The financial services industry stands at the precipice of a technological revolution that promises to fundamentally reshape how customers interact with their banks and financial institutions. Digital banking AI, particularly through sophisticated chatbots and comprehensive customer service automation, has emerged as the cornerstone of modern banking innovation, creating unprecedented opportunities for enhanced customer experiences, operational efficiency, and personalized financial services that adapt to individual needs and preferences.

Explore the latest AI developments in banking to understand how cutting-edge technologies are revolutionizing financial services and creating new possibilities for customer engagement. The integration of artificial intelligence into banking operations represents more than just technological advancement; it embodies a complete transformation of the banking paradigm, where traditional service models give way to intelligent, responsive, and highly personalized digital experiences that operate seamlessly across multiple channels and touchpoints.

The Evolution of Banking Customer Service

The traditional banking landscape has long been characterized by physical branch visits, lengthy phone calls with customer service representatives, and time-consuming processes for even the simplest transactions. This conventional approach often resulted in customer frustration, operational inefficiencies, and limited availability of services outside standard business hours. The emergence of digital banking AI has completely transformed this paradigm by introducing intelligent systems capable of providing instant, accurate, and personalized assistance around the clock.

Modern AI-powered banking solutions leverage sophisticated natural language processing, machine learning algorithms, and predictive analytics to understand customer intentions, resolve complex queries, and proactively offer relevant financial products and services. This technological evolution has not only improved customer satisfaction but has also enabled banks to reduce operational costs while simultaneously expanding their service capabilities to meet the diverse needs of an increasingly digital-native customer base.

The transformation extends beyond simple query resolution to encompass comprehensive financial advisory services, fraud detection and prevention, personalized product recommendations, and intelligent transaction monitoring that helps customers make informed financial decisions. This holistic approach to AI integration has established new standards for customer service excellence in the banking industry while creating opportunities for deeper customer relationships and enhanced financial literacy.

Chatbot Technology Revolutionizing Banking Interactions

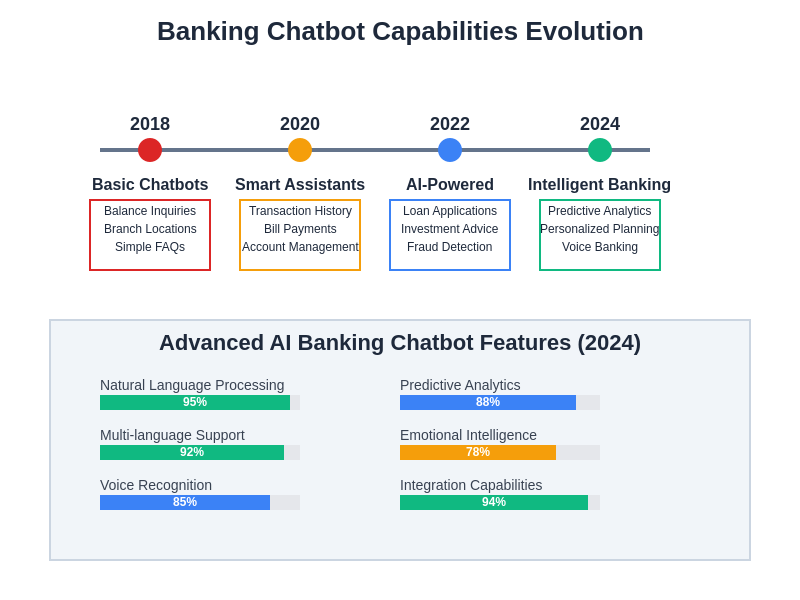

Banking chatbots represent one of the most visible and impactful applications of artificial intelligence in the financial services sector. These sophisticated conversational agents utilize advanced natural language understanding to interpret customer requests, access relevant account information, and provide accurate responses that match the quality of human customer service representatives. The evolution from simple rule-based chatbots to AI-powered conversational agents has enabled banks to offer personalized, context-aware interactions that can handle complex financial queries and transactions.

