The financial markets have undergone a revolutionary transformation with the advent of algorithmic trading and artificial intelligence-powered strategies that execute trades at lightning speed and unprecedented precision. High-frequency trading, powered by sophisticated AI algorithms, has fundamentally altered the landscape of modern finance, creating opportunities for substantial profits while simultaneously introducing new complexities and challenges that traditional trading methods could never have anticipated.

Discover the latest AI trends in financial technology to understand how cutting-edge artificial intelligence is reshaping investment strategies and market dynamics. The convergence of advanced machine learning techniques with high-speed computing infrastructure has created a new paradigm where milliseconds can determine the difference between substantial profits and significant losses, making algorithmic trading an essential component of modern financial strategy.

The Evolution of Algorithmic Trading

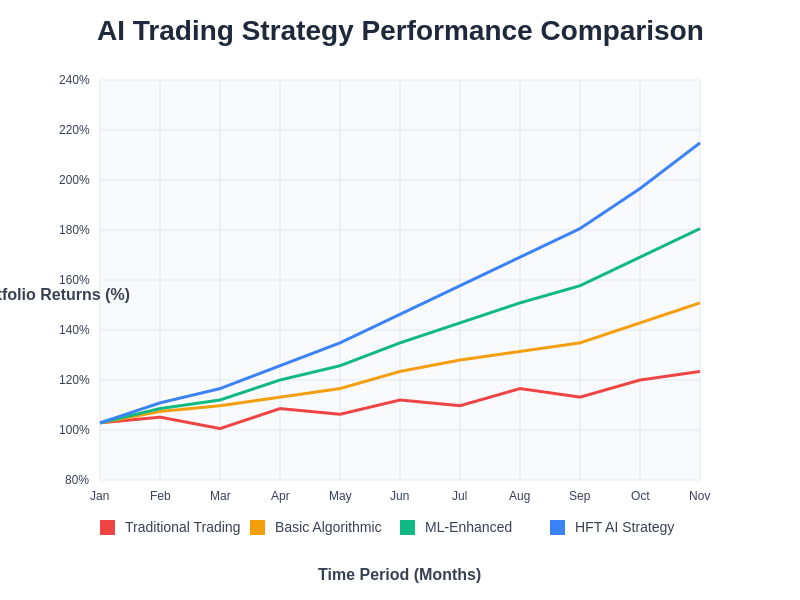

The journey from traditional floor trading to sophisticated algorithmic systems represents one of the most dramatic technological shifts in financial history. Early algorithmic trading systems were relatively simple, executing predetermined rules based on basic technical indicators and price movements. However, the integration of artificial intelligence and machine learning has transformed these systems into sophisticated entities capable of analyzing vast amounts of market data, identifying complex patterns, and adapting their strategies in real-time based on changing market conditions.

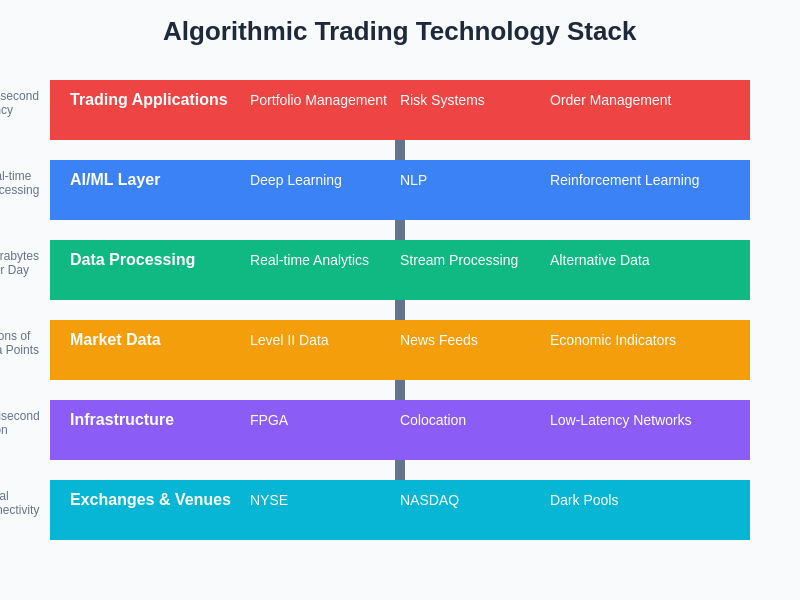

Modern algorithmic trading systems leverage advanced computational techniques including deep learning neural networks, natural language processing for sentiment analysis, and reinforcement learning algorithms that continuously optimize trading strategies based on historical performance and market feedback. These systems can process thousands of data points simultaneously, including price movements, trading volumes, news sentiment, economic indicators, and even social media trends, creating a comprehensive understanding of market dynamics that would be impossible for human traders to achieve.

