The intersection of artificial intelligence and microfinance represents one of the most promising developments in the quest for global financial inclusion, fundamentally transforming how financial services reach the world’s most underserved populations. This technological revolution has the potential to bridge the credit gap that affects billions of people worldwide, offering sophisticated yet accessible financial solutions that were previously impossible to deliver at scale to low-income communities, rural populations, and small business entrepreneurs in developing economies.

Stay updated with the latest AI financial innovations as the convergence of artificial intelligence and financial services continues to evolve rapidly, creating unprecedented opportunities for inclusive economic growth and poverty alleviation. The application of AI in microfinance extends far beyond simple automation, encompassing sophisticated risk assessment models, behavioral analysis, and personalized financial products that address the unique needs and circumstances of underserved populations.

The Global Financial Inclusion Challenge

The World Bank estimates that approximately 1.4 billion adults worldwide remain unbanked, lacking access to basic financial services that are fundamental to economic participation and prosperity. Traditional banking institutions have historically struggled to serve these populations due to several interconnected challenges including high operational costs, limited infrastructure, inadequate documentation, irregular income patterns, and the perceived risks associated with lending to individuals without conventional credit histories or collateral.

These barriers have created a persistent cycle of financial exclusion that perpetuates poverty and limits economic opportunities for millions of families and small businesses across developing nations. The conventional approach to credit assessment relies heavily on formal documentation, steady employment records, and established credit histories that are simply unavailable for the majority of the world’s poor population. This systemic exclusion has created an enormous untapped market for financial services while simultaneously denying crucial economic opportunities to those who need them most.

The microfinance industry emerged as a response to these challenges, pioneering innovative approaches to serve low-income populations through small loans, savings products, and other financial services. However, traditional microfinance institutions have faced their own limitations in terms of scalability, efficiency, and risk management, often struggling with high operational costs, limited reach, and difficulty in accurately assessing credit risk without conventional data sources.

AI-Powered Risk Assessment Revolution

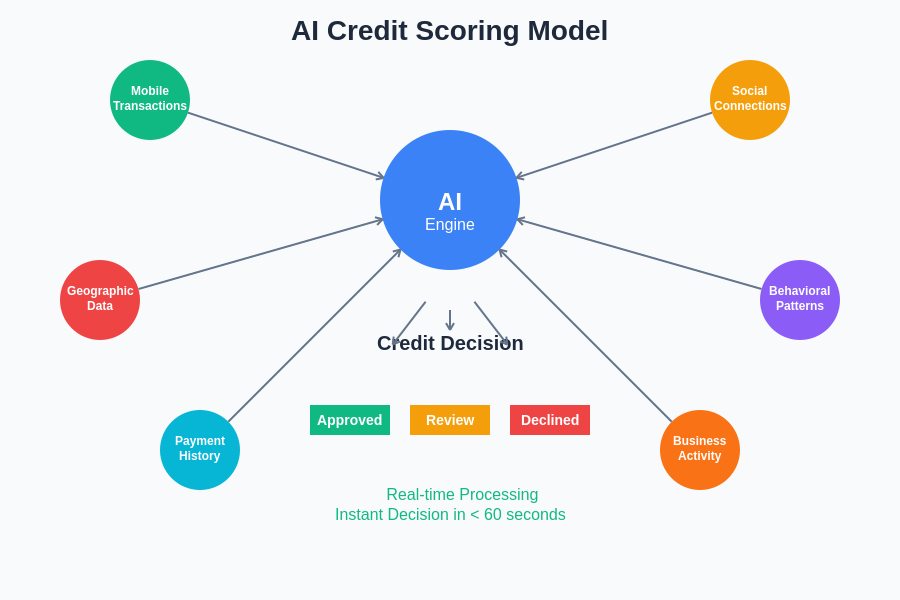

Artificial intelligence has fundamentally transformed the risk assessment landscape in microfinance by enabling the analysis of alternative data sources and non-traditional indicators of creditworthiness. Advanced machine learning algorithms can now process vast amounts of data from mobile phone usage patterns, social media activity, transaction histories, geographic information, and even satellite imagery to create comprehensive risk profiles for individuals who lack traditional credit documentation.