Modern banking chatbots are equipped with capabilities that extend far beyond basic account inquiries. They can facilitate money transfers, help customers navigate loan applications, provide investment advice based on individual risk profiles, assist with budget planning and expense tracking, and even detect potentially fraudulent activities by analyzing transaction patterns and customer behavior. This comprehensive functionality has made chatbots indispensable tools for both routine banking operations and sophisticated financial management tasks.

The evolution of banking chatbots from simple FAQ systems to sophisticated AI-powered financial assistants represents a remarkable transformation in customer service technology. Today’s advanced chatbots incorporate natural language processing, predictive analytics, and emotional intelligence to deliver personalized banking experiences that rival human interactions.

Experience advanced AI capabilities with Claude for understanding how sophisticated language models can enhance customer service interactions and provide intelligent financial guidance. The integration of advanced AI models into banking chatbots has created opportunities for more natural, intuitive conversations that can adapt to individual communication styles, remember previous interactions, and provide contextually relevant recommendations that align with customers’ financial goals and preferences.

Automation Transforming Customer Service Operations

Customer service automation in digital banking encompasses a broad spectrum of AI-powered solutions designed to streamline operations, reduce response times, and improve service quality across all customer touchpoints. This automation extends from initial customer contact through complex problem resolution, creating seamless experiences that often surpass traditional human-assisted service models in terms of speed, accuracy, and availability.

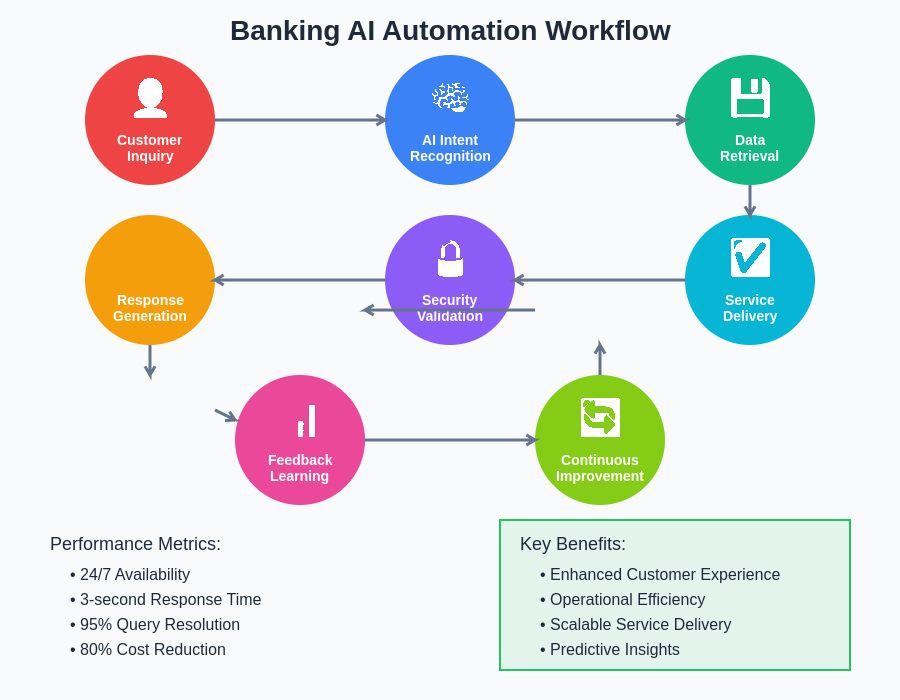

Intelligent routing systems analyze customer inquiries and automatically direct them to the most appropriate resource, whether that’s a specialized chatbot, a human agent with relevant expertise, or an automated workflow designed to resolve specific types of requests. This sophisticated triage system ensures that customers receive the most efficient service possible while optimizing resource allocation and reducing operational costs for banking institutions.

