The real estate industry stands at the precipice of a technological revolution that promises to fundamentally transform how properties are valued, markets are analyzed, and investment decisions are made. Artificial intelligence has emerged as the driving force behind this transformation, offering unprecedented accuracy in property valuations, sophisticated market prediction capabilities, and data-driven insights that were previously impossible to obtain through traditional methods. This technological evolution is not merely an enhancement of existing processes but represents a complete reimagining of how real estate professionals, investors, and consumers interact with property markets.

Explore the latest AI innovations in real estate to stay informed about cutting-edge technologies that are reshaping property markets and investment strategies worldwide. The integration of artificial intelligence into real estate operations has created opportunities for more efficient transactions, accurate valuations, and strategic decision-making that extends far beyond what human analysis alone could achieve.

The Evolution of Property Valuation Technology

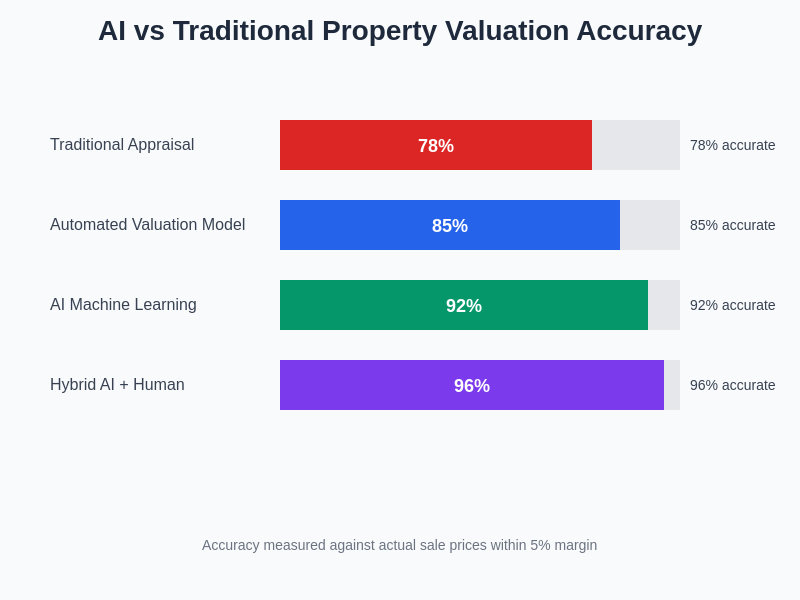

Traditional property valuation methods have long relied on comparative market analysis, human expertise, and subjective assessments that could vary significantly between appraisers. The introduction of artificial intelligence has revolutionized this fundamental aspect of real estate by introducing automated valuation models that can process vast amounts of data, identify complex patterns, and generate highly accurate property valuations in a fraction of the time required by conventional methods.

Modern AI-powered valuation systems leverage machine learning algorithms that continuously analyze millions of data points, including historical sales data, property characteristics, neighborhood trends, economic indicators, and even satellite imagery to determine property values with remarkable precision. These systems can account for subtle factors that human appraisers might overlook, such as proximity to transportation hubs, environmental conditions, zoning changes, and emerging neighborhood developments that influence property values.

The sophistication of these AI valuation models extends beyond simple comparative analysis to incorporate predictive elements that consider future market conditions, planned infrastructure developments, and demographic shifts that will impact property values over time. This forward-looking approach provides stakeholders with valuable insights that enable more informed decision-making and strategic planning.

