The wealth management industry stands at the precipice of a technological revolution, where artificial intelligence has emerged as the cornerstone of sophisticated client analytics and personalized financial services for high-net-worth individuals. This transformative technology is fundamentally reshaping how financial advisors understand, analyze, and serve their most valuable clients, creating unprecedented opportunities for deeper insights, enhanced decision-making, and superior investment outcomes that were previously impossible through traditional analytical methods.

Explore cutting-edge AI developments in finance to stay informed about the latest innovations transforming wealth management and investment strategies. The integration of artificial intelligence into wealth management represents more than mere technological advancement; it signifies a paradigm shift toward data-driven decision-making that enhances both advisor capabilities and client experiences through sophisticated analytical frameworks that process vast amounts of financial, behavioral, and market data in real-time.

The Evolution of High-Net-Worth Client Analytics

The traditional approach to serving high-net-worth clients relied heavily on relationship management, intuitive understanding of client needs, and standardized investment strategies that often failed to capture the nuanced requirements and sophisticated goals of affluent individuals. The emergence of artificial intelligence has revolutionized this landscape by introducing advanced analytical capabilities that can process and interpret complex data patterns, behavioral indicators, and market dynamics to create comprehensive client profiles that inform every aspect of the wealth management relationship.

Modern AI-driven analytics platforms can synthesize information from multiple sources including transaction histories, communication patterns, investment preferences, risk tolerance assessments, life events, family dynamics, and external market conditions to develop holistic understanding of each client’s unique financial ecosystem. This comprehensive approach enables wealth managers to anticipate client needs, identify emerging opportunities, and provide proactive guidance that aligns with both short-term objectives and long-term wealth preservation and growth strategies.

The sophistication of contemporary AI analytics extends beyond simple data aggregation to encompass predictive modeling, behavioral analysis, and scenario planning that helps wealth managers navigate the complexities of managing substantial assets while addressing the diverse and evolving needs of high-net-worth families and individuals.

Advanced Portfolio Optimization Through Machine Learning

Portfolio optimization for high-net-worth clients demands sophisticated analytical capabilities that can balance multiple objectives including capital preservation, growth potential, tax efficiency, liquidity requirements, and risk management across diverse asset classes and investment vehicles. Machine learning algorithms have transformed this process by enabling dynamic optimization that continuously adapts to changing market conditions, client circumstances, and evolving investment opportunities.

Leverage advanced AI tools like Claude for comprehensive financial analysis and strategic planning that incorporates complex variables and sophisticated modeling techniques. AI-powered portfolio optimization systems can process vast amounts of market data, historical performance metrics, correlation patterns, and economic indicators to identify optimal asset allocation strategies that maximize risk-adjusted returns while adhering to specific client constraints and preferences.

These advanced systems utilize reinforcement learning techniques to continuously improve their recommendations based on portfolio performance, market outcomes, and client feedback, creating adaptive strategies that evolve with changing market dynamics and client needs. The integration of alternative data sources including satellite imagery for real estate investments, social sentiment analysis for equity selections, and economic indicators for macro-economic positioning enables more informed investment decisions that capitalize on emerging opportunities while managing downside risks.

