The intersection of artificial intelligence and financial risk management represents one of the most transformative developments in modern finance, fundamentally reshaping how institutions approach portfolio optimization and stress testing. As financial markets become increasingly complex and interconnected, traditional risk management methodologies struggle to capture the nuanced relationships between assets, market conditions, and systemic risks that characterize today’s global financial ecosystem. Artificial intelligence has emerged as a powerful solution to these challenges, offering sophisticated analytical capabilities that enable more precise risk assessment, dynamic portfolio optimization, and comprehensive stress testing scenarios that were previously impossible to implement at scale.

Stay updated with the latest AI trends in finance to understand how cutting-edge technologies are continuously reshaping risk management practices and investment strategies. The evolution of AI-driven risk management represents not merely an incremental improvement over existing methodologies, but a fundamental paradigm shift that enables financial institutions to navigate uncertainty with unprecedented precision and adaptability.

The Evolution of Risk Management Through AI

Traditional risk management approaches have long relied on historical data analysis, statistical models, and human expertise to assess potential threats to investment portfolios and financial institutions. While these methods have served the industry for decades, they often struggle to adapt to rapidly changing market conditions, identify complex non-linear relationships between variables, and process the massive volumes of data that characterize modern financial markets. The integration of artificial intelligence into risk management practices has addressed these limitations by introducing adaptive learning capabilities, real-time data processing, and sophisticated pattern recognition that can identify emerging risks before they materialize into significant losses.

The transformation brought about by AI in risk management extends beyond simple automation of existing processes. Machine learning algorithms can discover hidden correlations in vast datasets, identify emerging market trends, and adapt their risk models continuously based on new information. This dynamic approach to risk assessment enables financial institutions to maintain more accurate risk profiles, optimize their portfolios more effectively, and respond to market changes with greater agility than ever before possible.

Advanced Portfolio Optimization Through Machine Learning

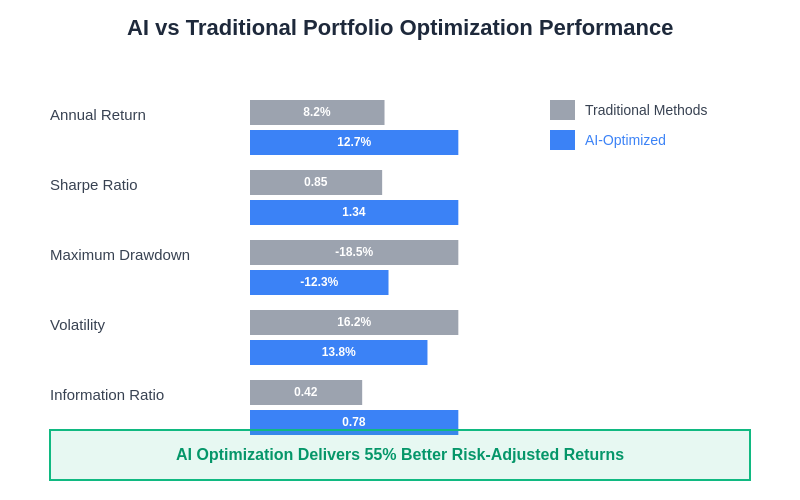

Portfolio optimization has been fundamentally revolutionized through the application of machine learning algorithms that can process complex multi-dimensional data and identify optimal asset allocation strategies under varying market conditions. Traditional portfolio optimization methods, such as Modern Portfolio Theory, while groundbreaking in their time, operate under assumptions that often do not hold in real-world market conditions. AI-powered optimization algorithms can account for non-linear relationships, time-varying correlations, and complex market dynamics that traditional models struggle to capture effectively.

Machine learning approaches to portfolio optimization utilize sophisticated algorithms such as reinforcement learning, genetic algorithms, and neural networks to continuously refine investment strategies based on market feedback and performance outcomes. These systems can process vast amounts of market data, economic indicators, news sentiment, and alternative data sources to make more informed allocation decisions that adapt to changing market conditions in real-time.

