The cryptocurrency market has evolved into a sophisticated ecosystem where artificial intelligence and algorithmic trading systems dominate the landscape, fundamentally transforming how traders approach market opportunities and risk management. The integration of advanced machine learning algorithms, neural networks, and predictive analytics has created an environment where successful trading increasingly depends on the ability to process vast amounts of data in real-time and execute trades with precision that far exceeds human capabilities.

Stay updated with the latest AI trading trends and strategies to understand how cutting-edge technologies are reshaping financial markets and creating new opportunities for both institutional and retail traders. The convergence of artificial intelligence and cryptocurrency trading represents one of the most significant developments in modern finance, offering unprecedented opportunities for those who understand how to leverage these powerful tools effectively.

The Evolution of AI-Powered Trading Systems

The transformation of cryptocurrency trading through artificial intelligence represents a paradigm shift from traditional manual trading approaches to sophisticated automated systems capable of analyzing market conditions, identifying patterns, and executing trades with remarkable speed and accuracy. Modern AI trading systems utilize complex algorithms that can process thousands of market indicators simultaneously, including price movements, trading volumes, social sentiment analysis, news events, and technical indicators to make informed trading decisions that would be impossible for human traders to replicate consistently.

These advanced systems have democratized access to institutional-grade trading strategies by enabling retail traders to deploy sophisticated algorithms previously available only to hedge funds and major financial institutions. The ability to analyze vast datasets, identify subtle market patterns, and execute trades across multiple exchanges simultaneously has created opportunities for consistent profitability in markets known for their extreme volatility and unpredictability.

The sophistication of modern AI trading systems extends beyond simple technical analysis to incorporate machine learning models that continuously adapt and improve their performance based on market feedback and changing conditions. These systems can identify emerging trends, detect market anomalies, and adjust their strategies in real-time to optimize performance while managing risk exposure across diverse cryptocurrency portfolios.

Advanced Bot Strategies and Implementation

Contemporary cryptocurrency trading bots employ a diverse array of strategies designed to capitalize on different market conditions and trading opportunities. Grid trading strategies utilize AI algorithms to place multiple buy and sell orders at predetermined intervals above and below current market prices, creating a trading grid that profits from market volatility regardless of overall directional movement. These systems continuously adjust their parameters based on market volatility, trading volume, and historical performance data to optimize grid spacing and order sizes.

Arbitrage trading bots represent another sophisticated application of AI technology in cryptocurrency markets, utilizing machine learning algorithms to identify price discrepancies across multiple exchanges and execute near-instantaneous trades to capture profit from these inefficiencies. Modern arbitrage systems must account for transaction fees, withdrawal limits, network congestion, and execution delays while maintaining the speed necessary to capitalize on opportunities that often exist for mere seconds.

Discover advanced AI capabilities with Claude for developing sophisticated trading algorithms and market analysis systems that can process complex financial data and generate actionable trading insights. The integration of natural language processing and advanced reasoning capabilities enables traders to incorporate qualitative factors and market sentiment analysis into their algorithmic trading strategies.

Mean reversion strategies powered by AI analyze historical price data and statistical patterns to identify when cryptocurrency prices deviate significantly from their expected values, positioning trades to profit from the eventual return to mean prices. These systems utilize advanced statistical models, including Bollinger Bands, z-scores, and custom volatility indicators, combined with machine learning algorithms that adapt to changing market conditions and evolving price dynamics.

The performance characteristics of different AI trading strategies vary significantly across key metrics including profit potential, risk exposure, and implementation complexity. Understanding these trade-offs enables traders to select strategies that align with their risk tolerance, technical expertise, and investment objectives while maximizing the potential for consistent returns in volatile cryptocurrency markets.

Momentum trading bots employ neural networks and deep learning algorithms to identify and capitalize on sustained price movements in cryptocurrency markets. These systems analyze multiple timeframes simultaneously, incorporating technical indicators, volume analysis, and market microstructure data to identify early signals of momentum shifts and position trades accordingly. The ability to process vast amounts of historical data enables these systems to recognize patterns that human traders might miss while maintaining the discipline necessary for consistent execution.

Market Analysis and Predictive Modeling

The application of artificial intelligence to cryptocurrency market analysis has revolutionized how traders understand and predict market behavior through the integration of multiple data sources and analytical approaches. Modern AI systems analyze not only traditional price and volume data but also incorporate social media sentiment, news analysis, regulatory developments, and macroeconomic factors to create comprehensive market models that provide deeper insights into potential price movements and market trends.

Sentiment analysis algorithms process millions of social media posts, news articles, and forum discussions in real-time to gauge market sentiment and identify potential catalysts for price movements. These systems utilize natural language processing and machine learning to distinguish between genuine market sentiment and artificial manipulation attempts, providing traders with accurate sentiment indicators that can be incorporated into their trading strategies.

