The intersection of artificial intelligence and personal finance has created an unprecedented revolution in how individuals approach retirement planning and investment goal setting. This technological transformation has democratized sophisticated financial planning strategies that were once exclusive to wealthy clients with access to premium advisory services, making intelligent financial guidance accessible to everyone regardless of their current wealth status or financial expertise.

Explore the latest AI innovations in finance to discover cutting-edge technologies that are reshaping investment strategies and retirement planning methodologies. The integration of machine learning algorithms, predictive analytics, and behavioral finance principles has created a new paradigm where financial planning becomes more precise, personalized, and adaptive to changing life circumstances and market conditions.

The Evolution of AI-Powered Financial Planning

Traditional financial planning relied heavily on generic rules of thumb, static portfolio allocations, and periodic manual adjustments that often failed to account for the dynamic nature of individual financial situations and market volatility. The emergence of AI-driven financial planning platforms has fundamentally transformed this approach by introducing sophisticated algorithms capable of processing vast amounts of economic data, market trends, and personal financial information to create highly customized strategies that evolve in real-time based on changing circumstances.

Modern AI financial planning systems leverage machine learning to analyze spending patterns, income fluctuations, risk tolerance changes, and life event impacts to continuously optimize financial strategies. These systems can identify subtle correlations between market conditions and personal financial goals that human advisors might overlook, while simultaneously processing thousands of potential scenarios to recommend the most optimal path toward retirement and investment objectives.

The sophistication of these AI systems extends beyond simple calculations to incorporate behavioral finance principles, understanding how psychological factors influence financial decisions and designing strategies that account for human tendencies toward emotional investing, procrastination, and risk aversion. This holistic approach ensures that financial plans remain practical and achievable while maximizing the probability of successful goal attainment.

Personalized Retirement Strategy Development

AI-powered retirement planning represents one of the most significant advances in personal finance technology, offering unprecedented levels of customization and precision in retirement strategy development. These systems analyze multiple variables including current age, income trajectory, existing savings, expected social security benefits, healthcare cost projections, and desired retirement lifestyle to create comprehensive retirement roadmaps that adapt to changing circumstances throughout an individual’s career.

The power of AI in retirement planning lies in its ability to simulate thousands of potential future scenarios, incorporating various market conditions, inflation rates, healthcare cost increases, and longevity projections to identify strategies that maximize retirement security across diverse potential outcomes. This Monte Carlo simulation approach provides individuals with realistic probability assessments for achieving their retirement goals under different saving and investment strategies.

Experience advanced AI financial planning with Claude for comprehensive analysis of your retirement strategy options and personalized recommendations based on your unique financial situation and goals. The integration of AI enables continuous monitoring and adjustment of retirement strategies as life circumstances change, ensuring that plans remain optimized for success regardless of unexpected events or market volatility.

Intelligent Investment Goal Optimization

Investment goal setting has been revolutionized through AI’s ability to create sophisticated optimization frameworks that balance multiple competing objectives while considering individual risk tolerance, time horizons, and liquidity needs. AI systems can simultaneously optimize for retirement savings, emergency fund accumulation, major purchase goals, and wealth preservation while maintaining appropriate asset allocation strategies that adapt to changing market conditions and personal circumstances.

The intelligence embedded in modern AI investment platforms extends to tax optimization strategies, automatically implementing tax-loss harvesting, asset location optimization, and Roth conversion strategies that can significantly enhance after-tax returns over long investment horizons. These systems continuously monitor tax law changes and market opportunities to implement strategies that minimize tax drag on investment growth while maintaining alignment with overall financial objectives.

AI-driven investment platforms also excel at behavioral coaching, recognizing when investors are likely to make emotionally driven decisions that could derail long-term financial goals and providing timely interventions to maintain discipline during market volatility. This behavioral guidance often proves more valuable than pure investment returns in determining long-term financial success.

