The financial services industry stands at the precipice of a regulatory revolution, where artificial intelligence has emerged as the cornerstone of modern compliance frameworks. RegTech AI represents a paradigm shift from traditional manual compliance processes to sophisticated automated systems that can navigate the complex labyrinth of financial regulations with unprecedented accuracy and efficiency. This technological transformation is not merely an upgrade to existing systems but a fundamental reimagining of how financial institutions approach regulatory compliance, risk management, and operational oversight in an increasingly complex global financial landscape.

Explore the latest AI developments transforming finance to understand how cutting-edge technologies are reshaping regulatory compliance and risk management across the financial sector. The integration of artificial intelligence into regulatory technology has created opportunities for financial institutions to achieve compliance excellence while simultaneously reducing operational costs and improving customer experiences through streamlined processes and enhanced security measures.

The Evolution of Regulatory Compliance

The journey from traditional compliance methodologies to AI-powered RegTech solutions represents one of the most significant transformations in financial services history. Traditional compliance frameworks relied heavily on manual processes, periodic audits, and reactive approaches to regulatory changes, creating environments where human error could lead to substantial financial penalties and reputational damage. The complexity of modern financial regulations, spanning multiple jurisdictions and covering diverse areas from anti-money laundering to data privacy, has made manual compliance management increasingly untenable for institutions operating at scale.

RegTech AI has emerged as the solution to these challenges by providing continuous monitoring capabilities, real-time risk assessment, and automated reporting mechanisms that ensure consistent compliance across all operational areas. The technology leverages machine learning algorithms to analyze vast datasets, identify patterns indicative of regulatory violations, and implement corrective measures before issues escalate into compliance breaches. This proactive approach to compliance management has transformed financial institutions from reactive entities constantly playing catch-up with regulatory requirements to proactive organizations that can anticipate and address compliance challenges before they materialize.

Transformative Applications in Anti-Money Laundering

Anti-money laundering represents one of the most successful applications of RegTech AI, where traditional rule-based systems have been enhanced with machine learning capabilities that can detect sophisticated money laundering schemes with remarkable precision. Traditional AML systems generated excessive false positives, requiring substantial human resources to investigate alerts that were often benign transactions. AI-powered AML solutions have revolutionized this process by implementing advanced pattern recognition algorithms that can distinguish between legitimate complex transactions and suspicious activities that warrant investigation.

The sophisticated nature of modern money laundering schemes, which often involve multiple jurisdictions, complex transaction structures, and subtle behavioral patterns, requires the analytical capabilities that only AI can provide. Machine learning models can process millions of transactions simultaneously, identifying anomalies in customer behavior, unusual transaction patterns, and suspicious network relationships that would be impossible for human analysts to detect manually. These systems continuously learn from new data, improving their detection capabilities and adapting to emerging money laundering techniques without requiring extensive reprogramming or rule updates.

Enhance your AI capabilities with Claude for advanced analysis and pattern recognition tasks that support comprehensive compliance monitoring and regulatory reporting across complex financial environments. The integration of multiple AI technologies creates robust compliance ecosystems that can handle the multifaceted nature of modern financial crime prevention while maintaining operational efficiency and customer satisfaction.

Know Your Customer Enhancement Through AI

Know Your Customer procedures have been fundamentally transformed through AI implementation, evolving from static document verification processes to dynamic, continuous customer monitoring systems that provide real-time risk assessments throughout the customer relationship lifecycle. Traditional KYC processes required customers to submit extensive documentation during onboarding, with periodic reviews that often failed to capture changes in risk profiles or emerging compliance concerns. AI-powered KYC systems have revolutionized this approach by implementing continuous monitoring capabilities that assess customer risk in real-time based on transaction patterns, behavioral analytics, and external data sources.

The enhancement of KYC through AI extends beyond simple identity verification to include sophisticated risk scoring algorithms that can evaluate customer relationships, assess beneficial ownership structures, and identify potential politically exposed persons or sanctioned entities. Natural language processing capabilities enable these systems to analyze unstructured data from news sources, regulatory publications, and social media to identify emerging risks associated with customers or their business relationships. This comprehensive approach to customer due diligence ensures that financial institutions maintain accurate risk assessments while reducing the burden on customers and improving the overall experience of financial services.

