The legal technology landscape has experienced a revolutionary transformation through the integration of artificial intelligence into compliance monitoring and regulatory analysis systems. Two industry titans, Thomson Reuters and Bloomberg Law, have emerged as dominant forces in this space, each offering sophisticated AI-powered analytics platforms that promise to revolutionize how legal professionals and enterprises approach compliance management, risk assessment, and regulatory oversight.

Explore the latest AI developments in legal technology to understand how these cutting-edge tools are reshaping the legal industry’s approach to compliance and regulatory challenges. The competition between these technological powerhouses represents more than just a battle for market share; it embodies the future of legal practice itself, where artificial intelligence serves as an indispensable partner in navigating the increasingly complex regulatory environment that defines modern business operations.

The Evolution of Compliance Technology

The traditional approach to compliance management relied heavily on manual processes, extensive human review, and reactive monitoring systems that often identified violations only after they had occurred. This paradigm has been fundamentally disrupted by the emergence of AI-powered compliance platforms that offer predictive analytics, real-time monitoring, and comprehensive risk assessment capabilities. Thomson Reuters and Bloomberg Law have positioned themselves at the forefront of this transformation, each developing sophisticated platforms that leverage machine learning, natural language processing, and advanced analytics to deliver unprecedented insights into regulatory compliance.

The shift from reactive to proactive compliance management represents a fundamental change in how organizations approach regulatory risk. Rather than simply responding to compliance issues as they arise, modern AI-powered systems enable continuous monitoring, predictive risk modeling, and automated alert systems that help organizations maintain compliance before violations occur. This evolution has created significant competitive advantages for organizations that successfully implement these advanced compliance technologies.

Thomson Reuters Compliance AI Platform Overview

Thomson Reuters has established itself as a formidable presence in the compliance AI space through its comprehensive suite of regulatory technology solutions that combine decades of legal expertise with cutting-edge artificial intelligence capabilities. The Thomson Reuters platform leverages the company’s extensive legal database, which encompasses millions of regulatory documents, case law precedents, and compliance frameworks from jurisdictions around the world, to provide AI-powered insights that are both comprehensive and contextually relevant.

The platform’s artificial intelligence engine utilizes advanced natural language processing algorithms to analyze regulatory texts, identify compliance requirements, and map these obligations to specific business processes and organizational structures. This sophisticated analysis enables the system to provide tailored compliance guidance that takes into account the unique regulatory landscape faced by each organization, considering factors such as industry sector, geographic presence, and business model complexity.

Thomson Reuters has integrated machine learning capabilities that continuously improve the platform’s accuracy and relevance through ongoing analysis of regulatory changes, enforcement patterns, and compliance trends. The system’s ability to learn from historical compliance data and regulatory enforcement actions enables it to provide increasingly sophisticated predictions about potential compliance risks and regulatory developments that may impact specific organizations or industry sectors.

Experience advanced AI-powered legal research with Claude to enhance your understanding of complex regulatory frameworks and compliance requirements. The integration of multiple AI technologies creates a comprehensive compliance management ecosystem that addresses the full spectrum of regulatory challenges faced by modern organizations.

Bloomberg Law Analytics Deep Dive

Bloomberg Law has leveraged its extensive financial and legal data infrastructure to create a compliance analytics platform that combines real-time market intelligence with sophisticated regulatory analysis capabilities. The Bloomberg Law Analytics platform distinguishes itself through its integration of financial market data, regulatory filings, and legal precedents to provide a holistic view of compliance risks that extends beyond traditional legal analysis to encompass market-driven regulatory considerations.

The platform’s artificial intelligence capabilities are built upon Bloomberg’s proprietary data analytics infrastructure, which processes vast quantities of financial and regulatory data in real-time to identify patterns, trends, and potential compliance issues. This data-driven approach enables Bloomberg Law Analytics to provide insights that are particularly valuable for organizations operating in heavily regulated financial sectors, where compliance requirements are closely tied to market conditions and financial performance metrics.