The automation of routine tasks such as account balance inquiries, transaction history requests, payment scheduling, and basic troubleshooting has freed human agents to focus on more complex customer needs that require empathy, creative problem-solving, and specialized knowledge. This division of labor between AI systems and human agents has resulted in improved job satisfaction for customer service representatives while enhancing overall service quality for banking customers.

The comprehensive automation workflow demonstrates how AI systems process customer inquiries through multiple sophisticated stages, from initial intent recognition through final service delivery and continuous learning. This systematic approach ensures consistent quality while maintaining the flexibility to adapt to evolving customer needs and preferences.

Personalization Through AI-Driven Insights

One of the most compelling advantages of AI-powered digital banking lies in its ability to deliver highly personalized experiences that adapt to individual customer preferences, financial behaviors, and life circumstances. Advanced machine learning algorithms analyze vast amounts of customer data, including transaction histories, spending patterns, savings behaviors, and interaction preferences, to create comprehensive profiles that enable targeted service delivery and proactive financial guidance.

This personalization extends to every aspect of the banking experience, from customized user interfaces that highlight the most relevant features for each customer to personalized financial recommendations that align with individual goals and risk tolerances. AI systems can identify opportunities for customers to save money, optimize their spending, consolidate debts, or take advantage of investment opportunities that match their financial situations and objectives.

The predictive capabilities of AI-driven personalization enable banks to anticipate customer needs before they arise, offering proactive solutions such as spending alerts when customers approach budget limits, suggestions for better savings products when account balances reach certain thresholds, or recommendations for credit products when customers demonstrate strong financial health and creditworthiness.

Enhanced Security Through AI-Powered Fraud Detection

Digital banking AI has revolutionized security and fraud prevention by implementing sophisticated monitoring systems that can detect suspicious activities in real-time and respond immediately to protect customer accounts. Advanced machine learning algorithms analyze transaction patterns, device fingerprints, geolocation data, and behavioral biometrics to establish baseline patterns for each customer and identify deviations that may indicate fraudulent activity.

These AI-powered security systems can distinguish between legitimate unusual transactions, such as vacation spending or large purchases, and genuinely suspicious activities that warrant immediate intervention. The ability to make these nuanced distinctions reduces false positives that can inconvenience customers while maintaining high levels of security protection against increasingly sophisticated fraud attempts.

The integration of AI-driven security measures with customer service automation enables immediate response to potential threats, including automatic transaction blocking, instant customer notifications, and rapid deployment of additional authentication measures when suspicious activities are detected. This proactive approach to security helps prevent financial losses while minimizing disruptions to legitimate banking activities.

Discover comprehensive AI research capabilities with Perplexity to explore the latest developments in financial security technologies and fraud prevention strategies. The continuous evolution of AI-powered security systems ensures that banks can stay ahead of emerging threats while providing customers with confidence in the safety and security of their digital banking experiences.

Omnichannel Integration and Seamless Experiences

Modern digital banking AI systems excel at creating cohesive experiences across multiple channels, ensuring that customers can seamlessly transition between mobile apps, web platforms, phone services, and even physical branch visits without losing context or repeating information. This omnichannel approach leverages centralized AI systems that maintain comprehensive customer profiles and interaction histories across all touchpoints.

The sophistication of omnichannel AI integration allows customers to begin transactions on one platform and complete them on another, receive consistent information regardless of their chosen communication method, and access their full banking relationship context through any channel. This flexibility has become increasingly important as customers expect banking services to adapt to their changing preferences and circumstances rather than forcing them to conform to rigid service delivery models.

Advanced AI orchestration ensures that customer service representatives, whether human or automated, have access to complete interaction histories and can provide informed assistance that builds upon previous conversations and transactions. This continuity eliminates frustration associated with repeating information and enables more efficient problem resolution and service delivery across all customer touchpoints.