Technical analysis has been enhanced through AI applications that can identify complex patterns and relationships in price data that would be impossible for human analysts to detect consistently. Machine learning algorithms analyze vast historical datasets to identify recurring patterns, seasonal trends, and correlations between different cryptocurrencies and market factors, enabling more accurate predictions of future price movements and optimal entry and exit points.

On-chain analysis represents a unique aspect of cryptocurrency market analysis where AI systems examine blockchain data to understand network activity, transaction patterns, and wallet behaviors that provide insights into underlying market dynamics. These systems can identify large wallet movements, exchange inflows and outflows, and network congestion patterns that often precede significant price movements, providing traders with early warning signals and confirmation of market trends.

Risk Management and Portfolio Optimization

Effective risk management in cryptocurrency trading requires sophisticated AI systems capable of continuously monitoring portfolio exposure, calculating value-at-risk metrics, and implementing dynamic hedging strategies that adapt to changing market conditions. Modern portfolio optimization algorithms utilize machine learning to analyze correlations between different cryptocurrencies, traditional assets, and market factors to construct portfolios that maximize returns while minimizing risk exposure.

Position sizing algorithms powered by AI analyze market volatility, trading volume, and historical performance data to determine optimal trade sizes that balance profit potential with risk management objectives. These systems continuously adjust position sizes based on market conditions, portfolio performance, and risk tolerance parameters to ensure that no single trade or market event can significantly impact overall portfolio performance.

Stop-loss and take-profit strategies have evolved through AI implementation to become dynamic systems that adjust based on market volatility, trend strength, and probability assessments of continued price movement. Rather than using fixed percentage levels, modern AI systems calculate optimal exit points based on statistical analysis of similar market conditions and price patterns, improving the probability of profitable trades while limiting downside risk.

Enhance your research capabilities with Perplexity to access comprehensive market data, regulatory information, and technical analysis resources that support informed decision-making in cryptocurrency trading. The ability to quickly research and verify market information is crucial for developing effective trading strategies and understanding the factors that influence cryptocurrency prices.

Technology Infrastructure and Execution Systems

The success of AI-powered cryptocurrency trading depends heavily on robust technology infrastructure capable of handling high-frequency data processing, real-time market analysis, and rapid trade execution across multiple exchanges and trading pairs. Modern trading systems require low-latency connections to cryptocurrency exchanges, redundant data feeds, and distributed computing resources to ensure reliable performance during periods of high market volatility and trading volume.

Cloud computing platforms have become essential for deploying scalable AI trading systems that can adapt to changing computational requirements and market conditions. These systems utilize containerized applications, microservices architectures, and distributed databases to ensure high availability, fault tolerance, and the ability to scale resources dynamically based on market activity and analysis requirements.

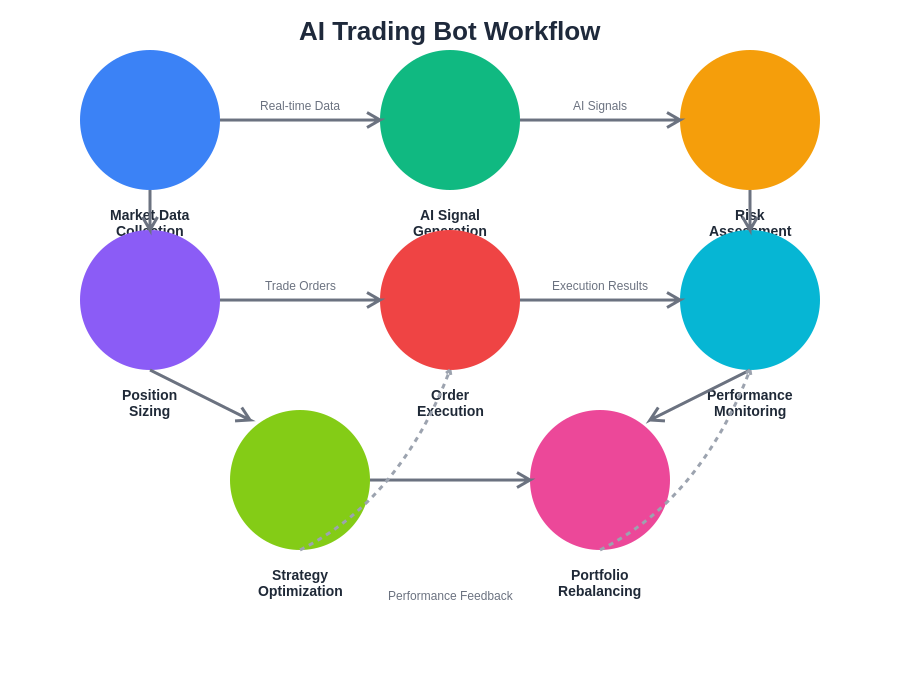

The comprehensive workflow of AI trading systems demonstrates the sophisticated integration of multiple components working in harmony to identify opportunities, assess risks, and execute trades with minimal human intervention. This systematic approach ensures consistent application of trading rules while continuously optimizing performance through machine learning feedback loops.

