The digital payment landscape has experienced unprecedented growth in recent years, with global transaction volumes reaching trillions of dollars annually and continuing to expand at remarkable rates. However, this explosive growth has been accompanied by an equally dramatic increase in sophisticated fraud attempts, creating an arms race between cybercriminals and financial institutions. In this high-stakes environment, artificial intelligence has emerged as the most powerful weapon in the fight against payment fraud, revolutionizing how financial institutions detect, prevent, and respond to fraudulent activities across digital payment ecosystems.

Stay updated with the latest AI developments in financial security as the landscape continues to evolve at an unprecedented pace. The integration of advanced machine learning algorithms and neural networks into payment systems has created a new paradigm where fraud detection operates in real-time, analyzing millions of data points instantaneously to identify suspicious patterns and protect legitimate transactions while minimizing false positives that could disrupt customer experiences.

The Evolution of Digital Payment Fraud

The sophistication of modern payment fraud has evolved far beyond simple credit card theft or identity manipulation. Today’s cybercriminals employ advanced techniques including synthetic identity creation, account takeover attacks, transaction laundering schemes, and coordinated bot networks that can execute thousands of fraudulent attempts simultaneously across multiple platforms and geographic regions. Traditional rule-based fraud detection systems, which relied on static parameters and predetermined thresholds, have proven inadequate against these dynamic and constantly evolving threat vectors.

The emergence of real-time payment systems, mobile wallets, cryptocurrency transactions, and cross-border digital transfers has created additional complexity in the fraud prevention landscape. Each payment channel introduces unique vulnerabilities and attack vectors that require specialized detection mechanisms and response strategies. The challenge for financial institutions lies not only in detecting fraudulent transactions but in doing so without creating friction for legitimate customers who expect seamless, instantaneous payment experiences across all digital channels.

Artificial Intelligence: The Game Changer

Artificial intelligence has fundamentally transformed fraud prevention by introducing adaptive learning systems that continuously evolve their detection capabilities based on emerging fraud patterns and attack methodologies. Unlike traditional systems that operate on fixed rules and static parameters, AI-powered fraud prevention platforms utilize machine learning algorithms that analyze vast datasets to identify subtle correlations, anomalies, and behavioral patterns that might indicate fraudulent activity.

The power of AI in fraud prevention lies in its ability to process and analyze enormous volumes of transaction data in real-time while considering hundreds of variables simultaneously. These systems can evaluate user behavior patterns, device characteristics, geographic locations, transaction timing, merchant categories, and countless other data points to create comprehensive risk profiles for each transaction. This multidimensional analysis enables AI systems to detect sophisticated fraud attempts that would be virtually impossible for human analysts or traditional rule-based systems to identify.

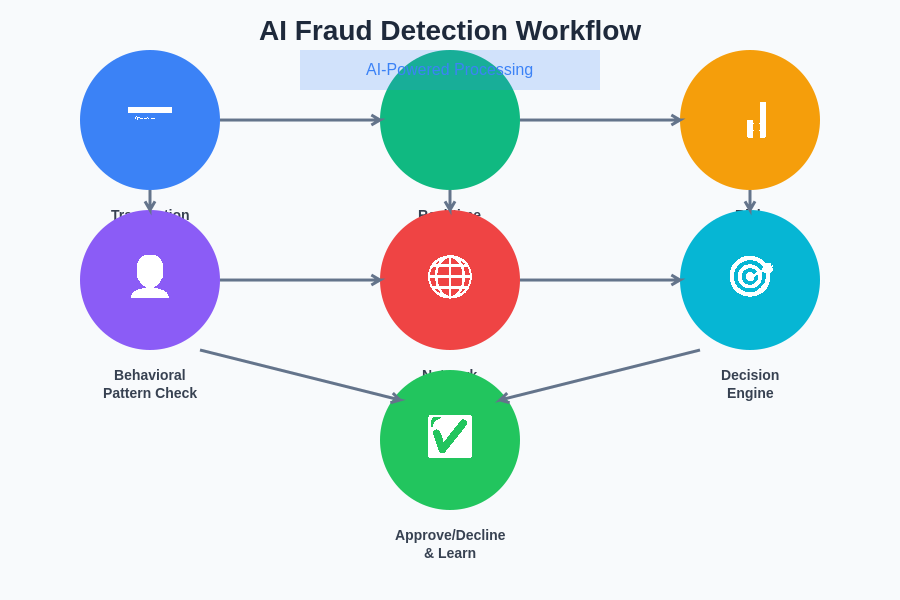

The sophisticated AI fraud detection workflow operates through multiple interconnected stages, each leveraging different machine learning techniques and data sources to build a comprehensive understanding of transaction legitimacy. This systematic approach ensures that every transaction is evaluated through multiple analytical lenses before final approval or rejection decisions are made.