Advanced Machine Learning in Market Analysis

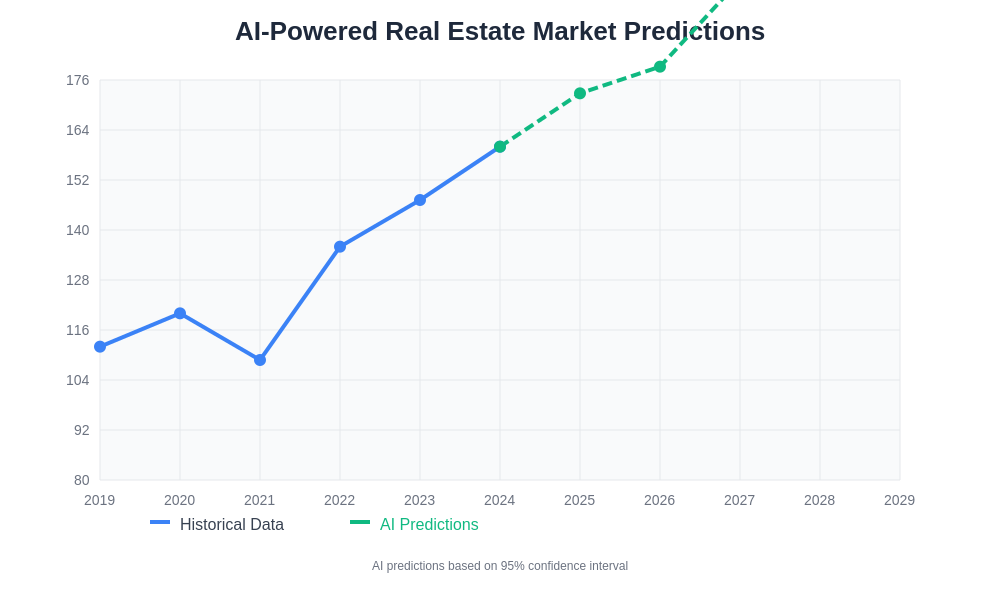

The application of machine learning algorithms to real estate market analysis has unlocked insights that were previously hidden within complex datasets. These sophisticated systems can identify emerging market trends, predict price movements, and analyze market cycles with a level of accuracy that surpasses traditional analytical methods. By processing information from diverse sources including economic indicators, demographic data, construction permits, and social media sentiment, AI systems create comprehensive market models that reflect the true complexity of real estate markets.

Machine learning models excel at recognizing patterns in historical data that correlate with future market movements, enabling real estate professionals to anticipate market shifts before they become apparent through conventional analysis. These predictive capabilities are particularly valuable for investors seeking to optimize their portfolios, developers planning new projects, and lenders assessing market risks.

Discover advanced AI capabilities with Claude for sophisticated analysis and decision-making support in real estate investments and market research. The combination of multiple AI technologies creates a comprehensive ecosystem that supports every aspect of real estate analysis from initial market research to final transaction completion.

Automated Property Assessment Systems

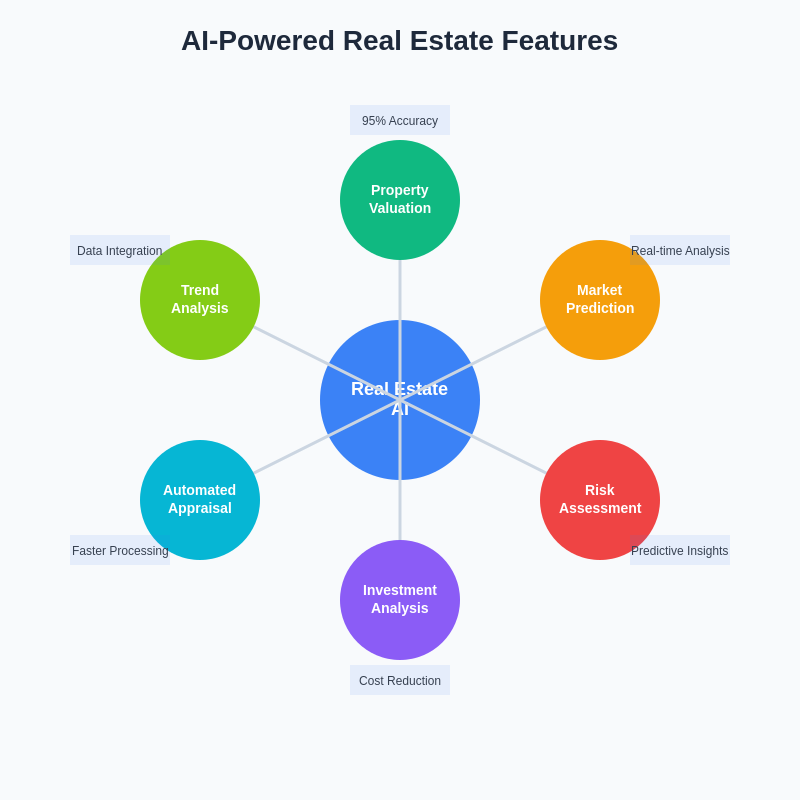

The development of automated property assessment systems represents one of the most significant advances in real estate technology. These systems combine computer vision, natural language processing, and machine learning to analyze property characteristics automatically from various data sources including listing photos, satellite imagery, public records, and property descriptions. The result is a comprehensive assessment that considers both quantitative and qualitative factors affecting property value.

Computer vision algorithms can analyze property photos to identify features such as architectural style, condition, upgrades, and amenities that impact value. These systems can detect subtle details that might be missed during traditional assessments, such as the quality of finishes, the presence of luxury features, or signs of deferred maintenance. Natural language processing capabilities enable the analysis of property descriptions and reviews to extract valuable insights about property characteristics and neighborhood desirability.