The sophistication of contemporary algorithmic trading extends beyond simple rule-based execution to encompass predictive modeling, risk management, and portfolio optimization. These systems can identify arbitrage opportunities across multiple markets, execute complex multi-leg strategies, and manage risk exposure across diverse asset classes while operating at speeds measured in microseconds rather than minutes or hours.

High-Frequency Trading Infrastructure

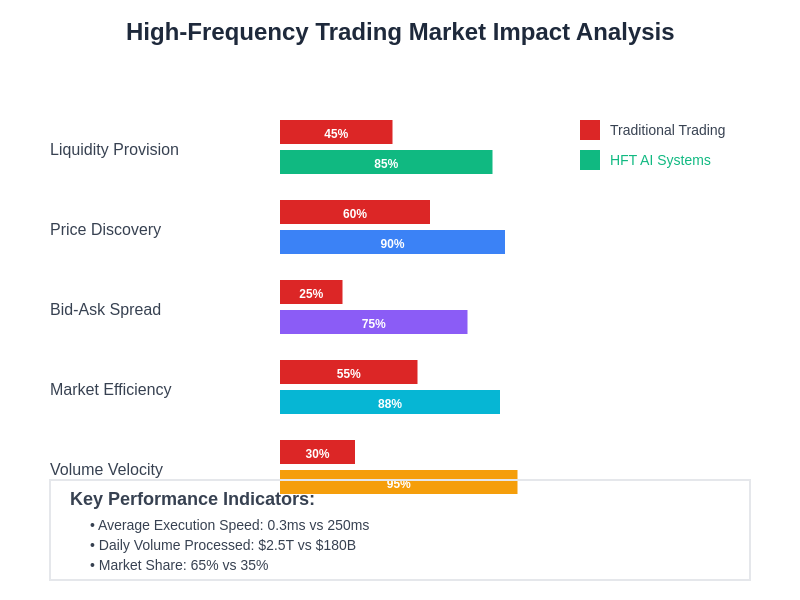

The backbone of successful high-frequency trading lies in cutting-edge technological infrastructure designed to minimize latency and maximize execution speed. Trading firms invest millions of dollars in specialized hardware, including custom-built servers with optimized processors, high-speed memory systems, and dedicated network connections that provide direct market access with minimal delay. These technological investments are essential because in high-frequency trading, even microsecond delays can result in missed opportunities and reduced profitability.

Colocation services, where trading servers are physically located within or adjacent to exchange data centers, have become crucial for maintaining competitive advantages in speed-sensitive strategies. The reduction in physical distance between trading systems and exchange matching engines can provide latency advantages measured in microseconds, which translates to significant competitive benefits in strategies that depend on rapid execution and order management.

Experience advanced AI capabilities with Claude for developing sophisticated trading algorithms and risk management systems that can process complex market data and execute strategies with precision. The integration of AI-powered decision-making with ultra-low latency infrastructure creates trading systems capable of responding to market opportunities faster than traditional approaches while maintaining sophisticated risk controls and strategy optimization.

Machine Learning in Trading Strategy Development

The application of machine learning techniques to trading strategy development has opened unprecedented possibilities for identifying profitable patterns and predicting market movements. Supervised learning algorithms analyze historical market data to identify relationships between various market factors and subsequent price movements, enabling the development of predictive models that can forecast short-term market direction with increasing accuracy. These models incorporate diverse data sources including technical indicators, fundamental analysis metrics, macroeconomic data, and alternative data sources such as satellite imagery and social media sentiment.

Unsupervised learning techniques play a crucial role in discovering hidden patterns and market regimes that may not be apparent through traditional analysis methods. Clustering algorithms can identify similar market conditions and group trading sessions based on volatility patterns, correlation structures, and behavioral characteristics, enabling the development of regime-specific trading strategies that adapt to different market environments.

Reinforcement learning represents perhaps the most sophisticated application of AI in trading, where algorithms learn optimal trading strategies through interaction with market environments. These systems continuously refine their decision-making processes based on reward feedback from trading outcomes, developing increasingly sophisticated strategies that can adapt to changing market conditions and evolving competitive landscapes.

The implementation of machine learning in trading strategy development requires careful consideration of overfitting, data quality, and model validation. Sophisticated backtesting frameworks and out-of-sample validation techniques ensure that strategies perform robustly across different market conditions and time periods, while continuous monitoring and model updating processes maintain strategy effectiveness as market dynamics evolve.

