The financial services industry faces an unprecedented challenge in combating sophisticated fraud schemes that evolve at lightning speed, leveraging advanced technologies to exploit vulnerabilities in traditional security systems. In response to this escalating threat landscape, artificial intelligence has emerged as the most powerful weapon in the fight against financial fraud, revolutionizing how institutions detect, prevent, and respond to fraudulent activities through sophisticated real-time monitoring systems that analyze millions of transactions simultaneously while identifying subtle patterns that human analysts would never catch.

Stay updated with the latest AI security innovations to understand how cutting-edge fraud detection technologies are evolving to meet emerging threats in the digital financial ecosystem. The integration of machine learning algorithms into transaction monitoring represents a fundamental shift from reactive fraud detection to proactive threat prevention, fundamentally transforming how financial institutions protect their customers and assets in an increasingly complex digital landscape.

The Evolution of Fraud Detection Technology

Traditional fraud detection systems relied heavily on rule-based approaches that flagged transactions based on predetermined criteria such as transaction amounts, geographic locations, or time patterns. While these systems provided a foundation for fraud prevention, they suffered from significant limitations including high false positive rates, inability to adapt to new fraud patterns, and delayed detection that often occurred only after substantial losses had been incurred. The static nature of rule-based systems made them particularly vulnerable to sophisticated fraudsters who could easily identify and circumvent established detection parameters.

The emergence of artificial intelligence and machine learning has fundamentally transformed fraud detection capabilities by introducing dynamic, adaptive systems that continuously learn from new data patterns and evolve their detection algorithms in real-time. These AI-powered systems analyze vast amounts of transaction data, customer behavior patterns, and external risk factors to identify anomalies and potential fraud indicators that would be impossible for human analysts to detect manually. The shift from reactive to predictive fraud detection has enabled financial institutions to prevent fraudulent transactions before they occur rather than simply identifying them after the fact.

Real-Time Transaction Monitoring Architecture

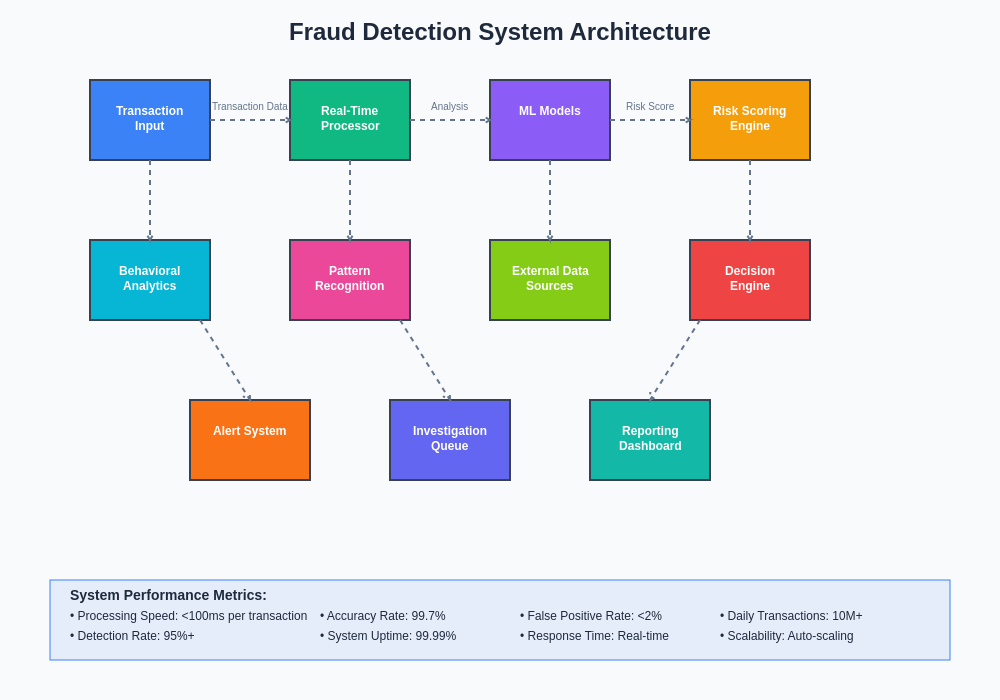

Modern AI-driven fraud detection systems operate through sophisticated real-time monitoring architectures that process and analyze millions of transactions per second while maintaining minimal latency to ensure seamless customer experiences. These systems employ distributed computing frameworks that can scale horizontally to handle massive transaction volumes while maintaining consistent performance standards across different geographic regions and time zones. The architecture typically includes multiple layers of analysis, from initial transaction screening to deep behavioral pattern recognition, ensuring comprehensive coverage of potential fraud vectors.