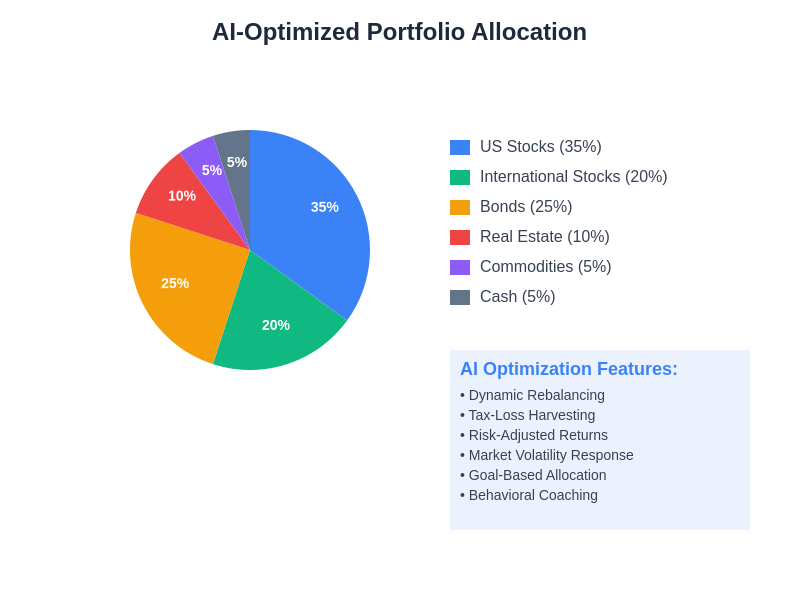

The sophisticated portfolio allocation strategies employed by AI systems demonstrate the technology’s ability to balance multiple asset classes while incorporating advanced optimization techniques such as dynamic rebalancing, tax-loss harvesting, and behavioral coaching to maximize long-term investment outcomes.

Risk Assessment and Management

One of the most sophisticated applications of AI in financial planning involves dynamic risk assessment and management that goes far beyond traditional questionnaire-based risk profiling. Modern AI systems analyze actual investor behavior, market response patterns, and life circumstance changes to develop nuanced understanding of individual risk tolerance that evolves over time and market conditions.

These systems can identify when an investor’s stated risk tolerance differs from their actual behavior during market stress, automatically adjusting portfolio allocations to match demonstrated comfort levels rather than theoretical preferences. This behavioral-based risk management approach significantly improves the likelihood that investors will maintain their long-term strategies during inevitable market downturns.

AI-powered risk management also incorporates sequence of returns risk analysis for retirement planning, identifying optimal withdrawal strategies and portfolio adjustments that minimize the probability of portfolio depletion during retirement. These systems can dynamically adjust withdrawal rates, spending patterns, and asset allocation based on portfolio performance and market conditions to extend portfolio longevity.

The comprehensive risk assessment framework employed by AI systems evaluates the relationship between expected returns and volatility across different investment strategies, identifying the optimal risk-return profile that aligns with individual investor preferences and long-term financial objectives within the AI optimization zone.

Market Analysis and Predictive Modeling

The application of AI in market analysis for financial planning purposes represents a significant advancement over traditional forecasting methods. AI systems can process vast amounts of economic data, corporate earnings information, geopolitical events, and market sentiment indicators to identify trends and patterns that inform strategic asset allocation decisions and timing adjustments.

While AI systems cannot predict short-term market movements with certainty, they excel at identifying long-term structural trends, sector rotation patterns, and economic cycles that inform strategic portfolio positioning. These insights enable more sophisticated rebalancing strategies that capitalize on market inefficiencies while maintaining appropriate risk levels for individual investor profiles.

The predictive modeling capabilities of AI extend to inflation forecasting, interest rate trend analysis, and currency movement predictions that inform international diversification strategies and inflation hedging approaches. This comprehensive market analysis ensures that financial plans remain robust across diverse economic environments and market conditions.

Automated Portfolio Rebalancing and Optimization

AI-driven portfolio management has automated the traditionally complex and time-consuming process of portfolio rebalancing and optimization. These systems continuously monitor asset allocation drift, tax implications of rebalancing transactions, and market conditions to implement optimal rebalancing strategies that maintain target allocations while minimizing transaction costs and tax consequences.

The sophistication of AI rebalancing extends to implementing sophisticated strategies such as threshold-based rebalancing, calendar rebalancing, and tactical allocation adjustments based on market valuation metrics. These systems can identify opportunities for tax-loss harvesting, asset location optimization, and strategic rebalancing that enhance after-tax returns while maintaining appropriate risk levels.

