The insurance industry stands at the precipice of a technological revolution as artificial intelligence fundamentally transforms how insurers process claims, assess risks, and serve their customers. This transformation represents more than mere automation; it embodies a complete reimagining of insurance operations where machine learning algorithms, predictive analytics, and intelligent automation converge to create unprecedented levels of efficiency, accuracy, and customer satisfaction. The integration of AI technologies into insurance workflows has ushered in an era where complex underwriting decisions can be made in minutes rather than weeks, where fraudulent claims are detected with remarkable precision, and where risk assessment becomes a dynamic, data-driven process that adapts in real-time to changing circumstances.

Explore the latest AI innovations in insurance to understand how cutting-edge technologies are reshaping traditional insurance practices and creating new opportunities for both insurers and policyholders. The evolution of insurance AI represents a paradigm shift that touches every aspect of the industry, from initial policy underwriting to final claim settlement, fundamentally altering the relationship between insurers and their customers while creating new standards for operational excellence.

The Evolution of Claims Processing Through AI

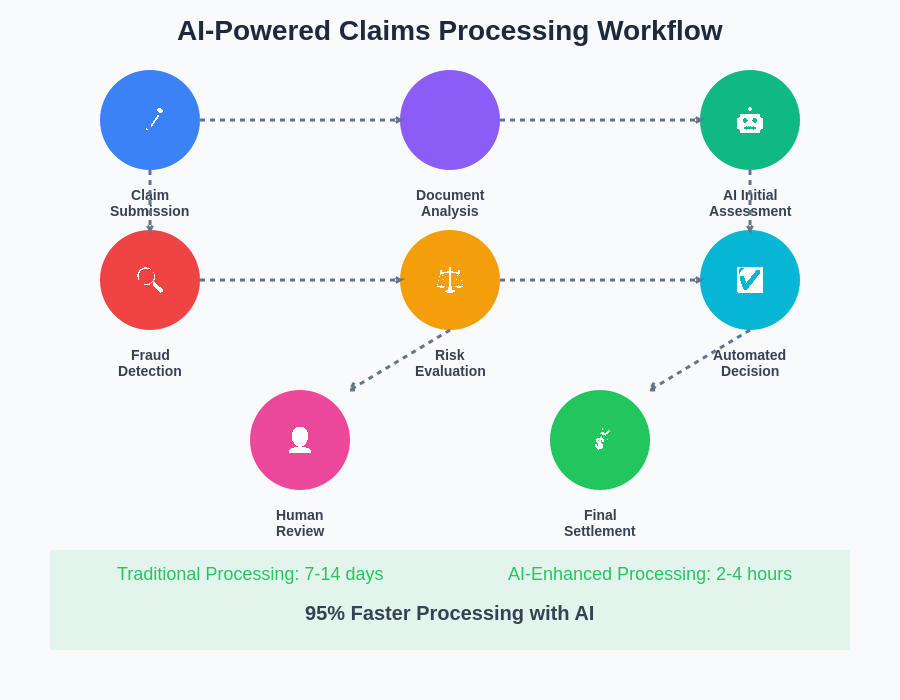

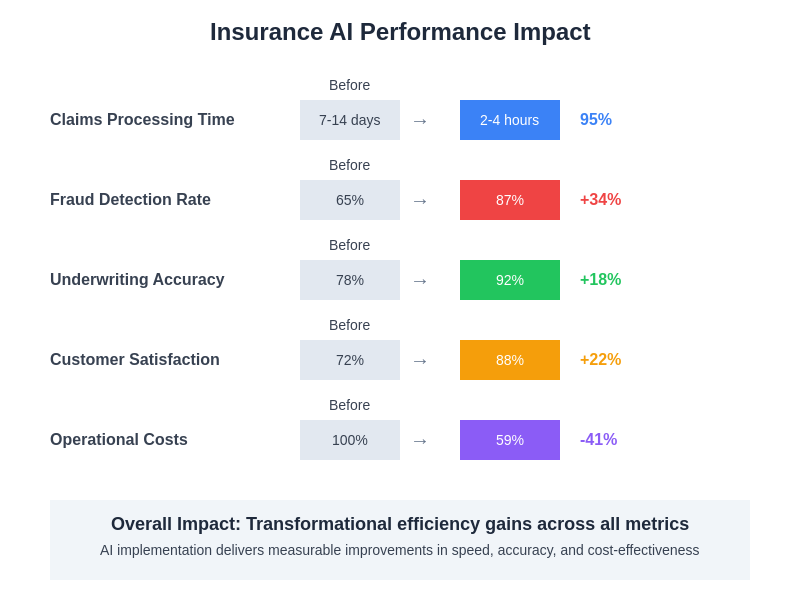

Traditional claims processing has long been characterized by manual procedures, extensive paperwork, and lengthy approval cycles that often frustrated customers and strained insurance company resources. The introduction of artificial intelligence into claims processing workflows has revolutionized this landscape by automating routine tasks, accelerating decision-making processes, and dramatically improving accuracy rates. Modern AI-powered claims systems can instantly analyze claim submissions, cross-reference policy details, validate coverage parameters, and initiate appropriate workflows without human intervention, reducing processing times from days or weeks to mere hours or minutes.

The sophisticated natural language processing capabilities of contemporary AI systems enable automatic extraction and interpretation of information from various document types, including medical reports, police statements, repair estimates, and photographic evidence. This automated document analysis not only accelerates the claims process but also reduces the likelihood of human error while ensuring consistent application of policy terms and conditions across all claims. Machine learning algorithms continuously improve their performance by learning from historical claims data, enabling them to identify patterns, predict outcomes, and make increasingly accurate assessments of claim validity and appropriate settlement amounts.

The integration of computer vision technologies has particularly transformed property and auto insurance claims processing, where AI systems can analyze photographs and videos to assess damage severity, estimate repair costs, and detect potential fraud indicators. These visual analysis capabilities enable remote claims assessment, reducing the need for in-person inspections while maintaining high levels of accuracy in damage evaluation. The combination of automated document processing, intelligent workflow management, and visual analysis creates a comprehensive claims processing ecosystem that delivers superior customer experiences while optimizing operational efficiency.

