape that demands sophisticated technological solutions for accurate, timely, and comprehensive compliance reporting. As regulatory requirements evolve and multiply across jurisdictions, financial institutions are turning to artificial intelligence-powered platforms to navigate this intricate environment while maintaining operational efficiency and regulatory compliance. Two prominent solutions have emerged as industry leaders in this space: AxiomSL’s comprehensive regulatory reporting platform and Moody’s Analytics advanced compliance suite.

Stay updated with the latest AI developments in financial technology as regulatory technology continues to revolutionize how financial institutions approach compliance challenges. The integration of artificial intelligence into regulatory reporting represents a fundamental shift from reactive compliance management to proactive risk identification and automated regulatory adherence that transforms traditional banking operations.

The Evolution of Regulatory Reporting Technology

The transformation from manual compliance processes to AI-driven regulatory reporting has fundamentally altered how financial institutions approach risk management and regulatory adherence. Traditional regulatory reporting methods often involved labor-intensive processes, manual data aggregation, and significant risks of human error that could result in costly compliance failures and regulatory penalties. The advent of sophisticated AI technologies has enabled financial institutions to automate complex reporting workflows, enhance data accuracy, and maintain continuous compliance monitoring across multiple regulatory frameworks simultaneously.

Modern regulatory reporting platforms leverage machine learning algorithms, natural language processing, and advanced analytics to interpret regulatory requirements, extract relevant data from disparate systems, and generate comprehensive compliance reports that meet stringent regulatory standards. This technological evolution has not only improved the accuracy and timeliness of regulatory submissions but has also provided financial institutions with unprecedented visibility into their compliance posture and risk exposure across various regulatory domains.

The competitive landscape for AI-powered regulatory reporting solutions has intensified as financial institutions seek platforms that can adapt to evolving regulatory requirements, integrate seamlessly with existing technology infrastructure, and provide comprehensive compliance coverage across multiple jurisdictions. AxiomSL and Moody’s Analytics have positioned themselves as leading providers in this space, each offering distinct approaches to addressing the complex challenges of modern regulatory compliance.

AxiomSL: Comprehensive Regulatory Reporting Platform

AxiomSL has established itself as a pioneering force in regulatory reporting technology through its comprehensive platform that addresses the full spectrum of compliance requirements across banking, insurance, and investment management sectors. The platform’s architecture is built on a foundation of advanced data management capabilities, sophisticated calculation engines, and flexible reporting frameworks that enable financial institutions to meet diverse regulatory obligations while maintaining operational efficiency and accuracy.

The AxiomSL platform distinguishes itself through its extensive regulatory coverage, supporting over 700 regulatory reporting requirements across more than 60 jurisdictions worldwide. This comprehensive coverage enables multinational financial institutions to consolidate their regulatory reporting operations on a single platform, reducing operational complexity while ensuring consistent compliance standards across all regulatory domains. The platform’s modular architecture allows institutions to implement specific regulatory modules based on their operational requirements, creating cost-effective solutions that scale with organizational growth and regulatory expansion.

Experience advanced AI capabilities with Claude for analyzing complex regulatory requirements and developing comprehensive compliance strategies that align with organizational objectives and regulatory expectations. The integration of AI-powered analysis tools enhances the strategic planning capabilities of compliance teams while providing sophisticated insights into regulatory trends and requirement changes.

Central to AxiomSL’s value proposition is its robust data management framework that enables seamless integration with existing banking systems, data warehouses, and third-party applications. The platform’s data lineage capabilities provide complete transparency into data sources, transformation processes, and calculation methodologies, enabling regulatory auditors and compliance teams to verify the accuracy and reliability of reported information. This comprehensive data governance approach has proven essential for financial institutions operating under strict regulatory scrutiny and audit requirements.

The platform’s calculation engine represents a significant technological advancement in regulatory reporting, capable of processing complex regulatory formulas, performing sophisticated risk calculations, and generating detailed analytical reports that support both regulatory compliance and business decision-making. The engine’s flexibility enables financial institutions to customize calculation methodologies based on specific regulatory interpretations while maintaining consistency with established regulatory standards and industry best practices.