The integration of these technologies creates assessment systems that can evaluate properties consistently and objectively, reducing the potential for human bias and error while increasing the speed and scalability of property evaluations. This consistency is particularly valuable for large-scale assessments such as mortgage lending, insurance underwriting, and portfolio management.

The superior accuracy of AI-powered valuation systems becomes evident when compared to traditional appraisal methods, with hybrid approaches combining artificial intelligence and human expertise achieving the highest levels of precision in property valuation across diverse market conditions and property types.

Predictive Analytics for Investment Strategies

Artificial intelligence has transformed real estate investment strategy development by enabling sophisticated predictive analytics that can forecast market performance, identify emerging opportunities, and optimize portfolio allocation. These AI-powered systems analyze countless variables that influence real estate performance, including economic trends, demographic shifts, infrastructure development, and regulatory changes to generate investment recommendations based on quantitative analysis rather than intuition alone.

Predictive models can identify markets that are likely to experience appreciation, forecast rental income potential, and assess risk factors that might impact investment performance. This analytical capability enables investors to make data-driven decisions about property acquisitions, development projects, and portfolio diversification strategies that align with their specific investment objectives and risk tolerance.

The sophistication of these predictive systems extends to micro-market analysis, where AI can identify specific neighborhoods or even individual streets that offer superior investment potential based on factors such as planned infrastructure improvements, demographic trends, and economic development initiatives that may not be readily apparent through traditional market analysis.

Data Integration and Market Intelligence

The power of real estate AI lies not just in individual algorithms but in the comprehensive integration of diverse data sources that create a holistic view of property markets. Modern AI systems aggregate information from public records, MLS databases, satellite imagery, social media, economic indicators, and demographic data to create comprehensive market intelligence platforms that provide unprecedented insights into real estate dynamics.

This data integration capability enables the identification of correlations and patterns that would be impossible to detect through manual analysis. For example, AI systems can correlate foot traffic patterns with commercial property values, analyze social media sentiment to predict neighborhood desirability, or use satellite imagery to assess new construction activity that might impact local property values.

The real-time nature of this data integration allows for dynamic market analysis that adapts to changing conditions instantly, providing stakeholders with current information that reflects the latest market developments and emerging trends.

Advanced AI systems demonstrate remarkable capability in forecasting real estate market trends by analyzing historical patterns and current market indicators to generate accurate predictions that extend several years into the future with quantifiable confidence intervals.

Risk Assessment and Market Volatility Prediction

Risk assessment has been revolutionized through AI applications that can analyze complex risk factors and predict market volatility with greater accuracy than traditional methods. These systems consider a vast array of risk indicators including economic conditions, regulatory changes, environmental factors, and market sentiment to generate comprehensive risk profiles for individual properties and entire markets.

AI-powered risk assessment models can identify potential issues such as flood risks, earthquake hazards, crime trends, and economic vulnerabilities that might impact property values or investment returns. These predictive capabilities enable proactive risk management strategies that protect investments and optimize returns while minimizing exposure to adverse market conditions.

Enhance your research capabilities with Perplexity for comprehensive market analysis and due diligence in real estate investments. The combination of multiple AI tools creates a powerful research environment that supports thorough market analysis and informed decision-making.

Commercial Real Estate Applications

The commercial real estate sector has experienced particularly significant transformation through AI implementation, with applications ranging from lease analysis and tenant screening to market forecasting and asset management. AI systems can analyze lease agreements to identify optimal rental rates, predict tenant behavior, and optimize space utilization to maximize revenue potential.

Commercial property valuation has been enhanced through AI systems that can analyze complex factors such as cash flow patterns, tenant creditworthiness, market comparables, and future income potential to generate accurate valuations for office buildings, retail centers, industrial properties, and mixed-use developments. These valuations consider sophisticated financial models that account for varying lease terms, tenant improvements, and market conditions.

AI applications in commercial real estate extend to property management optimization, where systems can predict maintenance needs, optimize energy consumption, and enhance tenant satisfaction through data-driven insights that improve operational efficiency and profitability.

Residential Market Transformation

The residential real estate market has been transformed through AI applications that enhance every aspect of the home buying and selling process. From initial property search and valuation to mortgage underwriting and closing procedures, artificial intelligence has streamlined operations while improving accuracy and customer experience.

AI-powered home valuation models provide instant property valuations that consider neighborhood trends, comparable sales, property characteristics, and market conditions to generate accurate estimates that help buyers, sellers, and lenders make informed decisions. These systems can also predict future value appreciation potential based on planned developments, infrastructure improvements, and demographic trends.

