The implementation of artificial intelligence and machine learning projects has become increasingly prevalent across industries, yet many organizations struggle to accurately measure and justify the return on investment from these technological initiatives. Understanding how to calculate AI ROI is crucial for business leaders, data scientists, and project managers who need to demonstrate value, secure funding, and make informed decisions about resource allocation in an era where AI investments can range from thousands to millions of dollars.

The complexity of measuring AI ROI extends beyond traditional financial metrics, encompassing both quantifiable benefits such as cost savings and revenue generation, as well as intangible advantages like improved customer satisfaction, enhanced decision-making capabilities, and competitive positioning. Stay updated with the latest AI trends and methodologies that are shaping how organizations approach ROI measurement and business value creation through artificial intelligence implementations.

Understanding the Fundamentals of AI ROI Measurement

Calculating return on investment for artificial intelligence projects requires a comprehensive understanding of both the direct and indirect costs associated with AI implementation, as well as the multifaceted benefits that these technologies can deliver across different organizational functions. Unlike traditional software implementations, AI projects often involve ongoing costs for data acquisition, model training, infrastructure scaling, and continuous improvement efforts that must be factored into long-term ROI calculations.

The foundational approach to AI ROI calculation begins with establishing a baseline of current operational performance before AI implementation, which serves as the benchmark against which improvements will be measured. This baseline should encompass relevant key performance indicators such as processing time, error rates, customer satisfaction scores, employee productivity metrics, and any other quantifiable measures that the AI solution is designed to improve. The establishment of accurate baseline measurements is critical because it forms the foundation for demonstrating genuine impact and avoiding the common pitfall of attributing natural business improvements to AI implementation.

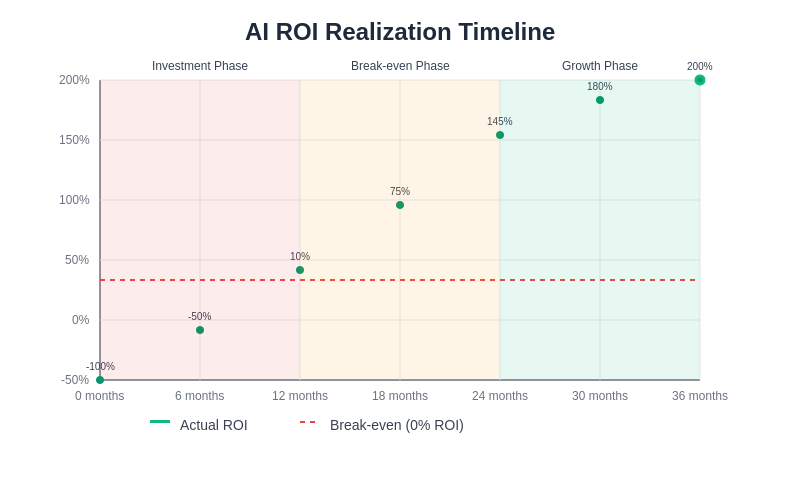

The time horizon for AI ROI measurement typically extends beyond traditional technology projects due to the iterative nature of machine learning model improvement and the gradual realization of benefits as organizations become more proficient in leveraging AI capabilities. Most AI projects require a minimum of 12-18 months to demonstrate meaningful ROI, with many enterprise-scale implementations requiring 2-3 years to achieve full potential value. This extended timeline necessitates careful consideration of cash flow impacts, opportunity costs, and the strategic value of early AI adoption even when immediate financial returns may be limited.

Developing a Comprehensive Cost Framework

The total cost of ownership for AI projects encompasses several distinct categories of expenses that must be carefully tracked and allocated to ensure accurate ROI calculations. Initial development costs typically include data scientist salaries, software licensing fees, cloud computing resources, data acquisition expenses, and any consulting or external development services required to build and deploy AI solutions. These upfront investments can be substantial, particularly for organizations building custom AI capabilities rather than implementing pre-built solutions.

Ongoing operational costs represent a significant component of AI project expenses and include infrastructure costs for model hosting and scaling, data storage and processing fees, continuous model training and improvement efforts, monitoring and maintenance activities, and the personnel costs associated with managing AI systems. These recurring expenses must be projected accurately over the entire lifecycle of the AI implementation to avoid underestimating the true cost of ownership and overestimating potential returns.

