The financial technology revolution has fundamentally transformed how individuals approach investing and wealth management, with artificial intelligence-powered robo-advisors leading this transformation. Among the most prominent players in this space, Betterment and Wealthfront have emerged as industry leaders, each offering sophisticated AI-driven investment platforms that democratize access to professional-grade portfolio management previously available only to high-net-worth individuals through traditional financial advisors.

Explore the latest AI trends in financial technology to understand how artificial intelligence continues to reshape investment strategies and portfolio optimization techniques. The emergence of robo-advisors represents a paradigm shift from traditional investment advisory services toward algorithm-driven, data-centric approaches that leverage machine learning and advanced analytics to deliver personalized investment solutions at scale.

The Evolution of AI-Powered Investment Management

The robo-advisor industry has experienced explosive growth over the past decade, with Betterment and Wealthfront pioneering the use of artificial intelligence in retail investment management. These platforms have revolutionized the investment landscape by combining sophisticated algorithmic trading strategies, tax optimization techniques, and behavioral finance principles to create comprehensive wealth management solutions that adapt to individual investor profiles and market conditions.

Both platforms utilize advanced machine learning algorithms to analyze vast amounts of market data, economic indicators, and individual investor behavior patterns to make real-time portfolio adjustments and optimization decisions. This AI-driven approach enables continuous portfolio rebalancing, tax-loss harvesting, and risk management without requiring active intervention from investors, making professional-grade investment management accessible to individuals regardless of their investment knowledge or portfolio size.

The sophistication of these AI systems extends beyond simple portfolio allocation to encompass comprehensive financial planning capabilities, including goal-based investing, retirement planning, and dynamic risk assessment that adapts to changing life circumstances and market conditions. This holistic approach to wealth management represents a significant advancement over traditional investment platforms that relied primarily on static asset allocation models and periodic manual rebalancing.

Betterment: Comprehensive AI-Driven Financial Wellness

Betterment has established itself as a pioneer in the robo-advisor space by developing a comprehensive platform that integrates artificial intelligence across every aspect of the investment experience. The platform’s core AI engine analyzes individual investor profiles, risk tolerance, and financial goals to create personalized investment strategies that automatically adjust based on market conditions and changing life circumstances.

The platform’s artificial intelligence capabilities extend to sophisticated tax optimization strategies, including automated tax-loss harvesting that identifies opportunities to realize losses for tax benefits while maintaining desired portfolio allocation. This AI-driven tax optimization can significantly enhance after-tax returns over time, particularly for investors in higher tax brackets who benefit most from strategic tax management.

Betterment’s goal-based investing approach leverages machine learning algorithms to optimize portfolio allocation based on specific financial objectives, time horizons, and risk preferences. The platform can simultaneously manage multiple investment goals with different risk profiles and time horizons, automatically adjusting allocation strategies as goals approach their target dates or as market conditions change.

Experience advanced AI capabilities with Claude for comprehensive analysis and decision-making support in financial planning and investment strategy development. The integration of artificial intelligence into financial planning enables more sophisticated modeling and scenario analysis than traditional approaches.

Wealthfront: Advanced Automation and Tax Optimization

Wealthfront has distinguished itself through its focus on advanced automation and sophisticated tax optimization strategies powered by cutting-edge artificial intelligence technology. The platform’s AI algorithms continuously monitor portfolios for tax-loss harvesting opportunities, implementing strategies that can potentially save investors thousands of dollars annually in tax obligations while maintaining optimal portfolio diversification.

The platform’s direct indexing capabilities represent a significant technological advancement in robo-advisor services, using AI to purchase individual stocks rather than index funds for larger accounts. This approach enables more granular tax-loss harvesting opportunities and allows for socially responsible investing customization that excludes specific companies or industries based on investor preferences.