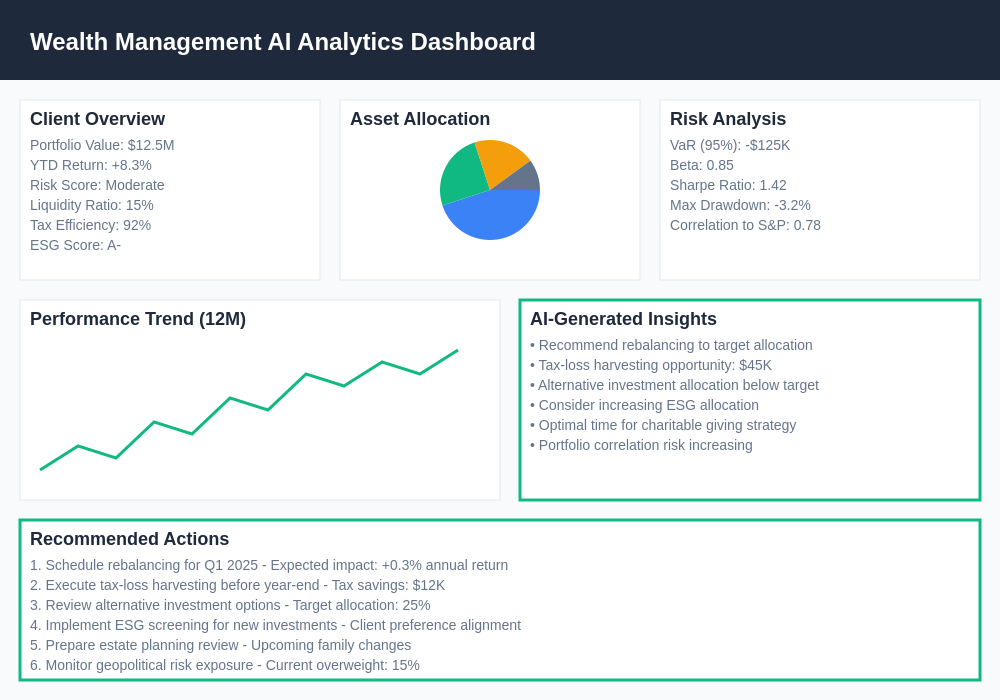

The comprehensive analytics dashboard provides wealth managers with real-time insights into client portfolios, risk exposures, performance metrics, and optimization opportunities, enabling data-driven decision-making that enhances both investment outcomes and client satisfaction through transparent and sophisticated analytical frameworks.

Behavioral Analytics and Client Insight Generation

Understanding client behavior represents one of the most valuable applications of artificial intelligence in wealth management, as high-net-worth individuals often exhibit complex behavioral patterns that influence their investment decisions, risk tolerance, and long-term financial planning strategies. AI-powered behavioral analytics systems can identify subtle patterns in client communications, transaction histories, and decision-making processes that reveal important insights about preferences, concerns, and motivations that inform personalized service delivery.

These sophisticated analytical frameworks can detect early indicators of changing client needs, emerging concerns about market conditions, or evolving family dynamics that may impact investment strategies or financial planning requirements. By analyzing communication patterns, meeting frequencies, portfolio adjustments, and external life events, AI systems can help wealth managers anticipate client needs and provide proactive guidance that strengthens relationships and improves outcomes.

The integration of natural language processing capabilities enables AI systems to analyze client communications, including emails, meeting notes, and recorded conversations, to extract sentiment indicators, priority concerns, and decision-making factors that inform service delivery strategies and relationship management approaches. This deep understanding of client psychology and behavior enables wealth managers to tailor their communication styles, recommendation approaches, and service offerings to align with individual client preferences and decision-making processes.

Risk Assessment and Management Innovation

Risk management for high-net-worth clients requires sophisticated analytical capabilities that can identify, quantify, and monitor diverse risk factors including market volatility, concentration risk, liquidity constraints, regulatory changes, and personal circumstances that may impact wealth preservation and growth objectives. Artificial intelligence has revolutionized risk assessment by enabling comprehensive analysis of complex interdependencies and scenario modeling that provides deeper insights into potential vulnerabilities and protective strategies.

Advanced AI systems can continuously monitor portfolio exposures across multiple dimensions including geographic regions, industry sectors, asset classes, and investment vehicles to identify emerging concentration risks or correlation patterns that may threaten portfolio stability during market stress periods. These systems utilize sophisticated modeling techniques to simulate thousands of potential market scenarios and assess portfolio performance under various stress conditions, enabling proactive risk management strategies that protect client wealth while maintaining growth potential.

The integration of external data sources including geopolitical indicators, economic forecasts, and regulatory developments enables AI systems to identify emerging risks that may not be apparent through traditional analysis methods. This comprehensive approach to risk assessment helps wealth managers implement protective strategies before potential threats materialize, preserving client wealth and maintaining confidence during periods of market uncertainty.

Personalized Investment Strategy Development

The development of personalized investment strategies for high-net-worth clients requires sophisticated understanding of individual goals, constraints, preferences, and circumstances that extend far beyond traditional risk tolerance assessments and return objectives. AI-powered strategy development systems can synthesize complex information about client situations, family dynamics, business interests, philanthropic goals, and legacy planning objectives to create comprehensive investment frameworks that address multiple priorities simultaneously.