Hidden costs often emerge during AI implementation and can significantly impact ROI calculations if not properly anticipated and budgeted. These may include data cleaning and preparation expenses, integration costs for connecting AI systems with existing business applications, change management and training expenses for employees who will work with AI tools, compliance and security measures required for AI systems, and the opportunity cost of internal resources diverted from other projects to support AI initiatives.

Explore advanced AI capabilities and tools that can help streamline cost management and improve ROI measurement accuracy through automated tracking and analysis of AI project expenses and performance metrics.

Quantifying Direct Financial Benefits

Direct financial benefits from AI implementation typically fall into several measurable categories that can be directly attributed to AI system performance and translated into monetary value. Cost reduction benefits often represent the most straightforward ROI calculations, including labor cost savings through automation, reduced error rates and associated correction costs, decreased processing time and improved operational efficiency, lower customer service costs through AI-powered self-service options, and reduced infrastructure costs through optimized resource utilization.

Revenue generation opportunities created by AI implementation can provide substantial returns on investment, particularly when AI enables new business models, improved customer experiences, or enhanced product offerings. These revenue benefits may include increased sales through personalized recommendations and targeted marketing, higher customer retention rates due to improved service quality, premium pricing enabled by AI-enhanced product features, new revenue streams created by AI-powered services or insights, and improved market share through competitive advantages gained from AI capabilities.

The quantification of direct financial benefits requires careful tracking of performance metrics before and after AI implementation, with appropriate controls to isolate the impact of AI from other business changes or market factors. Organizations should establish clear measurement protocols and data collection procedures to ensure that claimed benefits can be substantiated and defended during budget reviews or ROI assessments.

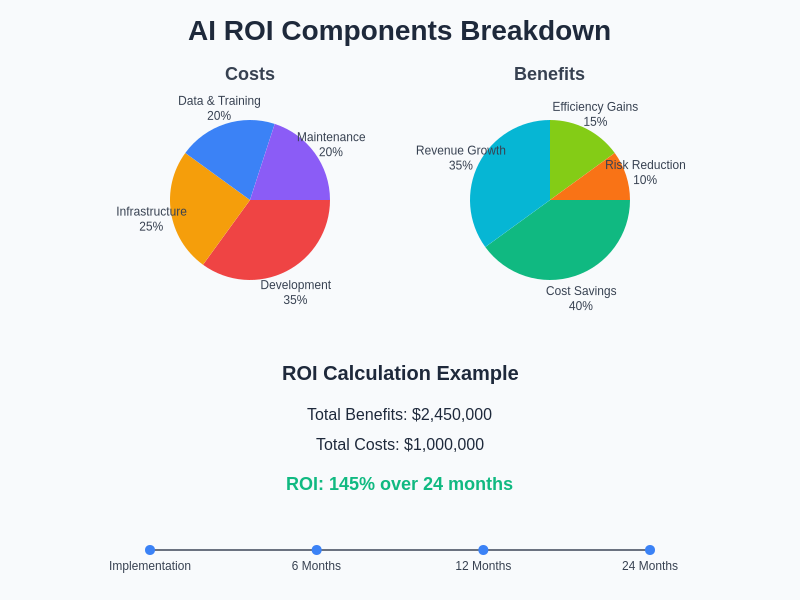

The comprehensive breakdown of AI ROI components reveals the complex interplay between various cost factors and benefit categories that must be carefully balanced to achieve positive returns on artificial intelligence investments. Understanding these relationships is essential for developing accurate financial projections and making informed decisions about AI project prioritization and resource allocation.

Measuring Indirect and Strategic Value

Beyond direct financial impacts, AI projects often deliver significant indirect benefits that, while more challenging to quantify, can represent substantial value to organizations and should be included in comprehensive ROI assessments. Improved decision-making capabilities enabled by AI-generated insights can lead to better strategic choices, reduced risks, and enhanced competitive positioning that may not immediately translate to measurable financial outcomes but provide long-term value that exceeds initial AI investments.

Employee productivity improvements represent another category of indirect benefits that can be substantial but require careful measurement methodologies to quantify accurately. AI tools that augment human capabilities, automate routine tasks, or provide intelligent assistance can significantly enhance employee effectiveness, job satisfaction, and retention rates. The value of these improvements can be estimated through productivity metrics, employee surveys, and analysis of task completion times and quality improvements.