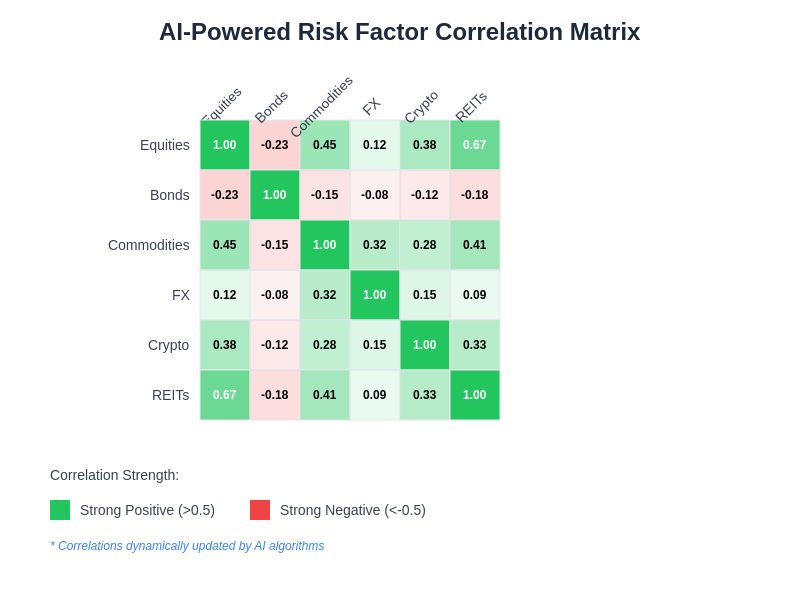

The dynamic correlation analysis capabilities of AI systems enable real-time monitoring of risk factor relationships, identifying when traditional asset correlations begin to break down during market stress events. This sophisticated analysis helps portfolio managers understand the true diversification benefits of their holdings and adjust allocations accordingly to maintain optimal risk-adjusted returns.

Enhance your financial analysis with Claude’s advanced reasoning capabilities to leverage AI-powered insights for more sophisticated risk management and portfolio optimization strategies. The synergy between human financial expertise and artificial intelligence creates powerful analytical capabilities that surpass what either could achieve independently.

Dynamic Risk Factor Modeling and Identification

One of the most significant contributions of artificial intelligence to risk management lies in its ability to identify and model complex risk factors that traditional approaches might overlook. AI systems can analyze thousands of variables simultaneously, identifying subtle relationships and emerging risk patterns that human analysts might miss. This capability is particularly valuable in today’s interconnected financial markets, where risks can propagate rapidly across different asset classes, geographic regions, and market sectors.

Machine learning algorithms excel at detecting regime changes in market behavior, identifying periods of increased correlation during stress events, and recognizing early warning signals that indicate potential market disruptions. These capabilities enable risk managers to adjust their strategies proactively rather than reactively, potentially avoiding significant losses and capitalizing on opportunities that arise during periods of market volatility.

Comprehensive Stress Testing Methodologies

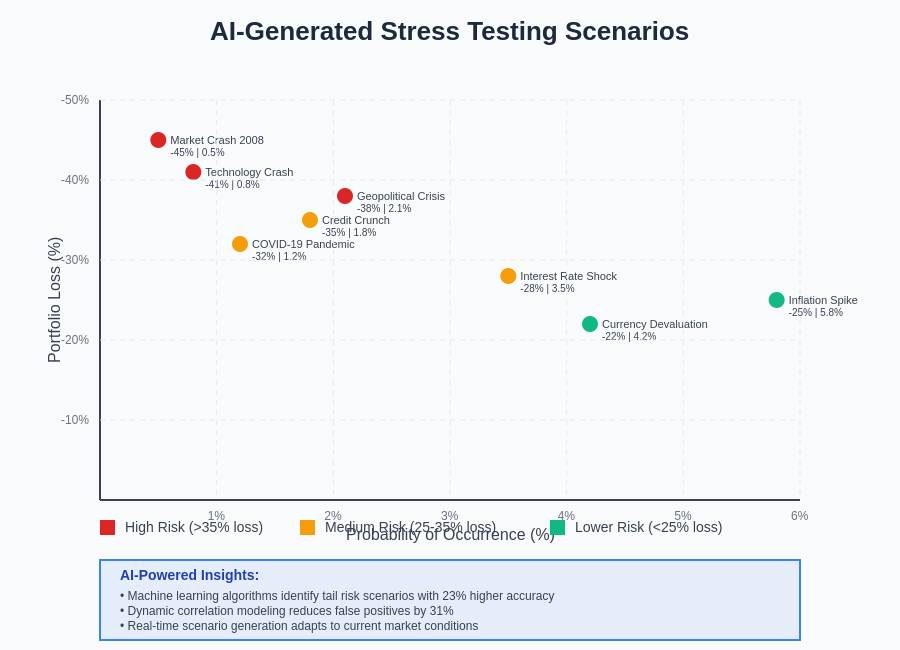

Stress testing has evolved dramatically through the incorporation of artificial intelligence, moving beyond traditional scenario-based approaches to encompass dynamic, adaptive testing methodologies that can generate thousands of potential market scenarios and assess portfolio performance under each condition. AI-powered stress testing systems can simulate complex market environments, incorporating multiple risk factors simultaneously and examining their interactions under extreme conditions.

