The insurance industry stands at the precipice of a technological revolution driven by artificial intelligence, fundamentally transforming how insurers assess risk, process claims, and interact with policyholders. This paradigm shift represents more than mere technological advancement; it embodies a complete reimagining of traditional insurance operations where data-driven insights, predictive analytics, and automated decision-making processes converge to create more accurate, efficient, and customer-centric insurance solutions that benefit both providers and consumers.

Explore the latest AI trends shaping industries to understand how artificial intelligence continues to reshape traditional business models across various sectors, including the rapidly evolving insurance landscape. The integration of AI technologies in insurance represents a strategic imperative for companies seeking to maintain competitive advantage while delivering superior value propositions to their customers in an increasingly digital marketplace.

The Foundation of AI-Powered Insurance Transformation

The insurance industry’s adoption of artificial intelligence represents a fundamental shift from traditional actuarial methods toward sophisticated machine learning algorithms capable of processing vast amounts of data to generate more accurate risk profiles and streamline operational processes. This transformation has been accelerated by the convergence of several technological factors, including increased computing power, advanced data analytics capabilities, and the proliferation of digital data sources that provide unprecedented insights into individual and collective risk patterns.

Modern insurance companies are leveraging AI technologies to address longstanding challenges in risk assessment accuracy, claims processing efficiency, fraud detection, and customer service delivery. The traditional approach to insurance underwriting, which relied heavily on historical data and standardized risk categories, has evolved into dynamic, personalized risk assessment models that consider hundreds of variables in real-time to provide more precise pricing and coverage recommendations.

The implementation of AI in insurance operations has created opportunities for significant cost reduction while simultaneously improving service quality and accuracy. Insurance providers can now process applications faster, detect fraudulent claims more effectively, and offer personalized products that better match individual customer needs and risk profiles. This technological evolution has positioned forward-thinking insurance companies to capture market share while delivering enhanced value to their policyholders.

Revolutionary Risk Assessment Through Machine Learning

Traditional risk assessment in insurance relied on broad demographic categories, historical claims data, and standardized actuarial tables that often failed to capture the nuanced risk profiles of individual applicants. AI-powered risk assessment has revolutionized this process by incorporating machine learning algorithms capable of analyzing thousands of data points to create highly personalized risk profiles that reflect the unique circumstances and behaviors of each potential policyholder.

Modern AI risk assessment systems integrate diverse data sources including social media activity, credit histories, driving patterns, health monitoring devices, property information, and behavioral analytics to create comprehensive risk profiles that far exceed the accuracy of traditional assessment methods. These systems can identify subtle correlations and patterns that human underwriters might overlook, leading to more precise risk pricing and reduced adverse selection problems that have historically plagued the insurance industry.

The predictive capabilities of AI risk assessment extend beyond static data analysis to include dynamic risk monitoring that continuously updates risk profiles based on changing circumstances and behaviors. This real-time risk assessment enables insurance companies to adjust premiums, coverage terms, and policy recommendations proactively, creating more responsive and fair pricing structures that better reflect actual risk exposure rather than broad categorical assumptions.

Experience advanced AI capabilities with Claude for complex data analysis and decision-making processes that can enhance your understanding of AI applications in various industries, including insurance and risk management. The sophisticated reasoning capabilities of modern AI systems enable insurance companies to process complex risk scenarios and generate actionable insights that drive better business outcomes.

Transforming Claims Processing Through Automation

The claims processing function represents one of the most significant opportunities for AI-driven transformation in the insurance industry, where traditional manual processes often result in lengthy processing times, inconsistent outcomes, and high operational costs. AI-powered claims processing systems have revolutionized this critical function by automating routine tasks, accelerating decision-making processes, and improving accuracy while reducing the need for human intervention in straightforward claims scenarios.