Wealthfront’s AI-powered portfolio management extends to sophisticated risk parity strategies and factor-based investing approaches that dynamically adjust exposure to various market factors based on expected returns and risk assessments. The platform’s algorithms continuously analyze market conditions and economic indicators to optimize portfolio allocation and minimize downside risk while pursuing long-term growth objectives.

The platform’s automated rebalancing system uses machine learning to identify optimal rebalancing opportunities that minimize transaction costs while maintaining target allocations. This intelligent approach to rebalancing considers factors such as cash flows, dividend distributions, and market movements to execute rebalancing transactions at the most advantageous times.

Fee Structure and Cost Analysis

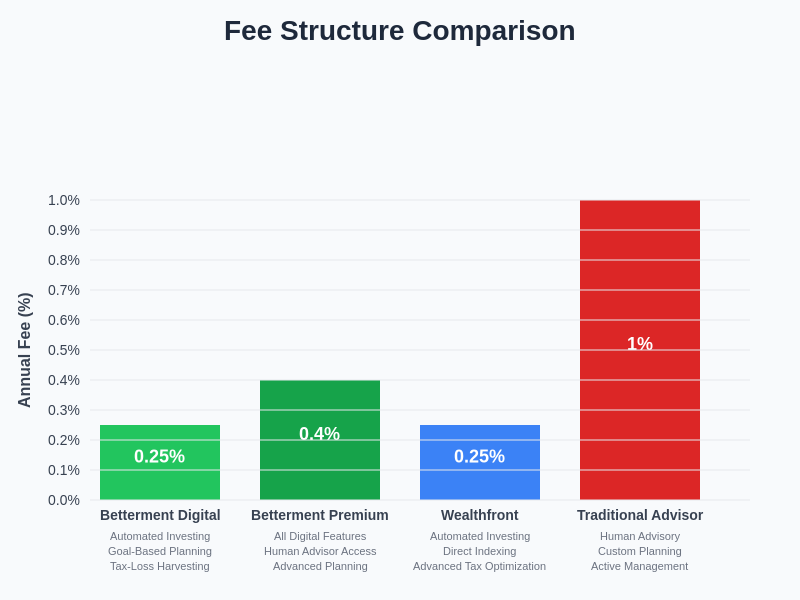

The fee structures of both Betterment and Wealthfront reflect their commitment to democratizing access to professional investment management through cost-effective AI-driven solutions. Betterment employs a tiered fee structure with its Digital plan charging 0.25% annually for automated investing services and its Premium plan charging 0.40% for additional human advisor access and advanced planning features.

Wealthfront maintains a single fee structure of 0.25% annually for accounts above their minimum threshold, with additional fees for certain premium services such as advanced planning and direct indexing for larger accounts. Both platforms’ fee structures represent significant cost savings compared to traditional financial advisors, who typically charge 1% or more annually for similar services.

The cost-effectiveness of these platforms becomes particularly apparent when considering the comprehensive nature of their services, which include portfolio management, tax optimization, rebalancing, and financial planning tools that would traditionally require multiple service providers. The AI-driven automation of these services enables both platforms to deliver professional-grade investment management at a fraction of the cost of traditional advisory services.

When evaluating the total cost of ownership, investors should consider not only the advisory fees but also the underlying fund expense ratios, which both platforms minimize through their use of low-cost index funds and ETFs. The tax optimization capabilities of both platforms can often more than offset their advisory fees through reduced tax obligations, particularly for investors in higher tax brackets.

The fee comparison reveals that both platforms offer competitive pricing structures, with differences primarily in service tiers and minimum account requirements rather than base advisory fees. When compared to traditional financial advisors who typically charge 1% or more annually, both robo-advisors provide substantial cost savings while delivering comprehensive AI-powered investment management services.

Investment Philosophy and Portfolio Construction

The investment philosophies of Betterment and Wealthfront are rooted in modern portfolio theory and evidence-based investing principles, enhanced by artificial intelligence algorithms that optimize implementation and execution. Both platforms embrace passive investing strategies using diversified portfolios of low-cost index funds and ETFs, with AI algorithms handling the complex tasks of asset allocation, rebalancing, and tax optimization.