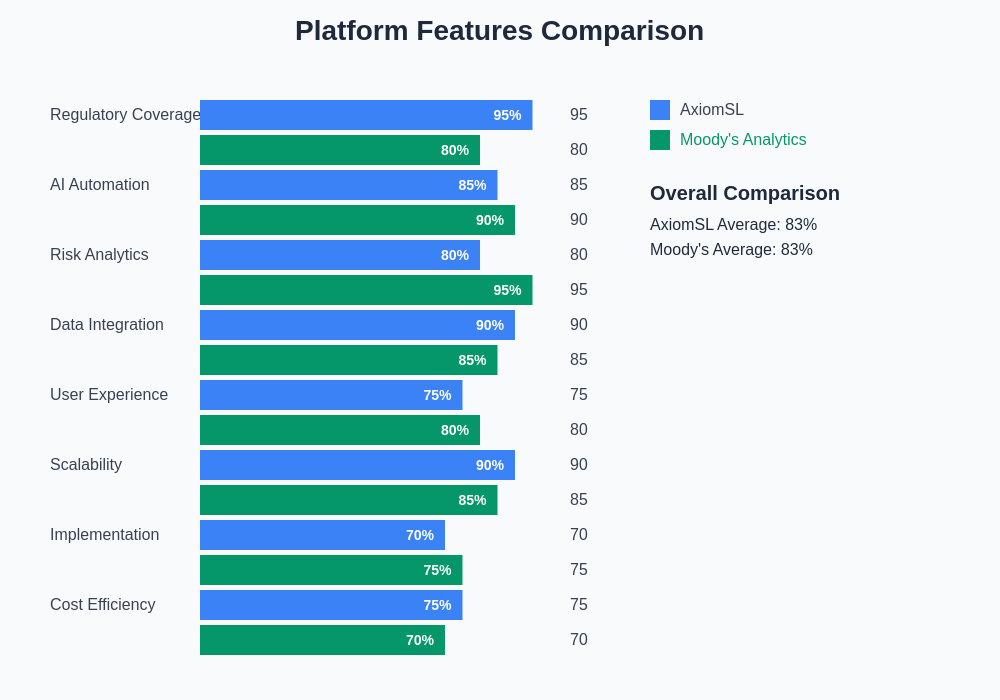

The comprehensive feature comparison reveals the distinct strengths and capabilities that differentiate leading regulatory reporting platforms in the modern compliance landscape. Each platform brings unique technological approaches and specialized functionalities that address specific aspects of regulatory compliance and risk management requirements.

Moody’s Analytics: Advanced Compliance and Risk Management

Moody’s Analytics has leveraged its extensive expertise in financial risk assessment and credit analysis to develop a sophisticated compliance platform that combines regulatory reporting capabilities with advanced risk management functionalities. The platform integrates Moody’s proprietary risk models, extensive financial databases, and advanced analytics to provide financial institutions with comprehensive solutions for regulatory compliance, stress testing, and risk assessment requirements.

The Moody’s Analytics approach to regulatory reporting emphasizes the integration of compliance functions with broader risk management objectives, enabling financial institutions to achieve regulatory compliance while simultaneously enhancing their risk management capabilities and strategic decision-making processes. This integrated approach has resonated with financial institutions seeking to maximize the value derived from their compliance investments while building comprehensive risk management frameworks that support business growth and regulatory adherence.

The platform’s strength lies in its sophisticated modeling capabilities that leverage Moody’s extensive experience in financial risk assessment and economic analysis. These models enable financial institutions to perform complex stress testing scenarios, conduct comprehensive credit risk assessments, and generate detailed regulatory reports that demonstrate thorough understanding of risk exposure and mitigation strategies. The integration of economic scenarios and forward-looking risk assessments provides regulatory submissions with enhanced analytical depth that supports both compliance requirements and strategic planning objectives.