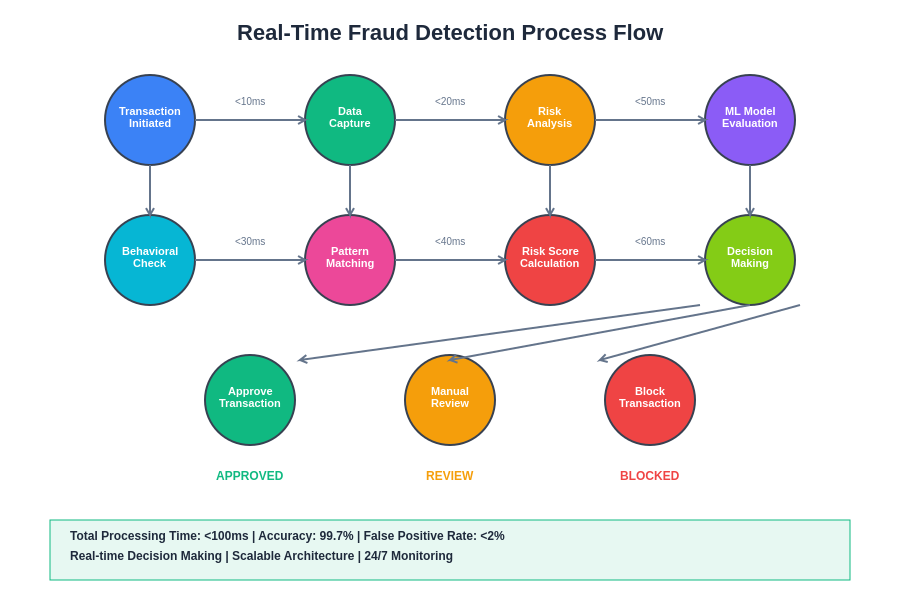

The real-time processing capabilities of these systems enable instant decision-making at the point of transaction, allowing legitimate transactions to proceed smoothly while flagging suspicious activities for immediate intervention. This real-time capability is achieved through advanced stream processing technologies that analyze transaction data as it flows through the system, applying multiple machine learning models simultaneously to evaluate different aspects of each transaction including amount patterns, merchant categories, geographic locations, and temporal characteristics.

Discover advanced AI capabilities with Claude for developing sophisticated fraud detection algorithms that can analyze complex transaction patterns and identify emerging fraud trends through advanced machine learning techniques. The integration of multiple AI technologies creates a comprehensive defense system that adapts to new threats while maintaining high accuracy rates and minimal false positives.

Machine Learning Models for Fraud Detection

The foundation of modern fraud detection systems lies in sophisticated machine learning models that can identify complex patterns and anomalies within massive datasets of financial transactions. Supervised learning algorithms, trained on historical fraud cases, excel at recognizing known fraud patterns and applying this knowledge to new transactions in real-time. These models learn from labeled datasets containing both fraudulent and legitimate transactions, developing the ability to distinguish between normal and suspicious transaction characteristics with remarkable accuracy.

Unsupervised learning algorithms play an equally crucial role by identifying previously unknown fraud patterns and emerging threats that have not been encountered before. These algorithms analyze transaction data without prior knowledge of what constitutes fraud, instead identifying statistical anomalies and unusual patterns that deviate from established baselines of normal customer behavior. The combination of supervised and unsupervised learning creates a comprehensive detection system that can handle both known fraud types and novel attack vectors.

Deep learning neural networks have revolutionized fraud detection by enabling the analysis of extremely complex, multi-dimensional transaction relationships that traditional algorithms cannot effectively process. These networks can identify subtle correlations between seemingly unrelated transaction features, customer demographics, and behavioral patterns that may indicate fraudulent activity. The ability of deep learning models to process unstructured data such as transaction descriptions, merchant information, and customer communication patterns has significantly enhanced the accuracy and comprehensiveness of fraud detection systems.