Data management represents a critical component of AI trading systems, requiring sophisticated databases and data processing pipelines capable of handling real-time market data, historical price information, and alternative data sources. Modern systems must process millions of data points per second while maintaining data integrity, ensuring low-latency access for trading algorithms, and providing comprehensive audit trails for compliance and performance analysis.

Regulatory Considerations and Compliance

The deployment of AI trading systems in cryptocurrency markets must navigate an evolving regulatory landscape that varies significantly across different jurisdictions and continues to develop as authorities adapt to technological innovations in financial markets. Compliance requirements include maintaining detailed records of trading activities, implementing appropriate risk controls, and ensuring that automated systems operate within regulatory guidelines and market manipulation rules.

Anti-money laundering and know-your-customer requirements impact the design and operation of AI trading systems, particularly those that interact with multiple exchanges or facilitate large-volume transactions. These systems must incorporate compliance monitoring capabilities that can detect suspicious activities, maintain transaction records, and report unusual patterns to appropriate authorities when required.

Market manipulation detection has become increasingly important as regulatory authorities develop sophisticated monitoring systems to identify artificial price movements and coordinated trading activities. AI trading systems must be designed to operate transparently and avoid strategies that could be interpreted as market manipulation, while maintaining detailed logs of decision-making processes and trade rationales.

Performance Measurement and Optimization

Evaluating the performance of AI trading systems requires comprehensive metrics that go beyond simple profit and loss calculations to include risk-adjusted returns, maximum drawdown analysis, Sharpe ratios, and consistency measures that provide insights into the sustainability and reliability of trading strategies. Modern performance analysis incorporates machine learning algorithms that can identify the factors contributing to trading success and areas requiring improvement or optimization.

Backtesting methodologies for AI trading systems must account for the unique characteristics of cryptocurrency markets, including extreme volatility, limited historical data, and rapidly changing market structure. Advanced backtesting frameworks incorporate realistic transaction costs, slippage assumptions, and market impact models to provide accurate assessments of strategy performance under various market conditions.

Continuous optimization processes utilize genetic algorithms, reinforcement learning, and other AI techniques to refine trading strategies based on changing market conditions and performance feedback. These systems can automatically adjust parameters, modify strategies, and incorporate new data sources to maintain optimal performance as markets evolve and new opportunities emerge.

The relationship between risk and expected returns across different AI trading strategies reveals the fundamental trade-offs that traders must consider when selecting automated systems. Strategies positioned along the efficient frontier offer optimal risk-adjusted returns, while those below the line may indicate opportunities for improvement through better algorithm design or parameter optimization.

Integration with Traditional Finance

The convergence of cryptocurrency markets with traditional financial systems has created new opportunities for AI trading systems that can operate across multiple asset classes and take advantage of correlations and arbitrage opportunities between crypto and traditional markets. These systems must understand the relationships between cryptocurrency prices and traditional market factors such as equity indices, currency exchange rates, and commodity prices.

Institutional adoption of cryptocurrency trading has driven demand for AI systems that can integrate with existing portfolio management systems, risk management frameworks, and compliance infrastructure used in traditional finance. These integration requirements have led to the development of more sophisticated trading platforms that can handle multiple asset classes while maintaining the specialized capabilities required for cryptocurrency markets.

The emergence of cryptocurrency derivatives, exchange-traded funds, and other traditional financial instruments linked to crypto assets has expanded the scope of AI trading opportunities while requiring more sophisticated risk management and portfolio optimization capabilities that can handle complex financial instruments and their interactions.

Future Developments and Emerging Technologies

The future of cryptocurrency AI trading will likely incorporate emerging technologies such as quantum computing, advanced neural network architectures, and decentralized autonomous organizations that can operate trading strategies without centralized control. These developments promise to further enhance the capabilities of AI trading systems while creating new challenges and opportunities in cryptocurrency markets.

Decentralized finance protocols and automated market makers represent new frontiers for AI trading systems that must understand the mechanics of liquidity provision, yield farming, and protocol governance while identifying opportunities for profitable interaction with these decentralized systems. The integration of AI with DeFi protocols could lead to more sophisticated automated trading strategies and improved market efficiency.

The development of central bank digital currencies and stablecoins backed by traditional assets will create new trading opportunities and require AI systems to adapt to different monetary policies, stability mechanisms, and regulatory frameworks that may differ significantly from current cryptocurrency markets.

Disclaimer

This article is for informational and educational purposes only and does not constitute financial, investment, or trading advice. Cryptocurrency trading involves substantial risk of loss and may not be suitable for all investors. The use of AI trading systems does not guarantee profits and may result in significant losses. Past performance of trading strategies does not indicate future results. Readers should conduct thorough research, understand the risks involved, and consider seeking advice from qualified financial professionals before engaging in cryptocurrency trading or implementing automated trading systems. Regulatory requirements and market conditions may vary by jurisdiction and change over time.