Bloomberg Law’s machine learning algorithms analyze regulatory enforcement patterns, judicial decisions, and regulatory guidance to predict potential compliance risks and recommend preventive measures. The platform’s integration with Bloomberg’s broader financial data ecosystem enables it to provide compliance insights that consider market volatility, regulatory sentiment, and economic factors that may influence enforcement priorities and regulatory interpretations.

The system’s natural language processing capabilities enable it to analyze complex regulatory documents and extract actionable compliance requirements that are presented in user-friendly formats designed for legal professionals and compliance officers. This combination of sophisticated analysis and accessible presentation ensures that compliance insights are both comprehensive and practically applicable to day-to-day compliance management activities.

Comparative Analysis of AI Capabilities

When examining the artificial intelligence capabilities of these two platforms, several key differentiators emerge that reflect the distinct approaches taken by Thomson Reuters and Bloomberg Law in developing their compliance analytics solutions. Thomson Reuters emphasizes breadth and depth of legal content, leveraging its extensive legal database to provide comprehensive coverage of regulatory requirements across multiple jurisdictions and practice areas. The platform’s AI engine excels at identifying complex regulatory relationships and providing detailed analysis of compliance obligations that span multiple regulatory frameworks.

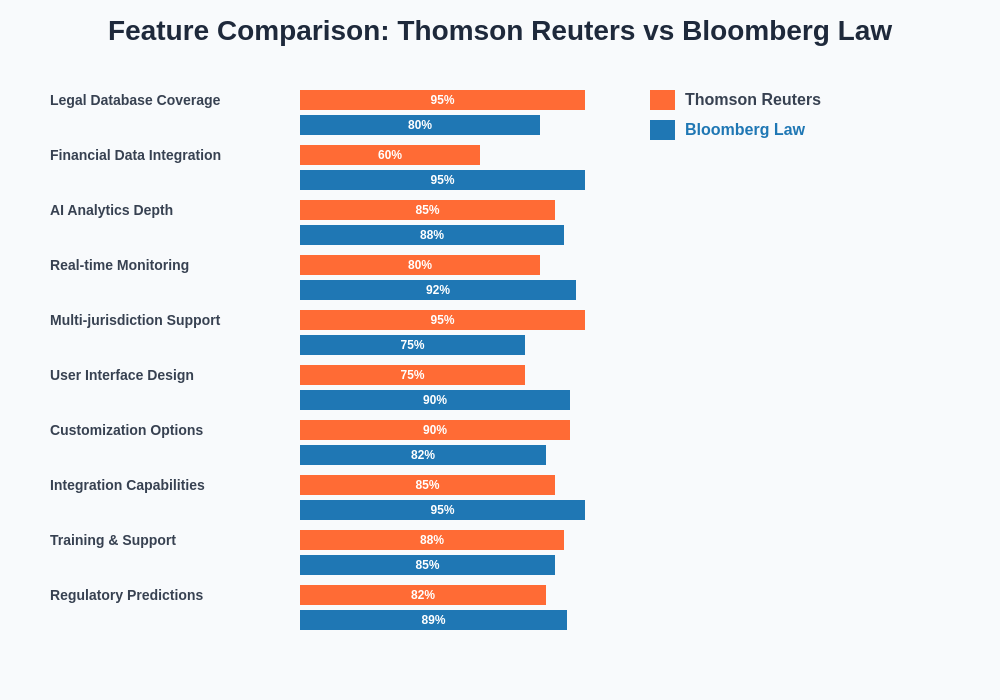

The comprehensive feature analysis reveals distinct strengths in each platform’s approach to compliance AI, with Thomson Reuters excelling in legal database coverage and multi-jurisdictional support, while Bloomberg Law demonstrates superior performance in financial data integration and real-time monitoring capabilities.