AI portfolio optimization also incorporates factor-based investing strategies, identifying exposure to various risk factors such as value, momentum, quality, and size premiums to enhance expected returns while maintaining diversification benefits. This factor-aware optimization ensures that portfolios capture systematic risk premiums while avoiding unintended concentrations that could increase portfolio volatility.

Leverage AI-powered research capabilities with Perplexity to stay informed about market trends and investment strategies that could enhance your financial planning approach. The integration of comprehensive market research with AI-driven portfolio management creates a powerful combination for achieving long-term financial objectives.

Goal-Based Financial Planning

AI has revolutionized financial planning by enabling truly goal-based approaches that optimize strategies for multiple competing objectives simultaneously. These systems can balance retirement savings, education funding, home purchase goals, and emergency fund requirements while optimizing tax efficiency and maintaining appropriate risk levels for each objective’s time horizon.

The sophistication of goal-based AI planning lies in its ability to prioritize goals dynamically based on changing circumstances, market conditions, and progress toward various objectives. When market performance exceeds expectations, these systems can recommend accelerating certain goals or increasing contribution levels, while market downturns trigger strategic adjustments that protect the most critical objectives.

AI goal-based planning also incorporates sophisticated cash flow analysis that accounts for irregular income patterns, bonus payments, and seasonal variations to optimize contribution timing and amounts. This dynamic cash flow management ensures that financial strategies remain practical and achievable while maximizing progress toward financial objectives.

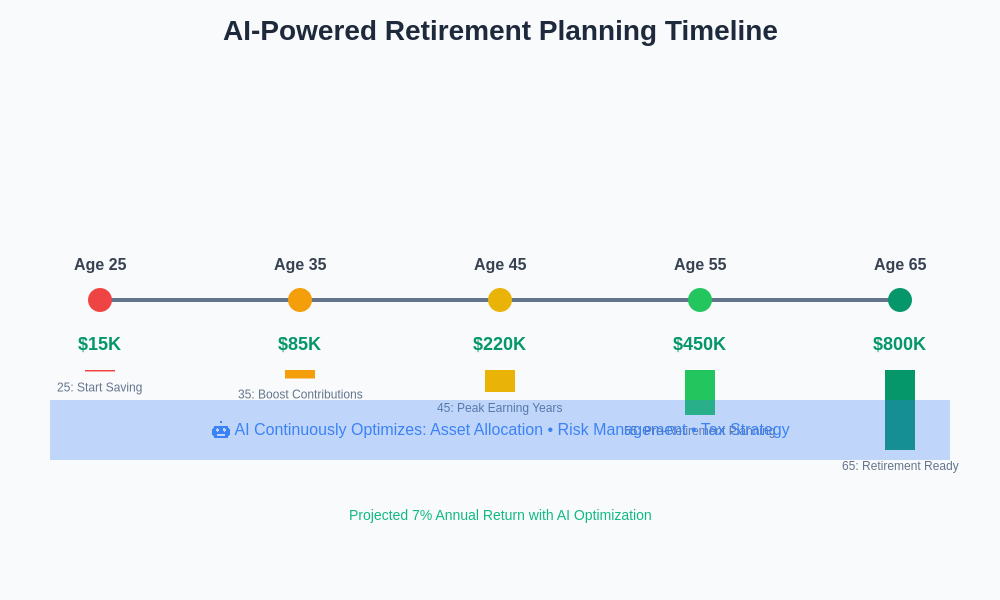

The retirement planning timeline demonstrates how AI continuously optimizes savings strategies throughout different life stages, from early career savings accumulation through pre-retirement planning, ensuring that individuals remain on track to achieve their retirement goals through intelligent asset allocation and contribution optimization.

Healthcare Cost Prediction and Planning

One of the most valuable applications of AI in retirement planning involves sophisticated healthcare cost prediction and planning strategies. AI systems analyze historical healthcare cost trends, demographic factors, geographic variations, and individual health indicators to project retirement healthcare expenses with unprecedented accuracy.