Revolutionizing Risk Assessment with Predictive Analytics

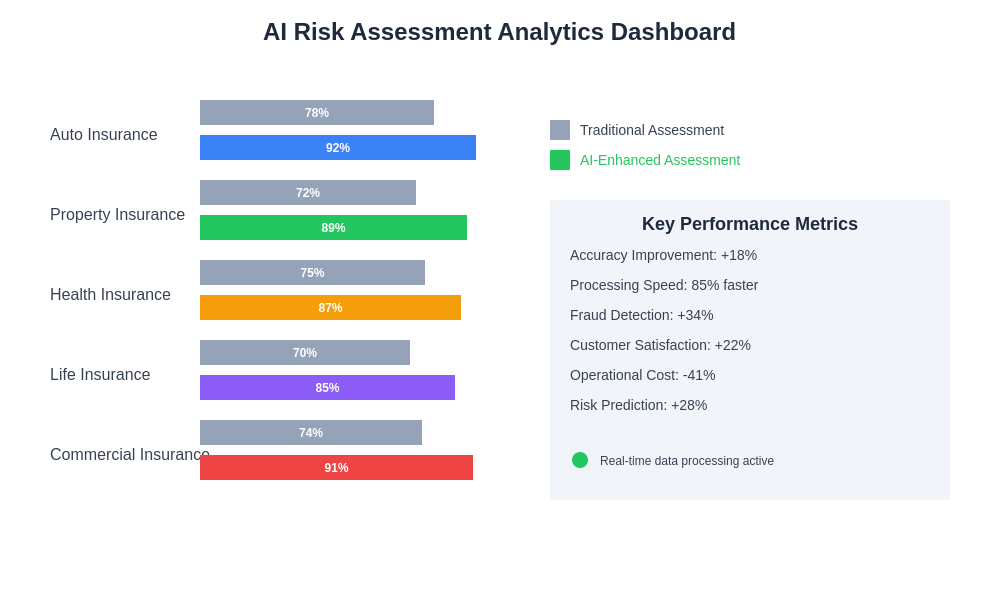

Risk assessment forms the foundation of insurance business models, and artificial intelligence has fundamentally transformed how insurers evaluate, price, and manage risk exposure across diverse portfolio segments. Traditional risk assessment methodologies relied heavily on historical data, broad demographic categories, and simplified actuarial models that often failed to capture the nuanced factors influencing individual risk profiles. Modern AI-powered risk assessment systems leverage vast datasets, including telematics data, social media activity, satellite imagery, weather patterns, and real-time behavioral indicators, to create comprehensive, dynamic risk profiles that accurately reflect current risk exposures.

Machine learning algorithms excel at identifying complex patterns and correlations within massive datasets that would be impossible for human analysts to detect, enabling the discovery of previously unknown risk factors and their relative importance in predicting claim frequency and severity. These sophisticated analytical capabilities allow insurers to develop more accurate pricing models, reduce adverse selection, and offer more competitive premiums to low-risk customers while appropriately pricing policies for higher-risk individuals. The continuous learning nature of machine learning systems ensures that risk models remain current and responsive to changing environmental conditions, emerging risks, and evolving customer behaviors.

Enhance your AI capabilities with Claude for advanced analytics and decision-making processes that can transform your organization’s approach to risk management and operational efficiency. The integration of artificial intelligence into risk assessment processes enables insurers to move beyond reactive claim processing toward proactive risk management strategies that prevent losses before they occur.

Predictive analytics powered by artificial intelligence enables insurers to identify high-risk situations before claims materialize, allowing for preventive interventions that protect both customers and company profitability. For example, AI systems can analyze driving patterns from telematics devices to identify potentially dangerous behaviors and provide personalized safety recommendations to policyholders. Similarly, property insurance systems can monitor weather patterns, building conditions, and maintenance records to predict potential property damage and recommend preventive measures. This proactive approach to risk management represents a fundamental shift from traditional reactive insurance models toward value-added services that actively protect customer assets.

Fraud Detection and Prevention Through Machine Learning

Insurance fraud represents a significant challenge for the industry, with estimated annual losses reaching billions of dollars globally while driving up premiums for honest policyholders. Traditional fraud detection methods relied primarily on rule-based systems and manual investigations that were time-consuming, expensive, and often ineffective at identifying sophisticated fraud schemes. The application of machine learning and artificial intelligence to fraud detection has revolutionized this critical area by enabling real-time analysis of claim patterns, identification of suspicious behaviors, and automatic flagging of potentially fraudulent activities with unprecedented accuracy and speed.

Advanced machine learning algorithms can analyze vast amounts of historical claims data to identify subtle patterns and anomalies that indicate fraudulent activity, including unusual claim timing, inconsistent damage patterns, suspicious repair estimates, and coordinated fraud rings involving multiple parties. These systems continuously learn from new fraud cases and investigative outcomes, constantly improving their ability to detect emerging fraud techniques and adapt to evolving criminal strategies. The real-time nature of AI-powered fraud detection enables immediate flagging of suspicious claims, allowing for prompt investigation and prevention of fraudulent payouts.

The automated fraud detection capabilities of modern AI systems extend beyond simple pattern recognition to include behavioral analysis, network analysis, and predictive modeling that can identify fraud indicators even in claims that appear legitimate on the surface. Natural language processing technologies can analyze claim descriptions, medical reports, and witness statements to identify inconsistencies, exaggerations, or fabricated details that suggest fraudulent intent. Computer vision systems can examine photographic evidence to detect signs of staged accidents, pre-existing damage, or manipulated images that are commonly associated with fraudulent claims.