Behavioral Analytics and Customer Profiling

Advanced fraud detection systems leverage behavioral analytics to create detailed customer profiles that establish individual baseline patterns for spending habits, transaction frequencies, geographic preferences, and temporal behaviors. These behavioral profiles enable the system to identify deviations from normal customer behavior that may indicate account compromise or fraudulent activity. By understanding each customer’s unique transaction patterns, AI systems can detect subtle anomalies that would not be apparent when analyzing transactions in isolation.

The behavioral profiling process involves continuous analysis of customer interactions across multiple channels including online banking, mobile applications, ATM usage, and point-of-sale transactions. Machine learning algorithms analyze this comprehensive behavioral data to establish dynamic baselines that evolve with changing customer circumstances such as travel, lifestyle changes, or new spending patterns. This adaptive approach ensures that the fraud detection system remains accurate even as customer behaviors naturally evolve over time.

The sophisticated architecture of modern fraud detection systems integrates multiple analytical layers that work together to provide comprehensive transaction monitoring and risk assessment capabilities. This multi-tiered approach ensures that potential threats are identified and addressed at various stages of the transaction lifecycle.

Real-Time Risk Scoring and Decision Making

Contemporary fraud detection systems employ sophisticated risk scoring algorithms that assign numerical risk values to each transaction based on multiple factors including transaction characteristics, customer behavior patterns, merchant risk profiles, and external threat intelligence. These risk scores are calculated in real-time, typically within milliseconds of transaction initiation, enabling immediate decision-making regarding transaction approval, decline, or additional authentication requirements.

The risk scoring process involves the integration of multiple machine learning models that evaluate different aspects of each transaction simultaneously. These models consider factors such as transaction velocity, geographic anomalies, merchant category deviations, amount patterns, and correlation with known fraud indicators. The resulting composite risk score provides a comprehensive assessment of fraud probability that enables automated decision-making while maintaining the flexibility for manual review of borderline cases.

Dynamic risk scoring systems continuously update their assessment criteria based on emerging fraud trends, seasonal patterns, and evolving customer behaviors. This adaptive approach ensures that the scoring algorithms remain effective against new fraud techniques while minimizing false positives that could disrupt legitimate customer transactions. The system’s ability to learn from both successful fraud detections and false positive incidents enables continuous improvement in scoring accuracy and overall system performance.

Advanced Pattern Recognition Techniques

Modern fraud detection systems employ sophisticated pattern recognition techniques that can identify complex fraud schemes involving multiple transactions, accounts, or time periods. These systems analyze transaction networks to identify suspicious patterns such as money laundering activities, account takeover schemes, or coordinated fraud attacks that involve multiple compromised accounts. Graph-based analysis techniques enable the detection of fraud rings and organized criminal activities that would be impossible to identify through individual transaction analysis.

Temporal pattern analysis allows fraud detection systems to identify time-based fraud patterns such as rapid-fire transactions, unusual transaction timing, or patterns that correlate with known fraud events or data breaches. These temporal analyses can detect fraud attempts that span extended periods, such as gradual account manipulation or testing transactions that precede larger fraudulent activities. The ability to analyze transaction patterns across different time scales provides comprehensive coverage of various fraud methodologies.

Enhance your research capabilities with Perplexity to stay informed about emerging fraud detection technologies and methodologies that are shaping the future of financial security. The rapid evolution of fraud detection techniques requires continuous learning and adaptation to maintain effective protection against sophisticated criminal organizations.

Integration with External Data Sources

Contemporary fraud detection systems enhance their effectiveness by integrating external data sources that provide additional context and risk indicators for transaction analysis. These external sources include credit bureau data, device fingerprinting information, geolocation services, merchant reputation databases, and threat intelligence feeds that provide real-time information about emerging fraud trends and compromised payment instruments.

Device intelligence plays a crucial role in fraud detection by analyzing the characteristics of devices used to initiate transactions, including device fingerprints, browser configurations, operating system details, and network characteristics. This device-level analysis can identify suspicious activities such as the use of compromised devices, virtual machines commonly used by fraudsters, or devices associated with previous fraudulent activities. The integration of device intelligence with transaction analysis provides an additional layer of fraud prevention that is difficult for criminals to circumvent.

Geolocation and velocity analysis combine transaction location data with timing information to identify impossible or highly unlikely transaction scenarios such as transactions occurring in different geographic locations within timeframes that would be physically impossible for legitimate travel. These analyses can detect card skimming activities, account takeover attempts, or the use of stolen payment credentials in different geographic regions.