This revolutionary approach to credit scoring leverages behavioral patterns, spending habits, communication networks, and lifestyle indicators to assess creditworthiness with remarkable accuracy. AI models can identify subtle patterns in mobile money transactions, analyze the stability of social connections, evaluate spending consistency, and even incorporate environmental factors such as weather patterns and agricultural cycles that affect rural borrowers’ ability to repay loans.

Experience advanced AI capabilities with Claude for sophisticated data analysis and risk modeling that can process complex financial datasets and identify patterns invisible to traditional assessment methods. The sophistication of these AI systems enables microfinance institutions to make informed lending decisions based on comprehensive behavioral and contextual analysis rather than relying solely on income verification and collateral requirements.

Mobile Technology and Digital Financial Services

The proliferation of mobile technology across developing nations has created an unprecedented opportunity for AI-powered microfinance solutions to reach previously inaccessible populations. Mobile phones have become ubiquitous even in remote rural areas, providing a digital footprint that AI systems can analyze to assess creditworthiness and deliver financial services directly to users’ devices.

Mobile money platforms have become the foundation for innovative credit products that leverage transaction data, usage patterns, and behavioral indicators to make real-time lending decisions. AI algorithms can analyze factors such as transaction frequency, money transfer patterns, account balance stability, and social network connections to create dynamic risk assessments that evolve with each interaction and transaction.

This mobile-first approach has enabled the development of instant microcredit products that can approve and disburse loans within minutes based on automated AI analysis of mobile data patterns. The seamless integration of AI-powered risk assessment with mobile payment systems has created efficient, scalable platforms that can serve millions of customers with minimal infrastructure investment while maintaining robust risk management standards.

Alternative Data Sources and Credit Scoring

The innovation in alternative data utilization for credit scoring represents one of the most significant breakthroughs in AI-powered microfinance. Traditional credit bureaus and formal financial records are largely unavailable for underserved populations, necessitating creative approaches to assessing creditworthiness and repayment capacity that go far beyond conventional financial metrics.

AI systems now incorporate psychometric data, social network analysis, utility payment histories, educational backgrounds, employment patterns, and even smartphone app usage to build comprehensive borrower profiles. Machine learning algorithms can identify correlations between seemingly unrelated behaviors and credit performance, such as the relationship between mobile phone charging patterns and loan repayment reliability or the connection between social media activity and financial stability.

Geographic and environmental data play increasingly important roles in rural microfinance applications, where AI systems analyze satellite imagery, weather patterns, crop yield predictions, and market accessibility to assess agricultural borrowers’ repayment capacity. This environmental intelligence enables more accurate risk pricing and loan structuring that accounts for seasonal variations and climate-related risks that significantly impact rural borrowers’ financial circumstances.

The sophistication of modern AI credit scoring models extends beyond simple risk assessment to encompass predictive analytics that can anticipate borrowers’ future financial needs, identify optimal loan terms, and recommend personalized financial products that maximize both borrower success and lender profitability.

Operational Efficiency and Cost Reduction

Artificial intelligence has dramatically improved the operational efficiency of microfinance institutions by automating numerous manual processes that previously required significant human intervention and oversight. Automated loan processing, document verification, risk assessment, and portfolio management have reduced operational costs while improving accuracy and consistency in decision-making processes.

AI-powered chatbots and virtual assistants provide 24/7 customer support in local languages, handling routine inquiries, loan applications, and payment processing without requiring extensive call center infrastructure. Natural language processing capabilities enable these systems to understand and respond to customer queries in multiple dialects and languages, making financial services more accessible to diverse populations with varying levels of literacy and technological familiarity.

The automation of compliance monitoring, fraud detection, and portfolio risk management has enabled microfinance institutions to maintain robust oversight standards while scaling their operations to serve larger customer bases. Machine learning algorithms continuously monitor transaction patterns, identify suspicious activities, and flag potential compliance issues before they escalate into significant problems, reducing both regulatory risk and operational complexity.

Leverage Perplexity’s research capabilities for comprehensive market analysis and competitive intelligence that supports strategic decision-making in the rapidly evolving microfinance sector. The integration of AI-powered research tools with operational systems enables continuous improvement and adaptation to changing market conditions and regulatory requirements.

Personalized Financial Products and Services

The application of artificial intelligence in microfinance extends beyond credit assessment to encompass the development of personalized financial products that address the specific needs and circumstances of individual borrowers. AI algorithms analyze customer data to identify patterns in financial behavior, predict future needs, and recommend appropriate products and services that align with borrowers’ goals and capacity.