Bloomberg Law Analytics, conversely, focuses on the integration of financial and legal data to provide compliance insights that are particularly valuable for organizations operating in regulated financial sectors. The platform’s AI capabilities are optimized for analyzing the intersection of regulatory requirements and market conditions, enabling it to provide insights that consider both legal compliance obligations and business performance implications.

The machine learning approaches employed by these platforms reflect their distinct strategic positions. Thomson Reuters utilizes machine learning to enhance the accuracy and comprehensiveness of its legal analysis, focusing on improving the platform’s ability to identify relevant legal precedents and regulatory requirements. Bloomberg Law Analytics applies machine learning to identify patterns in financial and regulatory data that may indicate emerging compliance risks or enforcement trends.

Both platforms demonstrate sophisticated natural language processing capabilities, though they apply these technologies in different ways. Thomson Reuters focuses on analyzing legal texts and regulatory documents to extract compliance requirements and identify potential conflicts or ambiguities in regulatory frameworks. Bloomberg Law Analytics emphasizes the analysis of regulatory filings, enforcement actions, and market communications to identify trends and patterns that may impact compliance strategies.

User Experience and Interface Design

The user experience design philosophy of these platforms reflects their target audiences and intended use cases. Thomson Reuters has developed an interface that prioritizes comprehensive information access and detailed analysis capabilities, providing legal professionals with the tools necessary to conduct thorough compliance research and analysis. The platform’s interface is designed to accommodate complex legal workflows and support the detailed analytical processes that characterize professional legal practice.

Bloomberg Law Analytics has created a user interface that emphasizes data visualization and executive-level reporting capabilities, reflecting its focus on providing compliance insights that are accessible to both legal professionals and business executives. The platform’s dashboard-oriented design enables users to quickly identify key compliance metrics and trends while providing access to detailed analytical capabilities for users who require more comprehensive analysis.

Leverage Perplexity’s research capabilities to gather comprehensive information about specific regulatory requirements and compliance frameworks relevant to your organization’s needs. The integration of multiple research tools creates a more complete understanding of the regulatory landscape and compliance obligations.

The customization capabilities of these platforms vary significantly in their approach and scope. Thomson Reuters provides extensive customization options that enable organizations to tailor the platform’s analysis and reporting capabilities to their specific regulatory environment and compliance processes. This flexibility is particularly valuable for organizations operating in unique regulatory contexts or those with complex compliance requirements that span multiple jurisdictions or industry sectors.

Bloomberg Law Analytics offers customization capabilities that focus on financial metrics and market-based compliance indicators, enabling organizations to configure the platform to emphasize compliance factors that are most relevant to their business model and risk profile. The platform’s customization options are designed to support both legal and business perspectives on compliance management, facilitating cross-functional collaboration in compliance planning and risk assessment.

Regulatory Coverage and Content Depth

The scope and depth of regulatory coverage represent fundamental differentiators between these platforms, reflecting their distinct approaches to compliance content curation and analysis. Thomson Reuters leverages its extensive legal publishing heritage to provide comprehensive coverage of regulatory frameworks across multiple jurisdictions, practice areas, and industry sectors. The platform’s regulatory coverage extends from federal and state regulations to local ordinances and international compliance frameworks, providing organizations with a comprehensive view of their regulatory obligations.

The content depth provided by Thomson Reuters reflects the company’s commitment to maintaining authoritative legal resources that support detailed legal analysis and compliance planning. The platform’s regulatory content includes not only current regulations but also historical regulatory development, proposed rule changes, and expert commentary that provides context and interpretation for complex regulatory requirements.

Bloomberg Law Analytics focuses its regulatory coverage on areas where financial and market considerations intersect with legal compliance requirements. The platform provides particularly comprehensive coverage of financial services regulations, securities compliance requirements, and market conduct rules that govern regulated financial institutions and public companies. This focused approach enables Bloomberg Law Analytics to provide exceptional depth in specific regulatory areas while maintaining broad coverage of general compliance requirements.

