The financial technology landscape has experienced a remarkable transformation with the integration of artificial intelligence and machine learning capabilities into traditional accounting and bookkeeping platforms. QuickBooks AI and Xero’s machine learning features represent the cutting edge of this evolution, offering businesses unprecedented levels of automation, accuracy, and insight in their financial management processes. These advanced technologies are not merely incremental improvements to existing systems; they represent a fundamental reimagining of how businesses can leverage intelligent software to streamline operations, reduce errors, and gain deeper understanding of their financial health and future prospects.

Stay informed about the latest AI developments in finance to understand how artificial intelligence continues to reshape business operations and financial management practices across industries. The integration of AI into financial tools represents a paradigm shift that extends far beyond simple automation, encompassing predictive analytics, intelligent categorization, fraud detection, and sophisticated reporting capabilities that were previously available only to large enterprises with dedicated data science teams.

The Evolution of Intelligent Financial Management

The journey from traditional bookkeeping to AI-powered financial management represents one of the most significant technological advances in business software. QuickBooks AI and Xero’s machine learning capabilities have emerged as leaders in this transformation, each bringing unique strengths and approaches to solving the complex challenges faced by modern businesses in managing their financial operations. These platforms have evolved from simple record-keeping tools into comprehensive financial intelligence systems that can anticipate needs, identify patterns, and provide actionable insights that drive business growth and operational efficiency.

QuickBooks AI leverages advanced machine learning algorithms to automate routine tasks, predict cash flow patterns, and provide intelligent recommendations for financial decisions. The platform’s AI capabilities extend across multiple domains, including transaction categorization, expense tracking, invoice processing, and financial forecasting. By analyzing historical data and identifying patterns in financial behavior, QuickBooks AI can help businesses make more informed decisions about spending, investments, and strategic planning while reducing the time and effort required for routine financial management tasks.

Xero’s machine learning approach focuses on creating a seamless, intelligent user experience that adapts to individual business needs and preferences. The platform’s AI-driven features include smart invoice processing, automated bank reconciliation, predictive cash flow analysis, and intelligent expense categorization. Xero’s machine learning capabilities continuously improve through exposure to diverse financial data, enabling the system to become more accurate and useful over time while providing increasingly sophisticated insights into business performance and financial trends.

Automated Transaction Processing and Categorization

One of the most immediately impactful applications of AI in financial management is the automation of transaction processing and categorization. Both QuickBooks AI and Xero’s machine learning systems excel in this area, though they employ different approaches to achieve accurate and efficient transaction handling. These systems can process thousands of transactions in seconds, applying consistent categorization rules while learning from user corrections and preferences to improve accuracy over time.

QuickBooks AI utilizes sophisticated pattern recognition algorithms to analyze transaction descriptions, amounts, and merchant information to automatically assign appropriate categories and accounts. The system learns from user behavior and corrections, gradually improving its accuracy for specific business contexts and industries. This intelligent categorization extends beyond simple rule-based systems, incorporating contextual understanding that allows the AI to handle complex scenarios such as split transactions, recurring payments, and industry-specific expense categories.

Enhance your AI capabilities with Claude for advanced financial analysis and decision-making support that complements automated bookkeeping systems. The combination of automated transaction processing with intelligent analysis creates a comprehensive financial management ecosystem that supports both routine operations and strategic planning initiatives.

Xero’s machine learning approach to transaction processing emphasizes user experience and adaptive learning. The system observes user patterns and preferences to create personalized categorization rules that reflect the unique needs of each business. This adaptive approach means that the system becomes more accurate and useful over time, reducing the need for manual intervention while maintaining the flexibility to handle unusual or complex transactions that may not fit standard categorization patterns.

Intelligent Invoice Management and Processing

Invoice management represents another area where AI and machine learning have delivered substantial improvements in efficiency and accuracy. Both platforms offer sophisticated invoice processing capabilities that can extract relevant information from various document formats, validate data accuracy, and integrate invoice information seamlessly into broader financial workflows. These systems can handle everything from simple text-based invoices to complex PDF documents with multiple line items and varying formats.