Customer experience enhancements driven by AI implementations often result in improved satisfaction scores, reduced churn rates, and increased customer lifetime value, though the attribution of these improvements specifically to AI requires careful analysis to avoid overstating benefits. AI-powered personalization, faster response times, more accurate recommendations, and proactive customer service can create competitive advantages that justify AI investments even when direct financial returns are difficult to quantify precisely.

Risk mitigation benefits provided by AI systems, such as fraud detection, predictive maintenance, or compliance monitoring, can deliver substantial value by preventing losses rather than generating direct revenue. The quantification of these benefits requires analysis of historical loss data, probability assessments of prevented incidents, and consideration of the potential costs of regulatory violations or system failures that AI helps prevent.

Establishing Measurement Frameworks and Metrics

Effective AI ROI measurement requires the establishment of comprehensive frameworks that track both leading and lagging indicators of AI project success across multiple dimensions of organizational performance. Leading indicators might include model accuracy improvements, data quality enhancements, user adoption rates, and system performance metrics that suggest future benefits will be realized. Lagging indicators include actual financial outcomes, customer satisfaction improvements, and operational efficiency gains that represent the ultimate value delivered by AI investments.

The selection of appropriate metrics for AI ROI measurement depends on the specific use case and business objectives of each AI project, but generally should include both quantitative measures such as cost savings, revenue increases, error rate reductions, and processing time improvements, as well as qualitative assessments of strategic value, competitive advantage, and capability enhancement. Organizations should establish baseline measurements before AI implementation and commit to consistent tracking methodologies throughout the project lifecycle to ensure reliable ROI calculations.

Measurement frequency and reporting cadence should align with the nature of the AI project and the decision-making needs of stakeholders, with some metrics requiring real-time monitoring while others may be assessed quarterly or annually. The key is establishing a rhythm of measurement and reporting that provides timely insights for project management while avoiding the overhead of excessive monitoring that could detract from project execution.

Enhance your AI research and analysis capabilities with advanced tools that provide comprehensive data gathering and analytical support for developing robust ROI measurement frameworks and conducting thorough competitive analysis of AI investment strategies.

Industry-Specific ROI Considerations

Different industries experience varying patterns of AI ROI realization due to factors such as regulatory environments, data availability, competitive dynamics, and the nature of business processes that AI can enhance. Healthcare organizations often see substantial ROI from AI applications in diagnostic imaging, drug discovery, and personalized treatment recommendations, but may require longer implementation timelines due to regulatory approval processes and the need for extensive validation of AI-driven medical decisions.

Financial services companies frequently achieve rapid ROI from AI implementations in fraud detection, algorithmic trading, and customer service automation, where the direct financial impact of AI improvements can be measured precisely and the value of prevented losses or improved efficiency can be calculated with high confidence. The regulatory environment in financial services also provides clear frameworks for measuring and reporting the value of risk management improvements enabled by AI systems.

Manufacturing organizations often experience significant ROI from predictive maintenance AI applications that prevent costly equipment failures, optimize production schedules, and improve quality control processes. The measurement of these benefits requires tracking of historical maintenance costs, production downtime incidents, and quality metrics to establish baselines and quantify improvements attributable to AI implementation.

Retail and e-commerce companies typically see strong ROI from AI-powered personalization engines, demand forecasting systems, and supply chain optimization tools, where the impact on sales, inventory management, and customer satisfaction can be measured directly through existing business metrics and attributed clearly to AI capabilities.

Building Practical ROI Calculation Models

The development of practical ROI calculation models for AI projects requires careful consideration of the time value of money, the probabilistic nature of AI project outcomes, and the need for sensitivity analysis to account for uncertainty in cost and benefit projections. Traditional ROI calculations using simple payback periods or return ratios may not adequately capture the complexity and risk profile of AI investments, necessitating more sophisticated financial modeling approaches.

Net present value calculations for AI projects should incorporate realistic assumptions about the timeline for benefit realization, the ongoing costs of AI system maintenance and improvement, and the potential for both upside and downside scenarios in benefit achievement. Discount rates used in NPV calculations should reflect the risk profile of AI projects, which may be higher than traditional technology investments due to the experimental nature of many AI applications and the uncertainty around long-term maintenance requirements.