Moody’s Analytics has invested significantly in artificial intelligence and machine learning capabilities that enhance the platform’s ability to identify emerging risks, detect anomalous patterns in financial data, and provide predictive insights that enable proactive risk management. These AI-powered capabilities have proven particularly valuable for institutions operating in volatile market conditions or facing evolving regulatory requirements that demand sophisticated analytical approaches to compliance and risk assessment.

Technology Architecture and Integration Capabilities

The technological foundations of both AxiomSL and Moody’s Analytics platforms reflect different philosophical approaches to addressing regulatory reporting challenges while maintaining high standards of performance, reliability, and scalability. AxiomSL’s architecture emphasizes comprehensive data integration capabilities, flexible reporting frameworks, and extensive regulatory coverage that supports diverse compliance requirements across multiple jurisdictions and regulatory domains.

The AxiomSL platform utilizes a service-oriented architecture that enables seamless integration with existing banking systems, data warehouses, and third-party applications through standardized APIs and data connectors. This architectural approach facilitates rapid implementation and minimizes disruption to existing operational processes while providing financial institutions with comprehensive regulatory reporting capabilities that scale with organizational growth and regulatory expansion requirements.

Moody’s Analytics has developed its platform architecture around advanced analytics engines, sophisticated modeling capabilities, and extensive data integration frameworks that support both regulatory compliance and broader risk management objectives. The platform’s architecture leverages cloud-native technologies, distributed computing capabilities, and advanced data processing frameworks that enable rapid analysis of large datasets while maintaining high standards of performance and reliability.

Explore comprehensive research capabilities with Perplexity to analyze complex regulatory requirements, benchmark compliance solutions, and develop strategic implementation plans that align with organizational objectives and regulatory expectations. The ability to conduct thorough research and analysis is essential for making informed decisions about regulatory technology investments and compliance strategy development.

Both platforms have invested extensively in artificial intelligence and machine learning capabilities that enhance their ability to automate complex compliance processes, identify potential issues before they become problematic, and provide predictive insights that support proactive compliance management. However, their approaches to AI integration reflect different priorities and strategic objectives that appeal to different segments of the financial services market.

Regulatory Coverage and Compliance Capabilities

The scope and depth of regulatory coverage represent critical differentiating factors between AxiomSL and Moody’s Analytics platforms, as financial institutions require comprehensive solutions that address their specific regulatory obligations while providing flexibility to adapt to evolving compliance requirements. AxiomSL’s extensive regulatory coverage encompasses over 700 reporting requirements across more than 60 jurisdictions, making it particularly attractive to large multinational financial institutions with complex compliance obligations spanning multiple regulatory domains.