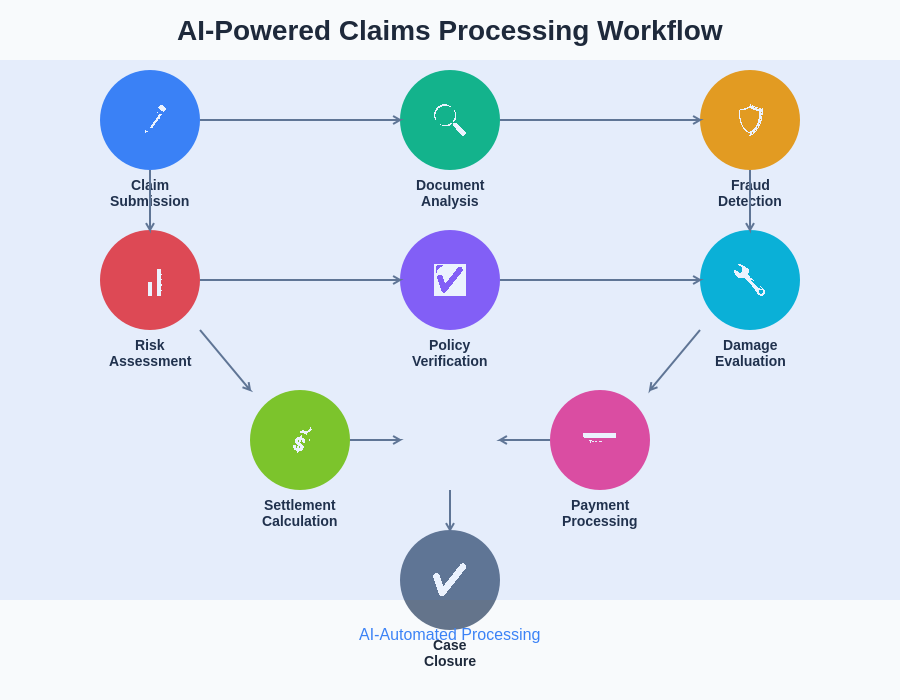

Intelligent document processing capabilities enable AI systems to automatically extract relevant information from claim submissions, policy documents, medical records, and supporting evidence, eliminating the time-consuming manual data entry tasks that traditionally slowed claims processing. Natural language processing algorithms can interpret written descriptions of incidents, analyze photographic evidence, and cross-reference policy terms to make initial determinations about claim validity and settlement amounts.

The implementation of AI in claims processing has enabled insurance companies to establish tiered processing systems where routine claims are handled entirely through automated processes, while complex or high-value claims are escalated to human adjusters who can focus their expertise on cases that truly require human judgment and negotiation skills. This optimization of human resources has resulted in faster processing times for customers while reducing operational costs for insurance providers.

The automated claims processing workflow demonstrates how AI technologies streamline the entire claims journey from initial submission through final settlement, incorporating fraud detection, policy verification, damage assessment, and settlement calculation into a seamless automated process that delivers faster, more consistent outcomes for policyholders.

Advanced Fraud Detection and Prevention Systems

Insurance fraud represents a significant financial challenge for the industry, with fraudulent claims costing billions of dollars annually and ultimately increasing premiums for honest policyholders. AI-powered fraud detection systems have emerged as powerful tools for identifying suspicious patterns, flagging potentially fraudulent claims, and preventing fraud before it results in improper payments, thereby protecting both insurance companies and their customers from the financial impact of fraudulent activities.

Machine learning algorithms excel at pattern recognition and anomaly detection, making them particularly well-suited for fraud identification tasks that require analysis of complex relationships between multiple data points. AI fraud detection systems can analyze claim patterns, identify unusual submission behaviors, detect inconsistencies in documentation, and flag claims that deviate from normal patterns associated with legitimate claims, enabling insurance companies to investigate suspicious activities before processing payments.

The sophistication of modern AI fraud detection extends beyond simple rule-based systems to include behavioral analytics that can identify subtle indicators of potential fraud, such as timing patterns in claim submissions, geographic clustering of similar claims, or unusual patterns in medical treatment following accidents. These advanced detection capabilities enable insurance companies to identify organized fraud schemes and prevent systematic abuse of insurance coverage.

Enhancing Customer Experience Through Intelligent Interfaces

The integration of AI technologies in customer-facing insurance applications has transformed how policyholders interact with their insurance providers, creating more personalized, responsive, and efficient service experiences that meet the evolving expectations of digital-native consumers. AI-powered chatbots, virtual assistants, and recommendation engines enable insurance companies to provide 24/7 customer support, instant policy quotes, and personalized coverage recommendations that enhance customer satisfaction and engagement.

Intelligent customer service systems can handle routine inquiries, process policy changes, assist with claims submissions, and provide policy information without human intervention, reducing wait times and improving service availability for customers who prefer digital interactions. Natural language processing capabilities enable these systems to understand customer intent and provide contextually relevant responses that address specific concerns and questions.

