The intersection of environmental, social, and governance investing with artificial intelligence has created a transformative paradigm in sustainable finance that is reshaping how institutional and individual investors approach responsible investment strategies. This revolutionary convergence has enabled unprecedented levels of data analysis, risk assessment, and performance evaluation that were previously impossible to achieve through traditional ESG evaluation methods, fundamentally altering the landscape of sustainable finance and creating new opportunities for investors to align their financial objectives with their environmental and social values.

Stay updated with the latest AI trends in sustainable finance as artificial intelligence continues to revolutionize how we approach environmental, social, and governance investing through sophisticated analytics and predictive modeling. The integration of AI into ESG investing represents a quantum leap forward in our ability to measure, analyze, and optimize sustainable investment strategies while maintaining robust financial performance and meaningful impact measurement.

The Evolution of ESG Analytics Through Artificial Intelligence

The traditional approach to ESG investing relied heavily on manual research, subjective assessments, and limited data sources that often resulted in inconsistent evaluations and potential gaps in understanding the true sustainability impact of investment decisions. Artificial intelligence has fundamentally transformed this landscape by introducing sophisticated analytical capabilities that can process vast amounts of structured and unstructured data from diverse sources including satellite imagery, social media sentiment, regulatory filings, supply chain documentation, and real-time environmental monitoring systems to create comprehensive and objective ESG assessments.

This technological evolution has enabled investment professionals to move beyond surface-level ESG ratings provided by traditional agencies and develop nuanced understanding of how environmental, social, and governance factors actually impact financial performance, risk profiles, and long-term value creation. AI-powered analytics can identify subtle correlations between ESG practices and financial outcomes that human analysts might overlook, while simultaneously processing information at scales that would be impossible for traditional research teams to manage effectively.

Advanced Data Processing and Alternative Data Integration

The power of AI in ESG investing lies significantly in its ability to process and analyze alternative data sources that provide real-time insights into company sustainability practices and environmental impact. Satellite imagery analysis can monitor deforestation activities, track industrial emissions, assess water usage patterns, and evaluate agricultural sustainability practices with precision that traditional reporting mechanisms cannot match. Natural language processing capabilities enable AI systems to analyze corporate communications, news articles, social media discussions, and regulatory documents to identify potential ESG risks and opportunities before they become apparent through conventional financial metrics.

Machine learning algorithms can integrate supply chain data, labor practice information, board composition analyses, and executive compensation structures to create holistic governance assessments that reflect the true decision-making processes and accountability mechanisms within organizations. This comprehensive data integration approach allows investors to make more informed decisions based on actual performance indicators rather than relying solely on self-reported ESG metrics that may not accurately reflect operational realities.

Explore advanced AI capabilities with Claude for sophisticated ESG data analysis and sustainable finance research that can enhance your investment decision-making process through comprehensive environmental, social, and governance insights. The combination of multiple AI technologies creates a robust analytical framework that supports evidence-based sustainable investing strategies.

Predictive Modeling for Sustainable Investment Outcomes

Artificial intelligence has introduced sophisticated predictive modeling capabilities that enable investors to forecast the long-term financial implications of ESG factors with unprecedented accuracy and granularity. These predictive models can analyze historical relationships between sustainability practices and financial performance across different sectors, market conditions, and regulatory environments to identify patterns that inform future investment strategies and risk management approaches.

Advanced machine learning algorithms can process complex interactions between environmental regulations, social trends, governance practices, and market dynamics to predict how ESG factors will influence company valuations, operational efficiency, and competitive positioning over extended time horizons. This predictive capability is particularly valuable for institutional investors who need to make long-term investment commitments while managing fiduciary responsibilities and achieving specific sustainability objectives.

The sophisticated analytical framework underlying AI-powered ESG investing integrates multiple data sources, analytical methodologies, and predictive models to create comprehensive sustainability assessments that inform investment decisions. This systematic approach ensures that environmental, social, and governance factors are evaluated consistently and objectively across different investment opportunities and market conditions.

Real-Time Risk Assessment and Monitoring

Traditional ESG risk assessment often relied on periodic reports and annual sustainability disclosures that provided limited visibility into emerging risks and changing circumstances that could impact investment performance. AI-powered monitoring systems have revolutionized this approach by providing continuous, real-time assessment of ESG risks through automated analysis of news feeds, regulatory announcements, environmental monitoring data, and social media sentiment indicators.