Artificial Intelligence and Adaptive Learning

The most advanced fraud detection systems employ artificial intelligence techniques that enable continuous learning and adaptation to emerging fraud patterns without requiring manual intervention or system updates. These adaptive learning systems automatically adjust their detection algorithms based on new fraud cases, changing customer behaviors, and evolving threat landscapes. The ability to learn and adapt in real-time ensures that the fraud detection system remains effective against novel attack vectors and sophisticated fraud schemes.

Reinforcement learning algorithms enable fraud detection systems to optimize their decision-making processes by learning from the outcomes of previous fraud detection decisions. These algorithms can identify which detection strategies are most effective for different types of fraud and automatically adjust their approach to maximize detection accuracy while minimizing false positives. This self-optimizing capability ensures that the system continuously improves its performance without requiring extensive manual tuning or reconfiguration.

Ensemble learning techniques combine multiple machine learning models to create more robust and accurate fraud detection capabilities than any single algorithm could achieve independently. These ensemble approaches leverage the strengths of different algorithms while compensating for their individual weaknesses, resulting in more reliable and comprehensive fraud detection. The diversity of algorithms within the ensemble ensures that the system can effectively handle various types of fraud attempts and maintain high accuracy across different fraud scenarios.

The real-time fraud detection process involves multiple analytical stages that work together to evaluate transaction legitimacy and determine appropriate response actions. This comprehensive flow ensures that all relevant factors are considered while maintaining the speed necessary for real-time transaction processing.

Challenges and Limitations in AI Fraud Detection

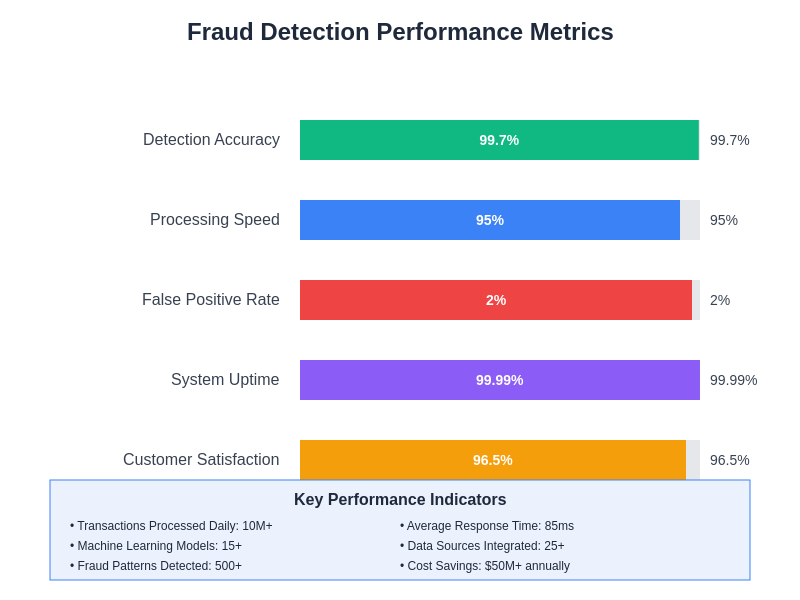

Despite the significant advances in AI-powered fraud detection, these systems face several challenges that require ongoing attention and development. The balance between fraud detection accuracy and customer experience remains a critical challenge, as overly aggressive fraud detection can result in legitimate transactions being declined, leading to customer frustration and potential revenue loss. Financial institutions must continuously optimize their systems to maintain high fraud detection rates while minimizing false positives that impact customer satisfaction.

Data quality and availability represent fundamental challenges for AI fraud detection systems, as the effectiveness of machine learning algorithms depends heavily on the quality, completeness, and timeliness of training data. Incomplete transaction histories, data inconsistencies, or biased training datasets can significantly impact the accuracy and fairness of fraud detection models. Ensuring high-quality data while maintaining customer privacy and regulatory compliance requires sophisticated data management and governance practices.

The adversarial nature of fraud detection creates an ongoing challenge as fraudsters continuously adapt their techniques to circumvent detection systems. This cat-and-mouse dynamic requires fraud detection systems to be constantly updated and improved to stay ahead of evolving criminal tactics. The ability of sophisticated fraudsters to analyze and potentially manipulate AI detection systems adds complexity to the development and deployment of effective fraud prevention measures.

