The financial industry stands at the forefront of artificial intelligence adoption, where sophisticated algorithms and machine learning models have fundamentally transformed how markets operate, trades are executed, and risks are assessed. This technological revolution has created an ecosystem where millisecond decisions can generate substantial profits or losses, and where traditional human-driven financial analysis has evolved into a symbiotic relationship between human expertise and artificial intelligence capabilities.

Stay updated with the latest AI developments in finance to understand how cutting-edge technologies are reshaping investment strategies and market dynamics. The integration of artificial intelligence into financial systems represents one of the most significant paradigm shifts in modern finance, creating opportunities for enhanced profitability while simultaneously introducing new categories of systemic risks that require careful consideration and management.

The Evolution of Algorithmic Trading Systems

The transformation from traditional floor trading to sophisticated algorithmic systems represents a fundamental shift in how financial markets operate. Modern algorithmic trading systems leverage artificial intelligence to process vast amounts of market data, identify trading opportunities, and execute transactions at speeds impossible for human traders to achieve. These systems continuously analyze market conditions, news feeds, economic indicators, and historical patterns to make split-second trading decisions that can capitalize on minute price discrepancies across different markets and asset classes.

The sophistication of contemporary algorithmic trading extends far beyond simple rule-based systems. Machine learning algorithms now adapt to changing market conditions, learning from past performance to refine trading strategies continuously. These systems can identify complex patterns in market behavior that would be invisible to human analysts, processing multiple data streams simultaneously to detect emerging trends, sentiment shifts, and arbitrage opportunities that exist for mere fractions of a second in today’s high-speed trading environment.

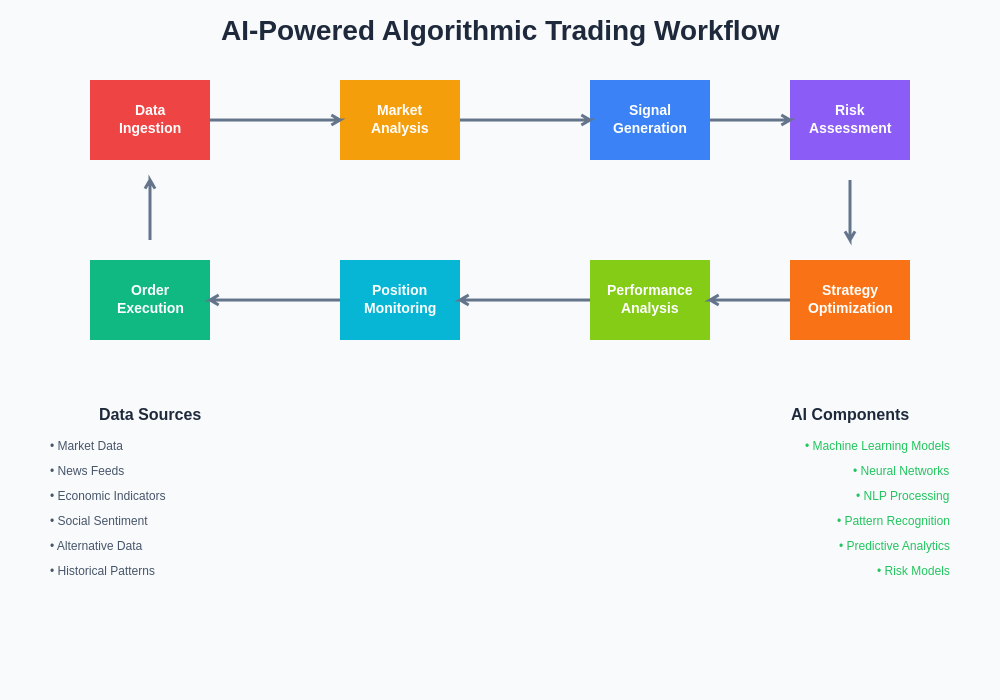

The comprehensive workflow of modern AI-powered trading systems demonstrates the intricate integration of data ingestion, analysis, and execution processes that operate continuously in financial markets. This systematic approach ensures optimal decision-making at every stage of the trading lifecycle while maintaining robust risk management protocols.