Dynamic loan structuring based on AI analysis enables microfinance institutions to offer flexible repayment schedules that accommodate seasonal income variations, irregular cash flows, and unexpected financial challenges that commonly affect low-income borrowers. Machine learning models can predict optimal loan amounts, terms, and repayment structures that maximize borrower success while maintaining acceptable risk levels for lenders.

AI-powered savings and insurance products provide additional financial security for underserved populations by automatically adjusting coverage levels, premium structures, and payout triggers based on individual risk profiles and behavioral patterns. These intelligent products can adapt to changing circumstances, provide timely financial protection, and encourage positive financial behaviors through personalized incentives and recommendations.

Fraud Detection and Security Enhancement

The implementation of sophisticated AI-powered fraud detection systems has significantly enhanced the security and integrity of microfinance operations while protecting both lenders and borrowers from fraudulent activities. Machine learning algorithms analyze transaction patterns, behavioral anomalies, and network connections to identify suspicious activities in real-time, preventing fraudulent loan applications and unauthorized access to financial services.

Advanced biometric authentication systems integrated with AI analysis provide secure, convenient access to financial services for populations that may lack traditional forms of identification. These systems can verify identity through multiple biometric factors while continuously learning and adapting to prevent spoofing and unauthorized access attempts.

The combination of behavioral analytics, device fingerprinting, and network analysis creates comprehensive security frameworks that protect against various forms of financial fraud while maintaining user-friendly interfaces that don’t create barriers to legitimate access. AI systems can distinguish between normal behavioral variations and suspicious activities, reducing false positives while maintaining high levels of security protection.

Impact on Financial Inclusion and Economic Development

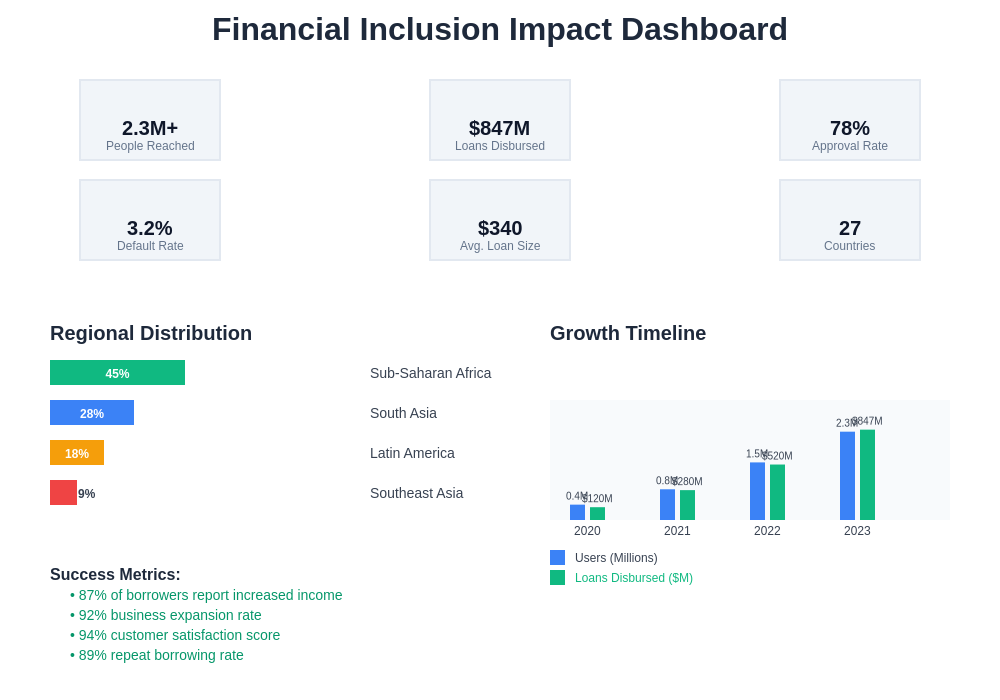

The transformative impact of AI-powered microfinance extends far beyond individual loan transactions to encompass broader economic development and poverty alleviation in underserved communities. Access to credit enables small business development, agricultural improvements, educational investments, and healthcare access that contribute to overall community prosperity and economic growth.

AI-enhanced microfinance has enabled the development of value chain financing that supports entire economic ecosystems by providing credit to farmers, suppliers, distributors, and retailers within interconnected business networks. Machine learning algorithms can analyze the relationships and dependencies within these value chains to optimize financing structures and support sustainable economic development.