These real-time monitoring capabilities enable investment managers to identify potential ESG risks before they manifest as material financial impacts, allowing for proactive portfolio adjustments and risk mitigation strategies. Machine learning algorithms can detect patterns in environmental data that may indicate emerging climate risks, analyze social media sentiment to identify potential reputational issues, and monitor governance changes that could affect company performance and stakeholder relationships.

The ability to receive early warning signals about ESG risks has become increasingly valuable as environmental regulations become more stringent, social expectations for corporate responsibility continue to evolve, and governance standards become more demanding across global markets. Real-time monitoring provides investors with the information they need to maintain portfolio alignment with sustainability objectives while protecting against potential financial losses associated with ESG-related risks.

Automated Screening and Portfolio Optimization

Artificial intelligence has significantly enhanced the efficiency and effectiveness of ESG screening processes by automating the evaluation of potential investments against complex sustainability criteria and optimization objectives. AI systems can simultaneously assess thousands of potential investments across multiple ESG dimensions, applying sophisticated scoring methodologies that consider sector-specific factors, regional variations, and temporal trends to identify optimal investment opportunities that align with specific sustainability mandates.

Advanced optimization algorithms can construct portfolios that maximize financial returns while achieving predetermined ESG objectives, managing risk constraints, and maintaining appropriate diversification across sectors, geographies, and investment styles. This optimization capability extends beyond simple negative screening approaches to enable positive selection strategies that actively seek investments with superior ESG characteristics and strong financial prospects.

The automation of screening and optimization processes has reduced the time and resources required for ESG investment research while improving the consistency and objectivity of investment decisions. Portfolio managers can now evaluate significantly more investment opportunities and construct more sophisticated portfolios that better balance financial and sustainability objectives than was possible through manual analysis and traditional optimization techniques.

Enhanced Due Diligence Through AI-Powered Analysis

Due diligence processes for ESG investments have been dramatically enhanced through AI-powered analysis capabilities that can evaluate potential investments with depth and comprehensiveness that exceeds traditional research methodologies. Natural language processing can analyze thousands of documents including annual reports, sustainability disclosures, regulatory filings, and third-party assessments to identify material ESG risks and opportunities that might be overlooked through manual review processes.

Machine learning algorithms can detect inconsistencies between corporate ESG claims and actual performance indicators, identify potential greenwashing practices, and assess the credibility of sustainability commitments through analysis of historical performance patterns and peer comparisons. This enhanced due diligence capability helps investors avoid investments that may appear attractive based on superficial ESG metrics but lack genuine sustainability substance or commitment to meaningful environmental and social impact.

Leverage Perplexity’s research capabilities for comprehensive ESG due diligence research that incorporates diverse data sources and analytical perspectives to support informed sustainable investment decisions. The integration of multiple AI research tools creates a robust foundation for thorough ESG investment analysis.

Impact Measurement and Reporting Automation

The measurement and reporting of ESG investment impact has been revolutionized through AI-powered systems that can automatically track, analyze, and report on the environmental and social outcomes associated with investment portfolios. These systems can process data from portfolio companies, third-party monitoring sources, and environmental databases to quantify actual impact metrics such as carbon footprint reduction, water conservation achievements, social program effectiveness, and governance improvement indicators.

Automated impact reporting capabilities enable investment managers to provide stakeholders with regular updates on portfolio sustainability performance, demonstrate progress toward ESG objectives, and identify opportunities for enhanced impact through strategic portfolio adjustments. Machine learning algorithms can identify correlations between specific investment strategies and measurable environmental and social outcomes, providing valuable insights for optimizing future investment decisions and impact objectives.

The ability to provide concrete evidence of ESG investment impact has become increasingly important as institutional investors face growing pressure to demonstrate the effectiveness of their sustainable investment strategies and regulatory requirements for sustainability reporting continue to evolve across global markets.