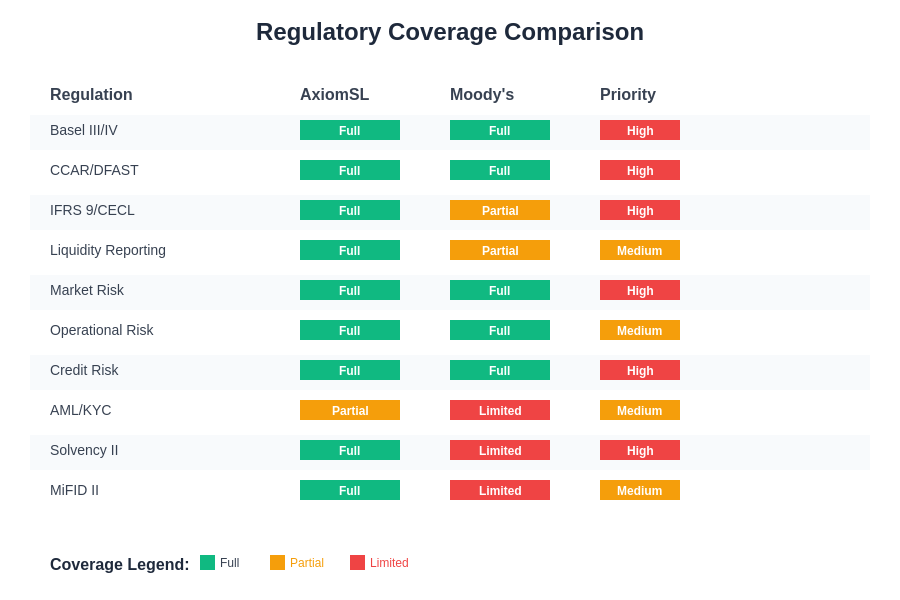

AxiomSL’s regulatory coverage includes comprehensive support for Basel III/IV requirements, CCAR/DFAST stress testing, IFRS 9 and CECL accounting standards, liquidity reporting requirements, and specialized regulations for insurance and investment management sectors. This comprehensive coverage enables financial institutions to consolidate their regulatory reporting operations while ensuring consistent compliance standards across all applicable regulatory frameworks and jurisdictions.

Moody’s Analytics focuses on providing deep expertise in specific regulatory areas where the company’s risk management and analytical capabilities provide significant competitive advantages. The platform excels in stress testing requirements, credit risk assessments, and economic capital calculations where Moody’s proprietary models and extensive economic databases provide enhanced analytical capabilities that exceed basic compliance requirements.

The regulatory interpretation and implementation approaches of both platforms reflect their respective strengths and market positioning strategies. AxiomSL emphasizes comprehensive regulatory coverage and flexible implementation approaches that accommodate diverse organizational requirements and regulatory interpretations. Moody’s Analytics focuses on providing sophisticated analytical capabilities and risk management insights that enhance the value and strategic utility of regulatory compliance processes.

The comprehensive regulatory coverage analysis demonstrates the extensive scope of compliance requirements addressed by leading regulatory reporting platforms, highlighting the specialized strengths and coverage areas where each solution excels in supporting financial institution compliance obligations.

Implementation Complexity and Resource Requirements

The implementation complexity and resource requirements associated with regulatory reporting platforms represent significant considerations for financial institutions evaluating technology solutions for compliance and risk management applications. AxiomSL’s comprehensive platform requires substantial implementation efforts that involve extensive data mapping, system integration, regulatory configuration, and organizational change management to achieve full operational capability and regulatory compliance.

AxiomSL’s implementation methodology emphasizes thorough requirements analysis, detailed project planning, and phased deployment approaches that minimize operational disruption while ensuring comprehensive platform capabilities are properly configured and validated. The company’s extensive implementation experience and regulatory expertise enable financial institutions to navigate complex deployment challenges while achieving timely implementation milestones and regulatory compliance objectives.

Moody’s Analytics implementation approach focuses on leveraging the platform’s sophisticated modeling capabilities and analytical frameworks to deliver rapid value realization while building comprehensive compliance capabilities over time. The company’s implementation methodology emphasizes quick wins and incremental capability expansion that enables financial institutions to realize immediate benefits while building long-term compliance and risk management capabilities.

The resource requirements for both platforms reflect their comprehensive capabilities and sophisticated technological architectures that demand skilled technical teams, experienced project managers, and knowledgeable compliance professionals to achieve successful implementations. Financial institutions must carefully evaluate their internal capabilities and implementation timelines when selecting regulatory reporting platforms to ensure successful deployment and operational integration.

Cost Structure and Value Proposition Analysis

The cost structures and value propositions of AxiomSL and Moody’s Analytics platforms reflect different business models and pricing approaches that appeal to distinct segments of the financial services market. AxiomSL’s comprehensive platform typically involves significant upfront implementation costs, ongoing licensing fees, and maintenance expenses that reflect the platform’s extensive regulatory coverage and sophisticated technological capabilities.