Real-Time Transaction Monitoring Revolution

Transaction monitoring has experienced a complete transformation through AI implementation, moving from batch processing systems that analyzed transactions hours or days after completion to real-time monitoring platforms that can assess transaction risk instantaneously. Traditional transaction monitoring systems relied on predetermined rules and thresholds that generated numerous false positives while potentially missing sophisticated schemes that operated within normal parameters. AI-powered transaction monitoring systems leverage machine learning algorithms that can analyze transaction patterns in real-time, considering multiple variables simultaneously to provide accurate risk assessments without generating excessive alerts.

The real-time nature of AI transaction monitoring enables financial institutions to implement immediate risk mitigation measures, such as transaction holds or enhanced verification procedures, before potentially suspicious transactions are completed. This proactive approach significantly reduces the risk of facilitating financial crimes while minimizing disruption to legitimate customer activities. Advanced analytics capabilities allow these systems to consider contextual factors such as customer history, geographic risk factors, and industry-specific patterns when evaluating transaction risk, resulting in more accurate risk assessments and reduced operational overhead from false positive investigations.

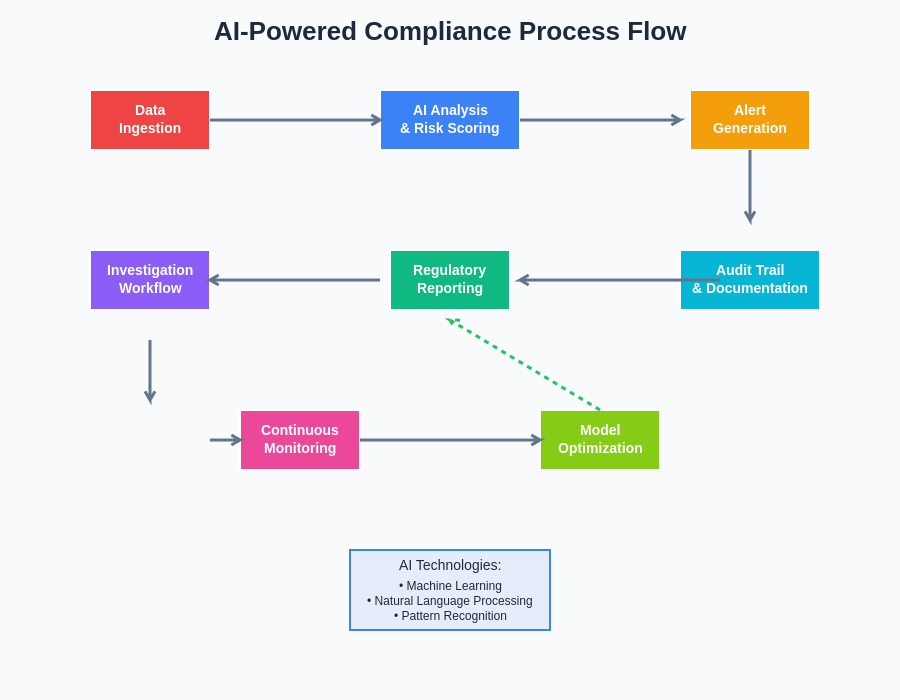

The comprehensive integration of artificial intelligence throughout the compliance process creates a seamless workflow that enhances every aspect of regulatory oversight. From initial data ingestion through final regulatory reporting, AI technologies ensure continuous monitoring and optimization of compliance operations while maintaining audit trails and documentation standards required by regulatory authorities.

Regulatory Reporting Automation

Regulatory reporting represents one of the most resource-intensive aspects of financial compliance, requiring institutions to compile vast amounts of data into specific formats for submission to multiple regulatory authorities across different jurisdictions. AI has revolutionized regulatory reporting by automating data collection, validation, and formatting processes that previously required extensive manual intervention and were prone to human error. Automated reporting systems can extract relevant information from multiple source systems, perform data quality checks, and generate reports in the specific formats required by different regulatory authorities.