QuickBooks AI’s invoice processing capabilities include optical character recognition technology combined with machine learning algorithms that can understand document structure and extract relevant financial information with high accuracy. The system can process invoices from email attachments, scanned documents, and digital uploads, automatically populating appropriate fields and suggesting categorizations based on vendor history and transaction patterns. This automation significantly reduces data entry time while minimizing errors that can occur during manual invoice processing.

The intelligent invoice matching capabilities of these systems extend beyond simple data extraction to include sophisticated validation and reconciliation processes. The AI can identify discrepancies between purchase orders, invoices, and receipts, flagging potential issues for review while automatically approving straightforward transactions that meet predefined criteria. This level of automation allows businesses to process larger volumes of invoices while maintaining strict accuracy and compliance standards.

Predictive Cash Flow Analysis and Forecasting

Cash flow management represents one of the most critical challenges for businesses of all sizes, and AI-powered predictive analytics have revolutionized how organizations approach this essential aspect of financial planning. Both QuickBooks AI and Xero’s machine learning capabilities offer sophisticated cash flow forecasting features that analyze historical data, identify seasonal patterns, and provide accurate predictions of future financial positions.

QuickBooks AI’s cash flow forecasting utilizes advanced time series analysis and machine learning models to predict future cash positions based on historical transaction patterns, seasonal variations, and pending obligations. The system can account for factors such as customer payment patterns, seasonal revenue fluctuations, and recurring expenses to provide accurate short-term and long-term cash flow projections. These predictions help businesses make informed decisions about investments, expenditures, and financing needs while avoiding cash flow crises that could impact operations.

The predictive capabilities extend beyond simple linear projections to include scenario analysis and sensitivity testing. Users can explore different assumptions about revenue growth, expense patterns, and market conditions to understand how various factors might impact future cash flow positions. This sophisticated analysis enables more robust financial planning and risk management strategies that account for uncertainty and variability in business operations.

AI-Driven Expense Management and Optimization

Expense management has been transformed through the application of artificial intelligence technologies that can automatically categorize expenses, identify potential savings opportunities, and provide insights into spending patterns that might otherwise go unnoticed. These AI-driven capabilities help businesses optimize their spending while ensuring accurate financial reporting and compliance with regulatory requirements.

Leverage Perplexity for comprehensive financial research to supplement AI-powered expense analysis with detailed market intelligence and industry benchmarking data. The combination of automated expense tracking with intelligent market research creates a powerful foundation for strategic financial decision-making.

Xero’s machine learning approach to expense management includes intelligent receipt processing that can extract relevant information from photos of receipts, automatically categorizing expenses and creating appropriate journal entries. The system can handle various receipt formats and languages while maintaining high accuracy in data extraction and categorization. This capability significantly simplifies expense reporting for employees while ensuring that all business expenses are properly documented and categorized for tax and accounting purposes.

The AI systems also provide sophisticated spending analysis that can identify unusual patterns, potential duplicate expenses, and opportunities for cost optimization. By analyzing spending patterns across different categories and time periods, the systems can highlight areas where businesses might be overspending or where more favorable vendor arrangements could be negotiated. This intelligence enables proactive expense management rather than reactive cost control measures.