AxiomSL’s value proposition centers on comprehensive regulatory coverage, operational efficiency improvements, and risk mitigation benefits that justify the platform’s investment requirements through reduced compliance costs, eliminated regulatory penalties, and enhanced operational effectiveness. The platform’s ability to consolidate multiple regulatory reporting requirements on a single technology infrastructure provides long-term cost benefits that often exceed the initial implementation investments.

Moody’s Analytics pricing structure reflects the platform’s sophisticated analytical capabilities, proprietary risk models, and extensive economic databases that provide enhanced value beyond basic regulatory compliance requirements. The platform’s pricing typically includes licensing fees for analytical capabilities, data access charges, and professional services costs associated with implementation and ongoing support requirements.

The return on investment calculations for both platforms must consider not only direct cost savings and efficiency improvements but also risk mitigation benefits, regulatory penalty avoidance, and strategic value creation that results from enhanced risk management capabilities and improved decision-making processes. Financial institutions increasingly recognize that regulatory reporting platforms provide value that extends beyond compliance requirements to support broader business objectives and strategic initiatives.

Performance Metrics and Operational Efficiency

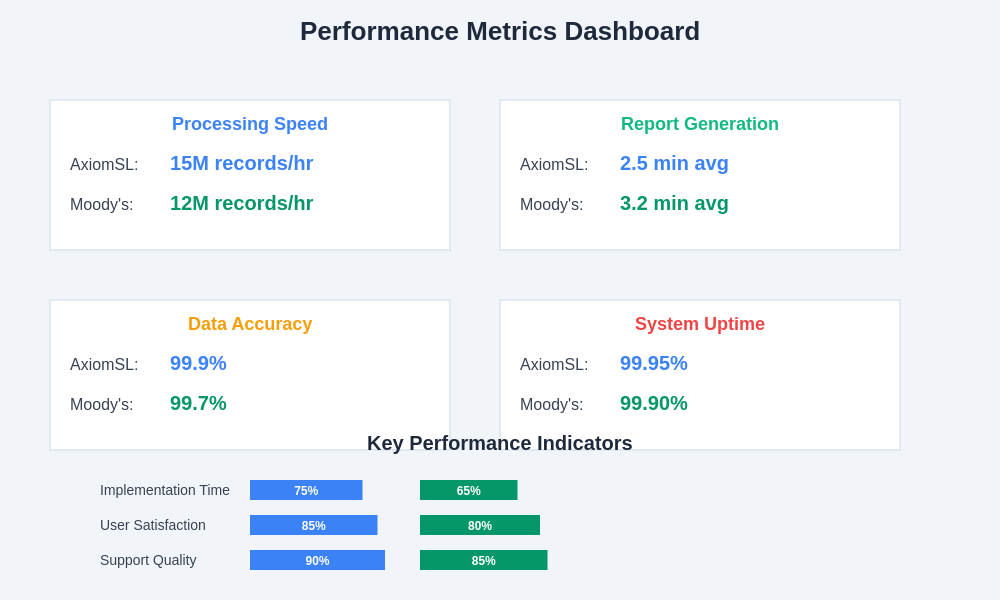

The performance characteristics and operational efficiency metrics of regulatory reporting platforms directly impact their suitability for different organizational requirements and operational environments. AxiomSL’s platform architecture has been optimized for handling large-scale data processing requirements, complex calculation workflows, and high-volume reporting operations that characterize large financial institutions with extensive regulatory obligations.

Performance benchmarking studies have demonstrated AxiomSL’s capability to process massive datasets, execute complex calculations, and generate comprehensive regulatory reports within tight submission deadlines while maintaining high standards of accuracy and reliability. The platform’s scalability characteristics enable financial institutions to accommodate growing data volumes, expanding regulatory requirements, and increasing operational complexity without experiencing performance degradation or operational disruptions.

Moody’s Analytics platform performance reflects its focus on sophisticated analytical processing, complex modeling calculations, and data-intensive risk assessments that require substantial computational resources and advanced processing capabilities. The platform’s performance characteristics have been optimized for analytical workloads, scenario processing, and model execution requirements that support advanced risk management and regulatory compliance applications.

