The convergence of artificial intelligence and central bank digital currencies represents one of the most significant transformations in modern monetary systems, fundamentally reshaping how nations conceptualize, implement, and manage their digital financial infrastructure. As governments worldwide accelerate their exploration of CBDCs, artificial intelligence emerges as the critical enabler that transforms these digital currencies from simple electronic cash replacements into sophisticated, adaptive monetary instruments capable of real-time economic analysis, predictive policy implementation, and unprecedented financial inclusion capabilities.

Stay updated with the latest AI developments in finance to understand how emerging technologies are revolutionizing traditional banking and monetary systems. The integration of AI into CBDC frameworks represents more than technological innovation; it signifies a fundamental evolution in how central banks approach monetary policy, financial surveillance, and economic stability in an increasingly digital world.

The AI-Driven CBDC Revolution

Central bank digital currencies enhanced by artificial intelligence capabilities represent a quantum leap beyond traditional digital payment systems, incorporating sophisticated machine learning algorithms that enable real-time transaction analysis, behavioral pattern recognition, and predictive economic modeling. Unlike conventional digital currencies that function primarily as electronic representations of physical cash, AI-powered CBDCs serve as dynamic monetary instruments that continuously adapt to economic conditions, user behaviors, and policy objectives while maintaining the security, stability, and regulatory compliance required by central banking institutions.

The revolutionary potential of AI-enhanced CBDCs extends far beyond simple payment facilitation, encompassing comprehensive economic data collection, real-time monetary policy implementation, and sophisticated fraud prevention mechanisms that operate at unprecedented scales and speeds. These systems leverage advanced machine learning models to analyze transaction patterns, predict economic trends, and automatically adjust monetary parameters in response to changing market conditions, creating a responsive financial ecosystem that can adapt to economic challenges with remarkable precision and speed.

Intelligent Fraud Detection and Security Architecture

The implementation of AI-driven fraud detection systems within CBDC infrastructure represents a paradigmatic shift in financial security, employing sophisticated machine learning algorithms that analyze transaction patterns, user behaviors, and network activities in real-time to identify and prevent fraudulent activities before they can impact the broader financial system. These AI systems continuously learn from transaction data, adapting their detection capabilities to emerging fraud patterns and evolving threat landscapes while maintaining the privacy and anonymity requirements essential for public trust in digital currency systems.

Discover how Claude can enhance your understanding of complex AI systems for implementing advanced fraud detection and security measures in financial technology applications. The integration of AI-powered security measures into CBDC systems creates multiple layers of protection that operate simultaneously, from transaction-level anomaly detection to network-wide pattern analysis, ensuring comprehensive security coverage that adapts to new threats as they emerge.