Cost Efficiency and Operational Optimization

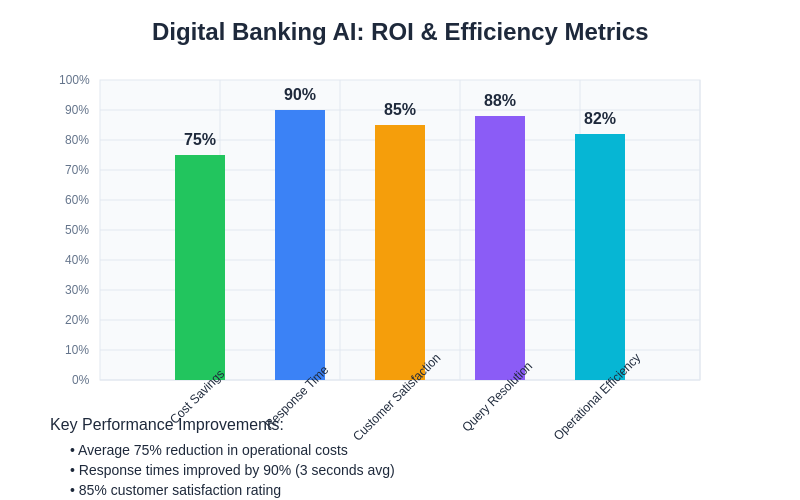

The implementation of AI-powered customer service automation has generated significant cost savings for banking institutions while simultaneously improving service quality and customer satisfaction. Automated systems can handle vast volumes of customer inquiries without the linear cost increases associated with human staffing, enabling banks to provide extensive customer support at a fraction of traditional operational costs.

These efficiency gains extend beyond simple cost reduction to encompass improved resource allocation, reduced error rates, and enhanced consistency in service delivery. AI systems never experience fatigue, mood variations, or knowledge gaps that can affect human performance, ensuring that customers receive consistently high-quality service regardless of when they seek assistance or how complex their requests may be.

The operational optimization achieved through AI automation also enables banks to redirect human resources toward higher-value activities such as relationship building, complex problem-solving, and strategic customer advisory services. This reallocation of human capital has improved job satisfaction for banking employees while creating opportunities for more meaningful customer relationships and enhanced service differentiation.

The quantifiable benefits of AI implementation in banking demonstrate substantial improvements across all key performance indicators. Banks utilizing comprehensive AI automation report significant cost reductions, dramatically improved response times, enhanced customer satisfaction scores, and superior operational efficiency compared to traditional service delivery models.

Real-Time Decision Making and Instant Service Delivery

AI-powered banking systems excel at making complex decisions in real-time, enabling instant service delivery that meets modern customer expectations for immediate gratification and efficient problem resolution. Advanced algorithms can instantly evaluate creditworthiness for loan applications, assess risk profiles for investment recommendations, and determine optimal product offerings based on customer profiles and current market conditions.

This real-time decision-making capability extends to dynamic pricing models that can adjust rates and terms based on current market conditions and individual customer relationships, personalized marketing campaigns that respond to immediate customer behaviors and preferences, and adaptive service delivery that adjusts to changing customer needs and circumstances without requiring manual intervention or lengthy approval processes.

The ability to provide instant responses and immediate service delivery has become a critical competitive advantage in the banking industry, where customers increasingly expect digital experiences that rival or exceed those provided by leading technology companies in other sectors. AI-powered systems enable banks to meet these expectations while maintaining the security, compliance, and reliability standards required in the financial services industry.

Advanced Analytics and Predictive Customer Service

The integration of advanced analytics into digital banking AI systems has enabled predictive customer service models that can anticipate customer needs and proactively address potential issues before they impact the customer experience. Machine learning algorithms analyze historical data, current behaviors, and external factors to predict when customers might need specific services, encounter problems, or benefit from particular financial products.