Experience advanced AI capabilities with Claude to understand how machine learning algorithms can be applied to complex pattern recognition and anomaly detection challenges. The sophistication of modern AI fraud prevention systems extends beyond simple pattern matching to include predictive modeling, behavioral analysis, and adaptive learning mechanisms that improve detection accuracy over time while reducing false positive rates.

Machine Learning Algorithms in Action

The foundation of AI-powered fraud prevention rests on sophisticated machine learning algorithms that have been specifically designed and optimized for financial transaction analysis. Supervised learning models are trained on massive datasets containing millions of labeled transactions, enabling them to learn the characteristics that distinguish legitimate payments from fraudulent attempts. These models utilize techniques such as random forests, gradient boosting, and support vector machines to create highly accurate classification systems.

Unsupervised learning algorithms play an equally critical role by identifying previously unknown fraud patterns and emerging attack methodologies. These systems can detect anomalies in transaction data without prior knowledge of specific fraud types, making them particularly valuable for identifying novel attack vectors and zero-day fraud schemes. Clustering algorithms group similar transactions and identify outliers that may represent fraudulent activity, while association rule mining reveals hidden relationships between different transaction attributes that could indicate coordinated fraud attempts.

Deep learning neural networks have revolutionized fraud detection by enabling the analysis of complex, non-linear relationships within transaction data. Recurrent neural networks and long short-term memory networks are particularly effective at analyzing sequential transaction patterns and identifying temporal anomalies that might indicate account takeover or other sophisticated fraud schemes. Convolutional neural networks have been adapted for analyzing transaction networks and identifying patterns in payment flows that suggest money laundering or other financial crimes.

Real-Time Transaction Analysis

The effectiveness of AI fraud prevention systems depends heavily on their ability to analyze transactions in real-time, making accept or decline decisions within milliseconds while the customer is completing their purchase. This requires highly optimized algorithms and infrastructure capable of processing thousands of transactions per second while maintaining accuracy and minimizing latency. Modern AI fraud prevention platforms utilize edge computing, distributed processing, and advanced caching mechanisms to achieve the performance levels required for real-time operation.

Real-time analysis involves the immediate evaluation of incoming transactions against multiple AI models simultaneously, with each model focusing on different aspects of fraud detection. Velocity checks analyze transaction frequency and patterns, behavioral models evaluate user activity against historical baselines, and network analysis algorithms examine relationships between different entities in the payment ecosystem. The results from these various models are combined using ensemble methods to produce final risk scores and decision recommendations.

The challenge of real-time processing is compounded by the need to maintain consistent performance across varying transaction volumes and during peak usage periods. AI fraud prevention systems must be capable of scaling dynamically to handle traffic spikes while maintaining low latency and high accuracy. This requires sophisticated load balancing, auto-scaling capabilities, and optimized data pipeline architectures that can adapt to changing operational demands.

Behavioral Pattern Recognition

One of the most powerful capabilities of AI fraud prevention systems is their ability to establish and monitor individual user behavioral patterns, creating unique digital fingerprints that can detect when account credentials have been compromised or when legitimate users are engaging in unusual activities. Behavioral analysis encompasses numerous factors including typing patterns, mouse movements, device usage habits, transaction timing preferences, geographic locations, and spending categories.

Machine learning algorithms continuously update these behavioral profiles as users interact with payment systems, adapting to gradual changes in user habits while identifying sudden deviations that might indicate fraud. This dynamic profiling enables the detection of account takeover attacks even when fraudsters have obtained valid credentials, as their behavior patterns will typically differ from those of legitimate account holders. The system can identify subtle differences in how users navigate interfaces, input information, and complete transactions.