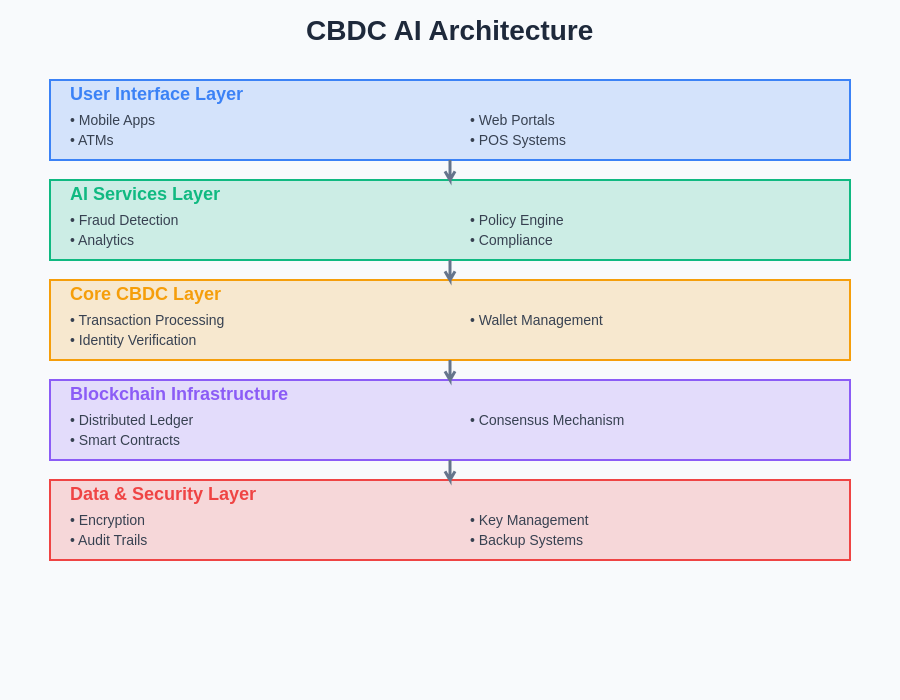

The sophisticated architecture of AI-enhanced CBDC systems demonstrates the complex interplay between artificial intelligence components, blockchain infrastructure, and regulatory compliance mechanisms that work together to create secure, efficient, and policy-compliant digital currency platforms. This comprehensive system design ensures that AI capabilities are integrated seamlessly throughout the CBDC lifecycle, from initial issuance through transaction processing to final settlement and regulatory reporting.

Real-Time Monetary Policy Implementation

Artificial intelligence transforms CBDC systems into powerful monetary policy instruments that enable central banks to implement policy changes with unprecedented speed and precision, utilizing machine learning algorithms to analyze economic indicators, predict policy impacts, and automatically adjust digital currency parameters in response to changing economic conditions. This capability represents a fundamental evolution from traditional monetary policy tools, which often require weeks or months to demonstrate their effects, to dynamic systems that can implement and assess policy changes in real-time.

The integration of AI-driven policy mechanisms within CBDC frameworks enables central banks to experiment with innovative monetary tools, such as programmable money that automatically adjusts interest rates based on economic indicators, targeted stimulus payments that activate under specific economic conditions, and dynamic currency supply mechanisms that respond to real-time demand fluctuations. These capabilities provide central banks with unprecedented control over monetary policy implementation while maintaining the transparency and accountability required for democratic oversight of monetary authorities.

Enhanced Financial Inclusion Through AI

The application of artificial intelligence to CBDC systems creates unprecedented opportunities for financial inclusion by enabling sophisticated user profiling, risk assessment, and service customization that can extend banking services to previously underserved populations without compromising security or regulatory compliance. AI algorithms can analyze alternative data sources, behavioral patterns, and economic indicators to assess creditworthiness and financial capabilities for individuals who lack traditional banking histories, creating pathways for financial participation that were previously unavailable through conventional banking systems.

Machine learning models embedded within CBDC platforms can provide personalized financial services, automated savings programs, and intelligent spending analysis that help users develop financial literacy and make informed economic decisions. These AI-driven features transform digital currencies from simple payment mechanisms into comprehensive financial education and empowerment tools that actively support users in achieving greater financial stability and economic participation.