The personalization capabilities of AI extend beyond customer service to include customized policy recommendations, targeted marketing communications, and proactive risk management advice that helps customers make informed decisions about their insurance coverage. By analyzing customer data, behavior patterns, and risk profiles, AI systems can identify opportunities to recommend additional coverage, suggest risk reduction strategies, or alert customers to potential exposures that might require insurance protection.

Discover comprehensive research capabilities with Perplexity to explore the latest developments in insurance technology and AI applications that continue to reshape customer experiences and operational efficiency in the insurance sector. The ongoing evolution of AI technologies promises even more sophisticated customer interaction capabilities that will further enhance the insurance customer experience.

Predictive Analytics for Proactive Risk Management

The power of AI in insurance extends far beyond reactive claims processing and risk assessment to include predictive analytics capabilities that enable insurance companies to anticipate future risks, prevent losses, and provide proactive guidance to policyholders. Predictive modeling algorithms can analyze historical data, environmental factors, and behavioral patterns to forecast potential risks and recommend preventive measures that reduce the likelihood of claims and losses.

Weather prediction models integrated with property insurance systems can alert homeowners to potential storm damage risks and provide recommendations for protective measures that might prevent or minimize property damage. Similarly, automotive insurance systems can analyze driving patterns, vehicle maintenance data, and road conditions to predict accident risks and provide safety recommendations to policyholders, potentially preventing accidents and reducing claims frequency.

The proactive risk management capabilities of AI extend to commercial insurance applications where predictive analytics can identify potential workplace safety issues, equipment failure risks, and operational vulnerabilities that could result in significant losses. By providing early warning systems and preventive recommendations, AI-powered insurance systems create value for both insurers and policyholders through loss prevention rather than simply loss compensation.

Regulatory Compliance and Ethical AI Implementation

The implementation of AI in insurance operations must navigate complex regulatory environments while ensuring ethical and fair treatment of all policyholders, requiring careful attention to algorithmic transparency, bias prevention, and compliance with evolving regulatory requirements. Insurance regulators worldwide are developing frameworks for AI governance that balance innovation opportunities with consumer protection and market stability concerns.

Algorithmic bias represents a significant concern in AI-powered insurance applications, where biased training data or flawed algorithms could result in unfair discrimination against certain demographic groups or geographic regions. Insurance companies implementing AI systems must establish robust testing and validation procedures to ensure that their algorithms produce fair and equitable outcomes while complying with anti-discrimination laws and regulations.

The transparency requirements for AI decision-making in insurance present ongoing challenges as regulators and consumers demand explanability for automated decisions that affect policy pricing, coverage terms, and claims settlements. Insurance companies must balance the competitive advantages of sophisticated AI algorithms with the need to provide clear explanations for their automated decisions, leading to the development of explainable AI systems that can provide reasoning for their outputs.

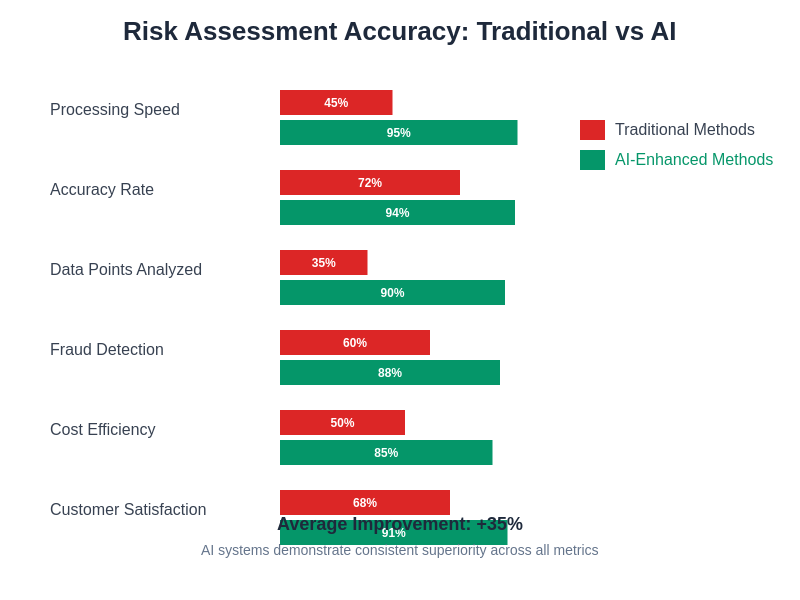

The comparison between traditional and AI-powered risk assessment demonstrates the significant improvements in accuracy, processing speed, and predictive capability that artificial intelligence brings to insurance underwriting, resulting in better outcomes for both insurance providers and their customers.