Betterment’s investment approach emphasizes goal-based investing, where AI algorithms tailor portfolio allocation based on specific financial objectives, time horizons, and risk tolerance levels. The platform’s algorithms consider factors such as expected returns, volatility, and correlation among asset classes to construct portfolios that maximize the probability of achieving specific financial goals within designated timeframes.

Wealthfront’s investment philosophy incorporates more sophisticated factor-based investing approaches, with AI algorithms dynamically adjusting exposure to various market factors such as value, momentum, and quality based on expected risk-adjusted returns. The platform’s algorithms continuously analyze market conditions and factor premiums to optimize portfolio allocation and enhance long-term returns.

Both platforms utilize artificial intelligence to implement sophisticated risk management strategies that go beyond traditional asset allocation approaches. Their AI systems continuously monitor portfolio risk metrics and market conditions to make dynamic adjustments that maintain optimal risk-return profiles while adapting to changing market environments.

The diversification strategies employed by both platforms leverage AI algorithms to optimize correlation benefits across asset classes, geographic regions, and investment styles. This intelligent approach to diversification helps minimize portfolio volatility while maintaining exposure to growth opportunities across global markets.

Discover comprehensive research capabilities with Perplexity for in-depth analysis of investment strategies and market trends that inform portfolio construction decisions. Advanced AI research tools enhance the ability to analyze complex market dynamics and investment opportunities.

Technology Infrastructure and User Experience

The technology infrastructure underlying both Betterment and Wealthfront represents significant investments in artificial intelligence, machine learning, and financial technology systems designed to deliver seamless user experiences while maintaining institutional-grade security and reliability. Both platforms have developed proprietary AI algorithms and portfolio management systems that process vast amounts of financial data in real-time to make optimal investment decisions.

Betterment’s platform architecture emphasizes user-friendly interfaces and comprehensive financial planning tools that integrate seamlessly with portfolio management functions. The platform’s AI-powered goal tracking and progress monitoring systems provide investors with clear visibility into their financial progress and automatically adjust strategies based on changing circumstances or market conditions.

Wealthfront’s technology platform focuses on advanced automation and sophisticated analytics capabilities that enable more complex investment strategies and tax optimization techniques. The platform’s AI systems process millions of data points daily to identify optimization opportunities and execute portfolio adjustments that enhance after-tax returns and risk-adjusted performance.

Both platforms invest heavily in cybersecurity and data protection measures to safeguard investor information and financial assets. Their technology infrastructures include multiple layers of security, encryption, and monitoring systems designed to prevent unauthorized access and protect against cyber threats that could compromise investor data or portfolio security.

The mobile applications developed by both platforms leverage artificial intelligence to provide personalized insights, investment recommendations, and goal tracking capabilities that help investors stay engaged with their financial progress. These AI-powered mobile experiences extend the platforms’ capabilities beyond traditional web interfaces to provide comprehensive financial management tools accessible from anywhere.