The platform’s integration with Bloomberg’s financial data infrastructure enables it to provide regulatory coverage that includes real-time analysis of regulatory impacts on market conditions, compliance costs, and business performance metrics. This integration creates unique value for organizations that need to understand both the legal requirements and business implications of regulatory compliance.

Integration Capabilities and Workflow Optimization

The ability to integrate with existing legal and business systems represents a critical factor in the practical value of compliance AI platforms. Thomson Reuters has developed extensive integration capabilities that enable the platform to connect with document management systems, legal practice management software, and enterprise compliance management platforms. These integration capabilities ensure that compliance insights generated by the AI platform can be seamlessly incorporated into existing legal workflows and compliance processes.

Thomson Reuters provides API access and data export capabilities that enable organizations to integrate compliance data and insights into their existing reporting and analytics systems. This flexibility ensures that the platform can support diverse organizational structures and compliance management approaches while maintaining consistency with established legal and business processes.

Bloomberg Law Analytics offers integration capabilities that emphasize connection with financial and business intelligence systems, enabling organizations to incorporate compliance insights into broader risk management and business analytics frameworks. The platform’s integration with Bloomberg’s financial data ecosystem creates opportunities for comprehensive risk analysis that considers both regulatory compliance and business performance factors.

The workflow optimization capabilities of Bloomberg Law Analytics are designed to support cross-functional collaboration between legal, compliance, and business teams. The platform provides shared workspaces, collaborative analysis tools, and executive reporting capabilities that facilitate communication and coordination across organizational boundaries while maintaining appropriate access controls and data security measures.

Pricing Models and Value Proposition

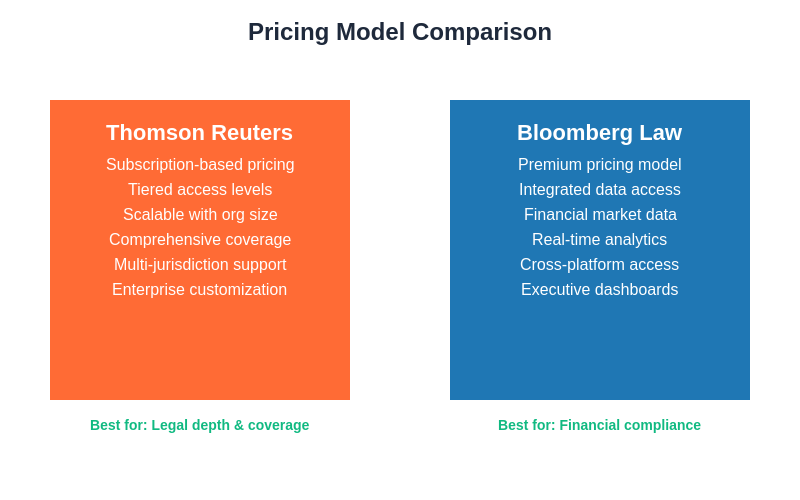

The pricing strategies employed by Thomson Reuters and Bloomberg Law Analytics reflect their distinct market positions and target customer segments. Thomson Reuters typically employs subscription-based pricing models that scale with organizational size and usage requirements, providing flexibility for organizations with varying compliance management needs and budgets. The platform’s pricing structure often includes tiered access levels that enable organizations to customize their subscription based on the specific features and capabilities most relevant to their compliance requirements.

Thomson Reuters emphasizes the long-term value proposition of comprehensive compliance management, positioning the platform as an investment in organizational risk reduction and operational efficiency. The company’s pricing approach reflects the platform’s role as a comprehensive compliance solution that can replace or supplement multiple existing compliance tools and processes.

Bloomberg Law Analytics employs pricing models that reflect the premium nature of its integrated financial and legal data platform. The platform’s pricing typically includes access to Bloomberg’s broader financial data ecosystem, creating additional value for organizations that can leverage both legal compliance and financial market intelligence. This integrated approach justifies higher pricing tiers while providing comprehensive value for organizations operating in regulated financial sectors.