Operational efficiency metrics for both platforms encompass not only technical performance characteristics but also user productivity improvements, process automation benefits, and organizational effectiveness enhancements that result from implementing comprehensive regulatory reporting solutions. These broader efficiency benefits often represent the most significant value drivers for financial institutions investing in advanced compliance technology platforms.

The comprehensive performance analysis reveals the distinct operational characteristics and efficiency metrics that differentiate leading regulatory reporting platforms, providing insights into their suitability for different organizational requirements and operational environments.

Integration Ecosystem and Third-Party Connectivity

The integration capabilities and third-party connectivity features of regulatory reporting platforms play crucial roles in determining their practical utility within complex financial technology environments. AxiomSL has developed extensive integration capabilities that support connectivity with major banking systems, data management platforms, and third-party applications commonly used within financial institutions.

The AxiomSL integration framework includes pre-built connectors for popular banking platforms, standardized APIs for custom integrations, and comprehensive data transformation capabilities that enable seamless connectivity with diverse technology environments. This integration flexibility has proven essential for financial institutions with heterogeneous technology landscapes that require comprehensive regulatory reporting capabilities without extensive system modifications or operational disruptions.

Moody’s Analytics has focused on developing integration capabilities that support its analytical and risk management strengths while providing connectivity with essential banking systems and data sources. The platform’s integration approach emphasizes data quality, analytical consistency, and model integrity requirements that support sophisticated risk assessments and regulatory compliance applications.

Both platforms recognize the importance of cloud connectivity, modern API frameworks, and emerging technology integration capabilities that enable financial institutions to leverage contemporary technology architectures while maintaining comprehensive regulatory reporting capabilities. The evolution toward cloud-native deployments and microservices architectures has influenced both platforms’ technical development priorities and integration strategy implementations.

Security, Governance, and Audit Capabilities

Security and governance capabilities represent fundamental requirements for regulatory reporting platforms operating within highly regulated financial services environments where data protection, audit trails, and compliance verification are essential operational requirements. AxiomSL has implemented comprehensive security frameworks that include encryption protocols, access controls, audit logging, and data governance capabilities that meet stringent financial services security standards.

The AxiomSL security architecture includes role-based access controls, comprehensive audit trails, data lineage tracking, and change management capabilities that enable financial institutions to demonstrate regulatory compliance while maintaining operational security and data integrity. These security capabilities have been validated through extensive regulatory examinations and third-party security assessments that confirm the platform’s suitability for sensitive financial data processing applications.

Moody’s Analytics security framework reflects the company’s extensive experience in handling sensitive financial information and proprietary analytical models that require sophisticated protection mechanisms. The platform includes comprehensive encryption capabilities, secure data transmission protocols, and advanced access controls that protect sensitive financial data while enabling authorized users to access necessary analytical capabilities and regulatory reporting functions.

Governance capabilities for both platforms encompass data quality management, regulatory change tracking, version control systems, and compliance validation frameworks that enable financial institutions to demonstrate regulatory adherence while maintaining operational effectiveness and audit readiness. These governance capabilities have become increasingly important as regulatory scrutiny intensifies and compliance requirements become more sophisticated.

Future Technology Roadmap and Innovation Priorities

The future development roadmaps and innovation priorities of AxiomSL and Moody’s Analytics platforms provide insights into their strategic positioning and competitive differentiation approaches in the evolving regulatory technology landscape. AxiomSL continues to invest in expanding its regulatory coverage, enhancing platform capabilities, and developing advanced automation features that reduce operational complexity while improving compliance effectiveness.

AxiomSL’s innovation priorities include artificial intelligence integration, machine learning capabilities, and advanced analytics features that enable predictive compliance monitoring, automated regulatory interpretation, and intelligent data validation processes. These technological enhancements are designed to reduce manual intervention requirements while improving the accuracy and timeliness of regulatory reporting processes.