The data insights generated through AI-powered microfinance operations provide valuable intelligence for policymakers, development organizations, and other stakeholders working to address poverty and promote economic inclusion. Aggregate anonymized data analysis reveals patterns in economic activity, identifies emerging opportunities and challenges, and supports evidence-based policy development that addresses the root causes of financial exclusion.

The measurable outcomes of AI-powered microfinance initiatives demonstrate significant improvements in borrower success rates, business growth, and overall financial wellness among previously underserved populations, validating the effectiveness of technology-driven approaches to financial inclusion.

Regulatory Considerations and Compliance

The integration of artificial intelligence in microfinance operations requires careful attention to regulatory compliance, consumer protection, and ethical considerations that ensure responsible lending practices and protect vulnerable populations from exploitation or discrimination. Regulatory frameworks are evolving to address the unique challenges and opportunities presented by AI-powered financial services while maintaining appropriate oversight and consumer safeguards.

Data privacy and protection regulations require microfinance institutions to implement robust safeguards for the collection, storage, and use of personal information while ensuring transparency in AI-driven decision-making processes. Compliance with local and international data protection standards necessitates sophisticated technical implementations that balance innovation with privacy protection and regulatory requirements.

Algorithmic fairness and bias prevention represent critical considerations in AI-powered credit scoring and financial services delivery. Machine learning models must be regularly audited and adjusted to prevent discrimination against protected classes and ensure equitable access to financial services across different demographic groups and geographic regions.

Challenges and Limitations

Despite the tremendous potential of AI-powered microfinance, several challenges and limitations must be addressed to ensure sustainable and responsible implementation. Digital literacy requirements, infrastructure limitations, and technology access barriers can create new forms of exclusion that may disadvantage certain populations even as overall access to financial services improves.

The complexity of AI systems can create opacity in decision-making processes that makes it difficult for borrowers to understand why their applications were approved or denied, potentially undermining trust and creating compliance challenges with regulations requiring explainable lending decisions. Balancing algorithmic sophistication with transparency and interpretability remains an ongoing challenge for AI-powered microfinance platforms.

Data quality and availability issues can limit the effectiveness of AI models, particularly in regions with limited digital infrastructure or populations with minimal digital footprints. Ensuring robust model performance across diverse contexts and populations requires ongoing investment in data collection, validation, and model refinement processes.