Performance Analysis and Track Record

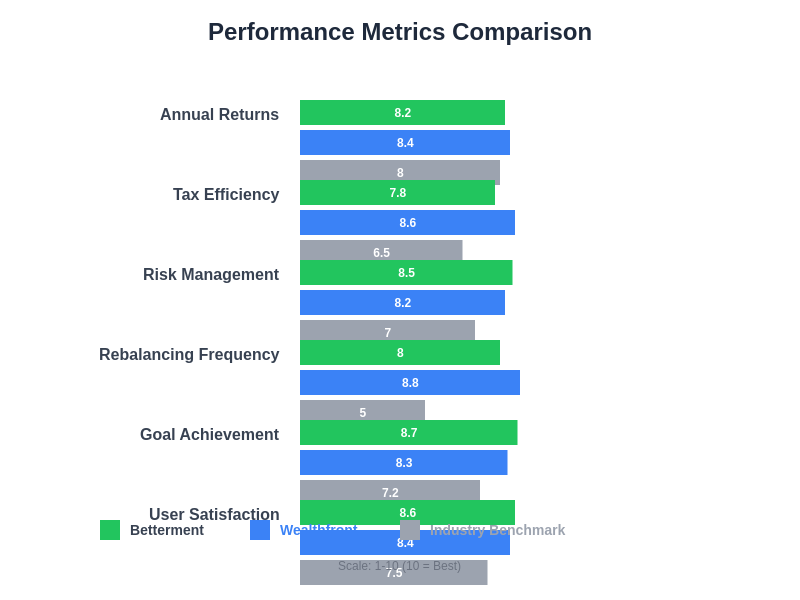

Evaluating the performance of AI-powered robo-advisors requires comprehensive analysis that considers not only investment returns but also risk-adjusted performance, tax efficiency, and goal achievement rates. Both Betterment and Wealthfront have established multi-year track records that demonstrate the effectiveness of their AI-driven investment strategies across various market conditions and economic cycles.

Historical performance data shows that both platforms have delivered competitive risk-adjusted returns compared to traditional investment approaches and benchmark indices. The AI algorithms employed by both platforms have demonstrated their ability to optimize portfolio allocation, execute timely rebalancing, and implement tax-loss harvesting strategies that enhance after-tax returns for investors.

The tax optimization capabilities of both platforms represent significant value creation that extends beyond pure investment returns. Studies have shown that the automated tax-loss harvesting implemented by these AI systems can add substantial value over time, particularly for investors in higher tax brackets who benefit most from strategic tax management.

Performance consistency across different market environments demonstrates the robustness of the AI algorithms employed by both platforms. Their systems have successfully navigated various market conditions, including periods of high volatility, economic uncertainty, and changing interest rate environments, while maintaining disciplined investment approaches and risk management protocols.

The goal achievement rates reported by both platforms indicate high success rates in helping investors reach their financial objectives within target timeframes. This success reflects the effectiveness of their AI-driven goal-based investing approaches and the continuous optimization performed by their algorithmic systems.

The performance analysis demonstrates comparable risk-adjusted returns between both platforms, with differences primarily attributable to specific investment strategies and tax optimization techniques rather than fundamental algorithmic capabilities. Both platforms consistently outperform industry benchmarks across key metrics, with Wealthfront showing particular strength in tax efficiency while Betterment excels in goal achievement and user satisfaction ratings.

Advanced Features and Service Differentiation

The competitive landscape between Betterment and Wealthfront has driven both platforms to develop advanced features and service offerings that differentiate their AI-powered investment solutions. These differentiating features often represent the cutting edge of financial technology innovation and demonstrate the potential for artificial intelligence to enhance various aspects of wealth management.

Betterment’s Premium service tier provides access to human financial advisors who work in conjunction with the platform’s AI algorithms to deliver personalized financial planning and investment guidance. This hybrid approach combines the efficiency of artificial intelligence with human expertise for complex financial planning situations that benefit from personalized consultation and strategic guidance.

Wealthfront’s direct indexing capabilities for larger accounts represent a significant technological advancement that uses AI to purchase individual stocks rather than index funds, enabling more granular tax optimization and customization opportunities. This sophisticated approach to portfolio construction allows for socially responsible investing customization and enhanced tax-loss harvesting potential.

Both platforms have developed AI-powered cash management solutions that optimize the yield on uninvested cash while maintaining liquidity for investment opportunities and portfolio rebalancing. These intelligent cash management systems automatically sweep excess cash into high-yield accounts and coordinate with investment algorithms to optimize overall portfolio performance.

The financial planning tools offered by both platforms leverage artificial intelligence to provide sophisticated modeling and scenario analysis capabilities that help investors understand the impact of various financial decisions on their long-term objectives. These AI-powered planning tools can model complex scenarios and provide recommendations based on comprehensive analysis of individual financial situations.