These projections enable more realistic retirement planning that accounts for the significant impact of healthcare costs on retirement security. AI systems can model various healthcare scenarios, including long-term care needs, chronic condition management, and prescription drug costs to develop comprehensive strategies for healthcare expense management during retirement.

The integration of healthcare cost planning with investment strategy optimization ensures that retirement portfolios are structured to handle both routine healthcare expenses and catastrophic medical events while maintaining lifestyle sustainability throughout retirement.

Estate Planning and Wealth Transfer

AI has enhanced estate planning and wealth transfer strategies by enabling sophisticated modeling of various estate planning techniques and their tax implications across multiple generations. These systems can analyze the effectiveness of different wealth transfer strategies, including gift and estate tax optimization, trust structures, and charitable giving approaches.

The sophistication of AI estate planning extends to generation-skipping transfer tax optimization, family limited partnership strategies, and charitable remainder trust planning that maximizes wealth transfer efficiency while minimizing tax consequences. These systems can model complex scenarios involving multiple beneficiaries, varying asset types, and changing tax law environments.

AI-driven estate planning also incorporates business succession planning for entrepreneurs and closely-held business owners, analyzing various exit strategies, valuation discounts, and tax optimization techniques that maximize after-tax wealth transfer to future generations.

Integration with Financial Institutions

The integration of AI financial planning with traditional financial institutions has created comprehensive wealth management ecosystems that combine sophisticated technology with human expertise. These hybrid approaches leverage AI’s analytical capabilities while maintaining access to human advisors for complex decision-making and emotional support during challenging market conditions.

Many financial institutions now offer AI-enhanced advisory services that combine robo-advisor efficiency with human advisor expertise, creating scalable wealth management solutions that serve clients across various asset levels and complexity requirements. This integration ensures that AI recommendations are implemented within appropriate regulatory frameworks and fiduciary standards.

The institutional integration of AI financial planning also enables access to institutional-quality investment strategies, alternative investments, and sophisticated tax planning techniques that were previously available only to ultra-high-net-worth clients.

Regulatory Compliance and Fiduciary Standards

The implementation of AI in financial planning operates within strict regulatory frameworks designed to protect investor interests and ensure appropriate fiduciary standards. AI systems must demonstrate transparency in their recommendation processes, maintain appropriate documentation of investment decisions, and comply with various regulatory requirements governing investment advice and portfolio management.

The regulatory compliance aspects of AI financial planning include requirements for algorithm transparency, bias testing, and ongoing monitoring to ensure that recommendations remain appropriate for client circumstances and objectives. These compliance frameworks provide investor protection while enabling innovation in financial planning technology.

Fiduciary standards for AI financial planning systems require that recommendations prioritize client interests above all other considerations, maintain appropriate documentation of decision-making processes, and provide clear explanations of recommendation rationales that clients can understand and evaluate.

Future Developments and Emerging Trends

The future of AI in financial planning promises even more sophisticated capabilities, including enhanced behavioral analysis, improved predictive modeling, and integration with broader financial ecosystems. Emerging technologies such as natural language processing, sentiment analysis, and alternative data sources will further enhance AI’s ability to provide personalized financial guidance.

The integration of AI with blockchain technology and decentralized finance protocols may create new opportunities for portfolio diversification and yield generation while maintaining appropriate risk management frameworks. These technological advances will likely expand the range of investment options available through AI-driven platforms.

Machine learning advances will continue to improve AI’s ability to understand individual preferences, behavioral patterns, and risk tolerance changes, enabling even more personalized financial planning approaches that adapt to evolving life circumstances and market conditions.

The evolution of AI financial planning will likely include enhanced integration with other aspects of personal finance management, including banking, insurance, and tax planning, creating comprehensive financial ecosystems that optimize all aspects of personal financial management through intelligent automation and personalization.

Disclaimer

This article is for informational purposes only and does not constitute financial advice, investment recommendations, or professional guidance. The information presented is based on current understanding of AI technologies and their applications in financial planning. Individual financial situations vary significantly, and readers should consult with qualified financial advisors and tax professionals before making investment decisions or implementing financial strategies. The effectiveness of AI-powered financial planning tools may vary based on individual circumstances, market conditions, and the specific algorithms employed by different platforms. Past performance does not guarantee future results, and all investments carry risk of loss.