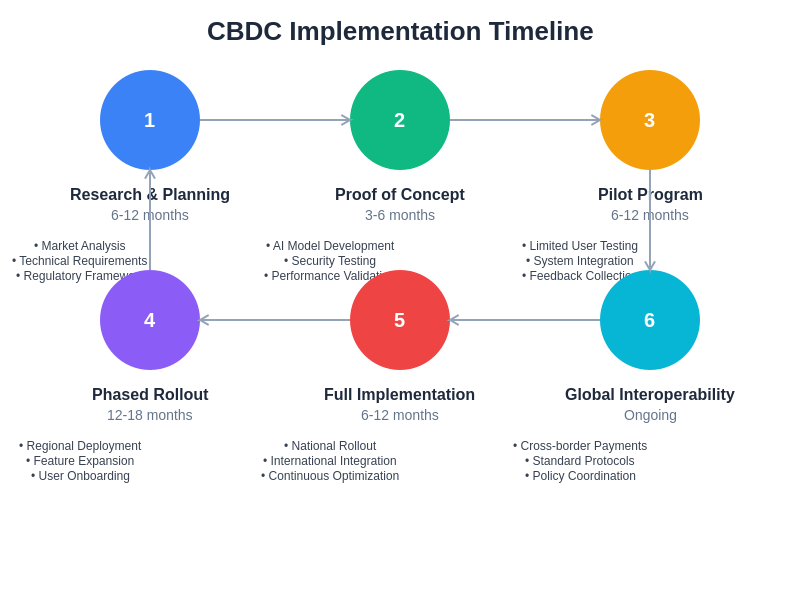

The strategic implementation timeline for AI-enhanced CBDC systems illustrates the complex coordination required between technological development, regulatory framework establishment, and public adoption phases. This comprehensive rollout approach ensures that artificial intelligence capabilities are integrated systematically throughout the implementation process, allowing for iterative improvement and adaptation based on real-world performance and user feedback.

Cross-Border Payment Optimization

AI-powered CBDC systems revolutionize international payments by implementing intelligent routing algorithms that optimize transaction paths, minimize settlement times, and reduce costs associated with cross-border financial transfers. These systems utilize machine learning models to analyze global payment networks, predict optimal routing paths, and automatically execute currency exchanges at favorable rates while maintaining compliance with international regulatory requirements and anti-money laundering protocols.

The integration of AI capabilities into cross-border CBDC transactions enables real-time currency conversion optimization, intelligent liquidity management, and predictive settlement scheduling that dramatically reduces the time and cost associated with international payments. These capabilities are particularly transformative for developing economies, where traditional cross-border payment systems often impose prohibitive costs and delays that limit economic participation and international trade opportunities.

Explore advanced AI research capabilities with Perplexity to dive deeper into the technical implementation details and emerging research in AI-enhanced financial systems and digital currency technologies. The combination of multiple AI tools creates a comprehensive research ecosystem that supports understanding of complex financial technology implementations and their broader economic implications.

Privacy-Preserving Analytics and Compliance

The implementation of AI-driven analytics within CBDC systems requires sophisticated privacy-preserving techniques that enable comprehensive transaction analysis and regulatory compliance while protecting individual privacy rights and maintaining public trust in digital currency systems. Advanced machine learning techniques, including federated learning, homomorphic encryption, and differential privacy, enable central banks to gain valuable insights into economic patterns and user behaviors without compromising individual transaction privacy or personal financial information.

These privacy-preserving AI systems can perform complex economic analysis, detect suspicious activities, and generate regulatory reports while ensuring that individual transaction details remain confidential and that user privacy is maintained throughout the analytical process. This balance between comprehensive oversight and individual privacy represents one of the most significant technical and policy challenges in CBDC implementation, requiring innovative approaches that satisfy both regulatory requirements and public expectations for financial privacy.

Economic Modeling and Predictive Analytics

AI-enhanced CBDC systems incorporate sophisticated economic modeling capabilities that enable central banks to simulate policy impacts, predict economic trends, and assess the potential consequences of monetary decisions before implementation. These predictive models utilize vast amounts of transaction data, economic indicators, and behavioral patterns to create comprehensive economic simulations that can inform policy decisions and help central banks anticipate the effects of various monetary interventions.

The integration of machine learning models into CBDC platforms enables continuous economic monitoring and real-time policy adjustment based on observed economic conditions and predicted future trends. This capability transforms central banking from a reactive discipline that responds to economic changes after they occur to a proactive field that can anticipate and prevent economic instabilities before they develop into systemic problems.

Smart Contract Integration and Programmable Money

The convergence of AI capabilities with smart contract functionality within CBDC systems creates unprecedented opportunities for programmable money that can automatically execute complex financial operations based on predefined conditions, economic indicators, or AI-driven predictions. These intelligent contracts can implement sophisticated monetary policies, automate stimulus payments, and create adaptive financial instruments that respond dynamically to changing economic conditions without requiring manual intervention from monetary authorities.

AI-powered smart contracts within CBDC systems can optimize resource allocation, implement targeted economic interventions, and create self-executing financial programs that adapt to changing circumstances while maintaining compliance with regulatory requirements and policy objectives. This capability enables central banks to implement increasingly sophisticated monetary policies that can respond to economic challenges with speed and precision that would be impossible through traditional monetary policy mechanisms.