Sector-Specific ESG Analytics and Insights

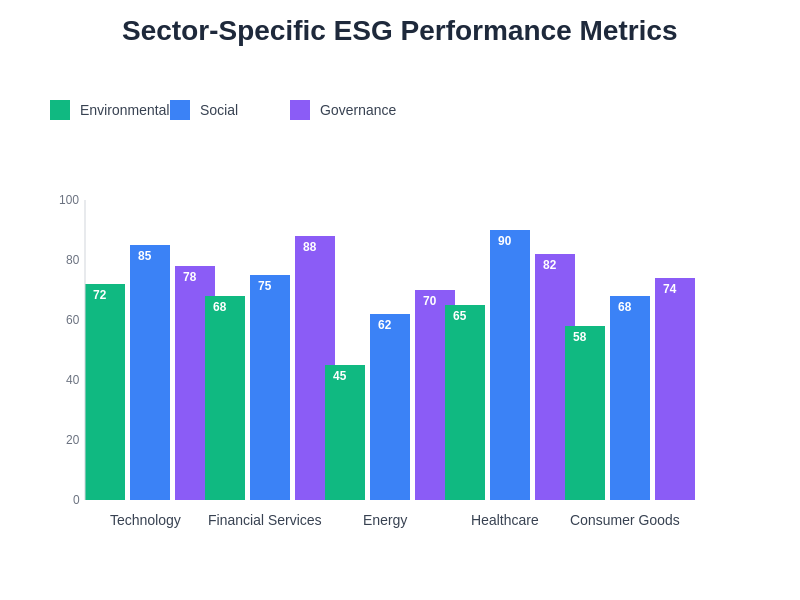

Different industry sectors face unique environmental, social, and governance challenges that require specialized analytical approaches and sector-specific expertise to evaluate effectively. AI-powered ESG analytics have been developed to address these sector-specific requirements through specialized algorithms and data sources that focus on the most material sustainability factors for particular industries and business models.

For technology companies, AI systems can evaluate data privacy practices, cybersecurity measures, supply chain labor conditions, and electronic waste management programs. In the energy sector, advanced analytics focus on transition planning toward renewable sources, environmental impact management, community engagement practices, and governance structures that support sustainable transformation. Financial services companies are evaluated through AI systems that assess lending practices, financial inclusion initiatives, risk management approaches, and governance frameworks that promote responsible financial services.

This sector-specific approach ensures that ESG evaluations focus on the factors that are most likely to impact financial performance and sustainability outcomes for particular types of businesses, rather than applying generic sustainability criteria that may not reflect the unique challenges and opportunities faced by companies in different industries.

The variation in ESG performance metrics across different sectors highlights the importance of industry-specific analytical approaches that recognize the unique sustainability challenges and opportunities faced by companies in various industries. This targeted analysis ensures that investment decisions are based on the most relevant and material ESG factors for each sector.

Integration with Traditional Financial Analysis

The most effective AI-powered ESG investing approaches integrate sustainability analytics with traditional financial analysis to create comprehensive investment evaluations that consider both financial performance potential and ESG characteristics. Advanced machine learning models can identify relationships between ESG factors and traditional financial metrics such as revenue growth, profitability, operational efficiency, and risk-adjusted returns to develop integrated scoring systems that support holistic investment decision-making.

This integration approach recognizes that ESG factors are not separate from financial performance but are increasingly important drivers of long-term value creation, competitive advantage, and risk management effectiveness. AI systems can quantify how specific ESG practices influence financial outcomes and identify companies that demonstrate superior performance across both sustainability and traditional financial dimensions.

The ability to seamlessly integrate ESG and financial analysis has been crucial for mainstream adoption of sustainable investing practices by institutional investors who must balance fiduciary responsibilities with sustainability objectives and demonstrate that ESG considerations enhance rather than compromise financial performance.

Regulatory Compliance and Reporting Automation

The evolving regulatory landscape for sustainable finance has created complex compliance requirements that vary across jurisdictions and continue to develop as governments implement new disclosure mandates and sustainability standards. AI-powered systems have become essential tools for managing these compliance requirements through automated monitoring of regulatory changes, analysis of portfolio alignment with various sustainability frameworks, and generation of required reporting documentation.

Machine learning algorithms can track regulatory developments across multiple jurisdictions, assess their implications for specific investment portfolios, and recommend necessary adjustments to maintain compliance with evolving requirements. Automated reporting systems can generate the detailed documentation required by regulations such as the European Union’s Sustainable Finance Disclosure Regulation, ensuring that investment managers can meet their obligations efficiently while maintaining focus on investment performance and impact objectives.

The complexity and dynamic nature of sustainable finance regulation makes AI-powered compliance management increasingly valuable for investment organizations that operate across multiple markets and must navigate diverse regulatory requirements while maintaining consistent ESG investment approaches.