Emerging Technologies and Future Innovations

The future of AI in insurance continues to evolve with emerging technologies such as computer vision, Internet of Things integration, blockchain applications, and advanced natural language processing capabilities that promise even greater transformation of traditional insurance operations. Computer vision technologies enable automated damage assessment through photograph analysis, reducing the need for physical inspections while improving accuracy and speed of claims processing.

Internet of Things devices provide real-time data streams that enable continuous risk monitoring and dynamic policy adjustments based on actual usage patterns and risk exposures. Smart home devices, connected vehicles, and wearable health monitors generate vast amounts of data that AI systems can analyze to provide personalized risk profiles and pricing recommendations that reflect actual rather than assumed risk levels.

The integration of blockchain technology with AI insurance systems promises enhanced security, transparency, and efficiency in policy management and claims processing while reducing fraud risks through immutable transaction records and smart contract automation. These technological convergences create opportunities for entirely new insurance products and service models that were previously impossible with traditional insurance operations.

Industry-Wide Transformation and Market Implications

The widespread adoption of AI technologies across the insurance industry is creating fundamental shifts in competitive dynamics, customer expectations, and operational models that require strategic adaptation by all market participants. Insurance companies that successfully integrate AI capabilities gain significant competitive advantages through improved operational efficiency, better risk selection, enhanced customer experiences, and reduced operational costs.

Traditional insurance companies face pressure to modernize their operations and adopt AI technologies to remain competitive with insurtech startups and technology-forward competitors who are capturing market share through superior digital experiences and more accurate risk pricing. This competitive pressure is driving industry-wide investment in AI capabilities and digital transformation initiatives that are reshaping the entire insurance ecosystem.

The transformation extends beyond individual companies to affect relationships between insurers, reinsurers, brokers, and technology providers, creating new partnership models and collaborative approaches to AI development and implementation. The insurance industry’s evolution toward AI-powered operations represents a fundamental shift that will define the competitive landscape for decades to come.

Implementation Strategies and Best Practices

Successful implementation of AI in insurance operations requires strategic planning, careful technology selection, robust data management practices, and comprehensive change management approaches that address both technical and organizational challenges. Insurance companies must develop clear AI strategies that align with business objectives while considering regulatory requirements, competitive positioning, and customer expectations.

Data quality and governance represent critical success factors for AI implementation, as machine learning algorithms require high-quality, comprehensive data sets to generate accurate and reliable results. Insurance companies must invest in data infrastructure, establish data governance frameworks, and implement quality control processes that ensure their AI systems have access to the information needed for optimal performance.

The human element remains crucial in AI-powered insurance operations, requiring workforce development programs that help employees adapt to new technologies while identifying opportunities for human expertise to complement AI capabilities. Successful AI implementation involves finding the optimal balance between automation and human judgment, ensuring that technology enhances rather than replaces human capabilities where they add the greatest value.