The sophistication of AI-powered reporting systems extends beyond simple data compilation to include intelligent data interpretation and regulatory change management. These systems can monitor regulatory publications for reporting requirement changes, automatically update reporting templates, and ensure that institutions remain compliant with evolving regulatory expectations without requiring extensive manual intervention. Natural language processing capabilities enable these systems to interpret regulatory guidance documents and implement necessary changes to reporting procedures, ensuring that institutions maintain compliance even as regulatory requirements continue to evolve.

Risk Assessment and Predictive Analytics

The integration of predictive analytics into compliance frameworks represents a fundamental shift from reactive compliance management to proactive risk prevention strategies. Traditional risk assessment methodologies relied on historical data and periodic reviews that often failed to identify emerging risks or predict future compliance challenges. AI-powered risk assessment systems leverage predictive modeling techniques that can analyze historical patterns, current trends, and external factors to forecast potential compliance risks and recommend preventive measures.

These predictive capabilities enable financial institutions to allocate compliance resources more effectively by focusing attention on areas of highest risk while reducing monitoring intensity for lower-risk activities. Machine learning algorithms can identify subtle patterns that indicate emerging compliance risks, such as changes in customer behavior that might suggest increased money laundering risk or transaction patterns that could indicate market manipulation. The ability to predict and prevent compliance issues before they occur represents a significant advancement in risk management capabilities and demonstrates the transformative potential of AI in regulatory compliance.

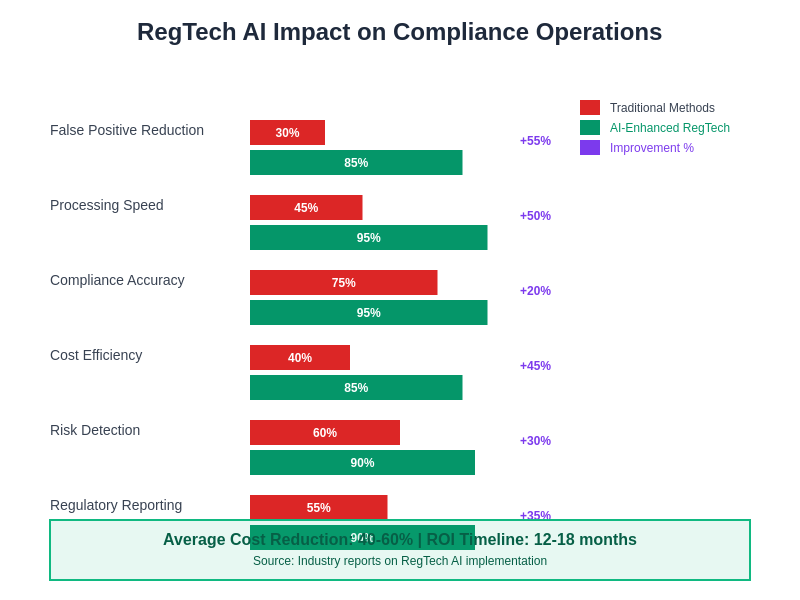

The quantitative benefits of implementing RegTech AI solutions demonstrate substantial improvements across all critical compliance metrics. Financial institutions utilizing AI-powered compliance systems consistently achieve significant reductions in false positives, enhanced processing speeds, improved accuracy rates, and substantial cost efficiencies compared to traditional manual and rule-based approaches.

Leverage advanced research capabilities with Perplexity to stay informed about evolving regulatory requirements and emerging compliance technologies that impact financial services operations. The combination of multiple AI tools creates comprehensive compliance ecosystems that can adapt to changing regulatory landscapes while maintaining operational efficiency and effectiveness.

Cybersecurity Integration and Data Protection

The intersection of RegTech AI with cybersecurity represents a critical evolution in financial services protection, where compliance requirements increasingly focus on data protection, cyber resilience, and digital operational risk management. AI-powered cybersecurity systems integrate seamlessly with compliance frameworks to provide comprehensive protection against cyber threats while ensuring adherence to data protection regulations such as GDPR, CCPA, and sector-specific requirements like PCI DSS. These integrated systems can monitor network activity, identify potential security breaches, and implement automated response procedures that maintain compliance with incident reporting requirements.