Moody’s Analytics is focusing its innovation efforts on expanding its analytical capabilities, developing advanced risk models, and integrating emerging technologies that enhance the platform’s ability to provide sophisticated risk assessments and predictive insights. The company’s research and development investments emphasize machine learning applications, alternative data integration, and advanced modeling techniques that provide competitive advantages in risk management and regulatory compliance applications.

Both platforms are investing in cloud-native architectures, modern user interfaces, and mobile accessibility features that reflect evolving user expectations and technological capabilities. The transition toward cloud-based deployments has enabled both companies to enhance their platforms’ scalability, reliability, and accessibility while reducing implementation complexity and operational costs for financial institution clients.

Strategic Decision Framework and Selection Criteria

Financial institutions evaluating AxiomSL and Moody’s Analytics platforms must consider comprehensive selection criteria that encompass regulatory coverage requirements, technological compatibility, implementation complexity, cost considerations, and strategic alignment with organizational objectives. The decision framework should evaluate both platforms’ capabilities against specific institutional requirements while considering long-term strategic implications and competitive positioning objectives.

Regulatory coverage requirements represent primary selection criteria for many financial institutions, particularly those operating across multiple jurisdictions or subject to diverse regulatory obligations that demand comprehensive compliance capabilities. AxiomSL’s extensive regulatory coverage makes it particularly attractive to large multinational institutions with complex compliance requirements, while Moody’s Analytics sophisticated analytical capabilities appeal to institutions prioritizing advanced risk management and strategic decision-making capabilities.

Technological compatibility and integration requirements significantly influence platform selection decisions, as financial institutions must ensure that chosen solutions integrate effectively with existing technology infrastructure while supporting future technological evolution and modernization initiatives. Both platforms offer comprehensive integration capabilities, but their specific technical approaches and architectural philosophies may align differently with institutional technology strategies and operational requirements.

Implementation complexity and resource requirements must be carefully evaluated against institutional capabilities, timeline constraints, and strategic priorities that influence deployment approaches and success criteria. Financial institutions with limited implementation resources or aggressive timeline requirements may find that one platform’s implementation methodology and support approach better aligns with their specific organizational constraints and objectives.

Cost considerations encompass not only direct platform costs but also implementation expenses, ongoing operational costs, and strategic value realization that results from enhanced compliance capabilities and risk management effectiveness. The total cost of ownership analysis should consider both quantifiable benefits and strategic value creation that supports broader organizational objectives and competitive positioning requirements.

Industry Trends and Competitive Landscape Evolution

The regulatory reporting technology landscape continues to evolve rapidly as financial institutions face increasing regulatory complexity, technological advancement opportunities, and competitive pressures that demand sophisticated compliance solutions and strategic technology investments. Industry trends indicate growing demand for integrated platforms that combine regulatory compliance capabilities with advanced risk management functionalities and strategic decision-making support tools.

Artificial intelligence and machine learning technologies are becoming increasingly prevalent in regulatory reporting applications, enabling automated compliance monitoring, predictive risk assessment, and intelligent regulatory interpretation capabilities that reduce manual intervention requirements while improving accuracy and effectiveness. Both AxiomSL and Moody’s Analytics are investing heavily in AI capabilities, but their approaches reflect different strategic priorities and competitive positioning objectives.

Cloud computing adoption continues to accelerate throughout the financial services industry, driven by scalability requirements, cost optimization objectives, and technological modernization initiatives that enable financial institutions to leverage advanced capabilities while reducing operational complexity and infrastructure costs. The transition toward cloud-native architectures has influenced both platforms’ development priorities and deployment methodologies.

Regulatory technology consolidation trends suggest that financial institutions increasingly prefer comprehensive platforms that address multiple compliance requirements rather than specialized point solutions that require extensive integration and coordination efforts. This trend favors platforms like AxiomSL and Moody’s Analytics that offer broad capabilities and comprehensive regulatory coverage, but also intensifies competitive pressure to continuously expand capabilities and enhance value propositions.