Behavioral pattern recognition extends beyond individual users to encompass merchant behavior, device characteristics, and network-level patterns. AI systems can identify merchants that exhibit suspicious transaction patterns, devices that are associated with multiple fraudulent attempts, and network addresses that are linked to coordinated fraud campaigns. This comprehensive behavioral analysis creates multiple layers of protection that make it extremely difficult for fraudsters to evade detection.

Enhance your research capabilities with Perplexity to stay informed about the latest developments in behavioral analysis and pattern recognition technologies. The integration of behavioral biometrics with traditional authentication methods creates a robust security framework that balances fraud prevention with user experience optimization.

Advanced Anomaly Detection Systems

Anomaly detection represents one of the most sophisticated applications of AI in fraud prevention, utilizing advanced statistical methods and machine learning algorithms to identify transactions that deviate significantly from established normal patterns. These systems operate by building comprehensive models of normal transaction behavior across multiple dimensions including amount ranges, frequency patterns, geographic distributions, merchant categories, and temporal characteristics.

The effectiveness of anomaly detection systems lies in their ability to adapt continuously to changing normal patterns while maintaining sensitivity to genuine anomalies that might indicate fraudulent activity. This requires sophisticated algorithms that can distinguish between natural variations in user behavior and suspicious deviations that warrant further investigation. Autoencoder neural networks are particularly effective for this purpose, as they can learn to reconstruct normal transaction patterns and identify inputs that cannot be accurately reconstructed.

Ensemble anomaly detection methods combine multiple different detection algorithms to improve overall accuracy and reduce false positive rates. These systems might simultaneously employ isolation forests, one-class support vector machines, and statistical outlier detection methods, using voting mechanisms or weighted scoring systems to produce final anomaly scores. The diversity of detection methods helps ensure that different types of fraud patterns can be identified even if they evade individual detection algorithms.

Network Analysis and Graph-Based Detection

Modern fraud prevention increasingly relies on network analysis and graph-based detection methods that examine relationships and connections between different entities in the payment ecosystem. These systems create comprehensive graphs that map relationships between users, merchants, devices, payment methods, and geographic locations, enabling the identification of fraud rings, money laundering networks, and coordinated attack campaigns.

Graph-based algorithms can identify suspicious patterns such as multiple accounts sharing common attributes, circular money movements, or unusual connection patterns between seemingly unrelated entities. Community detection algorithms can identify clusters of related accounts that might represent organized fraud operations, while centrality measures can identify key nodes in fraud networks that might represent money mules or compromised merchant accounts.

Machine learning algorithms specifically designed for graph data, such as graph neural networks and graph convolutional networks, can analyze complex network structures and identify patterns that traditional transaction-based analysis might miss. These systems can detect sophisticated fraud schemes that involve multiple coordinated accounts, layered transactions, and complex money movement patterns designed to evade traditional detection methods.

Predictive Analytics and Risk Scoring

AI fraud prevention systems utilize predictive analytics to forecast the likelihood of fraud for incoming transactions, assigning risk scores that enable intelligent decision-making about whether to approve, decline, or subject transactions to additional verification steps. These predictive models incorporate hundreds of features extracted from transaction data, user behavior, device characteristics, and external risk factors to produce highly accurate risk assessments.

The development of effective risk scoring models requires sophisticated feature engineering, where raw transaction data is transformed into meaningful variables that capture important aspects of fraud risk. This might include velocity features that measure transaction frequency over different time windows, behavioral deviation scores that quantify how much current activity differs from historical patterns, and network features that capture relationships to other entities in the payment ecosystem.

Risk scoring models must be continuously updated and retrained to maintain effectiveness against evolving fraud tactics. This requires automated model management pipelines that monitor model performance, detect concept drift, and trigger retraining when necessary. A/B testing frameworks enable the safe deployment of new models while measuring their impact on both fraud detection rates and customer experience metrics.