The sophistication of AI cybersecurity integration extends to behavioral analytics that can identify insider threats, unauthorized access attempts, and data exfiltration activities that might indicate compliance violations or security breaches. Machine learning algorithms analyze user behavior patterns, access logs, and data flow patterns to identify anomalies that warrant investigation, ensuring that financial institutions maintain robust security postures while meeting regulatory expectations for data protection and operational resilience.

Operational Risk Management Enhancement

Operational risk management has been significantly enhanced through AI implementation, enabling financial institutions to identify, assess, and mitigate operational risks with unprecedented accuracy and efficiency. Traditional operational risk management relied on manual reporting systems, periodic assessments, and reactive approaches to risk identification that often failed to capture emerging risks or provide timely intervention capabilities. AI-powered operational risk management systems can analyze vast amounts of operational data to identify patterns indicative of emerging risks, predict potential operational failures, and recommend preventive measures.

The comprehensive nature of AI operational risk management extends beyond simple risk identification to include sophisticated modeling capabilities that can assess the potential impact of operational risks on business operations, financial performance, and regulatory compliance. These systems can simulate various risk scenarios, evaluate the effectiveness of different mitigation strategies, and provide data-driven recommendations for risk management decisions. The integration of operational risk management with compliance monitoring ensures that institutions maintain comprehensive oversight of all risk factors that could impact regulatory compliance or business operations.

Market Surveillance and Trade Monitoring

Market surveillance represents a critical application of RegTech AI, where sophisticated algorithms monitor trading activities to detect market manipulation, insider trading, and other prohibited market behaviors. Traditional market surveillance systems relied on predetermined rules and manual investigation processes that often failed to detect sophisticated manipulation schemes or generated excessive false positives that consumed substantial investigation resources. AI-powered market surveillance systems leverage machine learning algorithms that can analyze trading patterns, price movements, and market data to identify suspicious activities with high accuracy.

The advanced capabilities of AI market surveillance extend to cross-market monitoring that can identify manipulation schemes spanning multiple trading venues, asset classes, or time periods. Natural language processing capabilities enable these systems to analyze news sources, social media content, and corporate communications to identify potential market moving information that could indicate insider trading or market manipulation. The real-time nature of AI surveillance systems enables immediate investigation and potential intervention to prevent market abuse while maintaining market integrity and investor confidence.

Stress Testing and Scenario Analysis

Stress testing and scenario analysis have been revolutionized through AI implementation, enabling financial institutions to conduct more comprehensive and accurate assessments of their resilience under adverse conditions. Traditional stress testing methodologies relied on historical scenarios and simplified modeling approaches that often failed to capture the complexity of modern financial markets or the interconnected nature of contemporary risks. AI-powered stress testing systems can generate dynamic scenarios that incorporate multiple risk factors, model complex interactions between different risk types, and provide more accurate assessments of institutional resilience.

The sophistication of AI stress testing extends to the ability to conduct continuous stress testing that adapts to changing market conditions, emerging risks, and evolving business models. Machine learning algorithms can identify emerging risk patterns, generate relevant stress scenarios, and assess the potential impact of these scenarios on institutional stability and regulatory compliance. This continuous approach to stress testing enables institutions to maintain current assessments of their risk exposure and implement timely risk mitigation measures when necessary.

Regulatory Change Management

The management of regulatory changes represents one of the most challenging aspects of financial compliance, requiring institutions to monitor regulatory developments across multiple jurisdictions, assess the impact of regulatory changes on business operations, and implement necessary modifications to policies, procedures, and systems. AI has transformed regulatory change management by automating the monitoring of regulatory publications, analyzing the potential impact of regulatory changes, and implementing automated compliance updates where appropriate.

AI-powered regulatory change management systems leverage natural language processing to analyze regulatory documents, identify relevant changes, and assess their impact on specific business activities or compliance requirements. These systems can prioritize regulatory changes based on their potential impact, generate implementation timelines, and track compliance with new regulatory requirements. The automation of regulatory change management reduces the risk of missed regulatory updates while ensuring that institutions can respond promptly to changing compliance requirements.