These advanced systems can identify optimal investment vehicles, tax-efficient structures, and timing strategies that maximize after-tax returns while addressing liquidity requirements, estate planning considerations, and family governance structures. The integration of tax optimization algorithms enables the development of strategies that minimize tax liabilities through strategic asset location, harvesting techniques, and charitable giving strategies that align with client values and objectives.

Enhance your analytical capabilities with Perplexity for comprehensive research and analysis that supports sophisticated investment strategy development and implementation. The dynamic nature of AI-powered strategy development enables continuous refinement and adaptation as client circumstances evolve, market conditions change, and new opportunities emerge, ensuring that investment approaches remain aligned with changing priorities and market dynamics.

Alternative Investment Analytics and Due Diligence

High-net-worth clients often seek access to alternative investment opportunities including private equity, hedge funds, real estate, commodities, and other sophisticated investment vehicles that require specialized analytical capabilities and due diligence processes. AI-powered analytics systems have transformed the evaluation and monitoring of alternative investments by enabling comprehensive analysis of complex performance metrics, risk factors, and operational considerations that inform investment decisions.

These sophisticated systems can analyze vast amounts of unstructured data including fund documents, performance reports, regulatory filings, and market intelligence to identify key risk factors, performance drivers, and competitive positioning that inform investment selection and portfolio construction decisions. The integration of natural language processing capabilities enables AI systems to extract important information from legal documents, investment memoranda, and due diligence materials that might be overlooked through traditional analysis methods.

Advanced monitoring systems can track alternative investment performance across multiple dimensions including absolute returns, risk-adjusted metrics, peer comparisons, and correlation patterns with traditional assets to ensure that alternative allocations continue to provide diversification benefits and attractive risk-adjusted returns. This comprehensive approach to alternative investment analysis enables wealth managers to identify opportunities that align with client objectives while avoiding investments that may introduce unacceptable risks or fail to meet performance expectations.

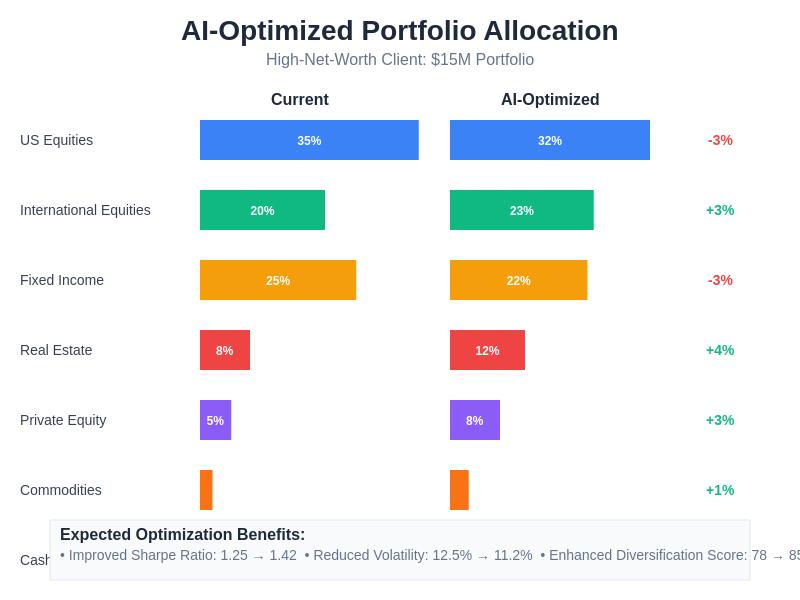

The AI-driven portfolio allocation model demonstrates optimal asset distribution across traditional and alternative investment categories, incorporating client-specific constraints, risk preferences, and return objectives to maximize portfolio efficiency and alignment with long-term wealth management goals.

Tax Optimization and Estate Planning Integration

Tax optimization represents a critical component of wealth management for high-net-worth clients, where sophisticated strategies can generate substantial value through efficient tax planning, strategic asset location, and coordinated estate planning approaches. AI-powered tax optimization systems can analyze complex tax scenarios, identify optimization opportunities, and coordinate strategies across multiple jurisdictions and family members to maximize after-tax wealth accumulation and transfer efficiency.