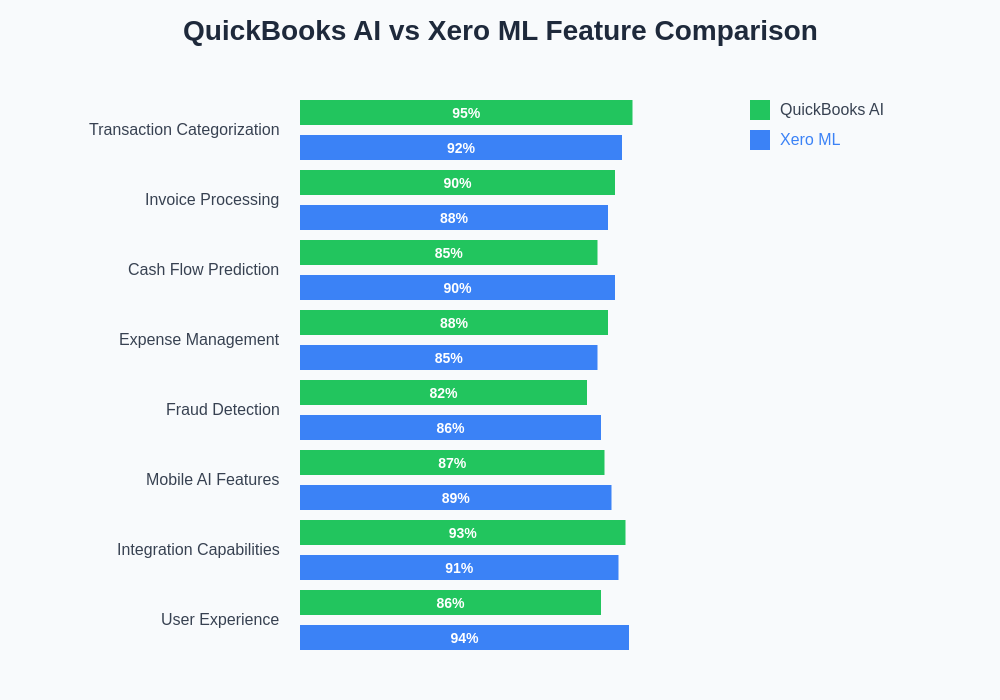

The comprehensive feature comparison reveals the strengths and capabilities of both platforms across critical financial management functions. While both systems excel in core areas, each platform demonstrates particular advantages in specific domains that align with different business needs and priorities.

Fraud Detection and Security Enhancement

Financial security has become increasingly important as businesses rely more heavily on digital financial management systems. Both QuickBooks AI and Xero incorporate advanced fraud detection capabilities that utilize machine learning algorithms to identify suspicious transactions and potential security threats. These systems continuously monitor financial activity for patterns that might indicate fraudulent behavior while maintaining the flexibility to adapt to legitimate but unusual business activities.

The fraud detection capabilities include analysis of transaction patterns, user behavior, and system access logs to identify potential security threats. The AI systems can detect anomalies such as unusual transaction amounts, unexpected vendor payments, or access from unfamiliar locations while minimizing false positives that could disrupt normal business operations. When suspicious activity is detected, the systems can automatically implement security measures while alerting appropriate personnel for further investigation.

Advanced security features also include intelligent user authentication and access control systems that adapt to user behavior patterns. The AI can identify unusual login patterns or access requests that might indicate unauthorized system access while maintaining smooth user experience for legitimate users. This intelligent security approach provides robust protection against various types of financial fraud and cybersecurity threats.

Integration with Business Intelligence and Analytics

The integration of AI-powered financial management systems with broader business intelligence and analytics platforms creates comprehensive insights that extend far beyond traditional accounting and bookkeeping functions. These integrations enable businesses to connect financial data with operational metrics, customer information, and market intelligence to create holistic views of business performance and opportunities.

QuickBooks AI’s integration capabilities include sophisticated API connections with popular business intelligence platforms, customer relationship management systems, and e-commerce platforms. These integrations enable seamless data flow between different business systems while maintaining data accuracy and consistency. The AI can analyze data from multiple sources to provide comprehensive insights into business performance, customer profitability, and operational efficiency.

The analytics capabilities extend to predictive modeling that can forecast business performance based on current trends and historical patterns. These predictions can inform strategic decisions about product development, market expansion, and resource allocation while providing early warning signals about potential challenges or opportunities. The AI systems can also perform comparative analysis against industry benchmarks and competitor performance to identify areas for improvement and competitive advantages.

Customization and Industry-Specific Solutions

Different industries have unique financial management requirements and regulatory compliance needs, and AI-powered financial systems have evolved to provide specialized solutions for various business sectors. Both QuickBooks AI and Xero offer industry-specific features and customizations that address the particular challenges faced by businesses in different sectors while maintaining the flexibility to adapt to unique business requirements.

The customization capabilities include specialized chart of accounts structures, industry-specific reporting formats, and compliance features that address sector-specific regulatory requirements. For example, construction companies can benefit from job costing features, while retail businesses can leverage inventory management and point-of-sale integrations. These specialized features are enhanced by AI capabilities that understand industry-specific transaction patterns and business processes.

Machine learning algorithms continuously improve these industry-specific features by analyzing data from similar businesses and identifying patterns that can enhance functionality for particular sectors. This collaborative learning approach means that improvements developed for one business can benefit others in similar industries while maintaining appropriate data privacy and security protections.