Scenario-based modeling can provide valuable insights into the range of potential outcomes for AI projects, helping decision-makers understand the sensitivity of ROI calculations to key assumptions about costs, benefits, and implementation timelines. Best-case, worst-case, and most-likely scenarios should be developed with input from technical teams, business stakeholders, and external experts to ensure realistic assessment of both opportunities and risks associated with AI investments.

The typical timeline for AI ROI realization demonstrates the importance of long-term planning and realistic expectations when evaluating artificial intelligence investments. Understanding these patterns helps organizations set appropriate milestones and maintain stakeholder support throughout the implementation process.

Overcoming Common ROI Measurement Challenges

One of the most significant challenges in AI ROI measurement is the attribution problem, where multiple factors may contribute to business improvements and isolating the specific impact of AI becomes difficult. Organizations can address this challenge through careful experimental design, including the use of control groups where possible, statistical analysis to isolate AI impacts from other variables, and conservative estimation approaches that err on the side of understating rather than overstating AI benefits.

The dynamic nature of AI systems, which continue to learn and improve over time, creates challenges for traditional ROI measurement approaches that assume static performance characteristics. AI ROI models must account for the improving performance trajectory of AI systems, the potential for diminishing returns as optimization opportunities are exhausted, and the ongoing investment required to maintain competitive AI capabilities as the technology landscape evolves.

Data quality and availability issues can significantly impact both the implementation success and ROI measurement accuracy of AI projects. Organizations should invest in data infrastructure and governance capabilities as part of AI project planning, recognizing that the costs of data preparation and quality improvement are essential components of AI project success and should be included in comprehensive ROI calculations.

The lack of industry benchmarks and standardized metrics for AI ROI measurement makes it difficult for organizations to assess whether their AI investments are generating competitive returns or to learn from the experiences of other companies. Industry associations, consulting firms, and academic institutions are beginning to develop standardized frameworks and benchmark data that can help organizations contextualize their AI ROI performance and identify opportunities for improvement.

Advanced ROI Optimization Strategies

Organizations seeking to maximize AI ROI should consider portfolio approaches to AI investment that balance high-risk, high-reward experimental projects with lower-risk implementations that provide more predictable returns. This portfolio strategy allows organizations to capture both the immediate value from proven AI applications and the potential breakthrough benefits from cutting-edge AI research and development efforts.

The modular design of AI systems can enable organizations to optimize ROI through incremental implementation approaches that deliver value in stages while building toward more comprehensive AI capabilities. This approach reduces upfront investment risks, allows for learning and adjustment throughout the implementation process, and provides opportunities to demonstrate value to stakeholders before requesting additional investment for advanced AI capabilities.

Partnerships with AI vendors, consulting firms, or academic institutions can help organizations access AI capabilities and expertise without the full cost of internal development, potentially improving ROI through shared risk, accelerated implementation timelines, and access to specialized knowledge that would be expensive to develop internally. The evaluation of build-versus-buy decisions for AI capabilities should include careful analysis of the total cost of ownership and expected returns from different implementation approaches.

Continuous improvement processes for AI systems can significantly enhance long-term ROI by ensuring that AI capabilities evolve to meet changing business needs, incorporate new data sources and algorithmic improvements, and maintain competitive advantages over time. Organizations should budget for ongoing AI system enhancement as a necessary component of maximizing return on AI investments rather than treating AI implementation as a one-time project with fixed benefits.

Integration with Business Planning and Budgeting

The successful integration of AI ROI measurement into organizational planning and budgeting processes requires the development of standardized methodologies, reporting templates, and approval criteria that enable consistent evaluation of AI investment opportunities across different business units and project types. Finance teams should be trained on the unique characteristics of AI projects and the appropriate methods for evaluating AI business cases to ensure informed decision-making about AI investments.

AI project portfolio management should be aligned with broader organizational strategy and resource allocation processes, ensuring that AI investments support strategic objectives and compete appropriately with other technology and business initiatives for limited organizational resources. The development of AI-specific investment criteria and evaluation frameworks can help organizations maintain discipline in AI investment decisions while remaining open to innovative applications that may not fit traditional business case models.

Regular review and adjustment of AI ROI models based on actual project performance can improve the accuracy of future AI investment decisions and help organizations develop institutional knowledge about the factors that drive successful AI implementations. This learning process should be documented and shared across the organization to build AI investment expertise and improve the overall success rate of AI initiatives.

The communication of AI ROI results to stakeholders requires careful attention to both the quantitative results and the strategic implications of AI investments, helping business leaders understand not just the financial returns but also the capability development and competitive positioning benefits that AI provides to the organization.