Customer Experience and Compliance Balance

The balance between compliance requirements and customer experience represents a critical challenge for financial institutions, where excessive compliance procedures can create friction that drives customers to competitors while insufficient compliance measures can result in regulatory penalties and reputational damage. AI has enabled institutions to achieve optimal balance by implementing intelligent compliance systems that can assess risk in real-time and apply appropriate compliance measures based on specific risk factors and customer profiles.

Dynamic compliance systems powered by AI can adjust verification requirements, monitoring intensity, and approval processes based on real-time risk assessments, ensuring that high-risk activities receive appropriate scrutiny while low-risk transactions proceed with minimal friction. This risk-based approach to compliance enables institutions to maintain robust compliance frameworks while providing superior customer experiences that support business growth and customer satisfaction.

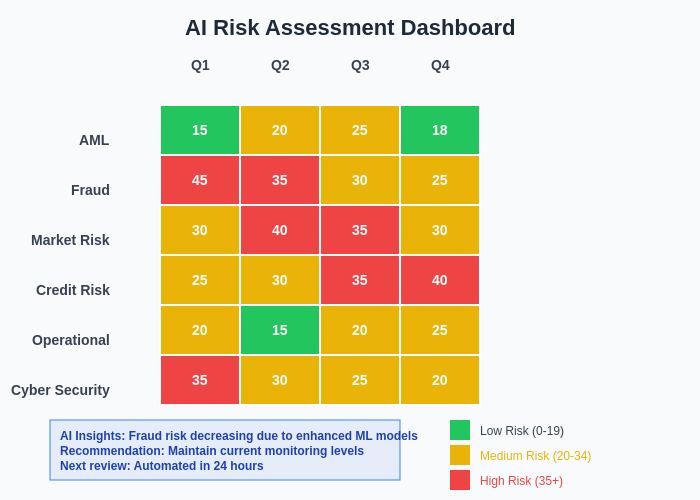

The implementation of AI-powered risk assessment dashboards provides real-time visibility into compliance risk levels across multiple categories and time periods. These sophisticated monitoring systems enable compliance teams to identify emerging risk patterns, track risk trends over time, and implement targeted interventions based on comprehensive data analysis and predictive modeling capabilities.

Future Evolution of RegTech AI

The future evolution of RegTech AI promises even more sophisticated capabilities that will further transform financial compliance through advanced technologies such as quantum computing, blockchain integration, and enhanced artificial intelligence models. Quantum computing capabilities could enable instantaneous analysis of massive datasets that currently require substantial processing time, while blockchain integration could provide immutable audit trails and automated compliance verification through smart contracts.

The continued advancement of AI models will likely result in more sophisticated predictive capabilities, enhanced natural language processing, and improved integration between different compliance functions. The development of explainable AI will address current concerns about algorithmic transparency, enabling institutions to understand and explain AI-driven compliance decisions to regulators and stakeholders. These technological advancements will continue to enhance the effectiveness of compliance programs while reducing operational costs and improving risk management capabilities.

The transformation of financial compliance through RegTech AI represents a fundamental shift toward more effective, efficient, and comprehensive regulatory compliance frameworks. As technology continues to evolve, financial institutions that embrace AI-powered compliance solutions will be better positioned to navigate the complex regulatory landscape while maintaining competitive advantages through improved operational efficiency and enhanced risk management capabilities. The future of financial compliance lies in the intelligent integration of human expertise with advanced AI capabilities that can adapt to changing regulatory requirements while maintaining the highest standards of compliance excellence.

Disclaimer

This article is for informational purposes only and does not constitute legal, financial, or professional advice. The views expressed are based on current understanding of RegTech AI applications and should not be considered as recommendations for specific compliance strategies or technology implementations. Financial institutions should consult with qualified legal and compliance professionals before implementing AI-powered compliance solutions. Regulatory requirements vary by jurisdiction and institution type, and compliance strategies should be tailored to specific operational requirements and risk profiles.