These advanced stress testing capabilities enable financial institutions to understand their vulnerability to various types of market shocks, including those that have never occurred historically but remain theoretically possible. By generating synthetic scenarios based on learned market patterns, AI systems can identify potential vulnerabilities that might not be apparent through historical backtesting alone.

The comprehensive scenario generation capabilities of AI systems enable financial institutions to explore thousands of potential market conditions, assessing portfolio resilience across various probability distributions and identifying tail risk events that could significantly impact performance. This systematic approach to stress testing provides deeper insights into portfolio vulnerabilities and helps institutions prepare for extreme market conditions.

Real-Time Risk Monitoring and Alert Systems

The implementation of artificial intelligence in risk management has enabled the development of sophisticated real-time monitoring systems that can track portfolio performance, risk metrics, and market conditions continuously. These systems can process streaming market data, news feeds, social media sentiment, and other information sources to provide immediate alerts when risk levels exceed predetermined thresholds or when unusual market conditions are detected.

Real-time risk monitoring systems powered by AI can identify emerging risks as they develop, enabling risk managers to take immediate corrective action before small problems escalate into significant losses. This proactive approach to risk management represents a substantial improvement over traditional periodic risk assessments that might miss rapidly developing threats.

Discover comprehensive research capabilities with Perplexity for in-depth analysis of market conditions, regulatory developments, and emerging risk factors that could impact your portfolio optimization strategies. Access to real-time information and analysis capabilities enhances the effectiveness of AI-powered risk management systems.

Alternative Data Integration and Analysis

Modern AI-powered risk management systems excel at integrating and analyzing alternative data sources that provide unique insights into market conditions and potential risk factors. These data sources include satellite imagery, social media sentiment, web scraping data, credit card transactions, and numerous other non-traditional information streams that can provide early indicators of economic trends and market movements.

The ability to process and extract meaningful insights from these diverse data sources gives AI-powered risk management systems a significant advantage in identifying emerging risks and opportunities. Alternative data analysis can provide leading indicators that traditional financial metrics might not capture, enabling more proactive risk management and portfolio optimization decisions.

Regulatory Compliance and Reporting Automation

Artificial intelligence has significantly streamlined regulatory compliance and reporting processes in risk management, automating the generation of required reports and ensuring adherence to complex regulatory requirements. AI systems can continuously monitor portfolio compositions, risk metrics, and trading activities to ensure compliance with regulatory constraints and automatically flag potential violations before they occur.

The automation of compliance processes not only reduces operational costs and human error but also enables more frequent and comprehensive monitoring of regulatory requirements. This capability is particularly valuable in highly regulated industries where compliance failures can result in significant penalties and reputational damage.

Behavioral Finance Integration and Sentiment Analysis

AI-powered risk management systems have incorporated insights from behavioral finance to better understand how human psychology and market sentiment influence asset prices and risk dynamics. Machine learning algorithms can analyze news sentiment, social media discussions, analyst reports, and other textual data to gauge market mood and predict how behavioral factors might impact portfolio performance.

This integration of behavioral analysis with traditional quantitative risk models provides a more comprehensive understanding of market dynamics and helps identify potential risks that arise from irrational market behavior, herding effects, and sentiment-driven price movements that purely quantitative models might not capture effectively.

Multi-Asset Class Risk Management

The complexity of modern investment portfolios, which often span multiple asset classes, geographic regions, and investment strategies, requires sophisticated risk management approaches that can account for cross-asset correlations and dependencies. AI-powered risk management systems excel at analyzing these complex relationships and providing integrated risk assessments across diverse portfolio components.

Machine learning algorithms can identify subtle relationships between different asset classes that might not be apparent through traditional correlation analysis, particularly during periods of market stress when correlations often increase unexpectedly. This capability enables more effective diversification strategies and better understanding of portfolio-wide risk exposure.

Operational Risk Management and Automation

Beyond market risk, artificial intelligence has enhanced operational risk management by automating the identification and mitigation of operational threats such as system failures, human errors, and process breakdowns. AI systems can monitor operational metrics, identify unusual patterns that might indicate emerging problems, and automatically trigger corrective actions or alerts.