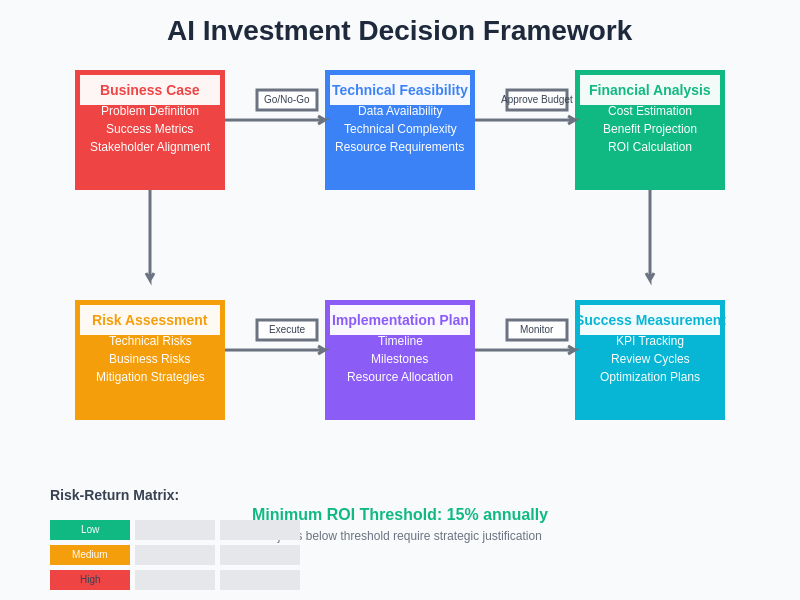

The structured approach to AI investment decision-making provides a comprehensive framework for evaluating opportunities, managing risks, and optimizing resource allocation across diverse artificial intelligence initiatives. This systematic approach ensures that AI investments align with organizational strategy while maximizing potential returns.

Future Trends in AI ROI Measurement

The evolution of AI ROI measurement practices is being driven by advances in AI explainability technologies that provide better insight into how AI systems generate value, enabling more precise attribution of benefits and improved accuracy in ROI calculations. As AI systems become more transparent and their decision-making processes more interpretable, organizations will be better equipped to understand and quantify the specific ways that AI contributes to business outcomes.

Automated ROI tracking systems that leverage AI to monitor and analyze the performance of AI implementations represent an emerging trend that can reduce the cost and complexity of ROI measurement while providing more timely and accurate insights into AI project performance. These systems can continuously track relevant metrics, identify trends and anomalies, and generate automated reports that keep stakeholders informed about AI ROI without requiring extensive manual analysis.

The development of industry-specific AI ROI benchmarks and standards will provide organizations with better context for evaluating their AI investment performance and identifying opportunities for improvement. Professional associations, consulting firms, and technology vendors are beginning to collaborate on the development of these benchmarks, which will mature over time to provide increasingly valuable guidance for AI investment decisions.

Regulatory developments related to AI transparency and accountability may introduce new requirements for AI ROI documentation and reporting, particularly in highly regulated industries where the impact of AI decisions on customers, employees, or society must be carefully monitored and justified. Organizations should anticipate these regulatory trends and develop ROI measurement capabilities that can satisfy both internal management needs and external reporting requirements.

The integration of sustainability and social impact metrics into AI ROI calculations reflects growing organizational awareness of the broader implications of AI implementations beyond direct financial returns. These expanded ROI frameworks will consider factors such as environmental impact, employee well-being, customer privacy, and social equity in evaluating the total value created by AI investments.

As artificial intelligence continues to mature from experimental technology to essential business capability, the measurement and optimization of AI return on investment will become increasingly sophisticated and standardized. Organizations that develop robust AI ROI measurement capabilities today will be better positioned to make informed decisions about future AI investments and maximize the strategic value of their artificial intelligence initiatives.

Disclaimer

This article is for informational purposes only and does not constitute financial or investment advice. The methodologies and frameworks discussed should be adapted to specific organizational contexts and requirements. ROI calculations for AI projects involve inherent uncertainties and assumptions that may not reflect actual outcomes. Organizations should consult with qualified financial and technical professionals when making AI investment decisions. The effectiveness of AI ROI measurement approaches may vary significantly based on industry, project scope, and organizational maturity.