Enhancing Customer Experience Through Intelligent Automation

The customer experience in insurance has traditionally been characterized by complex procedures, lengthy wait times, and frustrating communication challenges that often left policyholders feeling undervalued and poorly served. Artificial intelligence has fundamentally transformed customer interactions with insurance companies by enabling instant responses, personalized service delivery, and seamless digital experiences that meet modern consumer expectations for convenience and efficiency. AI-powered chatbots and virtual assistants provide 24/7 customer support, handling routine inquiries, guiding customers through claims processes, and providing real-time updates on claim status without requiring human intervention.

Intelligent automation systems can process simple claims end-to-end without human involvement, from initial submission through final settlement, dramatically reducing processing times and improving customer satisfaction. These automated systems can instantly verify policy coverage, assess claim validity, calculate settlement amounts, and initiate payments, enabling customers to receive claim settlements in hours rather than weeks. The integration of mobile applications with AI-powered backend systems allows customers to submit claims using smartphones, upload supporting documentation, and track progress in real-time, creating seamless digital experiences that rival the best technology companies.

Personalization represents another significant benefit of AI integration in customer service, where machine learning algorithms analyze customer preferences, communication patterns, and service history to deliver customized experiences that anticipate individual needs and preferences. AI systems can proactively reach out to customers with relevant information, policy updates, or risk prevention tips based on their specific circumstances and risk profiles. This proactive, personalized approach to customer service transforms the traditional transactional relationship between insurers and policyholders into ongoing partnerships focused on protection and value creation.

Optimizing Underwriting Through Data-Driven Insights

Underwriting represents one of the most critical functions in insurance operations, determining policy pricing, coverage terms, and risk acceptance decisions that directly impact company profitability and competitive positioning. Traditional underwriting processes often relied on limited data sources, manual analysis, and subjective judgment that could result in inconsistent decisions, pricing errors, and missed opportunities for profitable business. The integration of artificial intelligence into underwriting workflows has transformed this essential function by enabling comprehensive analysis of vast datasets, consistent application of risk criteria, and dynamic pricing strategies that optimize both profitability and competitiveness.

AI-powered underwriting systems can instantly access and analyze hundreds of data points from diverse sources, including credit reports, property records, claims history, demographic data, and external databases, to create comprehensive risk profiles that inform accurate pricing and coverage decisions. Machine learning algorithms can identify complex relationships between risk factors that human underwriters might overlook, enabling more precise risk assessment and more competitive pricing for preferred risks. The automation of routine underwriting tasks allows human underwriters to focus on complex cases, relationship management, and strategic decision-making while ensuring consistent, efficient processing of standard applications.

Leverage Perplexity’s research capabilities to stay informed about emerging trends, regulatory changes, and technological innovations that impact insurance underwriting and risk management strategies. The continuous evolution of AI technologies requires insurance professionals to maintain current knowledge of best practices and emerging opportunities for operational improvement.

Real-time underwriting capabilities enabled by artificial intelligence allow insurers to provide instant quotes and policy issuance for many types of coverage, dramatically improving the customer experience while reducing operational costs. These systems can dynamically adjust pricing based on real-time risk factors, market conditions, and competitive intelligence, ensuring optimal pricing strategies that maximize profitability while maintaining competitive positioning. The integration of external data sources, including satellite imagery, weather data, and economic indicators, enables underwriting systems to incorporate environmental and economic factors that significantly impact risk assessment accuracy.

Transforming Actuarial Science with Advanced Analytics

Actuarial science forms the mathematical foundation of insurance operations, providing the statistical models and risk calculations that determine pricing, reserves, and capital requirements essential for company solvency and profitability. Traditional actuarial methods, while mathematically sound, were often limited by data availability, computational constraints, and simplified assumptions that failed to capture the full complexity of risk relationships in modern insurance environments. The application of artificial intelligence and advanced analytics to actuarial science has revolutionized this discipline by enabling more sophisticated modeling techniques, incorporation of vast datasets, and dynamic model updating that reflects changing risk environments.