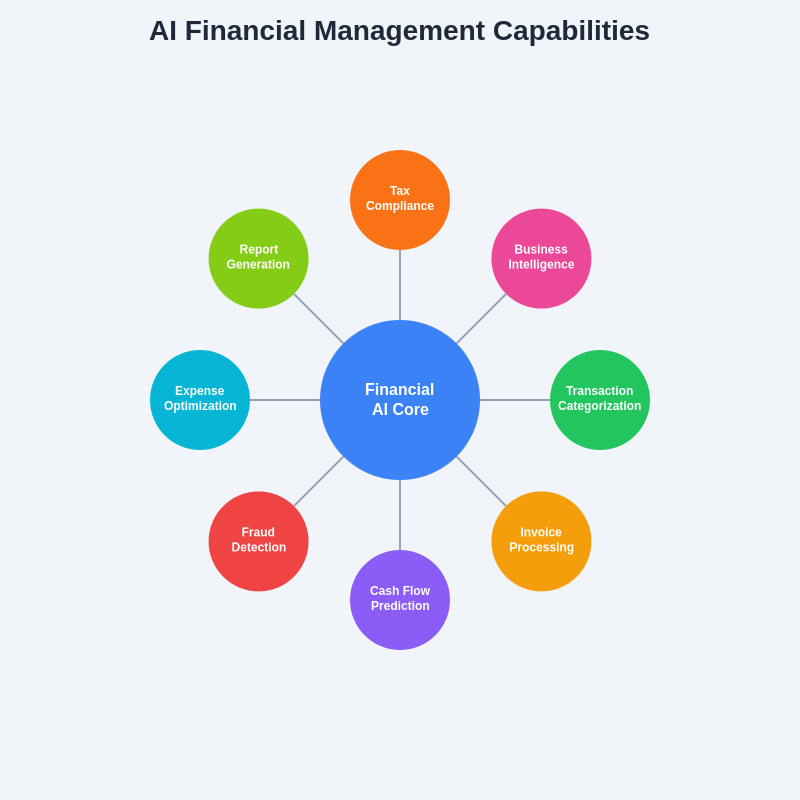

The comprehensive ecosystem of AI-powered financial capabilities demonstrates how modern platforms integrate multiple intelligent functions around a central processing core. This interconnected approach ensures that insights from one area inform and enhance performance across all financial management functions.

Mobile AI and Real-Time Financial Management

The proliferation of mobile devices and the need for real-time financial information have driven the development of sophisticated mobile AI applications that provide full financial management capabilities from smartphones and tablets. These mobile platforms maintain the full power of AI-driven features while optimizing user interfaces and functionality for mobile devices and on-the-go business management.

Mobile AI capabilities include voice-activated expense reporting, photo-based receipt processing, and real-time financial dashboard access that keeps business owners informed about their financial position regardless of location. The mobile applications can provide push notifications for important financial events, cash flow alerts, and approval requests that require immediate attention while maintaining seamless synchronization with desktop and web-based platforms.

The real-time nature of these mobile AI systems enables immediate financial decision-making based on current data rather than outdated reports or estimates. Business owners can check cash flow positions before making major purchases, approve vendor payments while traveling, and monitor key financial metrics during important business meetings or negotiations.

Implementation Strategies and Best Practices

Successfully implementing AI-powered financial management systems requires careful planning and consideration of business-specific requirements, existing workflows, and change management strategies. Organizations must evaluate their current financial processes, identify areas where AI can provide the greatest benefit, and develop implementation plans that minimize disruption while maximizing the value of new AI capabilities.

The implementation process typically begins with data migration and system configuration that aligns with existing business processes and accounting standards. This phase requires careful attention to data quality, chart of accounts structure, and user access permissions to ensure that the AI systems have access to clean, accurate data while maintaining appropriate security and compliance controls.

Training and change management represent critical components of successful AI implementation. Users must understand not only how to operate the new systems but also how to interpret AI-generated insights and recommendations effectively. This education process includes understanding the limitations of AI systems and knowing when human judgment and expertise are required to supplement automated capabilities.