Machine Learning in Market Prediction

Artificial intelligence has revolutionized market prediction by enabling the analysis of previously incomprehensible volumes of data from diverse sources. Machine learning models can process traditional financial metrics alongside alternative data sources such as social media sentiment, satellite imagery, supply chain data, and macroeconomic indicators to generate predictive insights about market movements. These comprehensive analytical approaches have proven particularly effective in identifying market anomalies and predicting short-term price movements with remarkable accuracy.

The predictive capabilities of AI systems extend beyond simple price forecasting to include complex scenario analysis and stress testing. Advanced neural networks can model the interdependencies between different financial instruments, sectors, and global markets to predict how various economic events might impact portfolio performance. This comprehensive analytical capability enables investment managers to make more informed decisions about asset allocation, hedging strategies, and risk management protocols.

Explore advanced AI tools like Claude for sophisticated financial analysis and strategic decision-making in complex market environments. The integration of multiple AI systems creates a comprehensive analytical framework that supports every aspect of modern financial management from initial market research to final trade execution.

High-Frequency Trading and Market Microstructure

High-frequency trading represents the pinnacle of algorithmic trading evolution, where artificial intelligence systems execute thousands of trades per second based on microscopic market movements and statistical arbitrage opportunities. These systems operate on timescales measured in microseconds, requiring co-location with exchange servers and specialized hardware optimized for minimal latency execution. The algorithms powering these systems must make complex decisions about order placement, timing, and execution strategies while continuously adapting to changing market conditions and competitor behavior.

The impact of high-frequency trading on market microstructure has been profound, fundamentally altering how prices are discovered and liquidity is provided across financial markets. AI-powered market-making algorithms now provide continuous bid-offer spreads across thousands of securities simultaneously, using machine learning models to optimize pricing strategies based on inventory levels, market volatility, and anticipated order flow. This technological evolution has generally reduced transaction costs for institutional investors while creating new challenges related to market stability and fairness.

Risk Assessment and Management Technologies

Artificial intelligence has transformed risk assessment from a reactive, historical analysis-based discipline into a proactive, predictive science capable of identifying and quantifying risks before they materialize. Modern risk management systems utilize machine learning algorithms to analyze portfolio exposures, stress-test investment strategies, and model potential loss scenarios across different market conditions. These systems can process real-time market data to continuously update risk assessments and automatically trigger defensive measures when predetermined risk thresholds are approached.

The sophistication of AI-powered risk assessment extends to the identification of previously unrecognized risk factors and correlations between seemingly unrelated assets or markets. Machine learning models can detect subtle patterns in market behavior that indicate emerging systemic risks, enabling financial institutions to adjust their positions proactively rather than reactively responding to market disruptions. This predictive capability has proven particularly valuable during periods of market stress when traditional risk models often fail to capture the full extent of potential losses.