This predictive capability enables banks to reach out to customers with relevant offers, warnings about potential account issues, reminders about important financial deadlines, and suggestions for optimizing their financial management strategies. The proactive nature of these interactions demonstrates value to customers while creating opportunities for deeper engagement and stronger banking relationships.

Predictive analytics also enable banks to optimize their service delivery by anticipating demand patterns, identifying potential system issues before they affect customers, and allocating resources more effectively across different service channels. This optimization improves overall system performance while reducing the likelihood of service disruptions that could negatively impact customer experiences.

Integration with Emerging Financial Technologies

Digital banking AI systems are increasingly integrated with emerging financial technologies such as blockchain networks, cryptocurrency platforms, open banking APIs, and regulatory technology solutions. This integration enables banks to offer comprehensive financial services that extend beyond traditional banking products to encompass modern financial instruments and services that customers increasingly demand.

The ability of AI systems to adapt to new technologies and integrate with diverse platforms ensures that banks can remain competitive as the financial services landscape continues to evolve. AI-powered systems can learn to work with new APIs, understand emerging financial products, and provide customer support for innovative services without requiring extensive system overhauls or lengthy implementation processes.

This technological flexibility has become crucial as regulatory requirements evolve, customer expectations change, and new competitors enter the financial services market with innovative solutions that challenge traditional banking models. AI-powered systems provide the adaptability and scalability needed to respond effectively to these dynamic market conditions while maintaining high service standards and customer satisfaction levels.

Compliance and Regulatory Automation

The complex regulatory environment of the financial services industry has been significantly simplified through AI-powered compliance automation that can monitor transactions, identify potential violations, and ensure adherence to evolving regulatory requirements. Advanced systems can automatically generate required reports, flag transactions that require additional scrutiny, and maintain detailed audit trails that satisfy regulatory oversight requirements.

AI-driven compliance systems can adapt to changing regulations by learning from updated rule sets and automatically adjusting monitoring parameters to ensure continued compliance without manual intervention. This adaptability is crucial in an industry where regulatory requirements frequently change and non-compliance can result in significant financial penalties and reputational damage.

The automation of compliance processes has reduced the burden on human staff while improving accuracy and consistency in regulatory adherence. AI systems can process vast amounts of transaction data to identify patterns that might indicate compliance issues, enabling proactive remediation before problems escalate to regulatory violations or customer impacts.

Future Innovations and Industry Transformation

The future of digital banking AI promises even more sophisticated capabilities that will further transform customer experiences and operational efficiency. Emerging technologies such as advanced natural language generation, emotional intelligence recognition, and contextual learning systems will enable more nuanced and empathetic customer interactions that can adapt to individual emotional states and communication preferences.

The integration of AI with Internet of Things devices, wearable technologies, and smart home systems will create opportunities for contextual banking services that can provide financial guidance based on real-world activities and lifestyle patterns. This expansion of AI capabilities beyond traditional banking channels will create new opportunities for customer engagement and value creation.

Advances in quantum computing, edge AI processing, and federated learning will enable even more sophisticated analysis capabilities while maintaining privacy and security standards that protect customer data. These technological advances will support the development of increasingly personalized and intelligent banking services that can adapt to individual needs while operating at scale across diverse customer bases.

The continued evolution of digital banking AI will likely result in complete transformation of traditional banking models, where intelligent systems provide comprehensive financial guidance, automated wealth management, and predictive financial planning that help customers achieve their financial goals more effectively than ever before. This transformation will require ongoing adaptation by both banking institutions and customers, but promises to deliver unprecedented value and convenience in financial services.

Disclaimer

This article is for informational purposes only and does not constitute financial or investment advice. The views expressed are based on current understanding of AI technologies and their applications in digital banking. Readers should conduct their own research and consult with qualified financial advisors before making decisions about banking services or financial products. The effectiveness and availability of AI-powered banking services may vary depending on specific institutions, regulatory environments, and individual customer circumstances.