These advanced systems can model the tax implications of various investment decisions, timing strategies, and structural arrangements to identify approaches that minimize tax liabilities while maintaining investment flexibility and family objectives. The integration of estate planning considerations enables AI systems to optimize strategies that balance current tax efficiency with long-term wealth transfer objectives, ensuring that optimization efforts support comprehensive family wealth management goals.

The dynamic nature of tax optimization AI enables continuous monitoring of changing tax regulations, evolving family circumstances, and emerging opportunities that may impact tax-efficient wealth management strategies. This proactive approach ensures that clients benefit from new optimization opportunities while avoiding potential pitfalls that could result in adverse tax consequences or regulatory complications.

Family Office Technology Integration

Family offices serving high-net-worth families require sophisticated technology platforms that can coordinate complex financial, operational, and strategic activities across multiple family members, entities, and service providers. AI-powered family office systems integrate various analytical capabilities including investment management, risk monitoring, tax optimization, and family governance support to provide comprehensive platforms that enhance operational efficiency and decision-making effectiveness.

These integrated systems can coordinate information across multiple financial institutions, investment managers, and service providers to provide consolidated reporting, performance analysis, and risk monitoring that gives family members and advisors comprehensive visibility into family wealth and activities. The integration of communication and collaboration tools enables efficient coordination among family members, advisors, and service providers while maintaining appropriate confidentiality and access controls.

Advanced workflow management capabilities enable family offices to standardize and optimize processes including investment due diligence, manager selection, performance monitoring, and compliance oversight, improving operational efficiency while maintaining high standards of service delivery and risk management. This systematic approach to family office management enables better decision-making and improved outcomes across all aspects of family wealth management and operations.

Regulatory Compliance and Reporting Automation

The regulatory environment surrounding wealth management for high-net-worth clients continues to evolve with increasing complexity and reporting requirements that demand sophisticated compliance monitoring and reporting capabilities. AI-powered compliance systems can automatically monitor investment activities, client communications, and operational processes to identify potential compliance issues and ensure adherence to applicable regulations and industry standards.

These systems can generate comprehensive reports that satisfy various regulatory requirements including client reporting, performance attribution, risk disclosure, and fiduciary documentation while reducing the administrative burden on wealth management teams. The integration of regulatory change monitoring enables AI systems to identify new requirements and automatically update compliance processes to ensure continued adherence to evolving regulatory standards.

Advanced exception monitoring capabilities can identify unusual patterns or activities that may require additional scrutiny or documentation, enabling proactive compliance management that reduces regulatory risks while maintaining operational efficiency. This comprehensive approach to compliance management provides confidence that wealth management activities meet all applicable standards while enabling focus on value-added advisory services and client relationship management.