Regulatory Compliance and Privacy Considerations

AI-powered fraud detection systems must navigate complex regulatory environments that govern data privacy, algorithmic transparency, and fair lending practices. Regulations such as the General Data Protection Regulation (GDPR) in Europe and various financial services regulations worldwide impose strict requirements on how customer data can be collected, processed, and used for fraud detection purposes. These regulatory constraints require careful design of fraud detection systems to ensure compliance while maintaining effectiveness.

Algorithmic transparency and explainability have become increasingly important regulatory requirements, particularly in jurisdictions that require financial institutions to explain automated decision-making processes to customers. This requirement poses challenges for complex machine learning models that may operate as “black boxes” with decision-making processes that are difficult to interpret or explain. The development of explainable AI techniques for fraud detection is an active area of research and development.

Privacy-preserving fraud detection techniques, such as federated learning and differential privacy, are being developed to enable effective fraud detection while protecting customer privacy and sensitive financial information. These approaches allow fraud detection systems to learn from distributed datasets without exposing individual transaction details or customer information, addressing privacy concerns while maintaining the collaborative benefits of shared fraud intelligence.

Future Trends and Technological Advances

The future of fraud detection AI is being shaped by several emerging technological trends that promise to further enhance detection capabilities and system effectiveness. Quantum computing has the potential to revolutionize fraud detection by enabling the analysis of vastly larger datasets and more complex algorithmic calculations than are currently possible with classical computing systems. While still in early development stages, quantum algorithms for pattern recognition and optimization could significantly enhance the speed and accuracy of fraud detection systems.

Blockchain technology is being explored for its potential to create tamper-proof audit trails and enable secure sharing of fraud intelligence between financial institutions. Blockchain-based fraud detection systems could provide enhanced security and transparency while enabling more effective collaboration in fraud prevention efforts across the financial services industry. The immutable nature of blockchain records could also improve the accuracy and reliability of fraud detection training data.

Edge computing and distributed AI processing are enabling more sophisticated fraud detection capabilities at the point of transaction, reducing latency and improving real-time response capabilities. These distributed architectures allow fraud detection algorithms to be deployed closer to transaction processing systems, enabling faster decision-making and reduced network dependency for critical fraud detection functions.

The measurement and optimization of fraud detection system performance requires comprehensive metrics that balance detection accuracy with operational efficiency and customer experience considerations. These metrics provide essential feedback for continuous system improvement and optimization.

Implementation Strategies and Best Practices

Successful implementation of AI-powered fraud detection systems requires careful planning, phased deployment, and continuous optimization to achieve optimal results. Organizations should begin with pilot programs that focus on specific fraud types or customer segments to validate system effectiveness and identify potential issues before full-scale deployment. This phased approach allows for iterative improvement and reduces the risk of system-wide disruptions or customer impact.

Data preparation and feature engineering represent critical success factors for AI fraud detection implementations. Organizations must invest significant effort in cleaning, organizing, and enriching their transaction data to ensure that machine learning models have access to high-quality, relevant information for training and operation. The identification and creation of relevant features that capture important fraud indicators while maintaining computational efficiency requires domain expertise and iterative experimentation.

Model validation and testing protocols are essential for ensuring that fraud detection systems perform reliably in production environments. Comprehensive testing should include validation against historical fraud cases, stress testing with high transaction volumes, and evaluation of system performance under various operational conditions. Regular model retraining and validation ensures that the system maintains its effectiveness as fraud patterns evolve and new threats emerge.

Industry Applications and Case Studies

The banking industry has been at the forefront of AI fraud detection adoption, with major financial institutions reporting significant improvements in fraud detection rates and reductions in false positives following the implementation of machine learning-based systems. Credit card companies have achieved particularly impressive results, with some reporting fraud detection improvements of over 50% while simultaneously reducing false positive rates by 30% or more. These improvements have resulted in substantial cost savings and enhanced customer satisfaction.

E-commerce platforms have successfully implemented AI fraud detection systems to combat online payment fraud, account takeover attacks, and fraudulent merchant activities. These systems analyze user behavior patterns, device characteristics, and transaction details to identify suspicious activities in real-time. The ability to detect fraud at the point of purchase has enabled e-commerce companies to reduce chargebacks and maintain customer trust while minimizing legitimate transaction disruptions.