The competitive landscape for regulatory reporting platforms is expanding as traditional technology vendors, specialized compliance providers, and emerging fintech companies develop innovative solutions that address specific market segments and regulatory requirements. This competitive evolution creates opportunities for financial institutions to access advanced capabilities while also requiring careful evaluation of vendor stability, long-term viability, and strategic alignment with institutional objectives.

Implementation Best Practices and Success Factors

Successful implementation of comprehensive regulatory reporting platforms requires careful planning, dedicated resources, and structured project management approaches that address technical, operational, and organizational change requirements. Financial institutions that achieve successful platform deployments typically invest significant effort in requirements analysis, stakeholder alignment, and project governance frameworks that ensure implementation objectives are clearly defined and consistently pursued.

Data preparation and system integration represent critical success factors that significantly influence implementation timelines, operational effectiveness, and long-term platform utility. Financial institutions must invest in comprehensive data quality assessment, system mapping, and integration planning activities that identify potential challenges and develop mitigation strategies before beginning platform deployment activities.

Organizational change management emerges as a crucial success factor that requires dedicated attention and resources throughout the implementation process. Successful platform deployments typically include comprehensive training programs, user adoption strategies, and ongoing support frameworks that enable organizational teams to effectively utilize platform capabilities while adapting to new processes and operational procedures.

Testing and validation procedures must be comprehensive and rigorous to ensure that implemented platforms meet regulatory requirements, accuracy standards, and operational performance expectations. Successful implementations typically include extensive testing phases that validate data accuracy, calculation methodologies, report formatting, and system integration functionality before transitioning to full operational deployment.

Ongoing platform optimization and capability expansion require continuous attention and investment to ensure that regulatory reporting solutions continue to meet evolving requirements while providing enhanced value and operational effectiveness. Financial institutions that realize maximum value from their platform investments typically establish dedicated teams responsible for platform administration, regulatory updates, and continuous improvement initiatives that optimize platform capabilities and organizational benefits.

Conclusion and Strategic Recommendations

The selection between AxiomSL and Moody’s Analytics platforms ultimately depends on specific institutional requirements, strategic objectives, and operational priorities that vary significantly across different financial services organizations. AxiomSL’s comprehensive regulatory coverage and extensive platform capabilities make it particularly suitable for large multinational institutions with complex compliance requirements and diverse regulatory obligations spanning multiple jurisdictions and regulatory domains.

Moody’s Analytics sophisticated analytical capabilities and risk management expertise appeal to institutions that prioritize advanced risk assessment capabilities and strategic decision-making support alongside regulatory compliance requirements. The platform’s integration of compliance functions with broader risk management objectives provides enhanced value for institutions seeking to maximize the strategic utility of their regulatory technology investments.

Both platforms represent significant technological achievements that address complex regulatory reporting challenges while providing advanced capabilities that support broader organizational objectives and competitive positioning requirements. The continued evolution of regulatory requirements, technological capabilities, and competitive pressures will likely drive further innovation and capability expansion from both providers as they compete for market leadership in the growing regulatory technology sector.

Financial institutions evaluating these platforms should conduct comprehensive assessments that consider not only current requirements but also future strategic objectives, regulatory evolution expectations, and technological advancement opportunities that will influence long-term platform utility and value realization. The investment in comprehensive regulatory reporting technology represents a strategic decision that will influence institutional competitiveness, operational effectiveness, and regulatory compliance capabilities for many years to come.

Disclaimer

This article is for informational purposes only and does not constitute professional advice regarding financial technology selection, regulatory compliance strategies, or investment decisions. The views expressed are based on publicly available information and industry analysis that may not reflect the most current platform capabilities or market conditions. Readers should conduct thorough due diligence, consult with qualified professionals, and evaluate their specific requirements when making technology selection decisions. The effectiveness and suitability of regulatory reporting platforms may vary significantly based on organizational requirements, regulatory obligations, and implementation approaches.