Future Developments in AI-Powered ESG Investing

The continued evolution of artificial intelligence capabilities promises to bring even more sophisticated analytical tools and investment strategies to the ESG investing landscape. Emerging technologies such as advanced natural language processing, computer vision applications, and quantum computing approaches may enable new forms of sustainability analysis and impact measurement that are currently beyond the capabilities of existing systems.

The integration of blockchain technology with AI analytics may create new opportunities for transparent and verifiable impact tracking, while advances in satellite monitoring and environmental sensing technologies will provide increasingly detailed and real-time data about corporate environmental performance. The development of more sophisticated predictive models may enable investors to anticipate ESG trends and regulatory changes with greater accuracy, supporting more proactive investment strategies.

The trajectory of AI development in ESG investing points toward increasingly sophisticated analytical capabilities that will enable more precise impact measurement, enhanced risk assessment, and better integration of sustainability factors with financial analysis. These technological advances will continue to democratize access to sophisticated ESG analytics while improving the effectiveness of sustainable investment strategies.

The democratization of AI-powered ESG analytics through cloud-based platforms and standardized analytical tools may make sophisticated sustainability analysis accessible to smaller investment managers and individual investors, potentially accelerating the mainstream adoption of ESG investing approaches across diverse market segments and investor types.

Challenges and Considerations in AI-Powered ESG Analytics

Despite the significant benefits of AI-powered ESG investing, several challenges and considerations must be addressed to ensure the effectiveness and reliability of these analytical approaches. Data quality and availability remain significant concerns, as ESG analytics depend on accurate and comprehensive data sources that may not always be available or reliable, particularly for smaller companies or emerging markets where data collection and reporting standards may be less developed.

The potential for algorithmic bias in AI systems presents another important consideration, as machine learning models may perpetuate or amplify existing biases in ESG data or evaluation methodologies. Ensuring that AI systems are designed and trained to provide objective and fair assessments across different types of companies, sectors, and geographic regions requires careful attention to model development, data selection, and validation processes.

The complexity of AI-powered analytical systems may also create challenges for investment professionals who need to understand and explain investment decisions to stakeholders, regulatory authorities, and beneficiaries. Maintaining transparency and interpretability in AI-driven investment processes requires sophisticated model design and comprehensive documentation of analytical methodologies and decision-making processes.

Building Sustainable Investment Strategies with AI

The development of effective AI-powered ESG investment strategies requires careful consideration of investment objectives, risk tolerance, sustainability priorities, and operational constraints that may influence the design and implementation of analytical systems. Investment organizations must establish clear frameworks for integrating AI analytics with existing investment processes while ensuring that technology enhances rather than replaces human judgment and expertise.

Successful implementation of AI-powered ESG investing often requires significant investment in technology infrastructure, data management capabilities, and staff training to ensure that investment professionals can effectively utilize sophisticated analytical tools while maintaining accountability for investment decisions and outcomes. The most effective approaches typically combine advanced AI capabilities with human expertise and oversight to create investment processes that leverage the strengths of both technological and human intelligence.

The continued evolution of AI-powered ESG investing will likely require ongoing adaptation and refinement of analytical methodologies, investment strategies, and operational processes to keep pace with technological advances, regulatory changes, and evolving stakeholder expectations for sustainable finance performance and impact measurement.

Conclusion: The Transformation of Sustainable Finance

The integration of artificial intelligence into ESG investing represents a fundamental transformation in how sustainable finance strategies are developed, implemented, and evaluated, creating new opportunities for investors to achieve both financial returns and meaningful environmental and social impact. The sophisticated analytical capabilities enabled by AI have addressed many of the traditional limitations of ESG investing while opening new possibilities for innovation in sustainable finance that were previously unimaginable.

As AI technologies continue to evolve and mature, their application to ESG investing will likely become even more sophisticated and effective, supporting the continued growth of sustainable finance and helping to direct capital toward investments that contribute to positive environmental and social outcomes while generating attractive financial returns. The future of ESG investing will be shaped by the continued advancement of AI capabilities and their thoughtful integration with human expertise and judgment to create investment approaches that serve both financial and sustainability objectives.

Disclaimer

This article is for informational purposes only and does not constitute investment advice or recommendations. ESG investing involves risks and considerations that may not be suitable for all investors. The effectiveness of AI-powered analytics in ESG investing may vary depending on data quality, market conditions, and specific implementation approaches. Readers should conduct their own research and consult with qualified financial advisors before making investment decisions. Past performance does not guarantee future results, and all investments carry the risk of loss.