Natural Language Processing for Market Sentiment

The integration of natural language processing capabilities into algorithmic trading systems has revolutionized how market sentiment and news impact are incorporated into trading decisions. Advanced NLP algorithms can process thousands of news articles, earnings reports, regulatory filings, and social media posts in real-time, extracting sentiment scores and identifying market-moving information that traditional quantitative models might miss. This capability enables trading systems to react to fundamental developments and sentiment shifts with unprecedented speed and accuracy.

Sentiment analysis algorithms have evolved beyond simple positive and negative classifications to incorporate nuanced understanding of financial language, context-dependent meaning, and the relative importance of different information sources. These systems can distinguish between routine corporate announcements and significant market-moving news, enabling more sophisticated filtering and weighting of information sources based on their historical impact on asset prices.

The processing of alternative data sources through NLP techniques has created new opportunities for alpha generation in increasingly efficient markets. Trading systems can analyze earnings call transcripts for management sentiment, process regulatory filings for material changes, and monitor social media discussions for emerging trends that may impact asset prices before these factors are reflected in traditional market data.

Risk Management and Portfolio Optimization

Sophisticated risk management systems form the foundation of successful algorithmic trading operations, employing advanced mathematical models to monitor and control exposure across multiple dimensions simultaneously. These systems continuously calculate value-at-risk metrics, stress test portfolios against historical scenarios, and implement dynamic hedging strategies that adjust risk exposure based on changing market conditions and strategy performance.

Portfolio optimization algorithms leverage modern portfolio theory enhanced with machine learning techniques to construct optimal asset allocations that maximize risk-adjusted returns while adhering to specified risk constraints. These systems can simultaneously optimize across thousands of securities, incorporating transaction costs, liquidity constraints, and correlation dynamics to create portfolios that achieve superior performance characteristics compared to traditional optimization approaches.

Real-time risk monitoring systems employ sophisticated alerting mechanisms that can halt trading, adjust position sizes, or modify strategy parameters when predetermined risk thresholds are exceeded. These safeguards are essential for protecting capital during periods of unusual market volatility or when algorithmic strategies encounter unexpected market conditions that fall outside their design parameters.

Enhance your research capabilities with Perplexity for comprehensive market analysis and strategy development that incorporates the latest academic research and industry best practices. The combination of advanced AI research tools with sophisticated trading platforms creates opportunities for developing innovative strategies that leverage cutting-edge insights from financial research and market analysis.

Market Microstructure and Execution Algorithms

Understanding market microstructure has become essential for developing effective execution algorithms that minimize market impact while achieving optimal fill prices. Advanced execution algorithms analyze order book dynamics, trading patterns, and liquidity characteristics to determine optimal order sizing, timing, and routing strategies that reduce transaction costs and improve execution quality.

Implementation shortfall algorithms seek to minimize the total cost of trading by balancing market impact against timing risk, dynamically adjusting trading intensity based on market conditions and urgency requirements. These algorithms incorporate sophisticated models of temporary and permanent market impact, enabling traders to execute large orders efficiently without significantly moving market prices.

Volume-weighted average price strategies and time-weighted average price strategies represent foundational execution approaches that have been enhanced through machine learning techniques to improve their effectiveness across different market conditions. These algorithms can adapt their execution patterns based on historical performance analysis and real-time market feedback, continuously optimizing their approach to achieve better execution quality.

The development of smart order routing systems enables optimal execution across multiple trading venues by analyzing liquidity availability, transaction costs, and execution probability across different exchanges and dark pools. These systems can simultaneously manage orders across dozens of trading venues while optimizing for best execution requirements and regulatory compliance.

Regulatory Compliance and Market Structure

The regulatory landscape surrounding algorithmic trading has evolved significantly as market regulators work to maintain fair and orderly markets while accommodating technological innovation. Compliance systems must monitor trading activity for potential market manipulation, ensure adherence to position limits and reporting requirements, and maintain audit trails that demonstrate regulatory compliance across all trading activities.

Pre-trade risk controls have become mandatory components of algorithmic trading systems, implementing real-time checks on order validity, position limits, and market impact before orders are submitted to exchanges. These controls help prevent erroneous trades and ensure that algorithmic strategies operate within predefined risk parameters and regulatory constraints.

Market makers using algorithmic strategies must navigate complex regulatory requirements related to quote obligations, fair access provisions, and best execution standards. These requirements necessitate sophisticated compliance monitoring systems that can demonstrate adherence to regulatory standards while maintaining the speed and efficiency required for successful high-frequency trading operations.