The automation of operational risk management processes reduces the likelihood of costly operational failures while improving the efficiency of risk management operations. AI systems can learn from historical operational incidents to improve their ability to predict and prevent similar problems in the future.

Cybersecurity and Technology Risk Assessment

As financial institutions become increasingly dependent on technology infrastructure, cybersecurity and technology risks have become critical components of comprehensive risk management programs. AI-powered security systems can monitor network traffic, identify unusual access patterns, and detect potential security threats in real-time.

These systems can adapt to evolving threat landscapes, learning from new attack patterns and updating their detection capabilities automatically. The integration of cybersecurity risk assessment into broader risk management frameworks ensures that technology risks are properly considered alongside traditional financial risks.

Performance Attribution and Risk Decomposition

AI-enhanced risk management systems provide sophisticated performance attribution and risk decomposition capabilities that help investment managers understand the sources of portfolio returns and risks. Machine learning algorithms can disaggregate portfolio performance into various risk factor contributions, enabling more precise understanding of what drives investment results.

This detailed analysis capability supports more informed decision-making about portfolio construction, risk budgeting, and performance optimization. Understanding the sources of risk and return enables more targeted adjustments to portfolio composition and risk management strategies.

Integration with Trading and Execution Systems

Modern AI-powered risk management systems are increasingly integrated with automated trading and execution systems, enabling real-time risk-adjusted trading decisions and automatic portfolio rebalancing based on changing risk conditions. This integration ensures that risk management considerations are incorporated into every trading decision, rather than being applied as an after-the-fact constraint.

The seamless integration of risk management with trading systems enables more efficient portfolio management and ensures that risk limits are continuously respected throughout the trading process. This real-time risk management approach provides better protection against unexpected market movements and trading errors.

Scenario Generation and Monte Carlo Simulation

Artificial intelligence has revolutionized scenario generation and Monte Carlo simulation techniques used in risk management and portfolio optimization. AI systems can generate more realistic and diverse scenarios by learning from historical market patterns while also creating synthetic scenarios that explore potential future market conditions that may not have historical precedents.

These enhanced simulation capabilities provide more robust stress testing and risk assessment, enabling financial institutions to better understand their potential exposure to extreme market events and tail risks that traditional simulation methods might underestimate.

Machine Learning Model Risk and Validation

As AI becomes more prevalent in risk management, the management of model risk associated with machine learning systems has become a critical consideration. Financial institutions must develop robust frameworks for validating AI models, monitoring their performance over time, and ensuring that they remain effective as market conditions change.

Model risk management for AI systems requires specialized expertise and methodologies that account for the complexity and adaptability of machine learning algorithms. Regular model validation, performance monitoring, and periodic recalibration ensure that AI-powered risk management systems continue to provide reliable and accurate risk assessments.

Future Directions and Emerging Technologies

The future of AI-powered risk management continues to evolve with emerging technologies such as quantum computing, advanced natural language processing, and more sophisticated machine learning architectures. These developments promise to further enhance the capabilities of risk management systems, enabling even more precise risk assessment and portfolio optimization.

Quantum computing, in particular, holds significant promise for solving complex optimization problems that are currently computationally intensive, potentially enabling real-time optimization of large portfolios with thousands of securities. Advanced natural language processing capabilities will improve the analysis of textual data sources and enhance sentiment analysis capabilities.

The continued evolution of AI technologies will likely lead to even more sophisticated risk management systems that can adapt to changing market conditions, identify emerging risks more quickly, and provide more precise portfolio optimization recommendations. Financial institutions that successfully integrate these emerging technologies will gain significant competitive advantages in risk management and investment performance.

The quantitative improvements delivered by AI-powered portfolio optimization are substantial, with institutions reporting significant enhancements in risk-adjusted returns, reduced volatility, and improved Sharpe ratios. These performance improvements demonstrate the tangible value that artificial intelligence brings to modern portfolio management and risk assessment practices.

Disclaimer

This article is for informational purposes only and does not constitute investment advice, financial planning guidance, or professional risk management recommendations. The views expressed are based on current understanding of AI applications in financial risk management and portfolio optimization. Readers should consult with qualified financial professionals and conduct their own research before implementing any risk management strategies or making investment decisions. The effectiveness of AI-powered risk management systems may vary depending on market conditions, implementation quality, and specific use cases. Past performance does not guarantee future results, and all investments carry inherent risks that should be carefully considered.