Measuring ROI and Performance Optimization

Organizations investing in AI-powered financial management systems need comprehensive approaches to measuring return on investment and optimizing system performance over time. These measurements extend beyond simple cost savings to include improvements in accuracy, decision-making quality, and strategic capabilities that may not have immediate financial impacts but provide significant long-term value.

Key performance indicators for AI financial systems include time savings in routine tasks, reduction in processing errors, improvement in cash flow prediction accuracy, and enhancement in financial reporting speed and quality. Organizations should also measure user satisfaction, system adoption rates, and the quality of AI-generated insights and recommendations to ensure that the systems are delivering expected value.

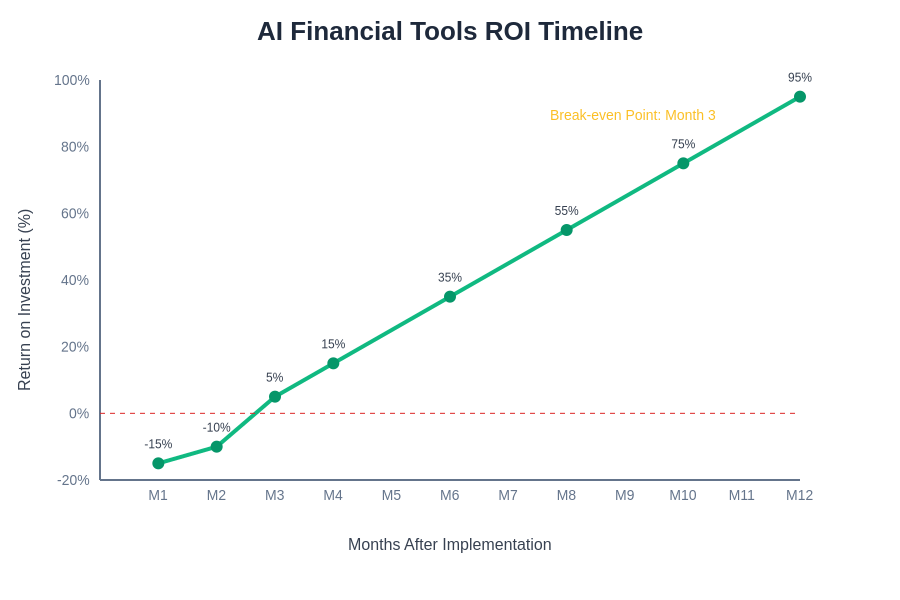

The typical return on investment trajectory for AI financial management systems demonstrates how initial implementation costs are quickly offset by operational efficiencies and improved decision-making capabilities. Most organizations achieve break-even within three months and realize substantial returns within the first year of implementation.

Performance optimization involves continuous monitoring of AI system accuracy and effectiveness while making adjustments to improve performance over time. This includes updating machine learning models with new data, refining categorization rules based on user feedback, and expanding AI capabilities to address new business requirements and opportunities.

Future Developments and Emerging Trends

The future of AI in financial management promises even more sophisticated capabilities as machine learning technologies continue to advance and businesses become more comfortable with AI-powered automation. Emerging trends include natural language processing for voice-activated financial management, blockchain integration for enhanced security and transparency, and advanced predictive analytics that can forecast market conditions and business opportunities.

Artificial intelligence systems are expected to become more autonomous and capable of handling complex financial decisions with minimal human intervention while providing transparent explanations for their reasoning and recommendations. This evolution will enable smaller businesses to access enterprise-level financial intelligence while allowing larger organizations to achieve new levels of operational efficiency and strategic insight.

The integration of AI financial management systems with broader business ecosystems will continue to expand, creating comprehensive platforms that manage all aspects of business operations while maintaining seamless data flow and consistent insights across different functional areas. These integrated systems will provide holistic views of business performance and opportunities that were previously available only through expensive consulting services and custom analytical solutions.

Disclaimer

This article is for informational purposes only and does not constitute financial or professional advice. The features and capabilities described may vary based on specific software versions, subscription levels, and individual business requirements. Readers should conduct thorough evaluations of their specific needs and consult with qualified professionals before implementing AI-powered financial management systems. The effectiveness of AI features may depend on data quality, proper configuration, and appropriate user training.