Future Innovations and Emerging Technologies

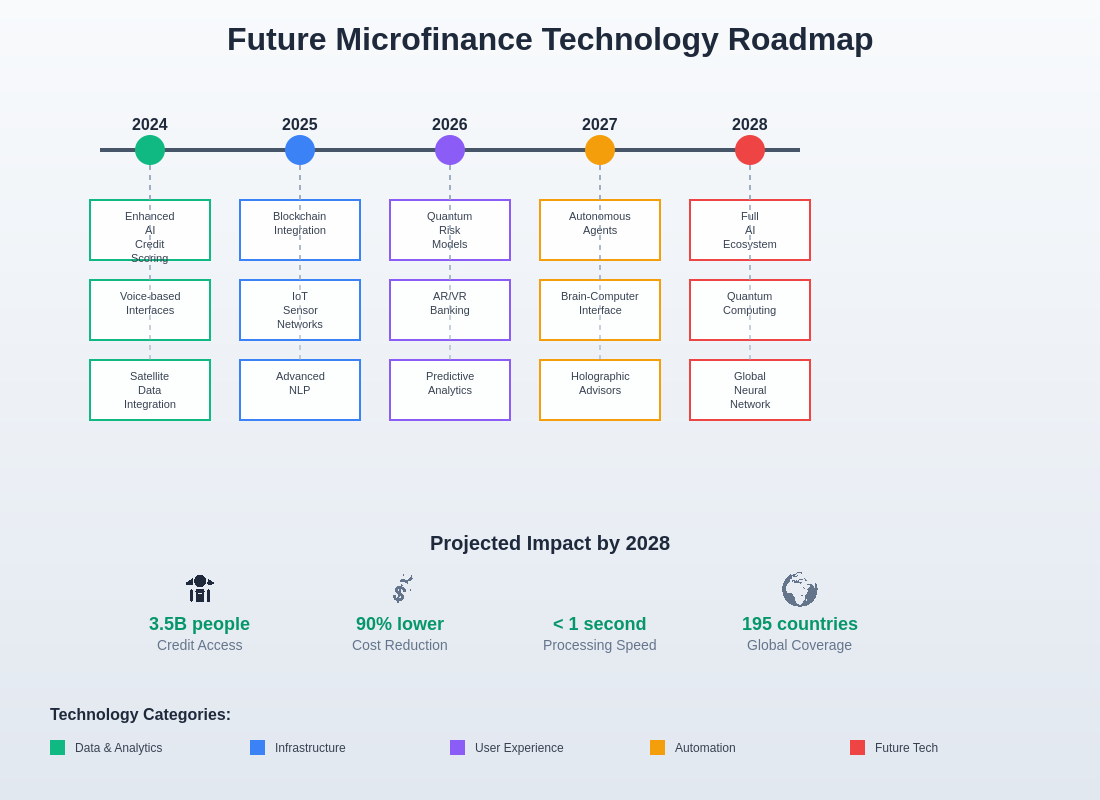

The future of AI-powered microfinance promises even more sophisticated applications including blockchain integration for transparent and secure transaction processing, Internet of Things sensors for real-time asset monitoring and collateral verification, and advanced natural language processing for multilingual customer service and financial education delivery.

Quantum computing applications may eventually enable even more complex risk modeling and portfolio optimization that can process vast amounts of data and identify subtle patterns that current systems cannot detect. These advanced computational capabilities could further improve risk assessment accuracy and enable new forms of financial products and services tailored to specific market segments and use cases.

The integration of AI with emerging technologies such as augmented reality, virtual reality, and advanced robotics may create new channels for financial service delivery and customer engagement that make sophisticated financial products accessible to populations with limited traditional banking infrastructure or financial literacy.

The convergence of multiple emerging technologies with AI-powered microfinance platforms promises to create unprecedented opportunities for financial inclusion and economic development while addressing the persistent challenges of poverty and inequality in developing economies.

Building Sustainable Microfinance Ecosystems

The successful implementation of AI-powered microfinance requires the development of comprehensive ecosystems that include technology providers, financial institutions, regulatory bodies, development organizations, and community partners working together to address the complex challenges of financial inclusion. These collaborative approaches ensure that technological innovations are implemented in ways that truly serve the needs of underserved populations while maintaining sustainable business models for service providers.

Capacity building and education initiatives are essential components of sustainable AI-powered microfinance ecosystems, ensuring that both service providers and borrowers have the knowledge and skills necessary to effectively utilize new technologies and financial products. Investment in local talent development, technology infrastructure, and regulatory frameworks creates the foundation for long-term success and continued innovation in financial inclusion.

The measurement and evaluation of impact outcomes provide crucial feedback for continuous improvement and refinement of AI-powered microfinance initiatives. Comprehensive data collection and analysis enable stakeholders to assess effectiveness, identify areas for improvement, and demonstrate the value of technology-driven approaches to financial inclusion for continued investment and support.

Conclusion

The integration of artificial intelligence with microfinance represents a transformative force in the global effort to achieve universal financial inclusion and economic empowerment for underserved populations. Through sophisticated risk assessment, operational efficiency improvements, personalized product development, and enhanced security measures, AI-powered microfinance platforms are creating unprecedented opportunities for economic participation and prosperity among the world’s poorest populations.

The continued evolution of AI technologies and their application to microfinance challenges promises to unlock even greater potential for positive impact while addressing the persistent barriers that have historically limited access to financial services for billions of people worldwide. Success in this endeavor requires ongoing collaboration between technology innovators, financial institutions, policymakers, and communities to ensure that these powerful tools are deployed in ways that truly serve the interests of those who need them most.

The future of microfinance lies in the intelligent combination of cutting-edge technology with deep understanding of local contexts, cultural considerations, and the complex needs of underserved populations, creating financial solutions that are both technologically sophisticated and genuinely accessible to those who have been excluded from traditional financial systems for far too long.

Disclaimer

This article is for informational purposes only and does not constitute financial or investment advice. The views expressed are based on current understanding of AI applications in microfinance and financial inclusion. Readers should conduct their own research and consult with qualified financial professionals before making investment decisions or implementing microfinance solutions. The effectiveness and risks of AI-powered microfinance may vary significantly across different markets, regulatory environments, and implementation contexts.