Machine learning algorithms can process enormous datasets to identify subtle patterns and relationships that traditional statistical methods might miss, enabling the development of more accurate predictive models for claim frequency, severity, and loss development. These advanced analytical capabilities allow actuaries to incorporate previously unavailable data sources, such as satellite imagery for catastrophe modeling, telematics data for auto insurance, and social media activity for behavioral analysis, creating more comprehensive and accurate risk models. The ability to process real-time data streams enables dynamic model updating that ensures actuarial calculations remain current and responsive to changing conditions.

Artificial intelligence enhances traditional actuarial techniques by automating routine calculations, identifying model errors, and suggesting improvements based on performance analysis and emerging data patterns. Natural language processing technologies can analyze regulatory changes, court decisions, and market reports to identify factors that might impact future claim costs or loss patterns, enabling proactive model adjustments that maintain accuracy and compliance. The integration of AI tools into actuarial workflows increases productivity, improves accuracy, and enables actuaries to focus on strategic analysis, model development, and business advisory functions that add greater value to insurance operations.

Regulatory Compliance and Governance in AI Implementation

The implementation of artificial intelligence in insurance operations must navigate complex regulatory environments that vary across jurisdictions while ensuring compliance with evolving standards for algorithmic fairness, transparency, and accountability. Insurance regulators worldwide are developing new frameworks for AI governance that require insurers to demonstrate that their AI systems operate fairly, produce explainable decisions, and maintain appropriate human oversight mechanisms. These regulatory requirements necessitate careful attention to algorithm design, data quality, model validation, and ongoing monitoring to ensure that AI systems meet both performance objectives and regulatory expectations.

Explainable AI represents a critical requirement for insurance applications, where regulators and customers demand transparency in how AI systems make decisions that affect policy pricing, claims processing, and coverage determinations. Insurance companies must implement AI systems that can provide clear explanations for their decisions, document the factors considered in each determination, and demonstrate that their algorithms do not exhibit unfair bias against protected classes or demographic groups. This requirement for transparency and explainability influences AI system design choices and requires ongoing investment in model interpretability tools and techniques.

Data governance becomes particularly critical in AI-powered insurance operations, where systems process vast amounts of sensitive personal information that must be protected, used appropriately, and managed in compliance with privacy regulations such as GDPR and CCPA. Insurance companies must implement comprehensive data management frameworks that ensure data quality, protect customer privacy, maintain data security, and provide appropriate access controls for AI systems. The global nature of many insurance operations requires coordination across multiple regulatory jurisdictions, each with unique requirements for data handling, algorithmic fairness, and consumer protection.

Integration Challenges and Implementation Strategies

The successful implementation of artificial intelligence in insurance operations requires careful planning, significant investment, and systematic change management approaches that address both technical and organizational challenges. Legacy system integration represents one of the most significant hurdles, as many insurance companies operate on decades-old technology platforms that were not designed to support modern AI applications. The complexity of insurance data, which often resides in multiple systems with inconsistent formats and quality standards, requires extensive data preparation and standardization efforts before AI systems can be effectively deployed.

Organizational change management becomes critical for successful AI implementation, as the technology fundamentally alters job roles, decision-making processes, and operational workflows throughout insurance organizations. Employees require training on new systems, updated processes, and collaborative approaches to working with AI tools, while management must adapt performance metrics, quality standards, and organizational structures to optimize the benefits of AI integration. Cultural resistance to automation and concerns about job displacement must be addressed through transparent communication, retraining programs, and demonstration of how AI enhances rather than replaces human capabilities.

Risk management for AI implementation requires new approaches to system validation, performance monitoring, and error detection that account for the unique characteristics of machine learning systems. Unlike traditional software that follows deterministic logic, AI systems can exhibit unexpected behaviors, bias amplification, or performance degradation that requires continuous monitoring and adjustment. Insurance companies must develop new capabilities for AI model validation, ongoing performance assessment, and rapid response to system anomalies or regulatory changes that affect AI operations.