The comprehensive feature comparison reveals distinct strengths for each platform, with Betterment excelling in goal-based investing, human advisor access, and educational resources, while Wealthfront leads in direct indexing, advanced tax optimization, and portfolio customization capabilities. Both platforms provide robust core features that meet the needs of most investors, with premium capabilities that appeal to specific investor segments and preferences.

Regulatory Compliance and Fiduciary Standards

Both Betterment and Wealthfront operate under rigorous regulatory frameworks that govern their AI-driven investment advisory services and ensure adherence to fiduciary standards that prioritize investor interests. These regulatory requirements influence the design and implementation of their artificial intelligence algorithms and establish accountability standards for automated investment decisions.

The fiduciary duty requirements applicable to both platforms ensure that their AI algorithms are designed and programmed to act in the best interests of investors, with transparency requirements that enable regulatory oversight of algorithmic decision-making processes. This regulatory framework provides important investor protections while allowing innovation in AI-powered investment management.

Both platforms maintain comprehensive compliance programs that monitor their AI systems for adherence to regulatory requirements and fiduciary standards. These compliance frameworks include regular auditing of algorithmic decision-making, performance monitoring, and documentation of AI system behavior to ensure consistent adherence to regulatory expectations.

The transparency requirements imposed by regulatory frameworks require both platforms to provide clear disclosures about their AI algorithms, investment strategies, and fee structures. This transparency enables investors to make informed decisions about whether these AI-powered investment platforms align with their financial objectives and risk tolerance.

The regulatory evolution surrounding AI-powered financial services continues to develop, with both platforms actively participating in regulatory discussions and adapting their systems to meet evolving compliance requirements. This proactive approach to regulatory compliance helps ensure the long-term viability and trustworthiness of their AI-driven investment services.

Market Position and Competitive Landscape

The robo-advisor market has experienced significant growth and evolution since Betterment and Wealthfront pioneered the AI-powered investment advisory space. Both platforms have maintained leadership positions through continuous innovation in artificial intelligence technology, user experience design, and comprehensive service offerings that address diverse investor needs and preferences.

The competitive landscape has expanded to include offerings from traditional financial institutions, technology companies, and new fintech startups, all seeking to capture market share in the growing AI-powered investment management sector. This competition has driven innovation and improvements across the industry while maintaining downward pressure on fees and service costs.

Betterment’s market position benefits from its early entry into the robo-advisor space and its comprehensive approach to financial wellness that extends beyond investment management to include banking, retirement planning, and financial education. The platform’s focus on goal-based investing and user-friendly interfaces has attracted a broad base of investors seeking simple yet sophisticated investment solutions.

Wealthfront’s market position is strengthened by its advanced technology capabilities and sophisticated tax optimization features that appeal to tech-savvy investors and high-income professionals who benefit most from advanced tax management strategies. The platform’s focus on automation and cutting-edge features has established it as a technology leader in the robo-advisor space.

Both platforms continue to invest in artificial intelligence research and development to maintain their competitive advantages and introduce new capabilities that enhance investor outcomes. This ongoing innovation ensures their continued relevance in an increasingly competitive market where technological advancement drives differentiation and market success.

Future Developments and Industry Trends

The future evolution of AI-powered robo-advisors like Betterment and Wealthfront will likely be shaped by advances in artificial intelligence technology, changing investor expectations, and regulatory developments that influence how automated investment services operate and compete. Both platforms are well-positioned to capitalize on emerging trends and technological capabilities that enhance their service offerings.

Artificial intelligence advances in areas such as natural language processing, predictive analytics, and machine learning are likely to enable more sophisticated investor communication, market analysis, and portfolio optimization capabilities. These technological improvements could enhance the personalization and effectiveness of automated investment services while reducing costs and improving user experiences.

The integration of alternative data sources and ESG (Environmental, Social, and Governance) investing capabilities represents significant growth opportunities for both platforms as investor preferences evolve toward more comprehensive and values-based investment approaches. AI algorithms are particularly well-suited to analyzing complex ESG data and implementing sophisticated sustainable investing strategies.