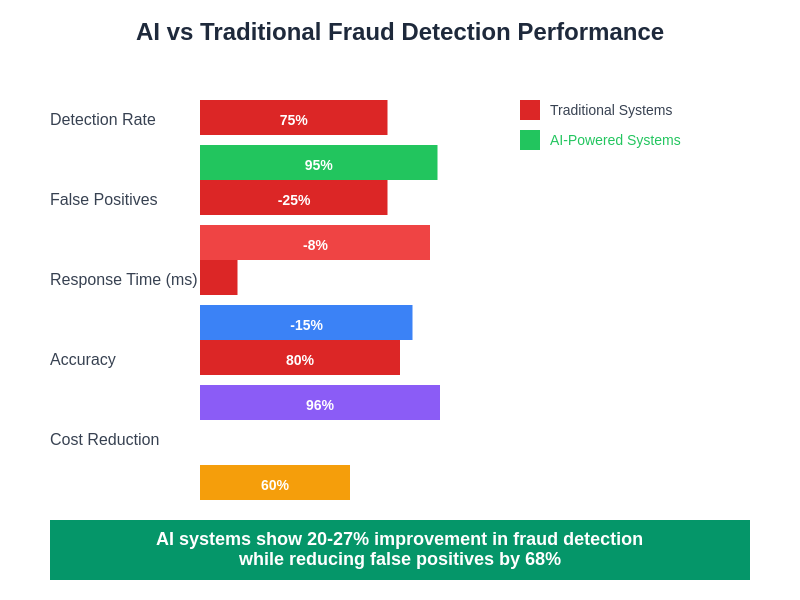

The quantitative benefits of AI-powered fraud detection systems are substantial when compared to traditional rule-based approaches. These improvements translate directly into reduced financial losses, enhanced customer satisfaction, and more efficient operational processes for financial institutions worldwide.

Multi-Modal Authentication and Verification

The integration of AI into payment systems has enabled sophisticated multi-modal authentication mechanisms that combine traditional password-based security with biometric verification, device fingerprinting, and behavioral analysis. These systems create multiple layers of authentication that are extremely difficult for fraudsters to compromise while remaining transparent and convenient for legitimate users.

Biometric authentication systems utilize machine learning algorithms to verify user identity based on unique physical characteristics such as fingerprints, facial features, voice patterns, or iris scans. These systems must account for natural variations in biometric data while maintaining high accuracy in distinguishing between legitimate users and impersonation attempts. Advanced algorithms can detect presentation attacks and other sophisticated biometric spoofing techniques.

Device fingerprinting technologies create unique identifiers for user devices based on hardware characteristics, software configurations, and usage patterns. AI algorithms analyze these device fingerprints to detect when fraudsters are attempting to use compromised devices or when legitimate devices are being used in suspicious contexts. The combination of device fingerprinting with behavioral analysis creates powerful authentication mechanisms that adapt to user patterns while detecting anomalous activities.

Fraud Prevention in Cryptocurrency Transactions

The emergence of cryptocurrency as a mainstream payment method has introduced new challenges and opportunities for AI-powered fraud prevention. Cryptocurrency transactions present unique characteristics such as irreversibility, pseudonymity, and global accessibility that require specialized detection techniques and prevention strategies. AI systems designed for cryptocurrency fraud prevention must analyze blockchain transaction patterns, wallet behaviors, and exchange activities to identify suspicious activities.

Blockchain analysis algorithms can trace the flow of cryptocurrencies through complex transaction networks, identifying patterns that might indicate money laundering, ransomware payments, or other criminal activities. Machine learning models trained on cryptocurrency transaction data can identify suspicious wallet addresses, detect mixing service usage, and flag transactions that deviate from normal cryptocurrency usage patterns.

The integration of cryptocurrency fraud prevention with traditional payment fraud detection creates comprehensive protection systems that can identify cross-platform fraud schemes and coordinated attacks that span multiple payment methods. These systems must account for the unique characteristics of different cryptocurrencies while maintaining compatibility with existing fraud prevention infrastructure.

The modern digital payment threat landscape presents a complex array of attack vectors that AI defense systems must continuously monitor and counter. From traditional card fraud to sophisticated synthetic identity schemes, AI-powered security systems provide comprehensive protection against the full spectrum of financial crimes.

Regulatory Compliance and AI Ethics

The implementation of AI fraud prevention systems must navigate complex regulatory requirements and ethical considerations while maintaining effectiveness in fraud detection. Regulatory frameworks such as PCI DSS, PSD2, and various national financial regulations impose specific requirements on how AI systems process payment data, make decisions about transactions, and maintain audit trails for regulatory review.