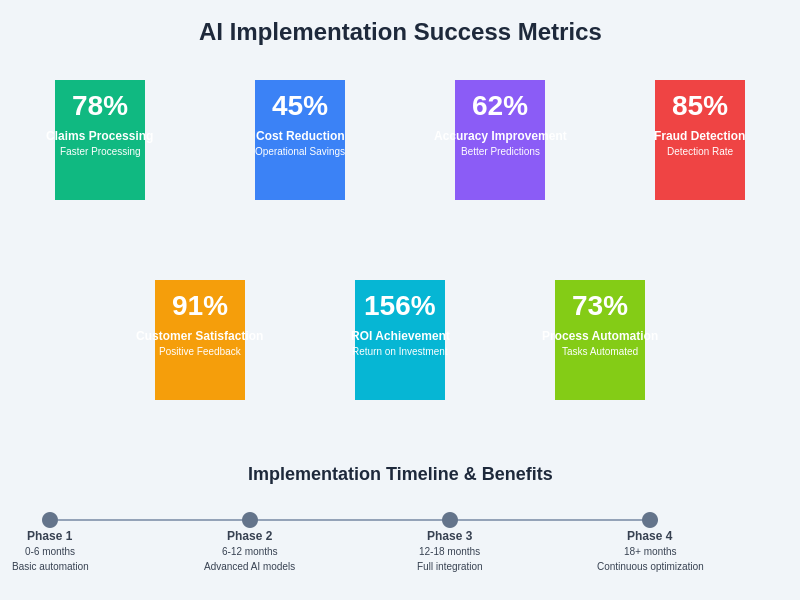

The key performance indicators for AI implementation in insurance demonstrate the measurable benefits that successful AI adoption delivers across operational efficiency, customer satisfaction, risk accuracy, and cost reduction, providing a framework for evaluating the success of AI transformation initiatives.

Global Market Trends and Regional Variations

The adoption of AI in insurance varies significantly across different global markets, influenced by regulatory environments, technological infrastructure, cultural factors, and competitive dynamics that create diverse implementation approaches and priorities. Developed markets with sophisticated regulatory frameworks and advanced technological infrastructure tend to lead in AI adoption, while emerging markets may focus on different AI applications that address their specific challenges and opportunities.

Regulatory differences between regions create varying approaches to AI governance, data privacy, and algorithmic transparency that influence how insurance companies implement and deploy AI technologies. European markets operating under GDPR requirements face different compliance challenges than Asian markets with different privacy frameworks, creating regional variations in AI implementation strategies and capabilities.

The global insurance industry’s AI transformation creates opportunities for cross-border collaboration, technology sharing, and best practice development that can accelerate AI adoption while addressing common challenges such as fraud detection, catastrophic risk modeling, and regulatory compliance across different market environments.

Measuring Success and Return on Investment

The evaluation of AI implementation success in insurance requires comprehensive measurement frameworks that capture both quantitative and qualitative benefits across multiple dimensions of business performance, customer satisfaction, and operational efficiency. Traditional financial metrics must be supplemented with AI-specific performance indicators that reflect the unique value propositions and capabilities that artificial intelligence brings to insurance operations.

Key performance indicators for AI success in insurance include improvements in risk assessment accuracy, reduction in claims processing times, enhanced fraud detection rates, increased customer satisfaction scores, and decreased operational costs per policy. These metrics must be tracked over time to demonstrate the sustained value of AI investments and identify opportunities for further optimization and enhancement.

The return on investment calculation for AI in insurance extends beyond immediate cost savings to include strategic benefits such as improved competitive positioning, enhanced customer retention, better risk selection, and increased market share that contribute to long-term business success. Insurance companies must develop sophisticated ROI models that capture the full spectrum of AI benefits to justify continued investment and expansion of AI capabilities.

Conclusion and Future Outlook

The integration of artificial intelligence in insurance represents a transformative force that is reshaping every aspect of the industry from risk assessment and underwriting to claims processing and customer service, creating unprecedented opportunities for improved efficiency, accuracy, and customer value. The successful adoption of AI technologies has positioned forward-thinking insurance companies to capture competitive advantages while delivering superior outcomes for their policyholders and stakeholders.

The future of AI in insurance promises even greater transformation as emerging technologies continue to evolve and new applications are developed that further enhance the industry’s ability to assess risk, prevent losses, and serve customers effectively. The ongoing evolution of AI capabilities, combined with increasing regulatory clarity and industry best practices, creates a foundation for sustained innovation and improvement in insurance operations.

The insurance industry’s AI transformation journey continues to accelerate, driven by competitive pressures, customer expectations, and the proven benefits of intelligent automation and data-driven decision-making. Companies that embrace AI technologies while maintaining focus on ethical implementation, regulatory compliance, and customer value creation will be best positioned to thrive in the evolving insurance landscape of the future.

Disclaimer

This article is for informational purposes only and does not constitute professional advice regarding insurance products, AI implementation strategies, or regulatory compliance requirements. The views expressed are based on current understanding of AI technologies and their applications in the insurance industry. Readers should conduct their own research and consult with qualified professionals when considering AI implementation or insurance-related decisions. The effectiveness and outcomes of AI applications may vary depending on specific implementation approaches, data quality, regulatory environments, and market conditions.