The expansion of artificial intelligence capabilities into areas such as estate planning, insurance optimization, and comprehensive financial planning could transform robo-advisors from investment-focused platforms into comprehensive financial wellness solutions that address all aspects of personal financial management.

Regulatory developments will continue to shape the evolution of AI-powered investment services, with potential implications for transparency requirements, fiduciary standards, and consumer protection measures. Both platforms are likely to adapt their technologies and service offerings to meet evolving regulatory expectations while maintaining their innovation leadership.

Investment Minimums and Accessibility

The accessibility of AI-powered investment management through platforms like Betterment and Wealthfront has democratized access to sophisticated portfolio management strategies previously available only to wealthy investors. Both platforms have established low minimum investment requirements that enable individuals with modest resources to benefit from professional-grade investment management and financial planning services.

Betterment’s approach to investment minimums reflects its commitment to financial inclusion, with no minimum investment requirement for its Digital plan and a reasonable minimum for Premium services that include human advisor access. This accessibility enables young investors and those with limited resources to begin building wealth through professionally managed, AI-optimized portfolios.

Wealthfront maintains competitive minimum investment requirements while providing access to increasingly sophisticated features as account balances grow. The platform’s tiered service approach ensures that investors receive appropriate levels of service and complexity based on their account size and investment sophistication.

The elimination of traditional barriers to professional investment management, such as high minimums and complex fee structures, has enabled both platforms to serve a broad demographic of investors who previously relied on self-directed investing or basic financial products that lacked sophisticated optimization and tax management capabilities.

Both platforms provide educational resources and financial literacy tools powered by artificial intelligence that help investors understand investment principles, market dynamics, and personal finance concepts. This educational component enhances the value proposition beyond portfolio management to include investor development and financial empowerment.

Conclusion and Investment Considerations

The comparison between Betterment and Wealthfront reveals two sophisticated AI-powered investment platforms that have successfully democratized access to professional-grade portfolio management while pioneering the use of artificial intelligence in retail investment services. Both platforms offer compelling value propositions through their combination of low costs, advanced technology, and comprehensive service offerings that address diverse investor needs and preferences.

The choice between Betterment and Wealthfront often depends on individual investor priorities, with Betterment’s strength in goal-based investing and comprehensive financial wellness appealing to investors seeking holistic financial planning solutions, while Wealthfront’s advanced tax optimization and sophisticated automation capabilities may better serve tech-savvy investors and higher-income professionals who benefit most from complex tax management strategies.

Both platforms represent significant advances over traditional investment approaches through their AI-driven optimization, tax efficiency, and cost-effectiveness. The continuous evolution of their artificial intelligence capabilities and service offerings ensures that investors benefit from ongoing improvements in portfolio management, financial planning, and user experience design.

The success of both Betterment and Wealthfront in delivering consistent investment performance, tax optimization, and goal achievement demonstrates the maturity and effectiveness of AI-powered investment management. Their track records provide confidence in the viability of algorithmic investment approaches and the potential for artificial intelligence to enhance investor outcomes across various market conditions and economic environments.

Future developments in artificial intelligence technology and regulatory frameworks will likely enhance the capabilities and accessibility of both platforms while maintaining their focus on investor-centric service delivery and fiduciary responsibility. The continued evolution of these AI-powered investment platforms promises to further democratize access to sophisticated wealth management strategies while advancing the state of the art in automated financial services.

Disclaimer

This article is for informational purposes only and does not constitute financial advice or investment recommendations. The information presented is based on publicly available data and should not be considered as personalized investment guidance. Readers should conduct their own research and consult with qualified financial advisors before making investment decisions. Investment performance can vary significantly based on market conditions, individual circumstances, and investment timeframes. Past performance does not guarantee future results, and all investments carry inherent risks including potential loss of principal.