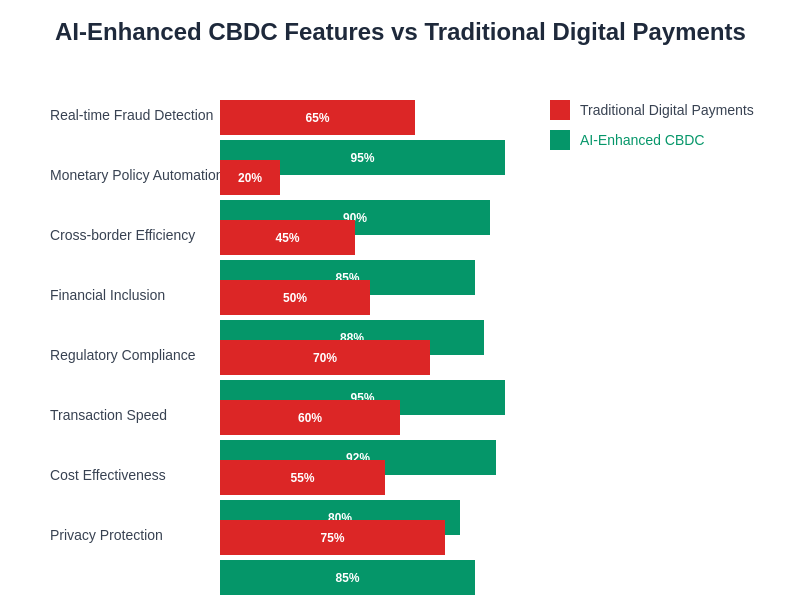

The comprehensive comparison of AI-enhanced CBDC features demonstrates the significant advantages that artificial intelligence brings to digital currency systems across multiple dimensions, including security, efficiency, policy implementation, and user experience. This analysis highlights how AI capabilities transform basic digital currency functions into sophisticated financial instruments that serve multiple policy objectives simultaneously.

Interoperability and Global CBDC Networks

The development of AI-driven interoperability protocols enables different national CBDC systems to communicate, transact, and coordinate policies across international boundaries, creating the foundation for a global digital currency ecosystem that maintains national sovereignty while facilitating international commerce and financial cooperation. Machine learning algorithms optimize cross-system transactions, predict exchange rate fluctuations, and automatically execute currency conversions while maintaining compliance with diverse national regulatory frameworks and monetary policies.

These AI-powered interoperability systems can adapt to different national priorities, regulatory requirements, and economic conditions while maintaining seamless transaction processing and settlement capabilities across multiple CBDC networks. The result is a flexible global financial infrastructure that supports both national monetary sovereignty and international economic cooperation through intelligent coordination and adaptive system integration.

Regulatory Technology Integration

The integration of artificial intelligence into CBDC systems enables sophisticated regulatory technology implementations that automate compliance monitoring, generate real-time regulatory reports, and ensure continuous adherence to evolving legal and policy requirements across multiple jurisdictions. AI-driven regulatory systems can analyze transaction patterns, identify potential compliance violations, and automatically implement corrective measures while maintaining detailed audit trails and generating comprehensive regulatory documentation.

These intelligent compliance systems adapt to changing regulatory requirements, update their monitoring parameters automatically, and provide central banks with comprehensive oversight capabilities that ensure CBDC operations remain compliant with all applicable laws, regulations, and policy directives. This capability is particularly important for international CBDC implementations that must navigate complex and often conflicting regulatory environments across multiple jurisdictions.

Performance Optimization and Scalability

AI-powered performance optimization systems within CBDC infrastructure continuously monitor system performance, predict capacity requirements, and automatically scale resources to maintain optimal transaction processing speeds and system reliability under varying load conditions. Machine learning algorithms analyze historical usage patterns, predict future demand, and implement proactive scaling measures that prevent performance degradation during peak usage periods or unexpected demand surges.

The integration of AI-driven optimization capabilities enables CBDC systems to maintain consistent performance across diverse usage scenarios while minimizing infrastructure costs and energy consumption. These systems can automatically optimize database configurations, adjust network parameters, and implement load balancing strategies that ensure reliable service delivery even as transaction volumes scale to accommodate entire national economies.