Explainable AI has become increasingly important in fraud prevention as financial institutions must be able to justify their decisions to regulators, customers, and internal stakeholders. This requires AI systems that can provide clear explanations for their risk assessments and decision-making processes, enabling human review and regulatory compliance. Advanced interpretability techniques help make complex machine learning models more transparent and accountable.

Bias detection and mitigation represent critical considerations in AI fraud prevention, as biased models could unfairly impact certain customer segments or geographic regions. Regular auditing of model performance across different demographic groups helps ensure that fraud prevention systems operate fairly and do not create discriminatory outcomes. Fairness-aware machine learning techniques can be employed to develop models that maintain effectiveness while minimizing bias.

Integration with Legacy Systems

The successful deployment of AI fraud prevention requires careful integration with existing payment processing infrastructure, legacy fraud detection systems, and operational workflows. This integration challenge involves connecting modern AI platforms with decades-old mainframe systems, ensuring data consistency across multiple platforms, and maintaining operational continuity during system upgrades and migrations.

API-based integration architectures enable AI fraud prevention systems to operate alongside existing systems, providing risk scores and recommendations that can be consumed by traditional decision engines and operational processes. This approach allows financial institutions to gradually adopt AI capabilities while leveraging existing investments in fraud prevention infrastructure.

Data integration presents particular challenges as AI systems require access to comprehensive, high-quality data from multiple sources including transaction systems, customer databases, external risk data providers, and fraud case management systems. Modern data integration platforms utilize real-time streaming technologies, advanced data transformation capabilities, and robust data quality management to ensure that AI systems have access to the information needed for effective fraud detection.

Performance Optimization and Scalability

The deployment of AI fraud prevention systems at enterprise scale requires sophisticated optimization techniques and scalable architectures capable of processing millions of transactions daily while maintaining sub-second response times. Performance optimization involves algorithm optimization, infrastructure scaling, data pipeline efficiency, and intelligent caching strategies that minimize computational overhead while maximizing detection accuracy.

Model optimization techniques such as quantization, pruning, and knowledge distillation can reduce the computational requirements of AI models without significantly impacting accuracy. These techniques are particularly important for real-time fraud detection where latency requirements are extremely strict and computational resources must be used efficiently.

Distributed computing architectures enable AI fraud prevention systems to scale horizontally across multiple servers and data centers, providing the processing capacity needed to handle peak transaction volumes. Container orchestration platforms and serverless computing technologies provide flexible scaling capabilities that can adapt to changing workload demands while optimizing resource utilization and operational costs.

Future Innovations and Emerging Technologies

The future of AI-powered fraud prevention will be shaped by emerging technologies including quantum computing, federated learning, advanced natural language processing, and next-generation biometric authentication methods. These technologies promise to enhance fraud detection capabilities while addressing current limitations in privacy, scalability, and detection accuracy.

Quantum computing could revolutionize fraud detection by enabling the analysis of vast datasets and complex optimization problems that are intractable for classical computers. Quantum machine learning algorithms could identify subtle patterns in transaction data that current systems cannot detect, while quantum cryptography could enhance the security of payment systems against future threats.

Federated learning technologies enable the development of fraud detection models that can learn from data across multiple financial institutions without compromising data privacy or competitive advantages. This collaborative approach could significantly improve fraud detection accuracy by leveraging larger, more diverse datasets while maintaining strict data protection requirements.

The convergence of AI fraud prevention with Internet of Things devices, 5G networks, and edge computing will create new opportunities for real-time fraud detection in mobile and embedded payment scenarios. These technologies will enable more sophisticated behavioral analysis and device authentication while reducing latency and improving user experiences.

The evolution of AI fraud prevention continues to accelerate as new threats emerge and technology capabilities advance. Financial institutions that invest in sophisticated AI fraud prevention capabilities will be best positioned to protect their customers and maintain competitive advantages in the rapidly evolving digital payment landscape. The future of digital commerce depends on the continued advancement of these critical security technologies.

Disclaimer

This article is for informational purposes only and does not constitute professional financial or security advice. The information presented reflects current understanding of AI fraud prevention technologies and may not apply to all situations or regulatory environments. Financial institutions should consult with qualified professionals and conduct thorough due diligence when implementing AI fraud prevention systems. The effectiveness of fraud prevention technologies may vary based on specific implementation details, data quality, and operational factors.