Future Innovations and Emerging Technologies

The future of insurance AI promises even more transformative innovations as emerging technologies mature and new applications are developed to address evolving industry challenges and opportunities. Quantum computing holds the potential to revolutionize actuarial modeling and risk calculations by enabling complex simulations and optimizations that are computationally impossible with current technology. The massive computational power of quantum systems could enable real-time processing of global risk factors, dynamic pricing optimization, and sophisticated fraud detection algorithms that operate at unprecedented scales and speeds.

Internet of Things integration will create new opportunities for real-time risk monitoring and preventive interventions as connected devices generate continuous streams of data about insured assets and policyholder behaviors. Smart homes equipped with sensors can monitor for fire risks, water damage, or security threats, enabling AI systems to provide early warnings and coordinate preventive responses that protect both property and lives. Connected vehicles will provide detailed driving behavior data that enables dynamic insurance pricing based on actual risk exposure rather than statistical estimates, creating more equitable pricing and incentives for safe driving behaviors.

Blockchain technology integration with AI systems promises to enhance data security, improve transparency, and enable new forms of automated insurance products such as parametric insurance and smart contracts that automatically trigger payments based on predefined conditions. The immutable nature of blockchain records combined with AI analysis capabilities could revolutionize fraud prevention, streamline claims processing, and enable new insurance products that automatically adjust coverage and pricing based on real-time risk assessments.

The convergence of artificial intelligence with other emerging technologies will continue to push the boundaries of what is possible in insurance operations, creating opportunities for new business models, improved customer experiences, and more effective risk management strategies. As these technologies mature and become more accessible, insurance companies that embrace innovation and invest in AI capabilities will be best positioned to thrive in an increasingly competitive and dynamic marketplace.

Measuring Success and ROI in Insurance AI

The successful implementation of artificial intelligence in insurance operations requires comprehensive measurement frameworks that capture both quantitative performance improvements and qualitative benefits that enhance competitive positioning and customer satisfaction. Traditional return on investment calculations must be expanded to account for the multiple ways AI creates value, including operational efficiency gains, improved decision accuracy, enhanced customer experiences, and risk reduction benefits that may not be immediately apparent in financial statements.

Key performance indicators for AI success in insurance should encompass processing speed improvements, accuracy enhancements, cost reductions, customer satisfaction scores, fraud detection rates, and regulatory compliance metrics that collectively demonstrate the comprehensive impact of AI implementation. Claims processing metrics might include average processing time, first-call resolution rates, customer satisfaction scores, and operational cost per claim, while underwriting metrics could focus on decision speed, pricing accuracy, loss ratios, and new business conversion rates.

Long-term value creation from AI investments often extends beyond immediate operational improvements to include strategic advantages such as improved market positioning, enhanced risk selection capabilities, and the ability to offer innovative products and services that differentiate the company from competitors. These strategic benefits may take years to fully materialize but can provide sustainable competitive advantages that justify significant AI investments and drive long-term profitability growth.

The measurement of AI success must also account for risk mitigation benefits, including reduced fraud losses, improved regulatory compliance, better customer retention, and enhanced reputation management that protect company value and support sustainable growth. Insurance companies should develop comprehensive measurement frameworks that capture both immediate operational benefits and long-term strategic value creation to ensure that AI investments deliver optimal returns and support continued innovation and improvement.

Disclaimer

This article is for informational purposes only and does not constitute professional advice. The views expressed are based on current understanding of AI technologies and their applications in insurance operations. Insurance companies should conduct thorough due diligence, consult with regulatory authorities, and consider their specific operational requirements when implementing AI systems. The effectiveness and appropriateness of AI applications may vary significantly depending on company size, market conditions, regulatory environment, and specific business objectives.