Insurance companies have applied AI fraud detection techniques to identify fraudulent claims, suspicious patterns in policy applications, and organized fraud schemes that involve multiple parties or policies. These applications have demonstrated the versatility of AI fraud detection beyond traditional financial transactions, showing promise for application across various industries that face fraud challenges.

Cost-Benefit Analysis and ROI Considerations

The implementation of AI-powered fraud detection systems requires significant upfront investment in technology infrastructure, data preparation, model development, and staff training. However, the return on investment for these systems is typically substantial, with most organizations reporting positive ROI within the first year of deployment. The cost savings from prevented fraud losses, reduced manual review requirements, and improved operational efficiency often far exceed the implementation and operational costs of AI systems.

Quantifying the benefits of fraud detection systems involves measuring both direct financial impacts such as prevented fraud losses and indirect benefits such as improved customer satisfaction, reduced operational costs, and enhanced regulatory compliance. The ability to process larger transaction volumes with fewer human resources represents a significant operational benefit that continues to generate value throughout the system’s operational lifetime.

The scalability of AI fraud detection systems provides additional economic benefits as transaction volumes grow, since the marginal cost of analyzing additional transactions is minimal once the system infrastructure is established. This scalability advantage becomes particularly valuable for growing organizations or those expanding into new markets where transaction volumes may increase significantly over time.

Collaboration and Information Sharing

The effectiveness of fraud detection systems is significantly enhanced through collaboration and information sharing between financial institutions, technology vendors, and regulatory authorities. Industry consortiums and fraud intelligence sharing platforms enable organizations to benefit from collective knowledge about emerging fraud trends and effective countermeasures. This collaborative approach helps smaller institutions access advanced fraud detection capabilities that might otherwise be beyond their individual resources.

Real-time fraud intelligence feeds provide participating organizations with immediate alerts about new fraud schemes, compromised payment instruments, and emerging threat indicators. These shared intelligence resources enable faster response to fraud attacks and more effective prevention of fraud propagation across multiple institutions. The network effects of collaborative fraud detection create benefits that exceed what any individual organization could achieve independently.

Privacy-preserving collaboration techniques are being developed to enable fraud intelligence sharing while protecting sensitive customer and transaction information. These approaches allow organizations to contribute to and benefit from collective fraud intelligence without exposing confidential data or competitive information, addressing concerns about data sharing while maintaining the collaborative benefits of fraud prevention networks.

Training and Workforce Development

The successful deployment and operation of AI fraud detection systems requires specialized expertise in machine learning, data science, and fraud investigation techniques. Organizations must invest in training existing staff and recruiting new talent with the necessary technical skills to develop, deploy, and maintain these sophisticated systems. The interdisciplinary nature of fraud detection AI requires collaboration between data scientists, fraud analysts, compliance specialists, and technology professionals.

Continuous education and professional development are essential for fraud detection teams to stay current with evolving technologies and fraud methodologies. The rapid pace of innovation in AI and machine learning requires ongoing training to ensure that staff can effectively leverage new capabilities and adapt to changing threat landscapes. Professional certification programs and industry conferences provide valuable opportunities for knowledge sharing and skill development.

The integration of human expertise with AI capabilities remains crucial for effective fraud detection, as human analysts provide essential context, investigation skills, and decision-making capabilities that complement automated detection systems. Training programs should focus on developing skills that enhance human-AI collaboration rather than replacing human expertise with automation.

The future of fraud detection lies in the continued evolution of artificial intelligence capabilities combined with enhanced collaboration, regulatory adaptation, and workforce development initiatives that ensure these powerful technologies are deployed effectively and responsibly. As fraud schemes become increasingly sophisticated, the financial services industry must continue to innovate and adapt their detection capabilities to protect customers and maintain trust in digital financial systems. The ongoing development of AI fraud detection represents a critical component of cybersecurity infrastructure that will continue to evolve in response to emerging threats and technological opportunities.

Disclaimer

This article is for informational purposes only and does not constitute professional advice regarding fraud detection implementation or financial security measures. The views expressed are based on current understanding of AI technologies and their applications in fraud detection. Readers should conduct their own research and consult with qualified professionals when implementing fraud detection systems. The effectiveness of AI-powered fraud detection may vary depending on specific use cases, regulatory requirements, and organizational circumstances. This article does not endorse any specific fraud detection products or services.