The value proposition presented by Bloomberg Law Analytics emphasizes the unique insights available through the integration of financial and legal data, positioning the platform as essential infrastructure for organizations that must navigate complex regulatory environments while maintaining competitive business performance.

The pricing model comparison illustrates the fundamental differences in approach between Thomson Reuters’ comprehensive subscription-based model and Bloomberg Law’s premium integrated data access strategy, each designed to serve distinct market segments and organizational requirements.

Implementation and Training Requirements

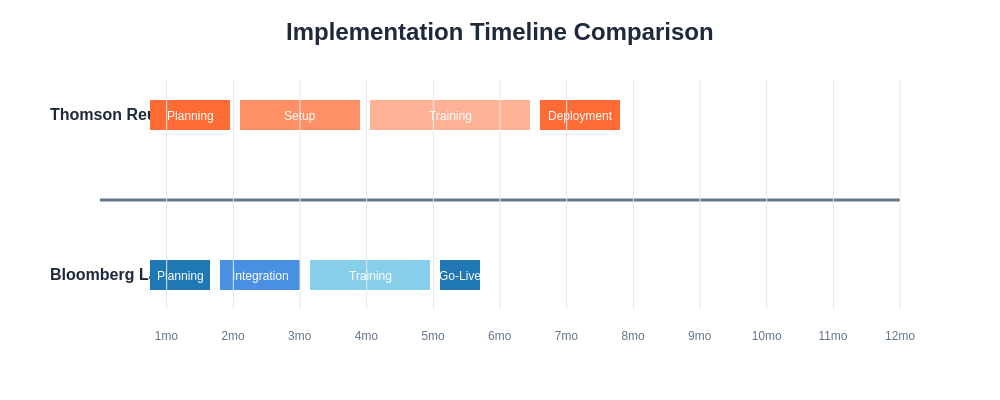

The implementation processes required for these platforms reflect their complexity and the organizational changes necessary to maximize their value. Thomson Reuters provides comprehensive implementation support that includes system configuration, data migration, user training, and ongoing technical support. The implementation process typically involves detailed analysis of organizational compliance requirements and customization of the platform to support existing compliance workflows and reporting requirements.

Thomson Reuters offers extensive training programs that address both technical platform usage and legal research methodologies optimized for AI-powered compliance analysis. These training programs are designed to help legal professionals and compliance officers maximize the value of the platform’s analytical capabilities while maintaining high standards of legal analysis and professional judgment.

Bloomberg Law Analytics implementation typically involves integration with existing Bloomberg infrastructure where applicable, streamlining the deployment process for organizations already using Bloomberg financial data services. The platform’s implementation support emphasizes cross-functional training that enables both legal and business users to effectively utilize the platform’s integrated analytical capabilities.

The training programs provided by Bloomberg Law Analytics focus on data interpretation, trend analysis, and the integration of compliance insights into business decision-making processes. These programs are designed to support organizations in developing comprehensive risk management capabilities that consider both regulatory compliance and business performance factors.

The implementation timeline comparison demonstrates Bloomberg Law’s streamlined deployment approach, leveraging existing Bloomberg infrastructure, while Thomson Reuters provides a more comprehensive but extended implementation process that ensures thorough customization and training.

Performance Metrics and Success Measurement

The measurement of success and performance for compliance AI platforms requires consideration of multiple factors that reflect both immediate operational benefits and long-term strategic value. Thomson Reuters provides performance metrics that emphasize the efficiency gains achieved through automated compliance analysis, including reduced research time, improved accuracy of compliance assessments, and enhanced identification of regulatory risks and opportunities.

Thomson Reuters tracks metrics related to user productivity, compliance coverage completeness, and the accuracy of regulatory risk predictions to demonstrate the platform’s impact on organizational compliance management capabilities. These metrics are designed to support both operational optimization and strategic compliance planning by providing quantitative evidence of the platform’s contribution to compliance effectiveness.

Bloomberg Law Analytics emphasizes performance metrics that reflect the platform’s impact on both compliance management and business performance. The platform tracks metrics related to regulatory risk reduction, compliance cost optimization, and the integration of compliance considerations into business strategy and decision-making processes.