The integration of AI into residential real estate platforms has created personalized property recommendation systems that can match buyers with suitable properties based on their preferences, financial capacity, and lifestyle requirements while considering factors such as commute times, school districts, and neighborhood amenities.

Market Trend Analysis and Forecasting

Advanced AI systems have revolutionized market trend analysis by processing vast amounts of real-time data to identify emerging patterns and forecast future market movements. These systems can analyze seasonal trends, economic cycles, and local market dynamics to provide accurate predictions about price movements, inventory levels, and market activity.

The forecasting capabilities of AI systems extend beyond simple price predictions to encompass comprehensive market analysis that considers supply and demand dynamics, construction activity, demographic shifts, and economic indicators that influence real estate markets. This comprehensive approach provides stakeholders with detailed insights that support strategic planning and investment decision-making.

AI-powered trend analysis can identify emerging markets, predict gentrification patterns, and forecast the impact of infrastructure developments on local property values, enabling proactive investment strategies and development planning that capitalize on future opportunities.

Integration with PropTech Ecosystems

The integration of AI technologies with broader PropTech ecosystems has created comprehensive platforms that support every aspect of real estate operations from property discovery and valuation to transaction completion and ongoing management. These integrated systems provide seamless workflows that eliminate friction in real estate transactions while improving accuracy and efficiency.

PropTech platforms enhanced with AI capabilities offer features such as virtual property tours, automated document processing, intelligent matching algorithms, and predictive analytics that transform the real estate experience for all participants. These platforms can streamline complex processes such as property due diligence, financing approval, and closing procedures through automation and intelligent analysis.

The ecosystem approach enables continuous learning and improvement as AI systems process more transactions and gather additional data, creating increasingly sophisticated and accurate tools that benefit from network effects and shared intelligence.

The comprehensive nature of AI implementation in real estate encompasses multiple interconnected capabilities that work together to provide property valuation, market prediction, risk assessment, investment analysis, automated appraisal, and trend analysis with unprecedented accuracy and efficiency.

Regulatory Considerations and Compliance

The implementation of AI in real estate must navigate complex regulatory environments that vary by jurisdiction and property type. AI systems must be designed to comply with fair housing laws, lending regulations, and privacy requirements while maintaining transparency in decision-making processes that affect property valuations and lending decisions.

Regulatory compliance in AI-powered real estate applications requires careful attention to algorithmic bias, data privacy, and decision transparency to ensure that AI systems do not perpetuate discrimination or violate consumer protection laws. This compliance framework must evolve alongside AI technology advancement to address emerging challenges and regulatory requirements.

The development of ethical AI frameworks for real estate applications ensures that technological advancement serves the public interest while protecting consumer rights and promoting fair access to housing and lending opportunities.

Future Developments and Market Evolution

The future of real estate AI promises even more sophisticated applications including augmented reality property viewing, blockchain integration for transparent transactions, and Internet of Things connectivity for smart building management. These emerging technologies will create new opportunities for market analysis, property management, and investment optimization that extend far beyond current capabilities.

Advanced AI development in real estate will likely focus on hyper-personalization of property recommendations, real-time market adjustment capabilities, and integrated ecosystem approaches that connect all aspects of real estate operations through intelligent automation and analysis.

The continued evolution of real estate AI will democratize access to sophisticated analysis tools and investment strategies while creating new opportunities for innovation and efficiency in property markets worldwide.

Industry Impact and Transformation

The transformation of the real estate industry through AI adoption extends beyond technological enhancement to fundamental changes in how markets operate, how decisions are made, and how value is created and distributed. This transformation creates opportunities for more efficient markets, better-informed participants, and improved outcomes for buyers, sellers, investors, and communities.

The long-term impact of AI in real estate will likely include more accurate pricing, reduced transaction costs, improved market liquidity, and enhanced access to real estate investment opportunities through democratized analysis tools and automated processes that remove traditional barriers to market participation.

The industry transformation driven by AI represents not just technological progress but a fundamental shift toward data-driven decision-making that improves outcomes for all market participants while creating more efficient and transparent real estate markets.

Disclaimer

This article is for informational purposes only and does not constitute professional real estate, investment, or financial advice. The views expressed are based on current understanding of AI technologies and their applications in real estate markets. Readers should conduct their own research and consult with qualified professionals before making real estate investment decisions. The effectiveness and accuracy of AI-powered real estate tools may vary depending on specific use cases, market conditions, and implementation approaches.