Alternative Data Integration

The incorporation of alternative data sources has become a crucial differentiator in modern algorithmic trading, enabling strategies to identify market opportunities that traditional approaches might miss. Satellite imagery analysis can provide early indicators of economic activity, crop yields, and retail foot traffic that impact commodity prices and equity valuations before this information is reflected in traditional economic reports.

Social media sentiment analysis and news flow monitoring provide real-time insights into market psychology and emerging trends that can influence asset prices. Advanced natural language processing techniques can identify subtle sentiment shifts and emerging narratives that may impact market sentiment before these factors are widely recognized by market participants.

Credit card transaction data, web scraping activities, and mobile application usage statistics provide alternative perspectives on corporate performance and consumer behavior that can inform investment decisions. The integration of these diverse data sources requires sophisticated data processing capabilities and analytical frameworks that can extract meaningful signals from noisy alternative data streams.

Technology Infrastructure Optimization

The optimization of technology infrastructure represents a continuous competitive battleground in algorithmic trading, where firms invest heavily in specialized hardware, optimized software, and advanced networking capabilities to gain microsecond advantages over competitors. Field-programmable gate arrays and custom silicon solutions enable ultra-low latency order processing and market data handling that can provide significant competitive advantages in speed-sensitive strategies.

Memory hierarchy optimization, including the use of high-speed cache systems and optimized data structures, ensures that critical trading algorithms can access necessary information with minimal delay. These optimizations become particularly important when processing large volumes of market data and maintaining real-time risk calculations across diverse portfolio holdings.

Network optimization techniques, including kernel bypass technologies and specialized network protocols, minimize the software overhead associated with market data processing and order transmission. These optimizations can reduce latency by hundreds of microseconds, which represents significant competitive advantages in high-frequency trading environments.

Cloud computing integration has enabled smaller trading firms to access sophisticated infrastructure capabilities without massive capital investments, democratizing access to advanced trading technologies. However, the latency requirements of high-frequency strategies continue to favor dedicated infrastructure solutions that prioritize speed over cost efficiency.

Performance Measurement and Attribution

Sophisticated performance measurement systems provide detailed analysis of trading strategy effectiveness across multiple dimensions, including risk-adjusted returns, Sharpe ratios, maximum drawdown statistics, and alpha generation capabilities. These systems enable continuous strategy refinement and optimization by identifying the specific factors that contribute to strategy performance and profitability.

Transaction cost analysis provides crucial insights into execution quality and helps optimize trading algorithms for better performance. These analyses examine the relationship between execution strategies and achieved fill prices, enabling continuous improvement in execution algorithms and trading venue selection.

Attribution analysis breaks down strategy performance into component factors, enabling traders to understand the sources of alpha generation and identify areas for strategy enhancement. This analysis can reveal whether performance derives from market timing, security selection, execution efficiency, or other factors, guiding future strategy development efforts.

Future Developments and Emerging Trends

The future of algorithmic trading promises even greater integration of artificial intelligence capabilities, including the development of more sophisticated reinforcement learning systems that can adapt to changing market conditions with minimal human intervention. Quantum computing developments may eventually provide computational advantages for certain types of optimization problems and pattern recognition tasks that are fundamental to trading strategy development.

The expansion of cryptocurrency and digital asset markets has created new opportunities for algorithmic trading strategies, with unique characteristics such as 24/7 trading, high volatility, and fragmented liquidity across multiple exchanges providing fertile ground for innovative trading approaches. These markets often exhibit different behavioral patterns compared to traditional assets, requiring specialized algorithms and risk management approaches.

Environmental, social, and governance considerations are increasingly being integrated into algorithmic trading strategies as investors demand more sustainable and socially responsible investment approaches. This trend requires the development of new data sources and analytical frameworks that can incorporate ESG factors into quantitative trading models while maintaining competitive performance characteristics.

The democratization of algorithmic trading through cloud-based platforms and accessible development tools is enabling broader participation in sophisticated trading strategies, potentially increasing market efficiency while creating new competitive dynamics. This trend may lead to increased competition and reduced alpha opportunities in some strategies while opening new possibilities for innovation and strategy development.

Disclaimer

This article is for informational and educational purposes only and does not constitute financial, investment, or trading advice. Algorithmic trading and high-frequency trading involve substantial risks, including the potential for significant financial losses. The strategies and technologies described in this article are complex and may not be suitable for all investors. Past performance does not guarantee future results. Readers should conduct thorough research and consider consulting with qualified financial professionals before implementing any trading strategies. The regulatory environment surrounding algorithmic trading is complex and subject to change. This article does not constitute legal or regulatory advice, and readers should ensure compliance with all applicable laws and regulations in their jurisdiction.