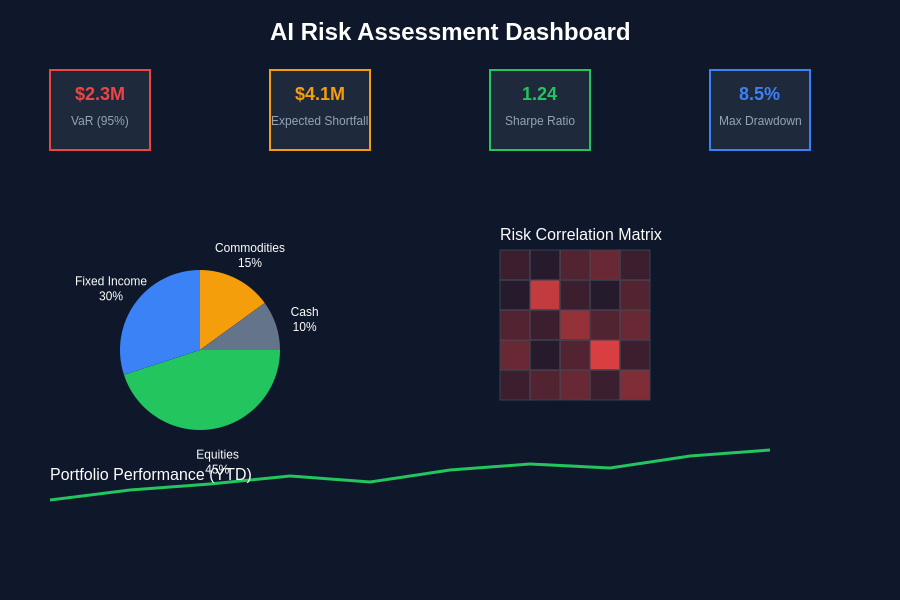

Modern risk management dashboards powered by artificial intelligence provide comprehensive real-time monitoring of portfolio exposures, correlation matrices, and performance metrics. These sophisticated visualization tools enable risk managers to identify potential vulnerabilities and make informed decisions about position adjustments and hedging strategies across diverse market conditions.

Credit Risk and Loan Assessment Automation

The application of artificial intelligence to credit risk assessment has revolutionized lending practices by enabling more accurate evaluation of borrower creditworthiness while simultaneously reducing the time required for loan approval processes. Machine learning models can analyze traditional credit metrics alongside alternative data sources such as transaction histories, employment patterns, and behavioral indicators to create comprehensive risk profiles for potential borrowers. These sophisticated assessment techniques have enabled lenders to extend credit to previously underserved populations while maintaining appropriate risk management standards.

AI-powered credit assessment systems continuously learn from loan performance data to refine their predictive accuracy and adapt to changing economic conditions. These systems can identify early warning signals of potential defaults, enabling proactive intervention strategies that benefit both lenders and borrowers. The automation of credit assessment processes has also reduced human bias in lending decisions while ensuring consistent application of risk criteria across all loan applications.

Fraud Detection and Financial Security

Artificial intelligence has become indispensable in the fight against financial fraud, providing real-time analysis capabilities that can identify suspicious transactions and patterns indicative of fraudulent activity. Machine learning models trained on vast datasets of historical fraud cases can detect anomalous behavior patterns that would be impossible for human analysts to identify manually. These systems continuously monitor transaction flows, account activities, and user behaviors to flag potential fraud attempts before significant losses occur.

The adaptive nature of AI-powered fraud detection systems enables them to evolve alongside increasingly sophisticated fraud techniques. As criminals develop new methods to circumvent security measures, machine learning algorithms automatically adjust their detection parameters to identify these emerging threat patterns. This continuous adaptation capability has proven essential in maintaining effective fraud prevention as the sophistication and scale of financial crimes continue to increase.

Enhance your research capabilities with Perplexity for comprehensive analysis of emerging financial technologies and regulatory developments affecting AI implementation in financial services. The combination of multiple AI platforms creates a robust analytical ecosystem that supports informed decision-making in complex financial environments.

Portfolio Optimization and Asset Allocation

Modern portfolio management has been transformed through the application of artificial intelligence to asset allocation and optimization strategies. AI-powered systems can analyze vast universes of potential investments across multiple asset classes, geographic regions, and market sectors to identify optimal portfolio compositions that maximize expected returns while minimizing risk exposure. These systems consider factors such as correlation structures, volatility patterns, and macroeconomic sensitivities to construct portfolios that are robust across different market scenarios.

The dynamic nature of AI-driven portfolio optimization enables continuous rebalancing and adjustment of asset allocations based on changing market conditions and evolving investment objectives. Machine learning algorithms can identify subtle shifts in market relationships and automatically adjust portfolio compositions to maintain optimal risk-return characteristics. This adaptive approach to portfolio management has proven particularly valuable in volatile market environments where static allocation strategies often fail to preserve capital effectively.

Regulatory Compliance and Automated Reporting

The complexity of modern financial regulations has made artificial intelligence essential for ensuring comprehensive compliance and accurate regulatory reporting. AI systems can continuously monitor trading activities, portfolio positions, and operational processes to identify potential compliance violations before they occur. These systems can interpret complex regulatory requirements and automatically generate the detailed reports required by various regulatory authorities, significantly reducing the compliance burden on financial institutions.