The success measurement framework employed by Bloomberg Law Analytics includes both quantitative metrics and qualitative assessments of the platform’s contribution to organizational risk management maturity and regulatory relationship management. These comprehensive metrics support both compliance optimization and broader business performance improvement initiatives.

Future Development and Innovation Trends

The continued evolution of compliance AI technology promises to deliver even more sophisticated analytical capabilities and broader integration with organizational systems and processes. Thomson Reuters is investing in advanced machine learning technologies that will enhance the platform’s predictive capabilities and enable more sophisticated analysis of regulatory trends and enforcement patterns. Future developments are expected to include enhanced natural language generation capabilities that will enable the platform to produce comprehensive compliance reports and recommendations with minimal human intervention.

Thomson Reuters is also exploring the integration of blockchain and distributed ledger technologies to enhance the transparency and auditability of compliance monitoring and reporting processes. These technological advances will enable organizations to maintain comprehensive compliance documentation while reducing the administrative burden associated with regulatory reporting and audit preparation.

Bloomberg Law Analytics is developing enhanced integration capabilities that will enable even deeper connection between financial market data and regulatory compliance analysis. Future platform enhancements are expected to include real-time regulatory impact analysis that considers market conditions, business performance metrics, and regulatory enforcement trends to provide dynamic compliance risk assessments.

The platform is also investing in artificial intelligence capabilities that will enable automated compliance strategy optimization, providing organizations with AI-generated recommendations for compliance approach modifications based on changing regulatory environments and business conditions.

Strategic Considerations for Platform Selection

The selection of an appropriate compliance AI platform requires careful consideration of organizational needs, regulatory environment complexity, and strategic compliance objectives. Organizations operating primarily in traditional legal and regulatory environments may find Thomson Reuters’ comprehensive legal content and analytical capabilities most aligned with their compliance management requirements. The platform’s strength in legal analysis and regulatory interpretation makes it particularly valuable for organizations with complex multi-jurisdictional compliance obligations.

Organizations operating in regulated financial sectors or those requiring integration of compliance and business performance analysis may find Bloomberg Law Analytics’ integrated approach more suitable for their strategic objectives. The platform’s strength in financial data integration and market-based regulatory analysis creates unique value for organizations that must consider both regulatory compliance and business performance implications in their decision-making processes.

The long-term strategic implications of platform selection extend beyond immediate compliance management capabilities to encompass organizational compliance maturity development and competitive advantage creation through superior regulatory risk management. Organizations should consider not only current compliance requirements but also anticipated regulatory evolution and organizational growth when evaluating these platform options.

The integration capabilities and workflow optimization features of these platforms should be evaluated in the context of existing organizational systems and processes to ensure that the selected platform can enhance rather than disrupt established compliance management approaches while providing opportunities for continuous improvement and optimization.

The market positioning analysis clearly illustrates the strategic differentiation between Thomson Reuters’ legal specialization focus and Bloomberg Law’s financial integration strength, helping organizations identify which platform aligns best with their specific compliance requirements and organizational priorities.

The future of compliance AI technology promises continued innovation and enhanced capabilities that will further transform how organizations approach regulatory risk management and compliance optimization. Both Thomson Reuters and Bloomberg Law Analytics are well-positioned to continue leading this transformation, each offering distinct advantages that align with different organizational needs and strategic objectives in the evolving landscape of AI-powered compliance management.

Disclaimer

This article is for informational purposes only and does not constitute legal, financial, or professional advice. The comparison presented is based on publicly available information and general industry knowledge. Organizations should conduct their own comprehensive evaluation of compliance AI platforms, considering their specific regulatory requirements, technical infrastructure, and strategic objectives. The effectiveness and suitability of these platforms may vary depending on specific use cases, organizational requirements, and regulatory environments. Readers should consult with legal and technology professionals before making platform selection decisions.