Performance Measurement and Attribution Analysis

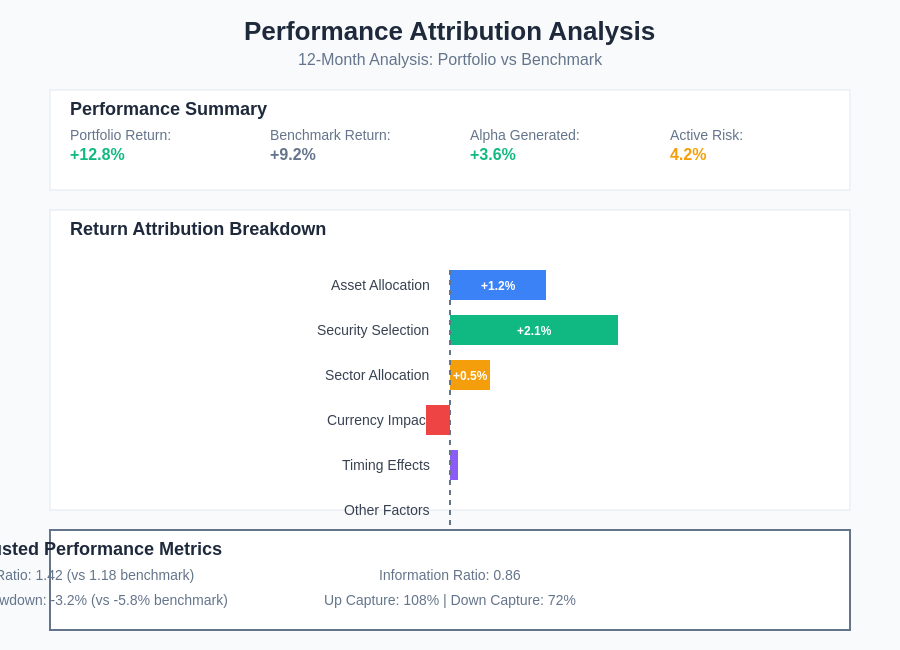

Sophisticated performance measurement and attribution analysis represents essential capabilities for demonstrating value creation and informing ongoing investment decisions for high-net-worth clients with complex portfolios spanning multiple asset classes, managers, and investment vehicles. AI-powered performance analysis systems can provide comprehensive insights into portfolio performance drivers, risk contributions, and value creation sources that inform strategic decisions and demonstrate advisory value.

These advanced systems can attribute performance across multiple dimensions including asset allocation, security selection, timing decisions, and manager contributions to provide detailed understanding of performance sources and areas for potential improvement. The integration of benchmark analysis and peer comparison capabilities enables comprehensive evaluation of investment results relative to appropriate standards and competitive alternatives.

Dynamic performance monitoring enables real-time identification of performance deviations, emerging risks, and optimization opportunities that inform tactical adjustments and strategic refinements. This comprehensive approach to performance analysis provides transparency and insights that strengthen client relationships while informing continuous improvement in investment processes and outcomes.

The comprehensive performance attribution analysis provides detailed insights into portfolio performance drivers, enabling wealth managers to identify successful strategies, address underperforming areas, and optimize future investment decisions through data-driven analysis of historical performance patterns and risk contributions.

Client Communication and Relationship Enhancement

Effective communication and relationship management represent fundamental components of successful wealth management for high-net-worth clients who expect sophisticated service delivery, proactive guidance, and transparent reporting that keeps them informed about their financial situation and investment performance. AI-powered communication systems can enhance client relationships by providing personalized reporting, automated updates, and intelligent insights that demonstrate ongoing value creation and advisory engagement.

These systems can generate customized reports that highlight relevant performance metrics, market developments, and strategic recommendations tailored to individual client interests and communication preferences. The integration of natural language generation capabilities enables the creation of comprehensive narratives that explain complex investment concepts, performance drivers, and strategic rationales in accessible language that enhances client understanding and engagement.

Advanced client relationship management capabilities can track communication patterns, meeting frequencies, and engagement levels to identify opportunities for enhanced service delivery and relationship strengthening. This systematic approach to relationship management ensures consistent and proactive communication that maintains strong client relationships while identifying opportunities for expanded service delivery and deeper engagement.

Future Developments and Industry Evolution

The continued evolution of artificial intelligence capabilities promises to further transform wealth management for high-net-worth clients through enhanced analytical sophistication, expanded data integration, and improved predictive capabilities that will enable even more personalized and effective wealth management services. Emerging technologies including quantum computing, advanced natural language processing, and enhanced machine learning algorithms will provide new opportunities for analytical innovation and service enhancement.

The integration of environmental, social, and governance considerations into investment analysis and decision-making processes will become increasingly sophisticated as AI systems develop capabilities to analyze complex ESG data and incorporate sustainability considerations into investment strategies and risk management frameworks. This evolution will enable wealth managers to address growing client interest in sustainable investing while maintaining financial performance and risk management standards.

The democratization of sophisticated analytical capabilities through AI-powered platforms will enable smaller wealth management practices to provide services that were previously available only through large institutional platforms, increasing competition and innovation while expanding access to sophisticated wealth management services for a broader range of high-net-worth clients. This evolution will drive continued innovation and improvement in service delivery standards across the entire wealth management industry.

Disclaimer

This article is for informational purposes only and does not constitute financial, investment, or professional advice. The views expressed are based on current understanding of AI technologies and their applications in wealth management. Readers should consult with qualified financial advisors and conduct their own research before making investment decisions. The effectiveness of AI-powered wealth management tools may vary depending on specific client circumstances, market conditions, and implementation approaches. Past performance does not guarantee future results, and all investments carry inherent risks that should be carefully considered.