Machine learning algorithms can adapt to evolving regulatory requirements by analyzing regulatory changes and automatically updating compliance monitoring parameters. This adaptive capability ensures that financial institutions maintain compliance even as regulatory frameworks continue to evolve in response to changing market conditions and emerging risks. The automation of compliance processes has also improved the accuracy and consistency of regulatory reporting while reducing the operational costs associated with manual compliance management.

Alternative Data Integration and Analysis

The incorporation of alternative data sources represents one of the most significant innovations in modern financial analysis, enabled by artificial intelligence capabilities to process and analyze unstructured data from diverse sources. AI systems can extract meaningful insights from satellite imagery, social media sentiment, web scraping data, supply chain information, and economic indicators to generate investment signals and risk assessments that provide competitive advantages in financial markets.

The challenge of integrating alternative data lies not only in processing the vast volumes of information but also in determining the relevance and reliability of different data sources for specific investment strategies. Machine learning algorithms can evaluate the predictive value of various alternative data sources and automatically adjust the weighting of different information streams based on their historical performance and current relevance to market conditions.

Behavioral Finance and Sentiment Analysis

Artificial intelligence has enabled sophisticated analysis of market sentiment and behavioral patterns that influence investment decisions and market movements. Natural language processing algorithms can analyze news articles, earnings call transcripts, social media posts, and analyst reports to extract sentiment indicators that provide insights into market psychology and potential price movements. These sentiment analysis capabilities have proven particularly valuable for short-term trading strategies and risk management applications.

The integration of behavioral finance principles with AI-powered analysis systems has created new opportunities for understanding and predicting market anomalies and irrational investor behavior. Machine learning models can identify patterns in investor sentiment and behavior that correlate with market movements, enabling more accurate prediction of market reactions to news events, earnings announcements, and economic data releases.

Systemic Risk and Market Stability Considerations

The widespread adoption of artificial intelligence in financial markets has introduced new categories of systemic risks that require careful monitoring and management. The potential for AI systems to exhibit similar behaviors or responses to market conditions could amplify market volatility and create new sources of systemic instability. Regulatory authorities and financial institutions are increasingly focused on understanding and mitigating these risks through stress testing, scenario analysis, and coordination mechanisms.

The interconnected nature of modern AI-powered trading systems creates the potential for cascading failures where problems in one system or market segment can rapidly propagate throughout the financial system. Understanding and modeling these interconnections has become crucial for maintaining market stability and preventing systemic crises that could result from AI system failures or coordinated responses to market stress.

Future Developments and Emerging Technologies

The future of financial AI promises even more sophisticated applications as quantum computing, advanced neural network architectures, and edge computing technologies mature. Quantum algorithms could potentially solve complex optimization problems that are currently intractable, enabling more sophisticated portfolio optimization and risk management strategies. The development of more interpretable AI models will also address current concerns about the “black box” nature of many machine learning applications in finance.

The integration of blockchain technologies with AI systems could create new opportunities for decentralized finance applications while improving transparency and auditability of algorithmic trading decisions. As these technologies continue to evolve, the financial industry will need to balance innovation with appropriate risk management and regulatory compliance to ensure that technological advancement contributes to overall financial system stability and efficiency.

The continued evolution of financial AI will likely focus on improving the interpretability and explainability of algorithmic decisions, addressing concerns about fairness and bias in automated financial processes, and developing more robust systems that can maintain performance across diverse market conditions. These developments will be crucial for maintaining public trust and regulatory approval as AI systems assume increasingly important roles in global financial markets.

The performance comparison between AI-powered and traditional trading methodologies demonstrates significant advantages across multiple operational dimensions. AI systems consistently outperform human traders in execution speed, data processing capabilities, and market analysis while maintaining superior consistency and adaptability in dynamic market environments.

Disclaimer

This article is for informational purposes only and does not constitute financial advice, investment recommendations, or professional guidance. The views expressed are based on current understanding of AI technologies and their applications in financial markets. Financial markets involve substantial risks, and the use of AI-powered systems does not guarantee profits or eliminate the possibility of losses. Readers should conduct thorough research and consult with qualified financial professionals before making investment decisions or implementing AI-powered trading systems. Past performance of AI systems does not guarantee future results, and market conditions can change rapidly in ways that may impact system performance.