Risk Management and Systemic Stability

Advanced AI systems integrated into CBDC platforms provide comprehensive risk management capabilities that monitor systemic financial stability, identify potential threats to monetary system integrity, and implement automatic protective measures that prevent localized problems from escalating into systemic crises. These intelligent risk management systems analyze transaction flows, market conditions, and economic indicators to identify emerging risks and recommend or automatically implement appropriate policy responses.

The predictive capabilities of AI-enhanced risk management systems enable central banks to anticipate potential financial instabilities and implement preventive measures before problems develop into significant economic challenges. This proactive approach to financial stability management represents a fundamental advancement in central banking capabilities, providing monetary authorities with unprecedented tools for maintaining economic stability and preventing financial crises.

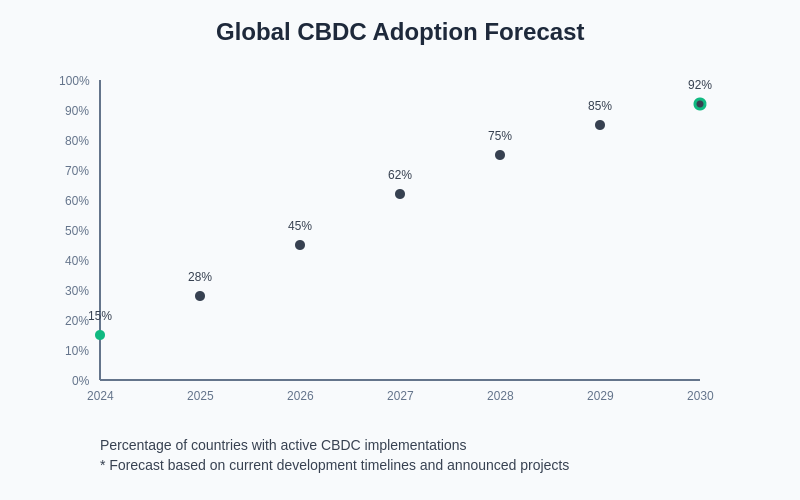

The projected timeline for global CBDC adoption illustrates the accelerating pace at which nations are implementing AI-enhanced digital currency systems, driven by the competitive advantages and policy capabilities that these systems provide. This adoption trajectory reflects the growing recognition that AI-powered CBDC systems represent essential infrastructure for maintaining monetary sovereignty and economic competitiveness in an increasingly digital global economy.

Future Implications and Economic Transformation

The widespread implementation of AI-enhanced CBDC systems promises to fundamentally transform global economic structures, enabling new forms of monetary policy, financial regulation, and international cooperation that were previously impossible through traditional banking and currency systems. These systems will likely catalyze broader economic digitization, create new opportunities for economic analysis and policy implementation, and establish the foundation for increasingly sophisticated approaches to monetary policy and financial system management.

The continued evolution of AI capabilities within CBDC systems will likely produce increasingly powerful monetary tools that enable central banks to respond to economic challenges with unprecedented precision and speed while maintaining the stability, security, and public trust essential for effective monetary policy implementation. This technological evolution represents not merely an improvement in existing monetary systems but a fundamental transformation in how societies conceptualize and implement monetary policy in an increasingly complex and interconnected global economy.

The integration of artificial intelligence into central bank digital currency systems represents one of the most significant technological and policy developments in modern monetary history, creating opportunities for economic innovation, financial inclusion, and policy effectiveness that will likely define the future of global financial systems. As these technologies continue to evolve and mature, they will undoubtedly create new possibilities for economic organization and monetary policy that are difficult to imagine within the constraints of current financial systems and economic theories.

Disclaimer

This article is for informational purposes only and does not constitute financial, investment, or regulatory advice. The views expressed are based on current understanding of AI technologies and their potential applications in central bank digital currency systems. Readers should conduct their own research and consult with qualified professionals when making decisions related to digital currencies, monetary policy, or financial technology implementations. The regulatory landscape for CBDCs continues to evolve rapidly, and actual implementations may differ significantly from the scenarios discussed in this article.